Stay Away from Capital Crypto Reserve!

Abstract:Pay more to get your funds back?! Capital Crypto Reserve is such a scrupulous broker that everyone must avoid.

WikiFX is a global forex broker regulatory inquiry app that has investigated and reviewed over 40,000 brokers while collaborating with more than 30 regulators. To learn more about the security and legitimacy of your chosen forex brokers, simply log on to www.wikifx.com and utilize the search bar to arrive at the answers for your broker inquiries. Simultaneously, we also act as an intermediary that solves disputes between trading clients and their brokers.

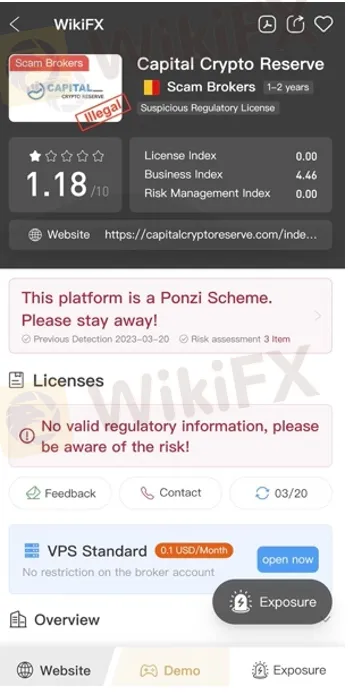

WikiFX did a review on Capital Crypto Reserve and failed to find any information about this broker's regulatory status. The reason for this investigation was that WikiFX received an Exposure submission from a trader named J****, who was ufairly treated by this broker.

Capital Crypto Reserve (www.capitalcryptoreserve.com) is an online broker that provides CFDs for several trading instruments, such as forex, commodities, cryptocurrencies and more.

Upon checking the database of WikiFX, we found that Capital Crypto Reserve is a relatively new broker that is currently operating without any valid licenses. We at WikiFX do not recommend choosing a broker with this high ambiguity level, as it could possess high underlying risks.

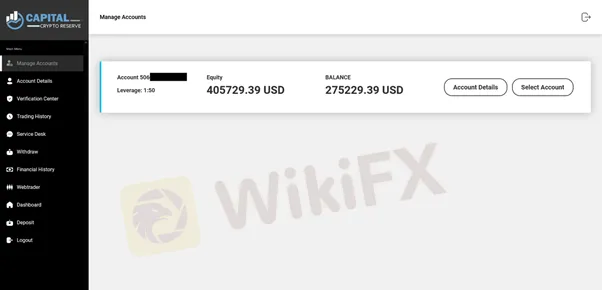

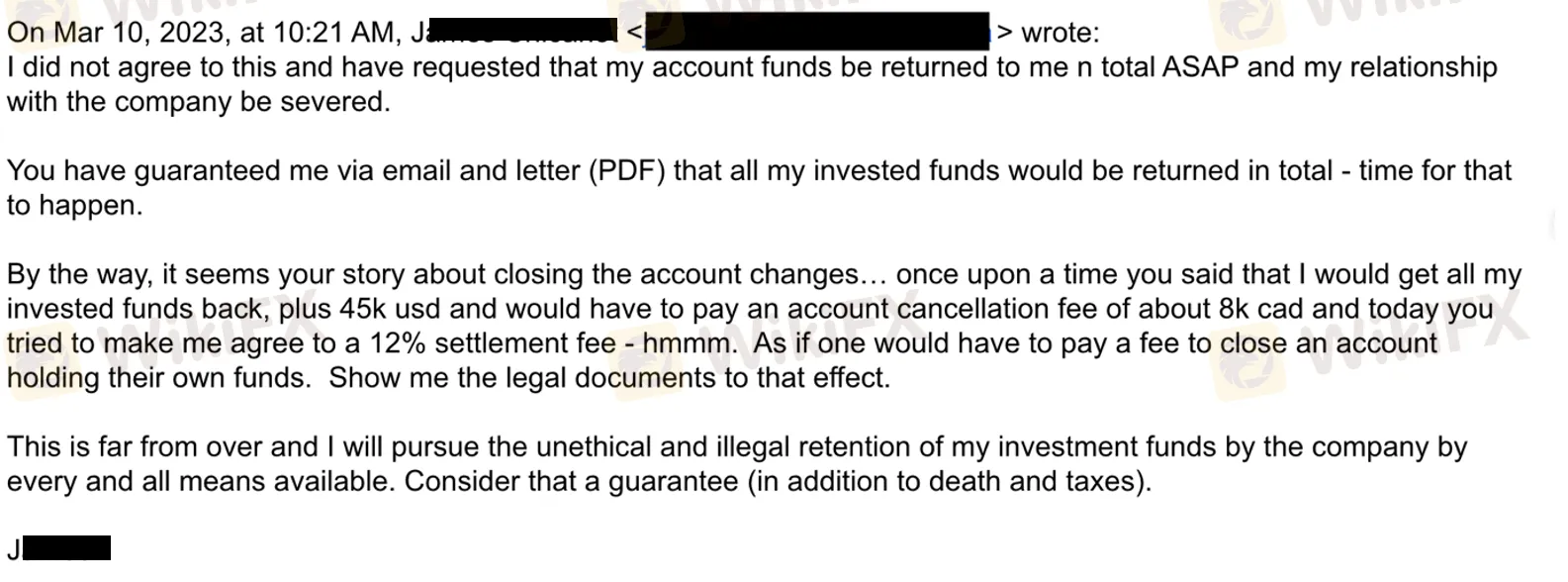

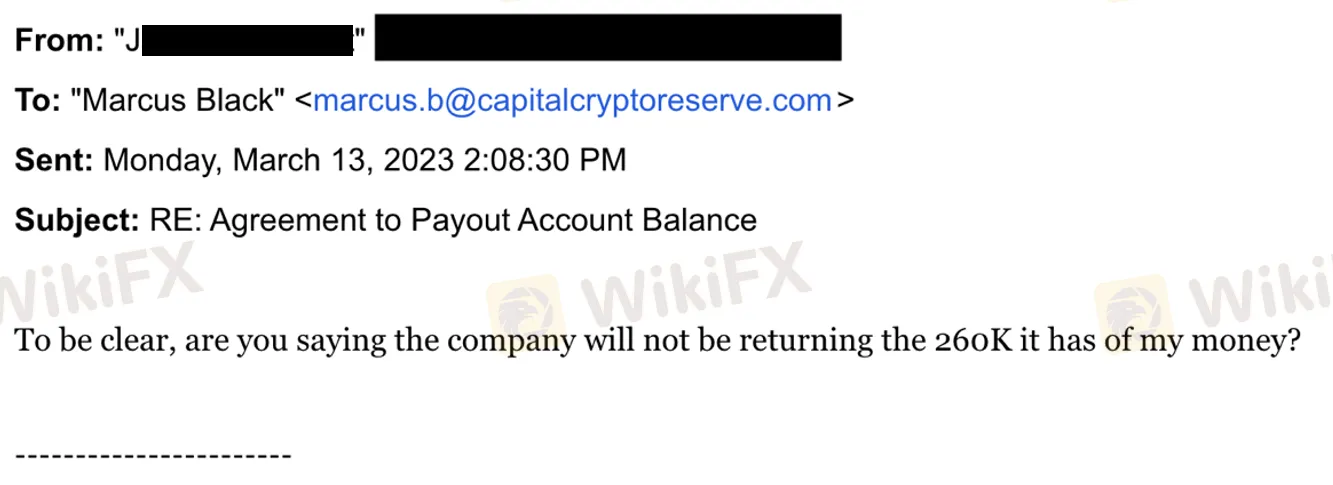

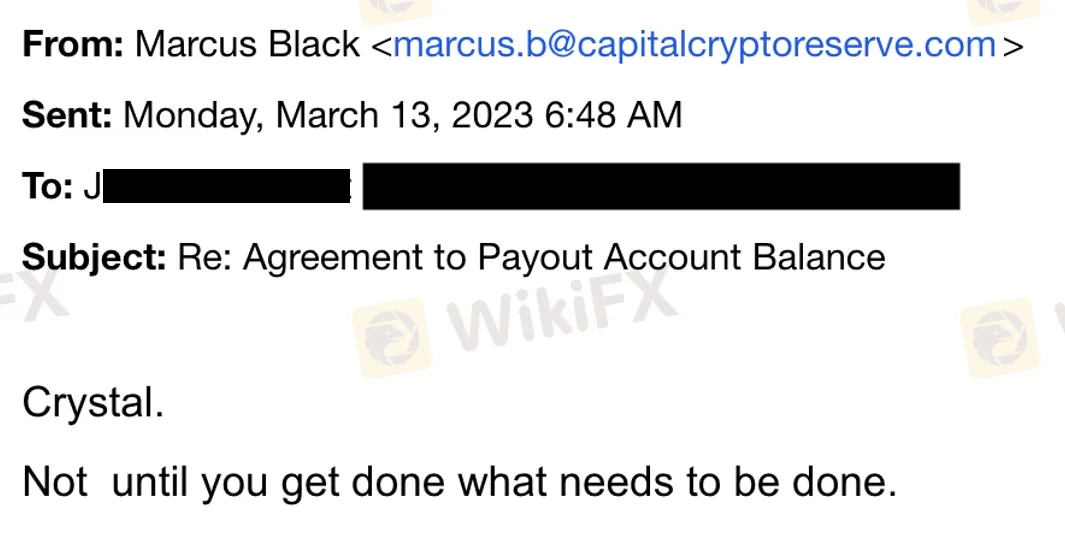

J**** (because of the request, we have covered the full name in the following screenshots) has a live trading account with Capital Crypto Reserve which he wishes to withdraw from.

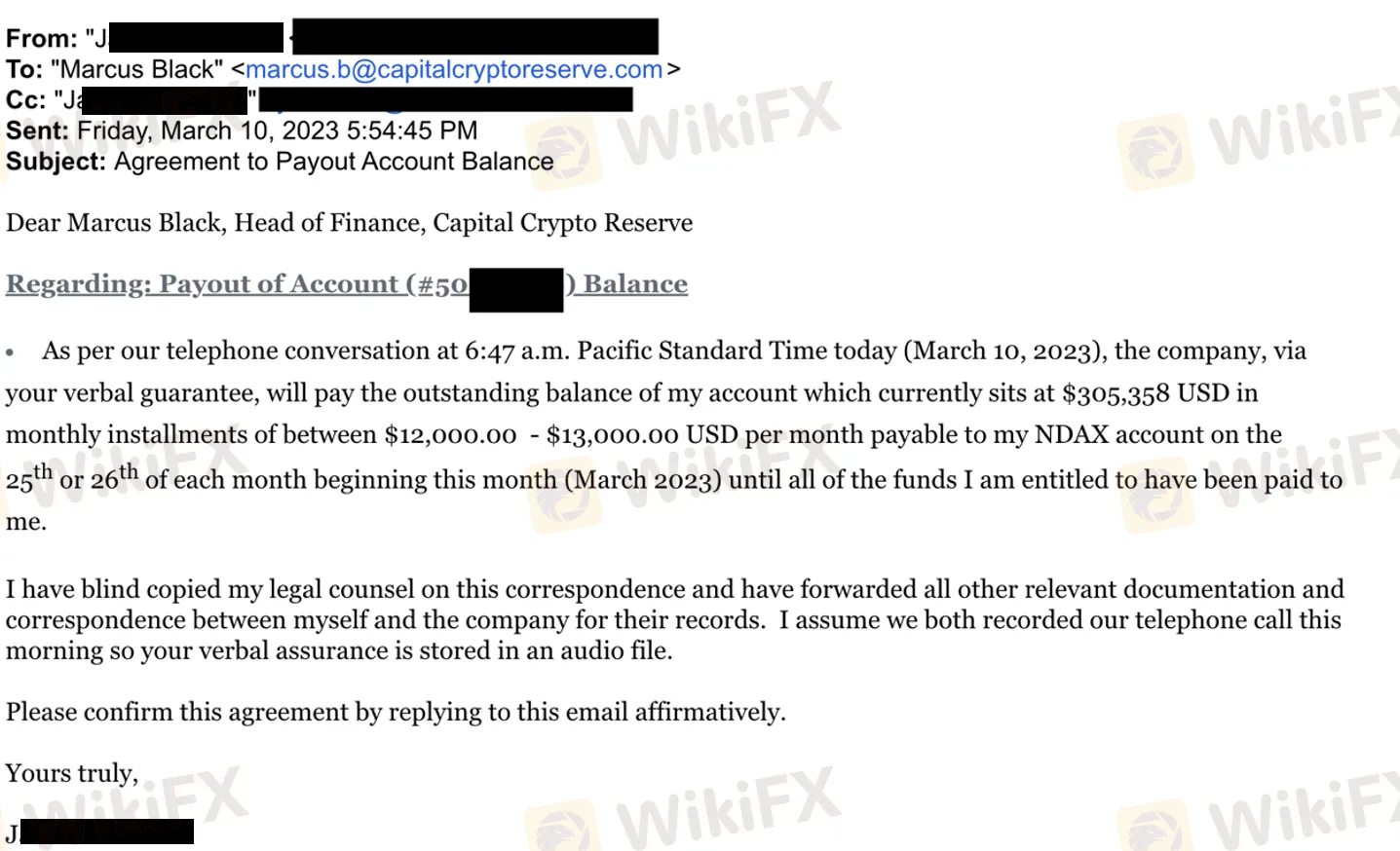

However, when he reached out to the broker for his withdrawal request, he was told that he had to deposit more money in order to be able to retrieve his funds. Of course, J**** was very unhappy about this response, so he continued seeking clarification from the customer representative who was serving him, Marcus Black. Little did J**** know that he would get rude treatment and accusations from Marcus.

From these screenshots and the crude replies from Marcus, it is evident that Capital Crypto Reserve is a scam broker. In no circumstances should a broker or its customer representative ask for more money from its clients if it is a reliable company.

Lastly, if you ever feel icky about the broker you are currently engaging with, do not hesitate to conduct a background check through our free mobile application or website. Just a few clicks could potentially save you from the traps of scammers.

Read more

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

WikiFX Broker

Latest News

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

OmegaPro Review 2026: Is This Forex Broker Safe?

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

Rate Calc