BidMarkets

Abstract:BidMarkets' businesss was started from 2014, and we can only get very limited information about this company due to unavailable website. The company requires a minimum deposit of $300, which is relatively high comparing to industry standard. Leverage is up to 1:400 and the broker is said to provide a lousy web-based trading platform with simplistic functions.

Note: BidMarkets' official website: https://bidmarkets.com/ is currently inaccessible normally.

| BidMarkets Review Summary | |

| Founded | 2014 |

| Registered Country/Region | / |

| Regulation | No regulation |

| Market Instruments | / |

| Demo Account | ✅ |

| Spread | 1 pip |

| Leverage | Up to 1:400 |

| Trading Platform | Web-based |

| Min Deposit | $300 |

| Customer Support | Tel: +44 (0) 2045771076 |

| Email: soporte@bidmarkets.com | |

BidMarkets Information

BidMarkets' businesss was started from 2014, and we can only get very limited information about this company due to unavailable website. The company requires a minimum deposit of $300, which is relatively high comparing to industry standard. Leverage is up to 1:400 and the broker is said to provide a lousy web-based trading platform with simplistic functions.

There are some facts that cannot be ignored by you if you want to trade with this broker. Firstly is that the broker operates without valid regulation from authority bodies, meaning less compliance to industry rules and customer protection. Wosely, it even receives warning from the CNMV, a Spanish regulatory body. Moreover, there's one piece of WikiFX exposure about scam issues about this broker. All these signs direct to a possible conclusion: this broker is a scam. That's why we strongly recommend you always to get rid of such brokers.

Regulatory Status

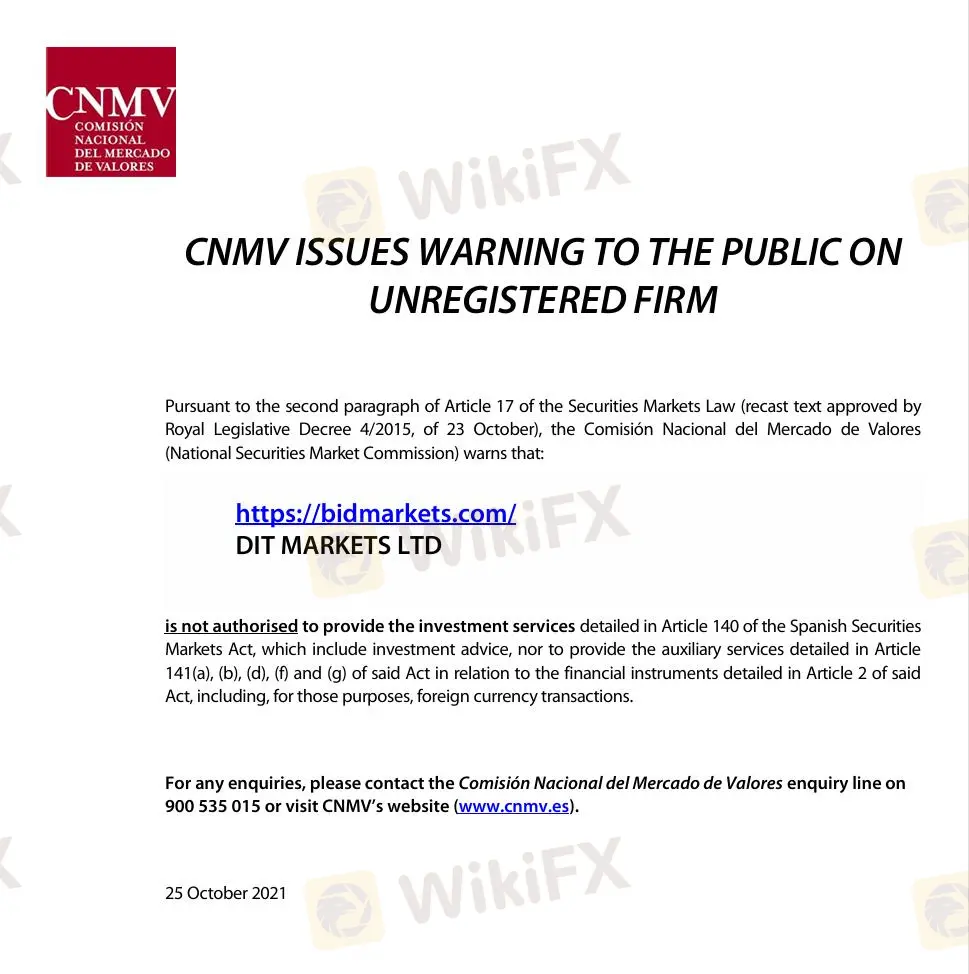

Regulation is a critical factor when assessing the legitimacy and reliability of a brokerage firm, and unfortunately, BidMarkets does not operate under valid regulatory oversight.

What's even worse, the National Securities Market Commission (CNMV) issued a specific warning regarding the BidMarkets website in 2021 that the firm is not authorized to offer financial services in Spain.

Downsides of BidMarkets

Unavailable website: BidMarkets' website cannot be opened currently, which indicates possibility of cease of operation.

Regulatory concerns: The broker not only operates without valid regulation by any financial institutions, but also received a warning letter from the Spanish regulator CNMV about unauthorization to offer financial services, which further highlights its illegitimacy and high risks to investors.

WikiFX exposure: Ther's one piece of exposure from WikiFX about scam issues, indicating unsatisfactory customer experience with this broker that investors can take reference to.

Account Type

BidMarkets offers a demo account for traders to practice themselves before tapping into real trading.

While for live accounts, there's only one Standard account with a minimum deposit of $300 available. The threshold is a little higher than the industry average, which is usually from $100.

Leverage

BidMarkets offers leverage up to 1:400, which allows investors to control a position of 500 times of their initial deposits.

However, you should be very prudent to use such tool since leverage not only amplify profits, but losses will be augmented at same level as well.

Fees

Spread is said to start from 1 pip,but other fees such as commissions are not publically disclosed.

Trading Platform

BidMarkets boasts an “award winning platform”, but actually it's just a web-based platform with only simplistic and limited trading functions.

Deposit and Withdrawal

BidMarkets advertises a wide range of payment methods with icons on its website: Neteller, Skrill, bank transfer, cash payments and credit/debit cards.

However, these info are doubtful due to inaccessibility to accounts.

Read more

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

WikiFX App Version 3.6.4 Release Announcement

We are pleased to announce that WikiFX App Version 3.6.4 has officially been released. This update includes significant functional optimizations. Below are the key updates.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Rate Calc