OU LIAN WEALTH-Some Important Details about This Broker

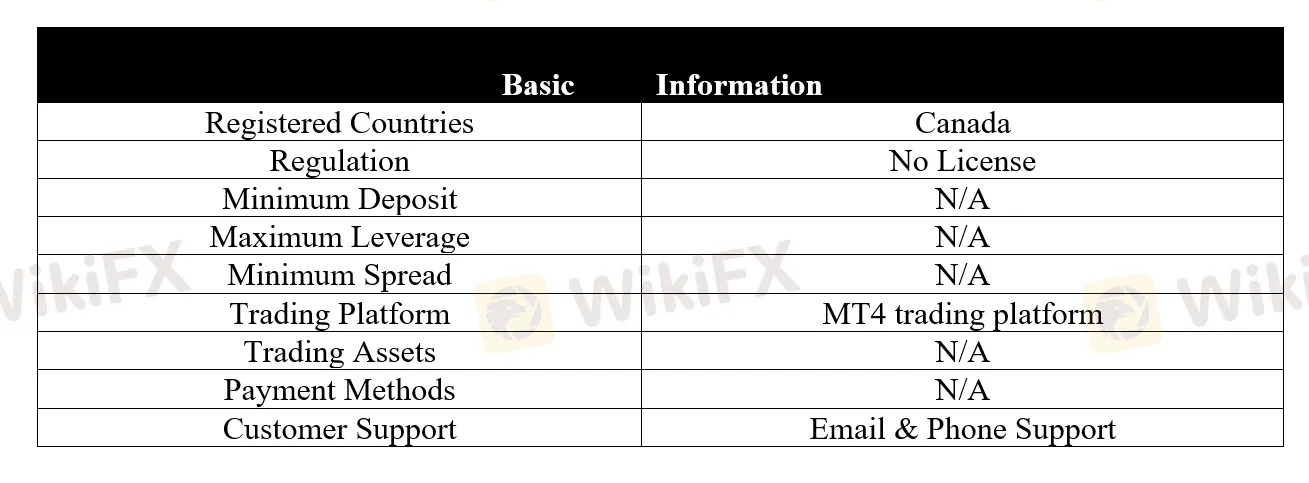

Abstract:According to its presentation, OU LIAN WEALTH is a brokerage firm which is based in Canada, offering a series of trading instruments to its clients. It claims to process daily trades in excess of $130 million and is also offering wealth management services. OU LIAN WEALTH seems to target the Chinese market only. OU LIAN WEALTH is actually based in the United Kingdom, and it is not authorized or regulated by any regulatory authority. Please be aware of the risk.

General Information

According to its presentation, OU LIAN WEALTH is a brokerage firm which is based in Canada, offering a series of trading instruments to its clients. It claims to process daily trades in excess of $130 million and is also offering wealth management services. OU LIAN WEALTH seems to target the Chinese market only.

OU LIAN WEALTH is actually based in the United Kingdom, and it is not authorized or regulated by any regulatory authority. Please be aware of the risk.

Trading Platform

OU LIAN WEALTH provides access to the industry-leading MT5 trading platform that allows one-click operations for opening and closing trades, setting stops and entry limits, placing direct orders, setting and editing limit and stop loss. Besides, it also features multiple technical indicators, user-friendly interface and more importantly, it supports EA (Expert advisors) and Algorithmic trading.

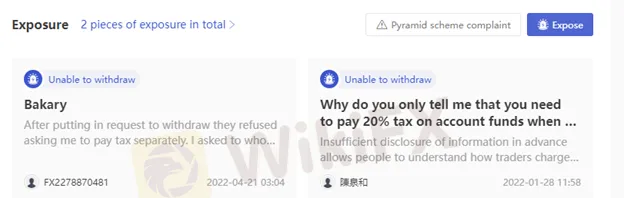

Negative Reviews

Some traders shared their terrible trading environment on this platform, saying that this broker ask him to pay tax after he submitted a withdrawal request. Come to WikiFX to read the whole story.

Customer Support

OU LIAN WEALTH provides the poor customer support, and clients with any inquiries can only get in touch with this broker through an email it gives:

This could be served as the further evidence that this forex broker is an unreliable one that you should not use at all.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Read more

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

5 Arrested in the TriumphFX Investment Scam Investigation

Malaysian authorities have intensified their investigation into the TriumphFX foreign exchange investment scam, resulting in the arrest of five individuals linked to the fraudulent scheme.

Notice: The WikiFX Simulated Trade Weekly Competition has been suspended for one week

Due to an upcoming product upgrade to enhance your overall trading simulation experience, the WikiFX Simulated Trading Weekly Contest will be temporarily suspended from March 10 to March 16. The contest will resume on March 17 with a host of improvements.

Nifty 50 Index Futures Now Available at Interactive Brokers

Trade Nifty 50 Index Futures with Interactive Brokers. Access India’s top 50 firms, diversify portfolios, and manage risk on a powerful trading platform.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

FINMA Opens Bankruptcy Proceedings

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc