cryptocurrency.ax

Abstract:Cryptocurrency.ax, founded in 2022 and headquartered in Estonia, operates as an unregulated brokerage firm offering a range of tradable assets including Forex, Stocks, Indices, Commodities, and Cryptocurrencies. The platform provides various account types, namely Basic, Gold, and Exclusive, each with different minimum deposit requirements and leverage options. Deposit methods include bank card, bank transfer, and cryptocurrencies, with customer support available via email and phone for offices in Estonia, Manchester, and London. Educational resources such as webinars, seminars, training courses, trade leaders' guidance, video lessons, and demo accounts are offered to assist traders. However, the company does not provide any bonus offerings.

| Cryptocurrency.ax | Basic Information |

| Company Name | Cryptocurrency.ax |

| Founded | 2022 |

| Headquarters | Estonia |

| Regulations | Not regulated |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

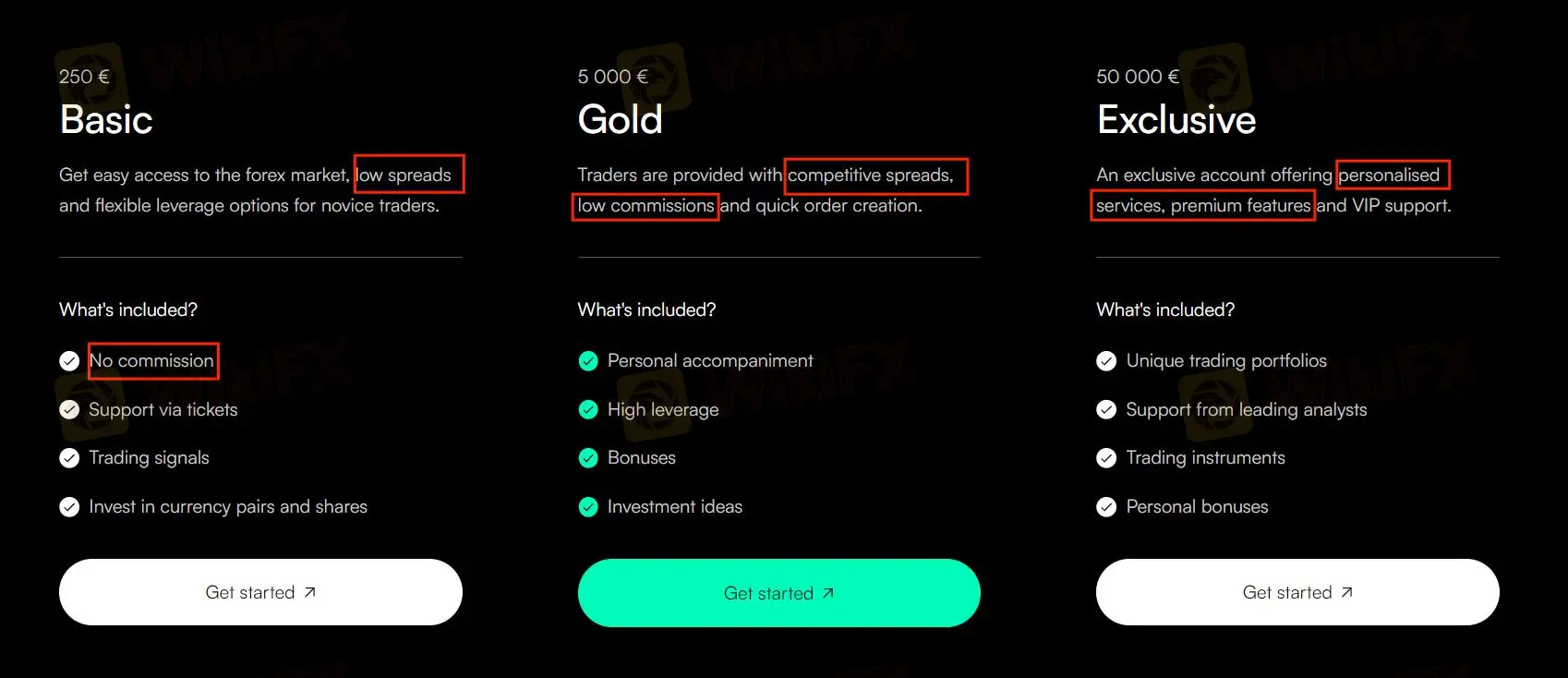

| Account Types | Basic, Gold, Exclusive |

| Minimum Deposit | Basic: €250, Gold: €5,000, Exclusive: €50,000 |

| Maximum Leverage | Basic: Flexible, Gold: High, Exclusive: Personalized |

| Spreads | Varies by account type |

| Commission | Varies by account type |

| Deposit Methods | Bank card, Bank transfer, Cryptocurrencies |

| Trading Platforms | Proprietary platform |

| Customer Support |

|

| Education Resources | Webinars and seminars, training courses, trade leaders' guidance, video lessons, demo accounts |

| Bonus Offerings | None |

Overview of Cryptocurrency.ax

Cryptocurrency.ax, established in 2022 and based in Estonia, operates as an unregulated brokerage firm, offering a diverse range of tradable assets including Forex, Stocks, Indices, Commodities, and Cryptocurrencies. With account types ranging from Basic to Exclusive, catering to varying levels of traders, and flexible deposit methods encompassing bank cards, bank transfers, and cryptocurrencies, Cryptocurrency.ax aims to provide accessible trading options. The platform also offers educational resources such as webinars, seminars, training courses, and demo accounts to support traders in enhancing their skills and knowledge. However, it's important to note that Cryptocurrency.ax does not provide regulated services, and traders should exercise caution when engaging with the platform.

Is Cryptocurrency.ax Legit?

Cryptocurrency.ax operates without regulation. It's crucial to understand that this broker lacks valid regulation, indicating it operates without oversight from established financial regulatory bodies. Traders should exercise caution when dealing with an unregulated broker like Cryptocurrency.ax due to potential risks. These risks include limited options for resolving disputes, concerns regarding the safety of funds, and a lack of transparency in the broker's operations. Traders are advised to conduct thorough research on a broker's regulatory status before engaging in trading activities to enhance the safety and security of their trading experience.

Pros and Cons

Cryptocurrency.ax boasts a diverse array of tradable assets and multiple account types to cater to varying trading preferences. However, its unregulated status poses risks due to the lack of oversight, and limited transparency regarding costs may impact trader confidence. Additionally, the absence of bonus offerings could deter traders seeking incentives. Overall, while the platform offers accessibility and options for portfolio diversification, traders should proceed with caution and consider the associated risks.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

Cryptocurrency.ax offers a range of trading instruments, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| Cryptocurrency.ax | Yes | Yes | Yes | No | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

Cryptocurrency.ax offers three account types: Basic, Gold, and Exclusive. The Basic account requires a minimum deposit of €250, the Gold account requires a minimum deposit of €5,000, and the Exclusive account requires a minimum deposit of €50,000.

Leverage

Cryptocurrency.ax offers three account types: Basic, Gold, and Exclusive. Each account provides different levels of access and benefits:

Basic: Flexible leverage options suitable for novice traders.

Gold: High leverage for experienced traders.

Exclusive: Personalized leverage options for VIP clients.

Spreads and Commissions

Cryptocurrency.ax offers three account types: Basic, Gold, and Exclusive, each with varying benefits. Regarding spreads and commissions:

Basic: No commission with low spreads for easy access to the forex market.

Gold: Competitive spreads and low commissions for traders seeking efficient order execution.

Exclusive: Premium features with personalized services, including unique trading portfolios and support from leading analysts.

Deposit & Withdrawal

Cryptocurrency.ax offers three Deposit & Withdraw Methods:

Cryptocurrencies: Transfer funds to/from specified crypto-wallets.

Bank card: Deposit/withdraw funds using card details.

Bank transfer: Initiate deposits/withdrawals via bank transfer.

Trading Platforms

Cryptocurrency.ax provides a proprietary trading platform with an innovative trading panel comparable to MetaTrader4 and MetaTrader5. It ensures full-fledged trading after completing simple procedures.

Customer Support

Cryptocurrency.ax offers customer support through multiple channels:

Email:

Tartu, Estonia: support.ee@cryptocurrency.ax

Manchester, UK: support.uk@cryptocurrency.ax

London, UK: support@cryptocurrency.ax

Phone:

Tartu, Estonia: (372) 6600433

Manchester, UK & London, UK: (44) 2045243912

Physical Addresses:

Tartu, Estonia: Riia 142, 50415 Tartu, Estonia

Manchester, UK: 1 Hardman St, Manchester M3 3EB

London, UK: 91 Battersea Park Rd, London SW8 4UD

Educational Resources

Cryptocurrency.ax provides traders with various educational resources, including webinars, training courses, trade leaders' guidance, video lessons, and demo accounts.

Conclusion

In conclusion, Cryptocurrency.ax presents traders with a diverse range of tradable assets and multiple account types, fostering accessibility and portfolio diversification. However, its unregulated status poses inherent risks, lacking oversight from financial regulatory authorities. Limited transparency regarding costs may impact trader confidence, while the absence of bonus offerings could deter those seeking additional incentives. Despite these drawbacks, Cryptocurrency.ax provides flexible deposit methods and educational resources, offering opportunities for traders to enhance their skills and knowledge. Ultimately, while the platform offers potential for growth and exploration in the trading world, traders should approach with caution and carefully consider the associated risks.

FAQs

Q: What assets can I trade on Cryptocurrency.ax?

A: Cryptocurrency.ax allows trading in a variety of assets, including currencies, stocks, indices, commodities, and cryptocurrencies.

Q: How many types of accounts does Cryptocurrency.ax offer?

A: Cryptocurrency.ax provides traders with three account options: Basic, Gold, and Exclusive, each tailored to different trading preferences and experience levels.

Q: Is Cryptocurrency.ax regulated by any financial authorities?

A: No, Cryptocurrency.ax operates as an unregulated brokerage firm, which means it lacks oversight from recognized financial regulatory authorities.

Q: What are the minimum deposit requirements for each account type on Cryptocurrency.ax?

A: The minimum deposit varies depending on the account type: Basic requires €250, Gold requires €5,000, and Exclusive requires €50,000.

Q: What deposit methods are available on Cryptocurrency.ax?

A: Cryptocurrency.ax offers multiple deposit options, including bank cards, bank transfers, and cryptocurrencies, providing flexibility for traders.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

IIFL Capital Faces SEBI's Regulatory Warning

How Can Fintech Help You Make Money?

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Good News for Nigeria's Stock Market: Big Gains for Investors!

Rate Calc