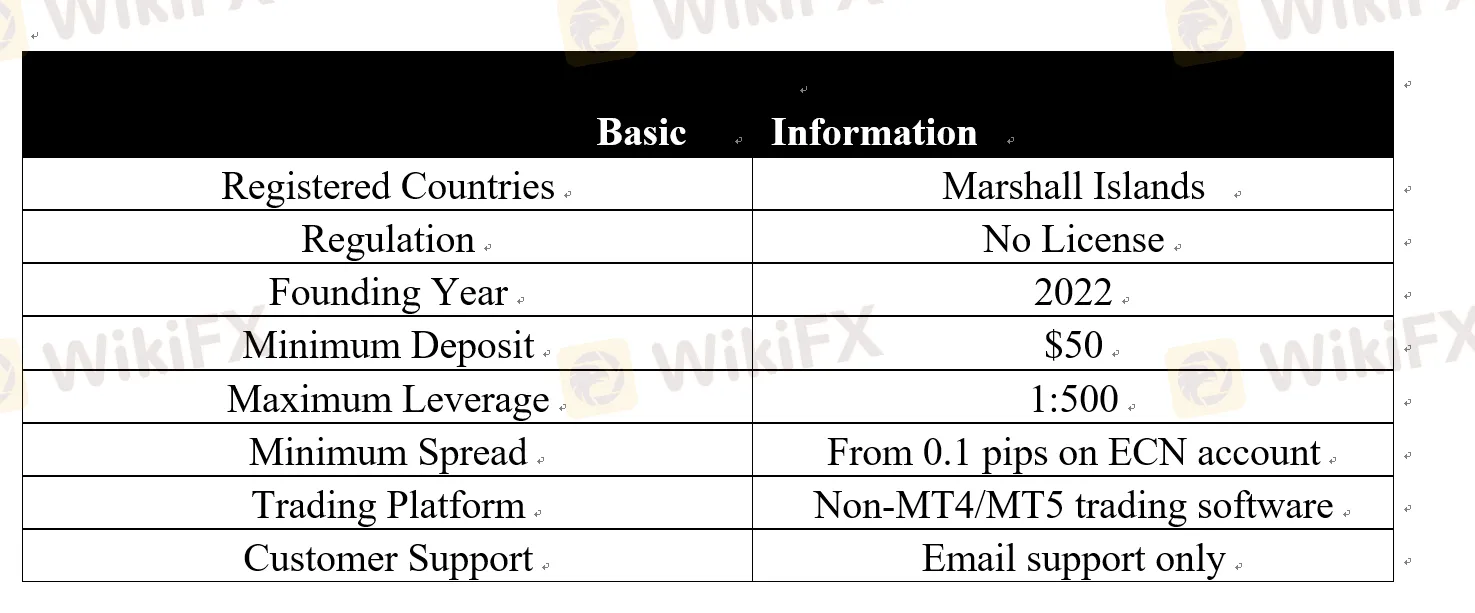

GreenWaveX-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Founded in 2022, GreenWaveX is a newly-established forex broker registered in Marshall Islands, offering its clients access to a series of trading instruments, such as currency pairs, commodities, indices, stocks and more. A total of six trading accounts are available on this brokerage platform and the maximum leverage that traders can use is up to 1:500.

General Information

Founded in 2022, GreenWaveX is a newly-established forex broker registered in Marshall Islands, offering its clients access to a series of trading instruments, such as currency pairs, commodities, indices, stocks and more. A total of six trading accounts are available on this brokerage platform and the maximum leverage that traders can use is up to 1:500.

Is GreenWaveX safe to trade with?

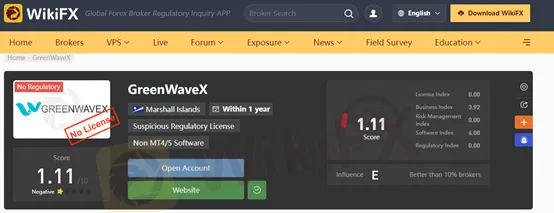

GreenWaveX has disappointed us when it comes to regulations. This broker has been confirmed to be outside of the purview of any regulatory bodies. In this way, its regulatory status on the WikiFX website has been classified as “No License” and it receives a quite low score of 1.11/10.

Forex and CFD trading involving margins contains a high level of risk, and before you decide on which forex broker to use, it is advisable that you go to the WikiFX website to check out a brokerages regulatory information.

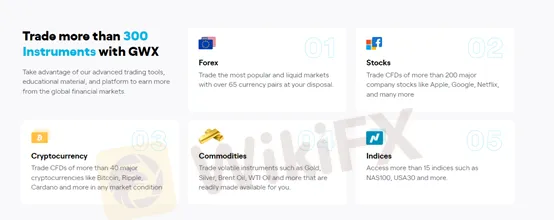

Market Instruments

GreenWaveX claims that it offers diversified range of more than 300 trading assets. Different types of trading instruments, such as Foreign Exchange, a series of CFDs on Commodities, Indices, Cryptocurrencies, Stocks, and Precious Metals are all available through this brokerage platform.

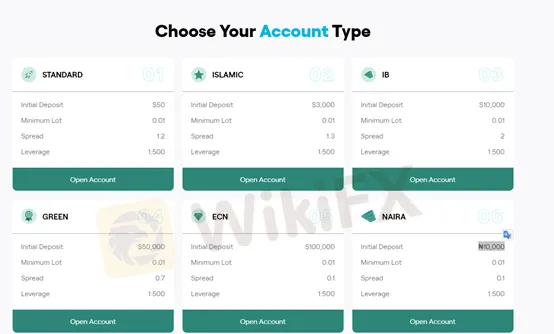

Account Types

A total of six account are available with the GreenWaveX platform: Standard, Islamic, IB, Green, ECN and NAIRA. The Standard account is perfect for novice Forex traders or those who only trade occasionally, with an initial deposit of $50.

If you're an experienced retail trader, you might want to try out the ECN Account that

offers low spreads.

The minimum deposits for these four trading accounts are: the Islamic account from $3,000, the IB account from $10,000, the GREEN account from $50,000, and the ECN account from $100,000.

A special trading account set by this broker, the NAIRA account, requires a quite low initial deposit of ₦10,000.

Spreads & Commissions

Spreads and commissions are set in the end by trading accounts. Spreads offered by the Standard account, the Islamic account, the IB account are relatively high, with the Standard account from 1.2 pips, the Islamic account from 1.3 pips, the IB account from 2 pips, while another three trading accounts offers relatively competitive spreads, with the GREEN account from 0.7 pips, the ECN account from 0.1 pips, and the NAIRA from 0.1 pips.

Leverage

When it comes to leverage, a key red flag with GreenWaveX is that it permits traders to use leverage of up to 1:500, which is significantly higher than the levels regarded appropriate by many regulators.

Since leverage can amplify gains as well as losses, it is important for traders to choose the proper amount that they feel most at ease.

Trading Platform

GreenWaveX only grants its IB trading account holders access to the Web MT4 trading platform, whilst traders with other accounts can only use a web-based trading platform.

Deposit & Withdrawal

There are several payment processor logos shown on the homepage of GreenWaveX website, including VISA, MasterCard, Bank Wire, USDT, and more. With further instruction on its deposit and withdrawal part, we have no idea what payment options work with this brokerage house.

Customer Support

The GreenWaveX official website is available on multiple languages. However, traders can only reach out to this brokerage house about any questions or concerns they may have about their accounts or their trading through an email it gives: support@greenwaves.com.

Or you can follow this brokerage on some popular social media platforms, such as Facebook, Twitter, Instagram, Linkedin, TikTok and Youtube.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc