Macau casino stocks: Can Sands and Wynn see further boost from Beijing?

Abstract:Macau casino stocks have jumped since early November. Beijing announcing existing licence will be renewed and hopes of an end/easing in covid restrictions are seen as key reasons for the stock rises.

Macau casino stocks have jumped since early November. Beijing announcing existing licences will be renewed and hopes of an end/easing in covid restrictions are seen as key reasons for the stock rises.

Sands China (Sands China) currently at HK$24 is up over 57% in the last month. Wynn Macau (WYNN)- currently at HK$7.74 is up 121% over the month.

MGM China (MGM China) - currently at HK$7.13 is up 98% over the month and Melco International Melco International (MLCO)- currently HK$7.88 is up 72% over the month.

Given the high percentage increase is there an argument that the positive noises on licensing and potential easing of Covid restriction are now priced into the stocks?

On closer inspection you could argue that the stock prices, historically speaking, are not inflated at current levels. Pre-pandemic, Sands China was priced at HK$44; Wynn Macau at HK$21;MGM China HK$17; and Melco International HK$22

All four stocks are still signficantly lower than these pre-Covid price levels. While the past month has shown positive momentum for these Macau names, it has been a pretty torrid year – so any bounce now is relative.

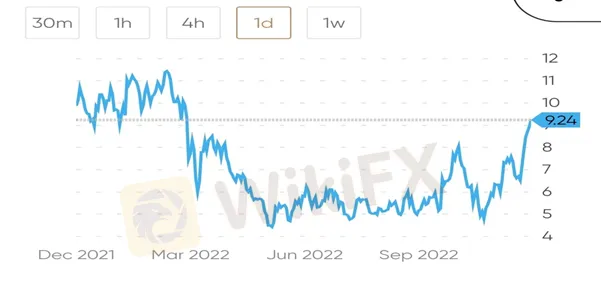

Melco International share price chart

Last year, the Macau government pledged to step up oversight of casinos. This hard-line stance wiped more than $20bn off the market value of listed gambling operators, as fears that tight regulations could squeeze margins already impacted by Covid-19.

Casino stocks took one hell of a tumble as investors feared that as licenses to operate in Macau expired and gaming laws were reviewed, casino groups were essentially a high-risk bet.

But the landscape has changed somewhat since then. Last month, Beijing confirmed that the casino licenses of many of the operators in Macau - including all four profiled here - would be renewed. Given the billions of dollars the casino groups have ploughed into the China-owned territory to make it a global gambling centre, there will have been a huge and collective sigh of relief.

Investment in Macau

There is though, a degree of compromise with Beijing‘s offer. Those awarded licenses will be obliged to increase the focus on overseas customers and develop non-gaming projects. It is believed casino groups may have to invest something in the region of $12.5bn (combined) and in so doing, diversify Macau’s tourist profile.

The attraction to families and non-gamblers is something that Las Vegas has pursued with theme/water parks, music events, shopping centres and art exhibitions included in the mix.

Lawrence Ho, chairman and chief executive of Melco, gave a clear indication that Beijings expectations for casino groups would be satisfied.

“We are committed to Macau and its development as Asia's premier tourist destination,” he said in a statement.

Brokers are largely bullish on these casino names right now. Marketbeat has a ‘strong buy’ recommendation for China Sands. And it has a ‘moderate buy’ rating for Melco International with a consensus price target of HK$11.51.

Read more

IVY MARKETS Exposure: Traders Allege Illegitimate Fees, Blocked Withdrawal Orders & No Refunds

Did IVY Markets deduct unfair fees from your deposit amount? Has your forex trading account been deleted by the broker on your withdrawal request? Failed to withdraw your funds after accepting the IVY Markets deposit bonus? Did the broker fail to address your trading queries, whether via email or phone? Such issues have been affecting many traders, who have expressed their displeasure about these on broker review platforms. In this IVY Markets review article, we have investigated some complaints. Keep reading to know the same.

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

WikiFX Broker

Latest News

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc