【MACRO Insight】The Fed’s policy adjustment and the precious metals market , exploring the future tre

Abstract:Fed Chairman Jerome Powell discussed a range of policy issues, including rate cuts, in an interview at the DealBook/Summit conference hosted by the New York Times. The Fed began a rate-cutting cycle i

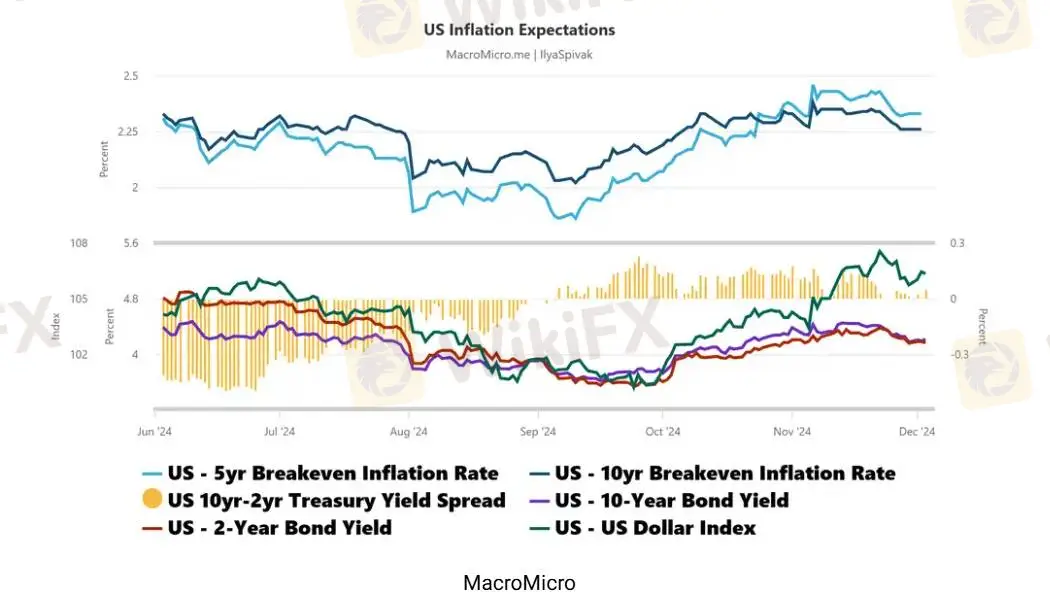

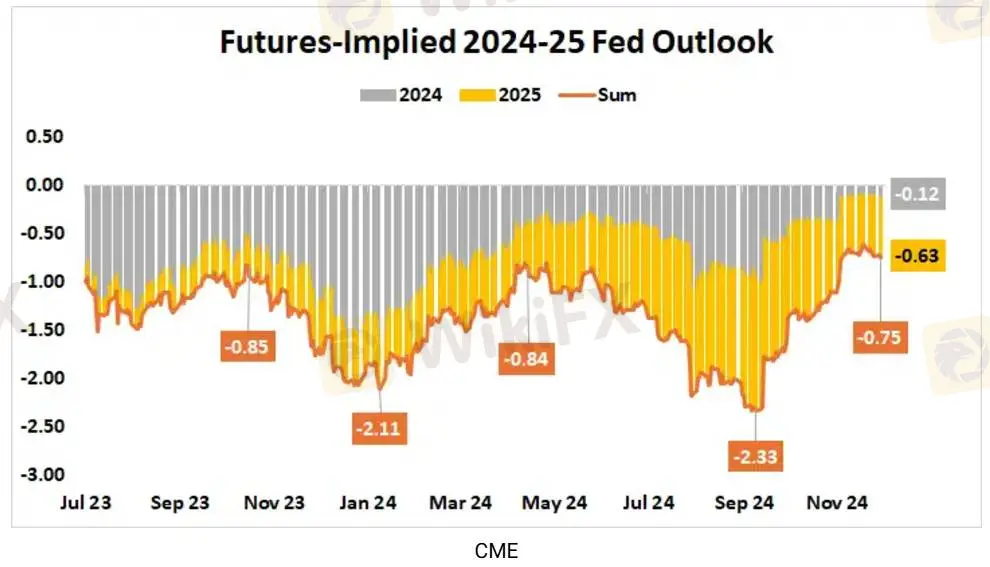

Fed Chairman Jerome Powell discussed a range of policy issues, including rate cuts, in an interview at the DealBook/Summit conference hosted by the New York Times. The Fed began a rate-cutting cycle in September, and the market viewed it as overly dovish, with the Federal Open Market Committee (FOMC) slashing rates by 50 basis points and projecting another 150 basis points of cuts by the end of 2025. It took the market more than two months to re-price the prospect of Fed rate cuts, and the reaction suggests that there is a widespread view that stimulus of this magnitude is unlikely to materialize as the Fed begins cutting rates at a time of rapid economic growth and inflationary pressures are likely to build again. The price growth expectations reflected in the bond market - the so-called “breakeven inflation rate” - have moved rapidly higher.

Two months into this repricing wave, the 10-year Treasury bond is down nearly 6% and the dollar is up nearly 8% against its average major currencies. The Fed has softened its rhetoric, stressing that rate cuts will not be on autopilot and that it will be ready to address reflation risks even if it cuts rates by another 25 basis points in November.

As global economic uncertainty intensifies, central banks in Eastern Europe are rapidly increasing their gold reserves. Countries such as the Czech Republic, Poland and Serbia have become the main players in the gold market, driving gold prices to continue to rise. Ales Michel, governor of the Central Bank of the Czech Republic, recently went to London in person to check the gold reserves stored in the Bank of England, revealing his plan to expand the country's gold reserves to 100 tons in the next three years. This move not only reflects the strategic intentions of the Czech Republic, but also reflects the preference of central banks throughout Eastern Europe for gold and the importance of gold in the current economic environment.

The rapid gold buying boom in Eastern European countries stems from the need to prevent investment risks and diversify asset allocation. In the face of changes in the international political situation, rising inflation and rising market volatility, gold, as a safe-haven asset with a negative correlation with the stock market, has become increasingly popular. Therefore, strengthening gold reserves by central banks in countries such as the Czech Republic, Poland and Serbia is undoubtedly an effective strategy to cope with external shocks.

In the precious metals market, Carsten Fritsch, precious metals analyst at Commerzbank, said he remains bullish on silver in 2025, as it moves in line with gold at the end of the year. The current gold-silver ratio is around 85, which is about the same as the beginning of the year, even though silver has risen 30% in 2024. “Silver is still cheap compared to gold,” Fritsch noted. Fritsch pointed out that the Fed's easing cycle has increased the investment attractiveness of silver this year while supporting the market's investment demand for gold, as evidenced by the net inflows of funds into silver ETFs. However, he also pointed out that demand for physical gold and silver is currently hovering at a four-year low.

The main pillar supporting silver comes from its industrial demand, which “keeps breaking records”. Specifically, the use of silver in photovoltaic solar panels remains an important and growing source of demand for the precious metal. The Silver Association's latest “Silver Market Mid-term Report” pointed out that the global silver market is expected to have a physical supply deficit for the fourth consecutive year in 2024, with the growth of industrial demand becoming the main driving force. The industrial demand for silver is expected to hit a new high throughout 2024, and the recovery of jewelry and silverware demand will also drive overall demand to 1.21 billion ounces. At the same time, mine supply will only increase by 1%.

The Fed's policy moves and market expectations will continue to influence the precious metals market, especially the prices of gold and silver. With global economic uncertainty and central bank easing policies, the demand for precious metals as safe-haven assets is likely to continue to grow. Silver's industrial demand growth and supply deficit expectations provide additional support for its price. Investors should pay close attention to the Fed's policy changes and global economic dynamics to seize investment opportunities in the precious metals market.

WikiFX Broker

Latest News

Middle East Geopolitical Crisis Triggers Energy Supply Disruption and Risk Repricing

Goldman Sachs: Qatari LNG Disruption to Persist Beyond Expectations

AI Infrastructure Enters Dual-Growth Cycle Amid Supply Chain Volatility

Crude Oil Rally Recedes as APAC Markets Stage Rebound

Can Traders Still Trust Their Forex Broker?

IQ Option Review: The High-Stakes Game Where the Only Winner is the House

Geopolitical Risk Reshapes Energy and Equity Markets: The 'Trump Playbook' in Focus

traze Review 2026: Trading Conditions, Regulation & Real User Feedback

7 Clear Signs You’re Ready to Enter Forex Market in 2026

Cyprus Turns Market Abuse Whistleblowing Into Hard Law

Rate Calc