BigFx-Overview of Minimum Deposit, Spreads & Leverage

Abstract:BigFx is allegedly an Estonian forex broker that provides its clients with a web-based trading platform, leverage up to 1:300, fixed spreads on diverse tradable assets, as well as a choice of five different account types.

General Information

BigFx is allegedly an Estonian forex broker that provides its clients with a web-based trading platform, leverage up to 1:300, fixed spreads on diverse tradable assets, as well as a choice of five different account types.

Market Instruments

BigFx advertises that it offers an extensive range of trading instruments in financial markets, including forex currency pairs and CFDs on indices, commodities, precious metals, stocks, cryptocurrencies, ETFs and bonds.

Account Types

There are five live trading accounts offered by BigFx, namely Elementary, Standard, Investor A, Trader VS and Premium A+. Opening an Elementary account requires the minimum initial deposit amount of $500, while the other four account types with the much higher minimum initial capital requirements of $2,500, $5,000, $10,000 and $50,000 respectively.

Leverage

Traders holding different account types can experience quite different maximum leverage ratios. Clients on the Elementary or Standard account can experience the leverage of 1:100, the Investor A account with the leverage of 1:150, the Trader VS account with the leverage of up to 1:200, while the Premium A+ account can enjoy the maximum leverage as high as 1:300. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads

As we tested on BigFxs web-based trading platform, we found the spread for EUR/USD pair is fixed at 3.5 pips. Other more detailed information about spreads is not involved directly on its official website.

Trading Platform Available

When it comes to trading platforms available, instead of the worlds most widely-used MetaTrader4 and MetaTrader5 platforms, BigFx gives traders a web-based platform. The interface of this web-based trading platform is just as the following screenshot shows. It looks simple and clear, yet it seems to lack many functionalities while MT4 and MT5 trading platforms are equipped with, such as technical analysis indicators, Expert Advisors for automated trading and others.

Deposit & Withdrawal

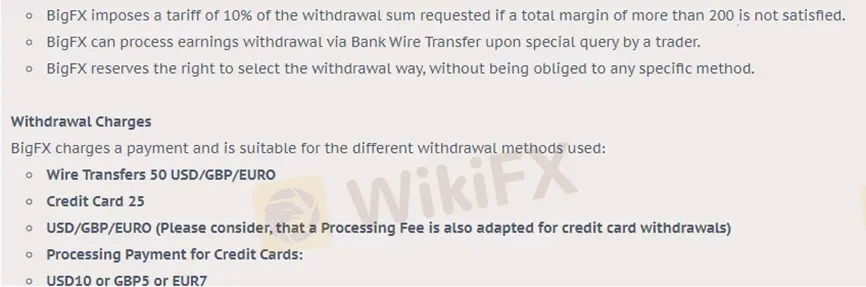

BigFx accepts deposits via credit cards, wire transfers, e-wallets, and cryptocurrencies. The minimum initial deposit amount is said to be $250. In the FAQ, the broker states “BigFX imposes a tariff of 10% of the withdrawal sum requested if a total margin of more than 200 is not satisfied”. Besides, it will charge some other withdrawal fees. For instance, a Wire Transfer fee is $/£/€50, credit card fee is $25. Other more detailed information can be seen in the following screenshot.

Customer Support

BigFx‘s customer support can be reached through telephone: 3726026545, email: support@bigfx.net. However, this broker doesn’t disclose other more direct contact information like company address while most brokers offer.

Read more

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

FINMA Opens Bankruptcy Proceedings

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc