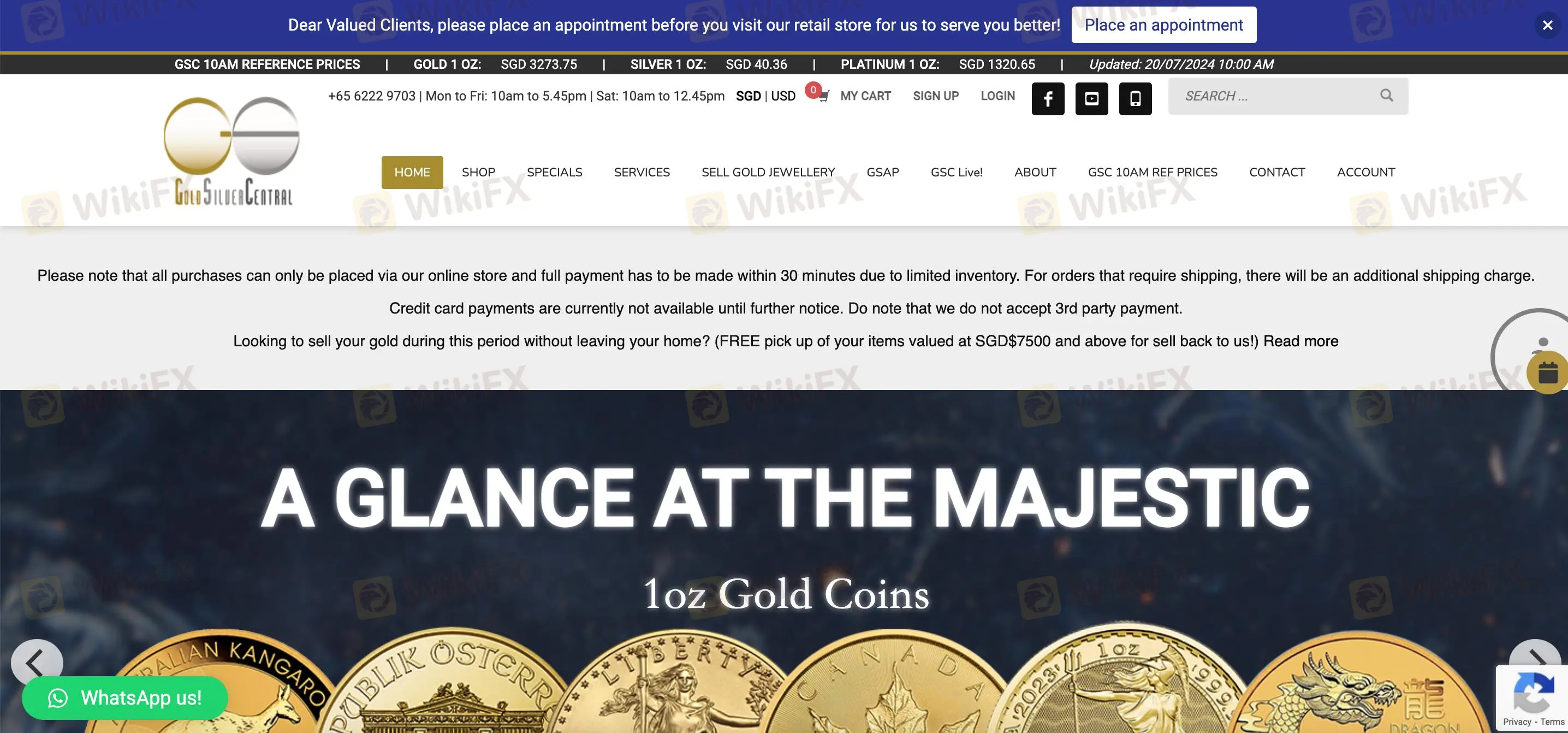

GoldSilver Central

Abstract:GoldSilver Central, founded 5-10 years ago and located in Singapore, specializes in trading precious metals such as gold, silver, and platinum. The platform operates without regulatory oversight. Users can trade with a low fee of 0.25% for both buying and selling, and face high distributor fees of 3% for smaller transactions. Payment methods include cash, internet banking, PayNow, NETS, telegraphic transfer, and cheques. Customer support is accessible via phone, WhatsApp, fax, and email.

| Aspect | Details |

| Company Name | GoldSilver Central |

| Registered Country/Area | Singapore |

| Founded Year | 5-10 years ago |

| Regulation | Unregulated |

| Market Instruments | Gold, Silver, Platinum, Numismatic Coins, Collectibles |

| Fees | 0.25% trading fee for buying and selling |

| Customer Support | Phone at +65 6222 9703, WhatsApp at +65 8893 9255, fax at +65 6750 4513, or email at enquiry@goldsilvercentral.com.sg |

| Deposit & Withdrawal | Cash, Internet Banking, PayNow, NETS, Telegraphic Transfer, Personal and Cashier's Cheque |

| Educational Resources | Simple FAQ, User Guide |

Overview of GoldSilver Central

GoldSilver Central, founded 5-10 years ago and located in Singapore, specializes in trading precious metals such as gold, silver, and platinum.

The platform operates without regulatory oversight. Users can trade with a low fee of 0.25% for both buying and selling, and face high distributor fees of 3% for smaller transactions.

Payment methods include cash, internet banking, PayNow, NETS, telegraphic transfer, and cheques. Customer support is accessible via phone, WhatsApp, fax, and email.

Regulatory Status

GoldSilver Central operates without regulatory oversight, meaning it is not monitored by any official financial authority. This lack of regulation can lead to higher risks for investors, as there is no guarantee of protection or adherence to industry standards.

Pros and Cons

| Pros | Cons |

| Low trading fees (0.25% per transaction) | Unregulated |

| Various payment methods | High distributor's fees for small trades (3%) |

| No storage fees for unallocated gold and platinum | Limited range of trading assets |

| Various customer support channels | Basic educational resources only |

Pros

- Low Trading Fees: GoldSilver Central charges a low trading fee of 0.25% per transaction, making it cost-effective for frequent traders.

- Various Payment Methods: The platform supports multiple payment options, including cash, internet banking, PayNow, NETS, telegraphic transfer, and personal and cashier's cheques, providing flexibility for users.

- No Storage Fees for Unallocated Gold and Platinum: Users storing unallocated gold and platinum do not incur any storage fees, reducing overall costs.

- Various Customer Support Channels: Customers can reach support through multiple channels, including phone, WhatsApp, fax, and email, ensuring accessibility and convenience.

Cons

- Unregulated: GoldSilver Central operates without regulatory oversight, potentially increasing risks for investors due to the lack of official monitoring and protection.

- High Distributor's Fees for Small Trades: The platform charges a high distributor's fee of 3% for small trades between USD 5,000.00 and USD 9,999.99, which can be costly for smaller investors.

- Limited Range of Trading Assets: Despite offering various precious metals, the overall range of trading assets is somewhat limited compared to other platforms, potentially restricting investment opportunities.

- Basic Educational Resources: The educational resources provided, such as the Simple FAQ and User Guide, are basic and are not sufficient for users seeking in-depth market analysis or advanced trading strategies.

Market Instruments

GoldSilver Central focuses on precious metal trading.

Their offerings include 514 different gold products and 343 silver products. Platinum is represented by 53 products, while the platform also features 38 items under the GSC Emotionals category and 63 proof coins and collectibles.

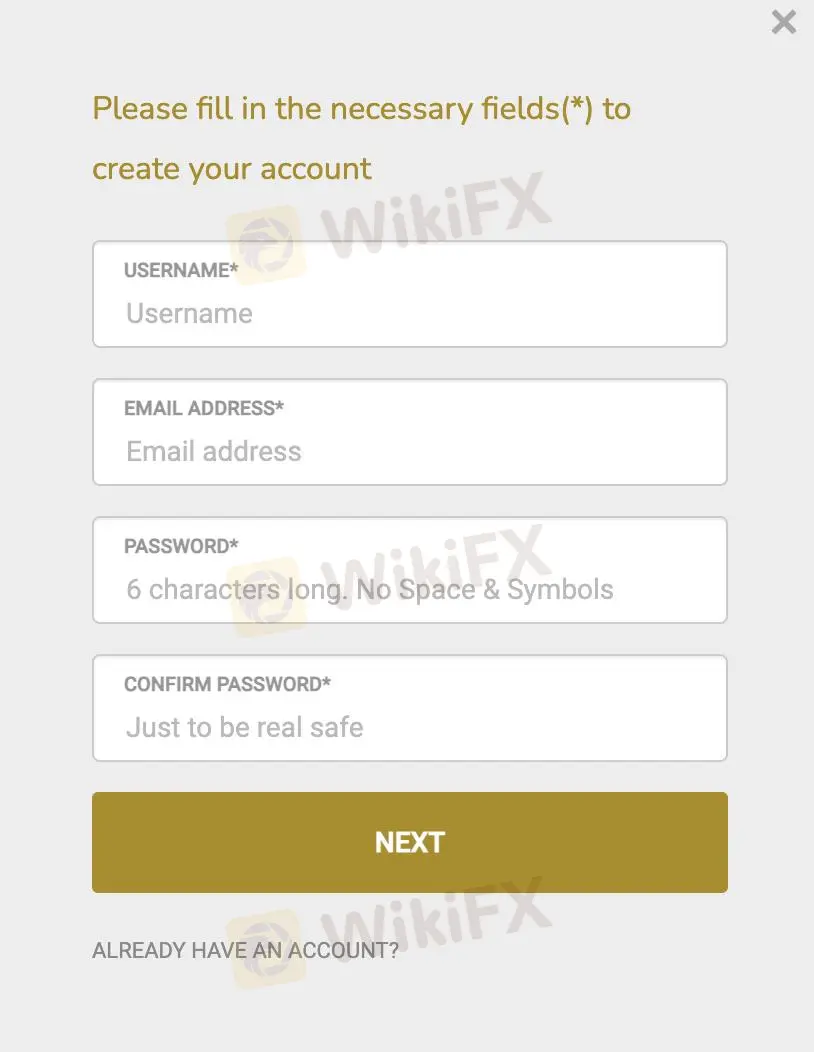

How to Open an Account?

- Visit the Website: Go to the official GoldSilver Central website.

- Navigate to Account Registration: Find and click on the “Open an Account” or “Sign up” button, located at the top right corner of the homepage.

- Fill in Personal Details: Complete the registration form with your personal information, including full name, contact details, and email address.

- Provide Identification: Upload required identification documents, such as a government-issued ID and proof of address, for verification purposes.

- Agree to Terms: Read and accept the terms and conditions of GoldSilver Central.

- Submit Application: Submit the completed application form and wait for a confirmation email from GoldSilver Central to finalize your account setup.

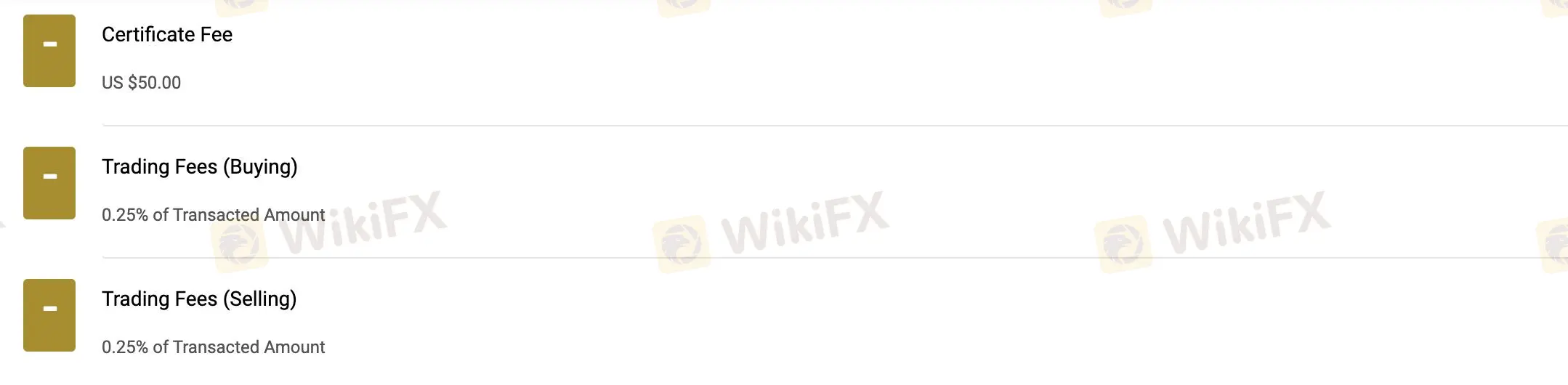

Spreads &Commissions

GoldSilver Central charges various fees for trading and storing precious metals.

The Trading Fees for both buying and selling are set at 0.25% of the transacted amount.

The Distributor's Fees for buying range from 3.00% for transactions between USD 5,000.00 to USD 9,999.99, down to 2.00% for amounts of USD 100,000.00 and above.

For selling, the Distributor's Fee is 3.00% for transactions between USD 5,000.00 to USD 9,999.99, with a flat rate of 1.0% for all amounts.

Compared to popular brokers, GoldSilver Central's trading fees of 0.25% are relatively standard, but the distributor fees, particularly for lower transaction amounts, are higher. For example, many brokers typically charge lower percentages or flat fees for larger transactions, making GoldSilver Central's fees more suitable for smaller, frequent traders rather than large, high-volume investors.

Additionally, there is a Certificate Fee of USD 50.00 and Storage Fees for pooled allocated silver at 0.95%. Gold and platinum have no storage fees for unallocated accounts.

Deposit & Withdrawal

GoldSilver Central offers various payment methods for customer convenience. You can make Cash Payments in SGD at their retail store or upon order collection. For online purchases, an advance payment of 20% is required to lock in the order, with the balance payable within five business days. Internet Banking and PayNow provide electronic transfer options, while NETS allows direct debit transactions. Telegraphic Transfer is available for international payments. Personal and Cashier's Cheques are also accepted.

For online orders, GoldSilver Central requires a minimum deposit of 20% of the total purchase amount to secure the order.

Customer Support

GoldSilver Central offers customer support through various channels.

Customers can reach them by phone at +65 6222 9703, WhatsApp at +65 8893 9255, fax at +65 6750 4513, or email at enquiry@goldsilvercentral.com.sg.

For payment and accounts matters, contact accounts@goldsilvercentral.com.sg.

Operating hours are Monday to Friday, 10am to 5.45pm, and Saturday, 10am to 12.45pm. They are closed on Sundays and Public Holidays.

Educational Resources

GoldSilver Central provides basic educational resources, including a Simple FAQ and a User Guide.

The FAQ section addresses common questions about trading, payment methods, and account management, offering straightforward answers to help users navigate the platform.

The User Guide provides step-by-step instructions for account setup, trading processes, and utilizing various features. While these resources are helpful for beginners, they can be limited for advanced investors seeking in-depth market analysis or sophisticated trading strategies.

Conclusion

GoldSilver Central offers a range of advantages, including low trading fees of 0.25% per transaction and various payment methods like cash, internet banking, and PayNow. Additionally, there are no storage fees for unallocated gold and platinum.

However, the platform's disadvantages include its unregulated status, which poses potential risks. Distributor fees can be high, reaching 3% for transactions between USD 5,000.00 and USD 9,999.99, and educational resources are limited to a basic FAQ and User Guide.

FAQ

- What is the trading fee for buying and selling?

- GoldSilver Central charges a trading fee of 0.25% for both buying and selling transactions.

- What are the distributor's fees?

- Distributor's fees are 3% for transactions between USD 5,000.00 and USD 9,999.99, and 2% for amounts over USD 100,000.00. Selling fees are 3% for transactions between USD 5,000.00 and USD 9,999.99, and 1.0% for all other amounts.

- Which payment methods are accepted?

- The platform accepts cash, internet banking, PayNow, NETS, telegraphic transfer, and personal and cashier's cheques.

- Are there any storage fees for metals?

- There are no storage fees for unallocated gold and platinum, but pooled allocated silver incurs a 0.95% fee.

- What educational resources are available?

- GoldSilver Central provides a basic FAQ and User Guide for educational purposes.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Read more

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

CPT Markets Secures UAE SCA License for FX and CFDs Services

CPT Markets’ UAE subsidiary, CPT MENA, secures an SCA Category Five license, expanding its FX and CFDs services in the region. Learn more about its UAE growth.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc