DBG Markets: Market Report for Oct 30, 2025

Abstract:Fed “Hawkish Cut” Triggers Dollar Bounce; Focus Shifts to BoJ ECBMarket Recap: Fed Cuts, Dollar RalliesThe Federal Reserve delivered a widely expected 25 basis point rate cut yesterday (Wednesday), l

Fed “Hawkish Cut” Triggers Dollar Bounce; Focus Shifts to BoJ & ECB

Market Recap: Fed Cuts, Dollar Rallies

The Federal Reserve delivered a widely expected 25 basis point rate cut yesterday (Wednesday), lowering the federal funds rate to 3.75%–4.00% and formally announcing the end of its Quantitative Tightening (QT) balance sheet runoff by December 1st.

Powell reinforced this hawkish message during the press conference, stating: “A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it.”

This clear divergence from market expectations triggered a strong repricing of rate-cut bets and lifted the dollar across the board.

Market Reaction: Dollar Surged to 99

USD Index, H4 Chart

The Dollar's sharp post-FOMC surge confirmed that the market had aggressively mispriced the speed of future cuts. The DXY successfully reclaimed the 98.50 level and is now testing higher resistance—99.0.

The structure is momentarily bullish due to the perceived policy resistance. The market's immediate focus will be on the 99.00 handle. A break above 99.00 confirms stronger conviction for a near-term rally.

Policy Focus today: Bank of Japan, European Central Bank

Following the Fed decision, attention turns to two key central banks in Asia and Europe — the Bank of Japan (BoJ) and the European Central Bank (ECB) — both of which could drive cross-currency volatility today.

1. Bank of Japan (BoJ)

Decision due during the Asian session. The BoJ is widely expected to hold its policy rate at 0.5%. The focus will be on the Outlook Report and Governor Ueda‘s remarks, especially on inflation persistence and whether Prime Minister Takaichi’s economic policies may prompt discussion of a near-term hike.

A hold paired with a cautious inflation outlook would reinforce structural JPY weakness.

2. European Central Bank (ECB)

Decision due in the European session. The ECB is expected to hold its deposit rate at 2.00%, maintaining a neutral stance.

If the central bank signals with confidence that it has completed its rate-cut cycle, the Euro could strengthen against the Dollar, especially amid the Feds more conditional easing bias.

However, a continuous dovish stance from ECB would signal a clear divergence with current cautious and hawkish Fed, leading to a further weakness in EUR/USD.

Technical Outlook: USDJPY, EURUSD

EUR/USD: Leverage Point Awaits ECB

The pair has been trading under significant pressure following the Dollar's post-FOMC surge, reversing some of its recent gains. The EUR/USD is trading near a crucial technical level of 1.1600 ahead of the ECB decision.

EUR/USD, H4

If the ECB firmly signals a pause to its easing cycle, the Euro could gain ground against the recovering DXY, stabilizing the pair. However, a dovish surprise from the ECB (hinting at future cuts) would accelerate the pair's decline.

Technically, a recent converging triangle and the key level of 1.1600 breakout is what trader want to monitor for next potential move.

USD/JPY: Conflicting Pressures

The Bank of Japan (BoJ) kept its policy rate unchanged in its latest decision, leaving the USD/JPY pair in a state of heightened sensitivity to the upcoming BoJ Outlook Report and Governor Uedas statement.

If the BoJ maintains its dovish stance or fails to deliver any meaningful signal of policy tightening, the resulting widening policy divergence between the BoJ and the Federal Reserve is likely to exert strong upward pressure on the yen pair.

USD/JPY, H4

The pair is currently consolidating near the 153.00 zone (more precisely 153.20), with momentum building for a potential breakout.

A confirmed move above 153.20 could open the door for a rally toward 156.50, which marks the major high seen in early 2025.

At this stage, market expectations remain tilted toward a status quo outcome from the BoJ. Any reaffirmation of the same dovish tone would likely disappoint yen bulls, paving the way for further upside in USD/JPY.

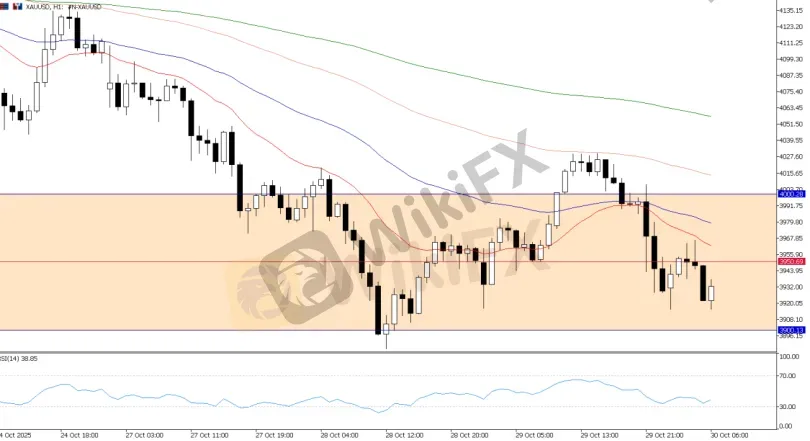

Gold: Hawkish Fed Sent Gold Lower Again

The Federal Reserves hawkish tone triggered another wave of selling in gold, pushing XAU/USD back below the $4,000 level. Attention now shifts to the $3900–$4000 range again — a critical zone where the market will determine whether gold can establish a near-term bottom.

XAU/USD, H4 Chart

XAU/USD, H1

In the near term, gold appears to be consolidating within this key range. A firm base around $3900–$4000 could set the stage for the next directional move. A decisive break above $4000 would signal renewed upward momentum and open the path for a potential recovery.

However, traders should closely monitor whether $3900 support can hold. Under the current macro backdrop — marked by a stronger dollar and hawkish Fed guidance — gold remains at risk of further downside if this support fails to hold.

Bottom Line

Key watchpoints today — DXY 99.00, EUR/USD 1.1600, USD/JPY 153.20, and Gold $3900–$4000 — will define the next directional momentum across major assets.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc