Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Abstract:Upway (JRJR) holds a valid license from the Hong Kong Gold & Silver Exchange Society (HKGX) and maintains a WikiFX score of 7.29, but this is heavily contrasted by over 143 user complaints in recent months. Investors frequently report severe price slippage, platform freezing during market volatility, and significant difficulties with fund withdrawals.

Quick Summary

Upway (also known as JRJR) is a Hong Kong-based broker established in 2017. While the broker holds a moderate WikiFX score of 7.29 and is regulated by the local exchange society, it currently faces a “Warning” status due to a high volume of user complaints.

Recent data indicates a significant gap between its regulatory status and user experience. With 143 complaints received in just the last 3 months, traders need to be extremely cautious. The primary issues reported involve technical instability, price slippage, and withdrawal barriers.

Key Takeaways

- Regulation: Upway is regulated by the HKGX (Hong Kong Gold & Silver Exchange Society), a self-regulatory industry body.

- Complain Volume: There is a very high number of recent disputes (143 in 3 months).

- Operational Risks: Users frequently report strict barriers to withdrawing funds and accounts being frozen.

- Technical Issues: Reports of platform freezing and severe slippage (difference between ordered price and execution price) are common.

Is the License Real?

According to WikiFX records, Upway does hold a valid license. However, it is vital to understand who is regulating them.

Regulatory Data Table

| Regulator | License Type | Status |

|---|---|---|

| Hong Kong Gold & Silver Exchange (HKGX) | AA Type License (No. 084) | Regulated |

What This Means for You

Upway is regulated by the HKGX (also known as CGSE). This is a long-standing industry association in Hong Kong that oversees gold and silver trading.

Important Note: The HKGX is a Self-Regulatory Organization, not a government statutory body like the SFC (Securities and Futures Commission). While the license is legitimate and checks out with license number 084, the protection level for international retail traders can differ from government-backed regulators. The broker has been operating since 2017, which shows longevity, but the license type requires you to trust the broker's internal dispute resolution more than a government court.

What Traders Say: The Risks

While the license provides a baseline of legitimacy, the user reports from WikiFX cases paint a worrying picture of the day-to-day trading experience.

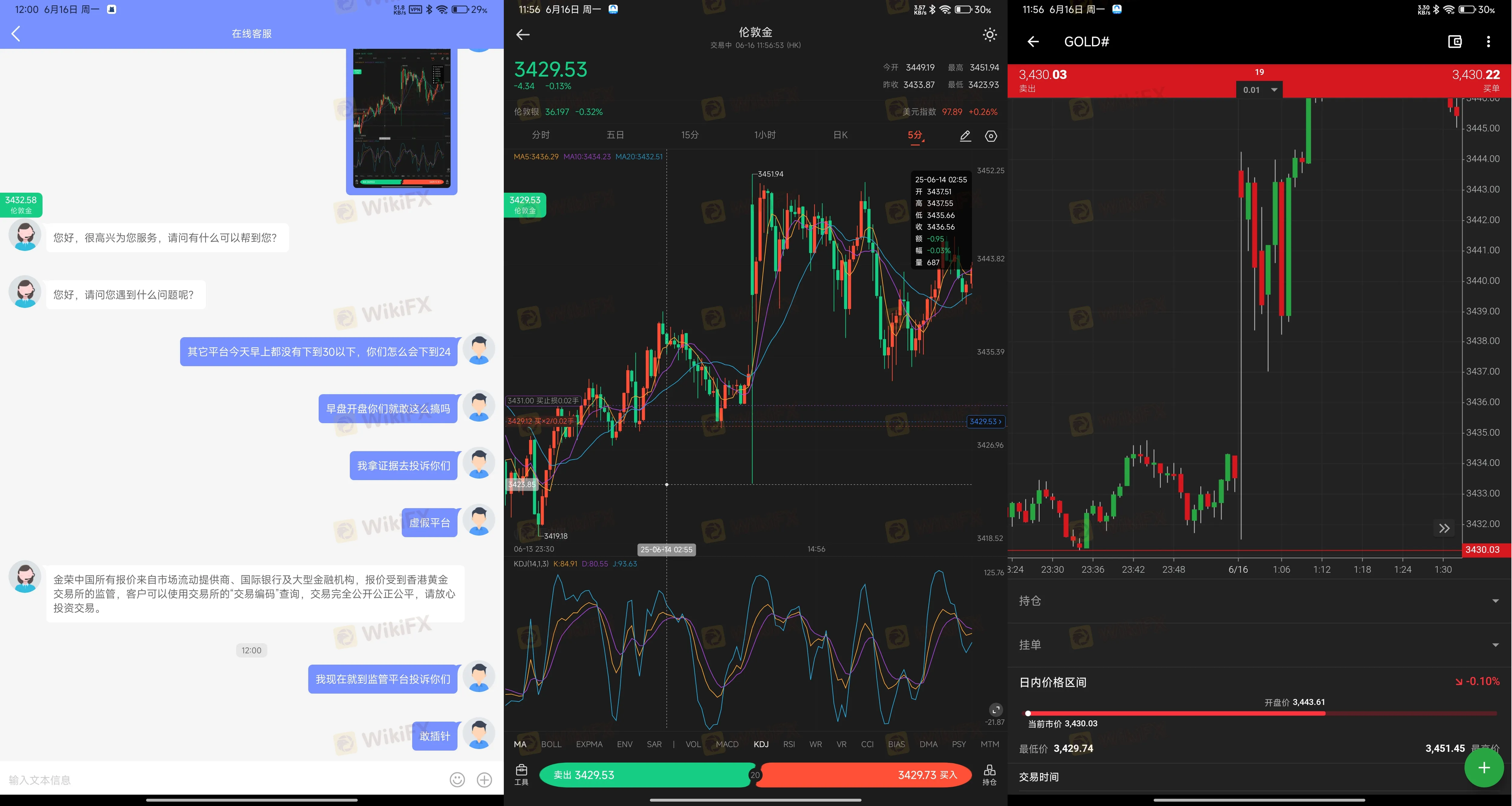

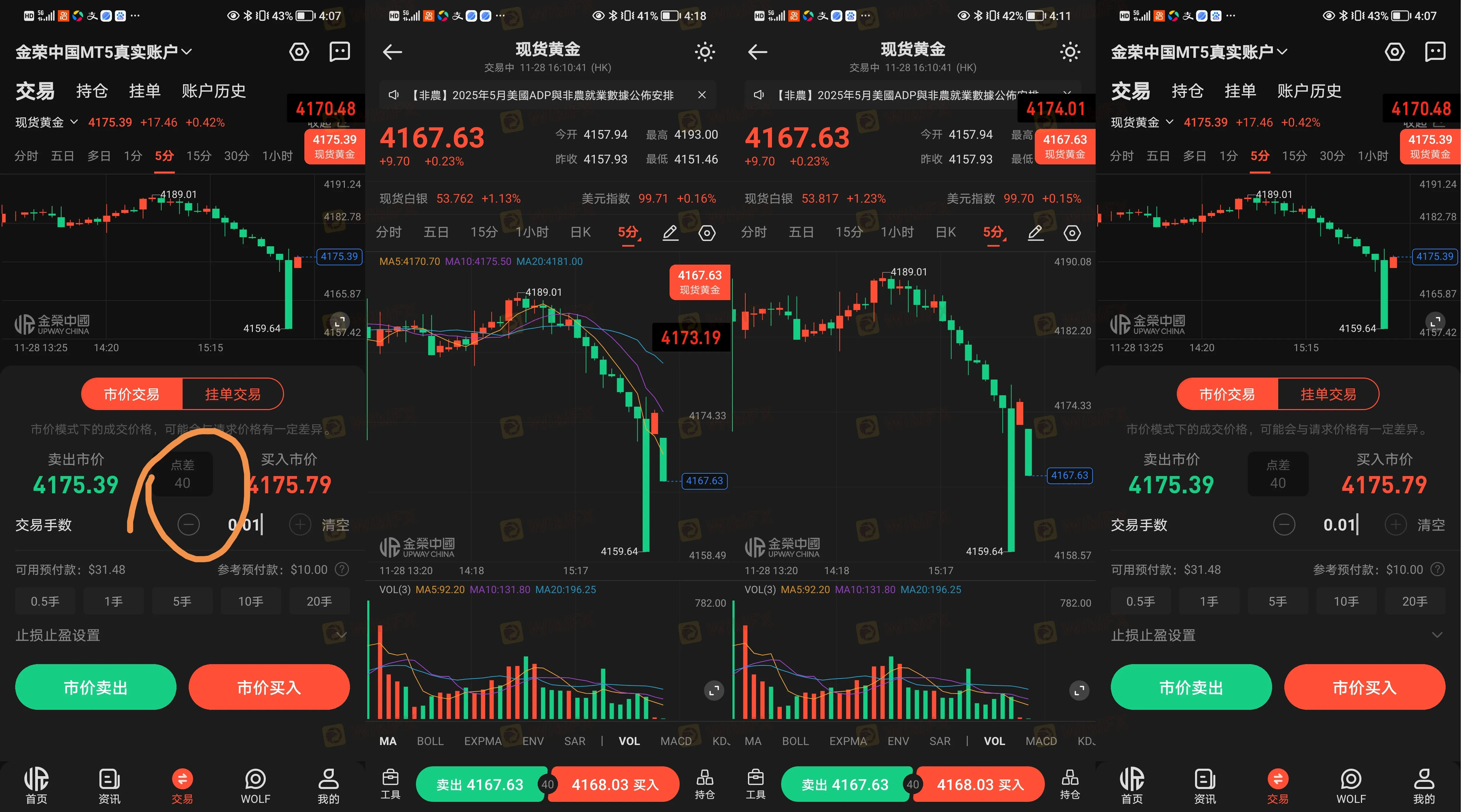

1. Severe Slippage and Price Manipulation Claims

A major pattern in the complaints is “slippage.” This happens when the price you click to buy/sell at is not the price you get.

- Evidence: In Case 26, a user from South Africa reported “Slippage Woes” and delayed data that messed with trades.

- Evidence: In Case 25, a trader set a stop-loss at 2200, but the platform closed the trade at 2199.86, causing a loss. When they asked customer service, they were told about hidden rules (like adding 0.5 to the price) that were not clear before.

- Evidence: In Case 12, a user reported slippage of 8 points during the market open, which was significantly worse than other platforms at the same time.

2. Platform Freezing During Profit Opportunities

Traders need a stable system to make money. Multiple reports suggest Upway's system struggles during busy times.

- Evidence: In Case 1, a user reported that the platform “stuck directly” when market trends arrived, stopping them from trading.

- Evidence: In Case 2, a user described the system as having “serious lag” and warned of human intervention in the background.

3. Withdrawal Barriers and Frozen Accounts

The most critical risk for any investor is the inability to get money back.

- Evidence: In Case 17 and Case 18, users reported being unable to withdraw remaining balances (e.g., $19 or $20), with customer service disconnecting when asked.

- Evidence: In Case 21, a user reported a severe banking risk. Their bank card was frozen by police after receiving funds, implying the money source might have been flagged as problematic (“clean money in, black money out”).

- Evidence: In Case 16, a user claimed the broker maliciously cancelled their account to prevent withdrawal.

4. Aggressive Account Management

Several users report that if they win too much or complain, they face account closures.

- Evidence:Case 22 describes the broker as a “counterparty” platform. The user claims that small profits are allowed to be withdrawn to build trust, but larger profits over $1000 become difficult to access, often leading to account bans.

Conclusion

Upway (JRJR) presents a conflicting profile. On paper, it is a legitimate broker with a history since 2017 and a license from the HKGX. However, the sheer volume of complaints—143 in 3 months—indicates serious operational issues.

The patterns in the data suggest that while you can open an account, you may face:

1. Technical Instability: High risk of the app freezing during volatile (profitable) times.

2. Pricing Issues: Executions that differ unfavorably from market rates.

3. Withdrawal Uncertainty: High risk of delays or account freezing if you attempt to withdraw significant profits.

Recommendation: Due to the “C” influence rank and the specific nature of complaints regarding funds safety and system stability, we advise investors to exercise extreme caution. The risks currently outweigh the benefits of their HKGX license. Look for brokers with better user feedback and government-level regulation for higher safety.

WikiFX Broker

Latest News

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Investigation: The "Imposter" Trap Draining OANDA Traders

Rate Calc