Mohicans markets :Eyes on EIA & US Government Continues to Seek to Increase Production Waiting for US CPI to Provide More clues for Fed Rate Hike

Abstract:On Tuesday, August 9, spot gold fell slightly after breaking the $1,800 mark, and finally closed up 0.29% at $1,794.49 per ounce. Spot silver was stable above the $20 mark, and finally closed down 0.84% at $20.54 per ounce. In terms of two oils, WTI crude oil erased most of the intraday gains in the U.S. market and finally closed up 0.1% at $90.52 per barrel. Brent crude closed down 0.15% at $96.48 per barrel.

Financial Events Today

09:00 China's July RMB loan balance annual rate (%) (0810-0817, it is uncertain), previous value 11.2, expected value -- , published value: to be released

09:30 China's July CPI annual rate (%), previous value was 2.5, expected value was 2.9, published value: to be released

09:30 China's July PPI annual rate (%), previous value was 6.1, expected value was 4.8, published value: to be released

14:00 German July CPI annual rate final value (%), previous value 7.5, expected value 7.5, published value: to be released

16:00 China's social financing scale in July - single month (RMB 100 million) (0810-0815), previous value 51700, expected value 13000, pubished value: to be released

16:00 China's July M2 money supply annual rate (%) (0810-0815), previous value 11.4, expected value 11.4, published value: to be released

22:00 U.S. June wholesale inventory monthly rate final value (%), previous value 1.9, expected value 1.9, published value: to be released

22:30 Changes in U.S. EIA refined oil inventories for the week ended August 5 (10,000 barrels), previous value -240, expected value -330, published value: to be released

22:30 U.S. EIA gasoline inventory changes in the week ended August 5 (10,000 barrels), previous value was 16.3, expected value was -41.7, announced value: to be released

22:30 U.S. EIA weekly crude oil imports for the week ended August 5 (10,000 barrels), previous value was 221.4, expected value -- , published value: to be released

Risk warning:

☆ 20:30 will announce the US July CPI. After the annual rate of CPI exceeded “9” in June, due to the decline in gasoline prices, the market expects that the CPI in July will drop, and the expected value is 8.7%. However, the Cleveland Fed's Nowcast model of headline inflation shows that if last year's trend continues, the annual rate of U.S. CPI will be close to 9% in July. It is worth mentioning that over the past year, the model has underestimated real inflation data by an average of 17.7 basis points. If the near-term error trend remains the same, this means that the US CPI will reach 9% in July.

☆ At 22:30, EIA crude oil inventories and strategic oil inventories will be announced for the week from the United States to August 5. The market expects crude oil inventories to fall by 400,000 barrels, and the previous value increased by 4.467 million barrels. The U.S. API crude oil inventories announced early this morning recorded an increase of 2.156 million barrels in the week to August 5, which is expected to decrease by 400,000 barrels, and the previous value increased by 2.165 million barrels. ☆ 23:00 Next year FOMC votes, Chicago Fed President Evans will discuss the US economy and monetary policy. At 2:00 in the morning tomorrow, next year's FOMC vote, Minneapolis Fed President Kashkari will discuss inflation. The two Fed officials have signaled their hawkish stance recently, and the July CPI data is expected to influence their rhetoric.

☆ What still needs attention in the day is that Japanese Prime Minister Fumio Kishida is expected to implement a cabinet reshuffle and high-level personnel adjustment of the Liberal Democratic Party today. The former Prime Minister Shinzo Abe and Defense Minister Nobuo Kishi, who was assassinated a few days ago, may be replaced. The UK's ban on imports of Russian coal also came into effect today.

This week will focus on the following key economic data and events:

1. On Wednesday, China's July PPI annual rate, China's July CPI annual rate, the US July CPI annual rate not seasonally adjusted, Chicago Fed President Evans speech, Minneapolis Fed President Kashkari speech, EIA crude oil inventories;

2. On Thursday, U.S. July PPI annual rate, U.S. initial jobless claims for the week ended August 6, IEA‘s monthly crude oil market report, and OPEC’s monthly crude oil market report;

3. Last Friday, UK June GDP monthly rate, UK June industrial output monthly rate, US July import price index annual rate, US August University of Michigan consumer confidence index initial value, US oil for the week ended August 12 Total number of wells

Global Views - List of Major Markets

On Tuesday, August 9, spot gold fell slightly after breaking the $1,800 mark, and finally closed up 0.29% at $1,794.49 per ounce. Spot silver was stable above the $20 mark, and finally closed down 0.84% at $20.54 per ounce.

In terms of two oils, WTI crude oil erased most of the intraday gains in the U.S. market and finally closed up 0.1% at $90.52 per barrel. Brent crude closed down 0.15% at $96.48 per barrel.

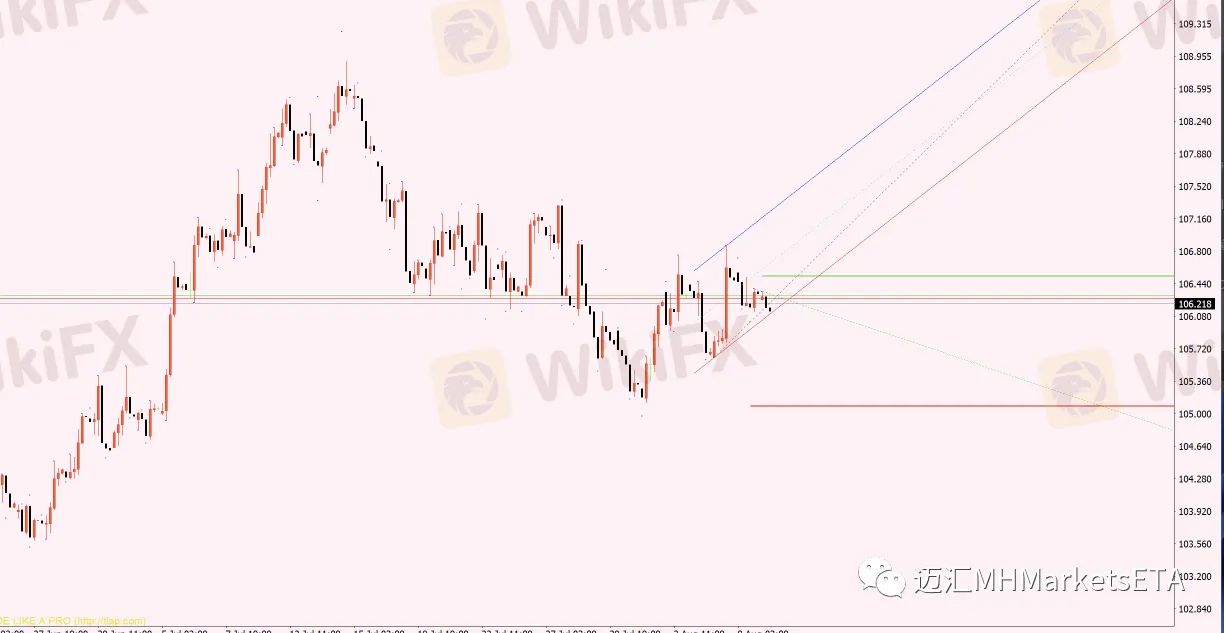

The US dollar index rebounded after breaking the 106 mark, recovering most of the losses in the day, and finally closed down 0.01% at 106.32.

US stocks closed, the Dow closed down 0.18%, the Nasdaq closed down 1.19%, and the S&P 500 closed down 0.42%. Cruise concepts and department stores were among the top decliners. Zhifu Capital fell about 90%, Nvidia fell about 4%, and Novavax Pharmaceuticals fell about 30%.

European stocks opened higher and moved lower. Germany's DAX index closed down 1.12%, the European Stoxx 50 index closed down 1.13%, and the French CAC40 index closed down 0.53%.

Precious Metal

In the early trading hours of Wednesday, August 10, spot gold was hovering around the 55-day moving average and was currently trading around 1792.65. Although the gold price was blocked at the 1800 mark after a surge overnight, the current upward trend of the gold price is intact, and the short-term gold price is still biased towards bulls. On the one hand, the geopolitical situation is still attracting safe-haven buying to support the price of gold, and the decline in the yields of the U.S. dollar and U.S. bonds is also positive for the gold market outlook.

The market is generally concerned about the US July CPI data released in the evening, although the data is expected to show that US inflation is still at a multi-decade high, which is expected to provide support for the Federal Reserve to further raise interest rates, which may suppress the trend of gold prices in the short term.

Judging from the market trend after the release of the U.S. CPI data for many times in the past, even if the inflation data is stronger than market expectations, and the markets expectations for aggressive interest rate hikes by the Federal Reserve are heating up, the price of gold has been fluctuating and rising after a rapid dip, because for a long time, the market has been Gold is a tool to resist inflation. High inflation will increase the attractiveness of gold. Investors need to beware of “history repeating itself”. And it should be reminded that the current market expects the annual rate of CPI in the United States to be 8.7% in July, which will be lower than the 9.1% in June, which is also expected to provide opportunities for bulls.

The Fundamentals Are Mainly Bearish

[Federal Reserve Bullard: It is too early to say that inflation has peaked]

[U.S. bond yields rise, investors await Wednesday's U.S. CPI data]

[BoE Deputy Governor: Rate hikes and government bond sales should continue]

Fundamentals Are Mostly Bullish

[U.S. non-farm productivity fell at an annual rate of 4.6% in the second quarter, the largest decline since 1948]

[U.S. stocks closed down on Tuesday, chip maker Micron issued a warning once again triggering a rout of technology stocks]

[Bank of America: U.S. Treasury yield curve inversion still has room to deepen]

[U.S. President Biden signs the protocol for Sweden and Finland to join NATO]

[Kyiv urges travel ban on Russians, Moscow launches new offensive in eastern Ukraine]

On the whole, in the short-term, we need to pay close attention to the performance of the US CPI data in July. The data may support the Feds expectation of raising interest rates by 75 basis points in September in the short-term, which is favorable for the US dollar and negative for the price of gold in the short-term. After the decline, it is expected to attract bargain-hunting buying. The price of gold is expected to break through the 1800 mark in this trading day, and further test the resistance near the high point of 1814.16 on July 4.

However, investors also need to pay attention to the speeches of Fed officials, and it is expected that the possibility of hawkishness is relatively high, which may drag down the performance of gold prices in the short term. Below, pay attention to the support near the 10-day moving average at 1775. If the support is broken below, then the short-term bullish sentiment will be weakened.

Crude

In early trading on Wednesday,August 10, U.S. oil traded around $90.37 per barrel. Oil prices were blocked on Tuesday, and the intraday trend was volatile, due to concerns that an economic slowdown could cut demand and Russia to Europe via Ukraine Druzhba The news of the suspension of some oil exports of the oil pipeline jointly affected the market. In addition, the escalation of tensions in the conflict between Russia and Ukraine and the waiting for the final decision on the Iranian nuclear negotiations also intensified the long-short competition for oil prices at the 90 mark.

During the day, we will focus on the EIA data, the US July CPI data, and the Fed Evans at 23:00 to discuss the US economy and monetary policy.

Bullish Factors Affecting Oil Prices

[U.S. crude oil inventories increased by about 2.2 million barrels last week]

[The Biden administration will continue to seek to increase oil production]

On the whole, API data shows that crude oil inventories in the United States have increased, but refined oil products have declined, coupled with escalating geopolitical tensions, and Russia has suspended oil exports through the southern section of the Druzhba pipeline. During the day, focus on the evening EIA data, as well as the OPEC monthly report and the IEA monthly report to be released on Thursday.

Foreign Exchange

In early trading on Wednesday,August 10, Beijing time, the U.S. dollar index rose slightly and is currently trading around 106.34. The U.S. dollar index closed down 0.06 percent at 106.31 on Tuesday. Risk appetite dipped ahead of key U.S. inflation data for July that could provide clues on how aggressively the Federal Reserve will raise interest rates in September.

EUR/USD closed up 0.22% at 1.0212 on Tuesday. Recession risks still limit the upside of the euro.

GBP/USD closed down 0.01% at $1.2074 on Tuesday. Recession risks and political instability weighed on the pound.

The Australian dollar is seen as a barometer of market risk. AUD/USD closed down 0.27% at 0.6961 on Tuesday.

The main focus of traders is the US July CPI report to be released at 20:30 on August 10. The report is expected to show inflation, at a multi-decade high, eased in July after the Federal Reserve raised interest rates by 75 basis points in a row in June and July.

But data on Friday showed U.S. payrolls rose by far more than expected and wages were still growing strongly, fueling bets for another outsized rate hike by the Federal Reserve at its Sept. 20-21 meeting.

International News

1. The yield on the U.S. 2/10-year Treasury note inverted by 49 basis points.

2. Rosneft said that since August 4, Ukrtransnafta, the Ukrainian pipeline operator, has suspended transit services for Russian gas.

3. The State Nuclear Power Corporation of Ukraine stated that emergency protection has been activated for a unit of the Zaporozhye nuclear power plant, and there is a risk of hydrogen leakage.

4. Yesterday, the agreement reached by EU member states last month to cut natural gas consumption came into effect. High gas prices in Europe and a gas supply crisis could extend into next year, according to the Economist Intelligence Unit.

5. The UK plans to implement potential power curtailment measures for industry and households in January next year.

6. Qatar set the September offshore crude oil price at a premium of $8.90/barrel over the average Oman/Dubai price, and set the onshore crude oil price at a premium of $10/barrel over the average Oman/Dubai price.

7. For the first time, Iran uses cryptocurrency to pay for import orders worth $10 million.

8. The U.S. Food and Drug Administration grants Emergency Use Authorization for monkeypox vaccine to increase supply.

9. U.S. President Joe Biden signs the Chip and Technology Act of 2022. The semiconductor sector of U.S. stocks tumbled, with the Philadelphia Semiconductor Index closing down 4.57% on Tuesday. Intel CEO Pat Gelsinger believes that the bill may be the “most important industrial policy” in the United States since World War II.

10. The U.S. Securities and Exchange Commission will propose new rules on Wednesday to increase leverage disclosures by hedge funds and private equity funds, sources said. As part of the confidential disclosure, the proposal requires funds to provide more leverage information.

11. Micron plans to invest $40 billion by the end of the current decade to build a “leading memory manufacturing business” in the U.S. in multiple phases.

12. The U.S. Department of Justice is preparing to file a lawsuit against Google over advertising marketing as early as September.

Institutional Currency Viewpoint

1. Scotiabank: USD/CAD sees technical pause ahead of another downtrend

2. Societe Generale: GBP/USD may fall below 1.2 in the next month

3. Mitsubishi UFJ Bank: GBP/USD will not be able to stand above 1.2

4. Morgan Stanley: EUR/USD at risk of falling towards 0.9700

5. National Bank of Canada Wealth Management: EUR/USD will weaken further in the short term

6. ING: EUR/USD will hover in the 1.00-1.02 range for the rest of the year

7. HSBC: GBP/USD will weaken in the short to medium term, Bank of England rate hike is not enough to boost GBP

8. British investment bank Liberum: The euro is expected to recover, boosting some stocks

Declaration| Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

MohicansMarkets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

Read more

December 9-European Perspective

On Friday, December 9, Beijing time, during the Asian and European session, spot gold shocks up, and is currently trading near $ 1795 per ounce. Market concerns about the lingering U.S. recession dragged the dollar down, approaching support for more than five-month lows, providing support for gold prices. Market expectations that the Federal Reserve will slow down some of its interest rate hikes also helped the bulls. However ……

MHM Today’s News

☆ 09:30 China publishes annual rate of CPI for November. ☆ 21:30 U.S. publishes annual rate and month rate of PPI for November. ☆23:00 U.S. releases one-year inflation rate expectations for December and preliminary of University of Michigan Consumer Confidence Index for December. ☆ The following day 02:00 U.S. releases total number of oil wells drilled for the week to Dec. 9. ☆ Next day 04:30 U.S. Commodity Futures Trading Commission publishes its weekly COT Report.

MHMarkets:Gold Bulls Bet on a Rebound, Crude Oil Spot Price Long and Short Competition

On Monday, September 27, during the Asian session and the Asia-Europe session, spot gold fluctuated and dropped, extending the decline of last Friday, reaching a minimum of $1,626.60 per ounce, the lowest since April 7, 2020.

MHMarkets:Pay Attention to the Speeches of Fed Officials

☆At 15:30, the 2023 FOMC voting committee and Chicago Fed President Evans was interviewed by CNBC. Investors will need to be on the lookout for this hawkish call after three Fed officials have said they need to keep raising interest rates and slow the economy "moderately".

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Rate Calc