Is Multibank Group reliable? A guide to signs and risks.

Abstract:According to public sources, Multibank Group could have accumulated a high volume of complaints and a low risk score. If these reports are accurate, there could be a pattern of withdrawal obstacles, a fragmented corporate structure, and the use of offshore entities. A prudent investor could choose to validate licenses directly with regulators and conduct a withdrawal test before depositing significant amounts.

The appearance of a “big player” versus the user experience: is there a gap?

Looking at its public communications, Multibank Group appears to present itself as a global player in derivatives, CFDs, and Forex, with a presence in multiple countries, polished marketing campaigns, sponsorships, and a narrative of “robust regulation.” However, third-party reports have reportedly recorded a significant number of user complaints, which could suggest a gap between the brand promise and certain practical experiences. In this context, retail investors may feel uncertain about operational predictability (key to any risk management strategy).

How would a broker like Multibank Group “earn” trust?

According to market analysis, a broker with an aggressive commercial focus could use resources such as:

- Global reputation messages, with supposed distinctions and awards.

- High leverage (e.g., 1:500), attracting novice profiles who might underestimate the risk.

- Deposit bonuses with conditions that, if not thoroughly read, could hinder future withdrawals.

- Regional campaigns (Latin America/Asia) and local language support to generate rapport.

If these tactics coincide with experiences of withdrawal delays or unilateral changes in terms, a prudent trader might suspect inconsistencies between the commercial narrative and daily operations.

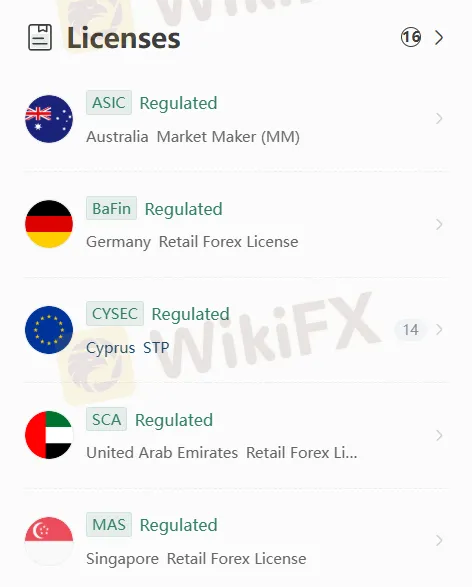

The promise of “strong regulation”: what might happen in practice?

It is common for some groups to highlight “multiple licenses” and “top-tier regulators.” In practice, this could be the case:

- Certain licenses do not cover all the promoted activities.

- There may have been historical revocations or restrictions in some jurisdictions.

- There may be offshore entities (Vanuatu, BVI, etc.) with limited safeguards for clients and no strong compensation schemes.

- There may be corporate fragmentation (multiple company names, headquarters, and domains), making it difficult to locate the true contractual counterparty.

Under this assumption, if there is a dispute, the client may not be clear about who to sue and where to pursue legal action, increasing legal uncertainty.

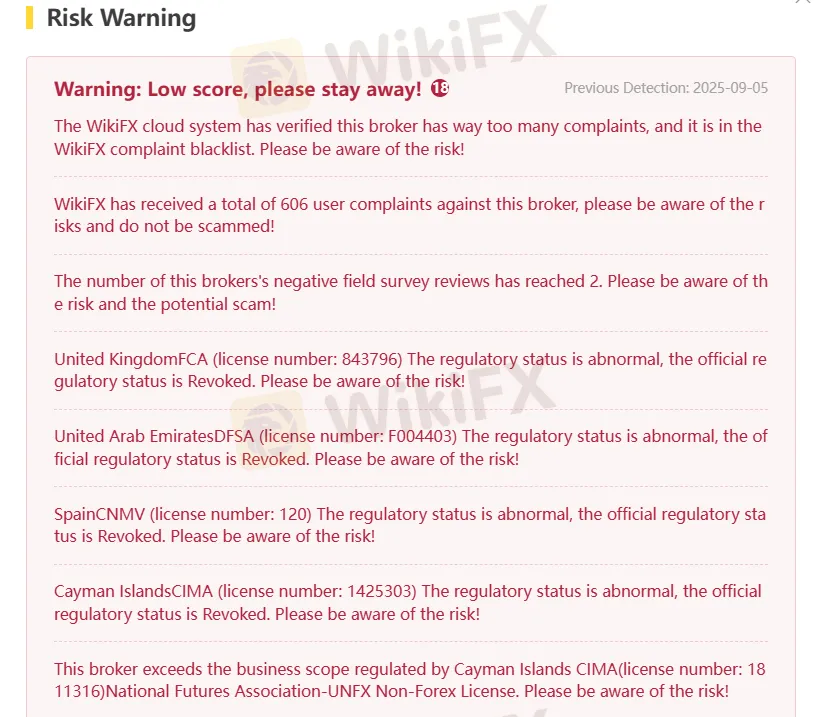

Revoked licenses, offshore licensing, and corporate confusion: what could it mean?

In complaint files compiled by third parties, warnings could be repeated, such as:

- Mentions of past revocations/suspensions in reputable venues.

- Public warnings from European regulators regarding certain domains or associated entities.

- Frequent changes in domains, trademarks, and registered addresses.

- Dependence on offshore entities to serve international clients.

If this scenario were correct, the client's daily operations could be exposed to a significant mix of regulatory and operational risk.

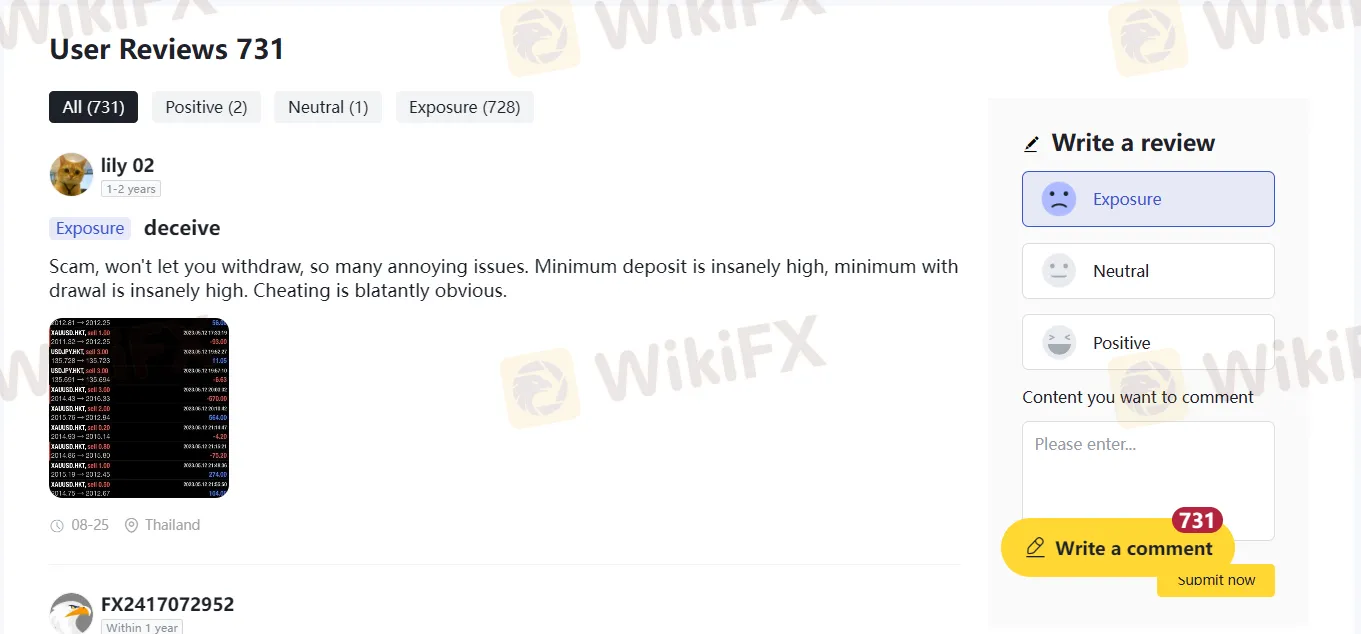

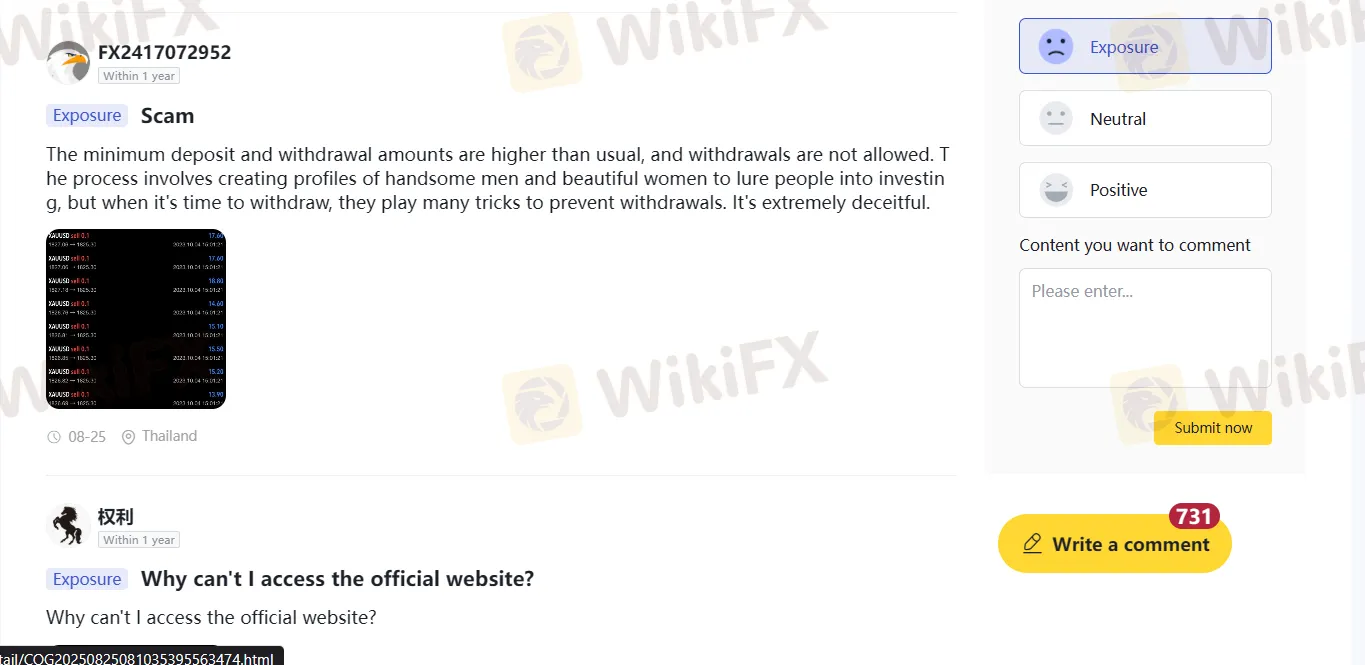

Recurring Complaints: What Could Users Have Reported?

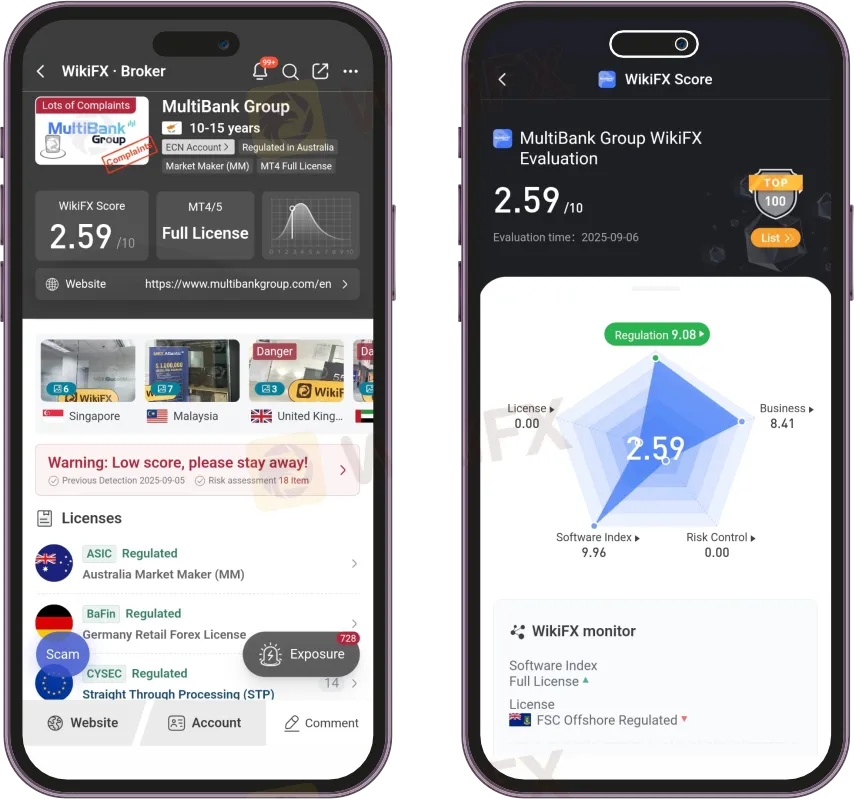

According to the WikiFX report (August 28, 2025), the complaints reached 728 and could focus on:

- Delayed or blocked withdrawals, under prolonged review.

- Repeated requests for documentation (proof of address, source of funds, selfies with documents, etc.).

- Bonuses with volume requirements that could block withdrawals.

- Altered history or reports that don't match expectations.

- Evasive support and multiple contacts without clear service agreements.

The existence of many of these factors could, if combined, create an unfriendly environment for the retailer.

Typical patterns: What signals could be repeated?

Comparing public testimony, patterns such as:

- Proactive acquisition and intense communication at the outset; bureaucracy at the outset.

- Promises of “institutional” execution with moments of slippage/requotes.

- Shifting of responsibility between group entities.

- Gaps in “24/5” support, with uncertain timing and outcomes.

A disciplined trader might consider these signals as operational “red flags.”

Low Risk Score: How to Interpret It?

WikiFX appears to assign a low risk score to Multibank Group (2.59/10) and links a patchwork of entities/registrations with varying statuses. If this rating reflected real risks, it could be explained by a combination of:

- History of revocations/restrictions.

- Inconsistencies between marketing and license scope.

- Corporate architecture that dilutes responsibilities.

- Volume of complaints linked to withdrawals/support.

Again, this is mentioned for informational purposes and not as a conclusive fact.

Latin America and Brazil: Priority Markets for Customer Acquisition?

For expanding markets with a higher proportion of new traders, certain campaigns could prioritize Latin America. In Brazil, the lack of local registration could mean that retailers lack effective protection if the entity serving them is not subject to the relevant local supervision.

In cross-border scenarios, opening disputes could require legal action abroad (costs, language, jurisdiction), which could increase the power asymmetry with respect to the customer.

What would be at stake for a retail trader?

Trading with a group with a diffuse structure could expose the user to:

- High counterparty risk if there is no clear segregation of funds or robust compensation schemes.

- Total loss due to stalled withdrawals.

- Strategy distortion due to slippage/requotes.

- Dependence on less supervised offshore entities.

For the trader who makes a living from risk management, operational predictability is as critical as the spread.

Anti-Fraud Checklist: How to Reduce Risk Before Investing

Before depositing, a prudent reader could:

Verify the actual license

- Get the license number from the broker's website.

- Confirm it directly on the regulator's website (FCA, ASIC, BaFin, CySEC, NFA/CFTC, etc.).

- Confirm that the entity that will hold the balance is licensed (exact match of company name and country).

Avoid offshore trading for the main account

- If there is an alternative “offshore vs. a top-tier regulator,” the top-tier option could be chosen, even if it comes with slightly higher costs.

Withdrawal Test

- Deposit a small amount, trade, request a withdrawal. If it doesn't work out, leave.

Say No to Bonuses

- Many bonuses may come with conditions that make withdrawal difficult.

Read recent reviews

- Check third-party platforms (e.g., WikiFX's own article from 08/28/2025 for reference), looking for trends in complaints.

Save evidence

- Screenshots, emails, terms, and receipts: everything.

Prioritize risk management

- If the brokerage itself adds operational risk, it doesn't offset the rest.

What should you do if you already have a blocked account or funds?

In a hypothetical dispute, a cautious user could:

- Immediately stop depositing.

- Request a (partial) trial withdrawal.

- Request a written request for the reason and resolution deadline if there is a block.

- Open a formal case with the Customer Service/Support Center and save the number.

- File a complaint on independent platforms and, if appropriate, contact the regulator of the entity signing the contract.

- Consult a lawyer with experience in international disputes/CFDs.

- Do not give in to requests for “extra deposits” to “unblock” withdrawals.

Conclusion: Is it worth the risk of operating with Multibank Group?

If the public references were accurate—728 reported complaints and a low risk rating—it could be inferred that the risk/reward balance would not favor the demanding retailer. Those who prioritize regulatory compliance, contractual clarity, and frictionless withdrawals might prefer alternatives with top-tier regulation and a transparent track record. Ultimately, true trust in financial intermediation could be proven by the withdrawal, not the promise.

WikiFX Broker

Latest News

Stand a Chance to Earn $10 for Each Broker Review – Join Now!

FCA Warning list 2025: Unauthorised firms to Avoid

Traders Report Fund Scam & High Slippage at TD365: Read What They are Saying

Bank of America says investors are ignoring one major stock market risk

French PM backs freezing Macron\s pension reform to save government

Want to Trade Via Daicha Iconic Markets Ltd? Wait and Read This Review First!

WikiFX Warning: 5 Scam Brokers Exposed in October 2025

How to Spot a Forex Scammer Before You Invest

FCA Cracks Down on £1m Ponzi Scheme in UK

Freedom24 Review: License and Regulation

Rate Calc