Beware! Scammer Targeting Users of Paxful Financials!

Abstract:In the dynamic landscape of digital finance, a recent incident within Paxful Financials sheds light on the risks faced by users, as Adefisayo's encounter with fraudulent activity underscores the importance of vigilance and caution in navigating cryptocurrency platforms.

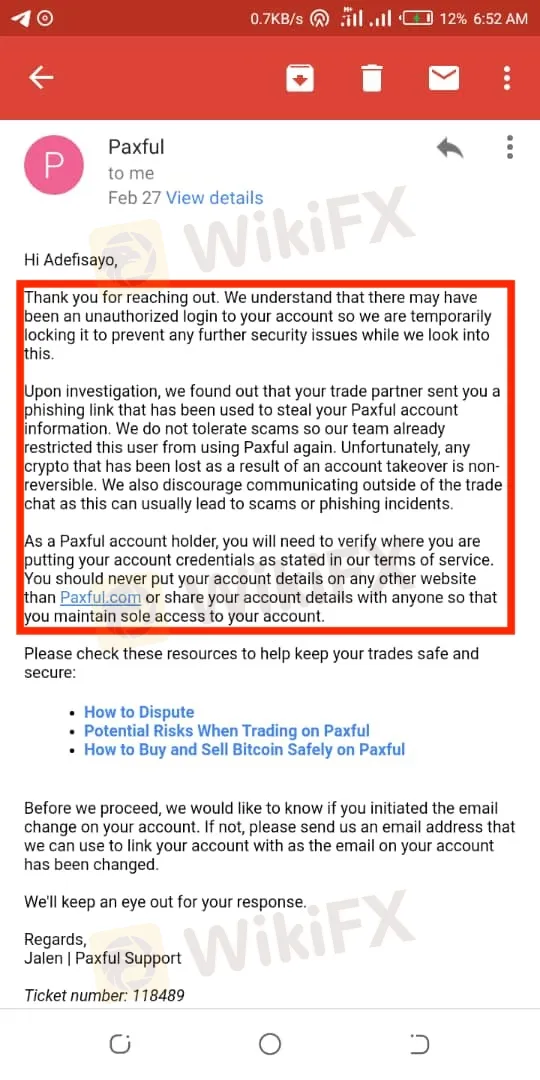

In the realm of digital finance, instances of deception and monetary loss unfortunately often emerge, leaving victims to grapple with the aftermath of trust betrayed. One such incident has arisen within Paxful Financials, where a user, Adefisayo, encountered a troubling ordeal involving a merchant known as SubskbotuqZ. Adefisayo, like many others drawn to the allure of digital transactions and financial autonomy, navigated onto Paxful Financials (Paxful). However, their journey took an unexpected turn upon encountering SubskbotuqZ. Under the guise of legitimate transactions, SubskbotuqZ managed to swindle Adefisayo out of a significant sum, accessing their account without authorization through a phishing link and resulting in a loss of $65.45 in Neteller funds.

Promptly recognizing the fraudulent nature of the transaction, Adefisayo sought recourse through Paxful's official channels, anticipating a swift resolution and the recovery of their lost funds. However, instead of finding solace in the platform's purported safeguards, Adefisayo was met with disappointment. Paxful's response, rather than offering tangible assistance in recovering the lost funds, merely involved the removal of the offending merchant from the platform.

This unfortunate sequence of events serves as a poignant reminder to all participants in the digital finance sphere of the inherent risks associated with such endeavours. Despite promises of security measures and regulatory oversight, instances of deceit and financial loss persist, leaving victims stranded in the wake of deception.

Established by a team of developers, Paxful operates as a peer-to-peer exchange platform aimed at simplifying access to Bitcoin. Facilitating direct exchanges, the platform enables buyers and sellers of cryptocurrencies to connect and conduct transactions directly. Transactions on Paxful typically entail buyers depositing cash through various payment methods supported by the platform, such as prepaid VISA, Gift Card Code, or Western Union, into the seller's account. Upon confirmation of receipt of funds from Paxful's escrow service, sellers release Bitcoins directly to the buyers. Notably, Paxful stands out from centralized exchanges due to its streamlined access - users are not required to create a username or password to access the marketplace; only their email address is necessary. For individuals residing in regions where centralized cryptocurrency exchanges are inaccessible or prohibited, Paxful emerges as a viable solution. Its accessibility from any location with internet connectivity positions it as a convenient option for users seeking alternative avenues for cryptocurrency transactions. However, notwithstanding Paxful's ambitious claims, it's essential to note that the platform is not regulated according to WikiFX's findings. With a low WikiScore of 1.36 out of 10, Paxful is deemed a highly risky broker to engage with.

WikiFX emphasizes the importance of opting for regulated brokers with a WikiScore of 7.0 or above to safeguard capital and trading experiences effectively.

Read more

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Did you encounter the sudden disappearance of Tag Markets’ MT5 one-click button? Did it result in wiping out your forex trading account balance? Does the broker disallow you profit withdrawals? Do you frequently witness price mismatches on the Tag Markets login? Has this piled on your capital losses? These experiences sum up the below-standard forex trading journey many traders have had with the broker. Some of them discussed such experiences while sharing the Tag Markets review. Take a look!

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

WikiFX Broker

Rate Calc