Plus500 Review 2025: Is This Forex Broker Safe?

Abstract:A comprehensive 2025 review of Plus500, analyzing its high WikiFX Score of 7.99, extensive regulatory framework (FCA, ASIC, CySEC), trading apps, and recent user complaints regarding withdrawals.

As a globally recognized entity in the online trading space, the Plus500 broker (also known as “嘉伍佰”) presents itself as a heavily regulated financial service provider. Established in 2010 and headquartered in Israel, this broker has achieved a notable WikiFX Score of 7.99, reflecting its strong regulatory standing. While its influence rank is rated “AA,” recent data highlights a mix of high-level safety compliance and verified user grievances.

Pros and Cons of Plus500

Based on the current data and market evaluation, here are the key advantages and disadvantages:

- ✅ Global Regulation: Regulated by top-tier authorities including the UK FCA, Australian ASIC, and Singapore MAS.

- ✅ High Trust Score: A WikiFX score of 7.99 indicates a strong operational history.

- ✅ Proprietary Technology: Offers a highly customizable, self-developed mobile trading app.

- ✅ Global Influence: significant market presence in the UAE, Australia, and Europe.

- ❌ Customer Complaints: 34 complaints received within the last 3 months.

- ❌ Withdrawal Issues: Users have reported delays and excessive documentation requests.

- ❌ Platform Limitations: Data indicates a lack of support for standard platforms like MT4/MT5, relying solely on proprietary software.

Plus500 Regulation and License Safety

Plus500 holds an impressive array of licenses, making it one of the most heavily supervised brokers in the industry. Adhering to strict compliance standards, the broker operates under the oversight of multiple jurisdictions:

Tier-1 Regulatory Licenses

- United Kingdom: Authorized by the Financial Conduct Authority (FCA), license no. 509909.

- Australia: Regulated by the Australian Securities & Investments Commission (ASIC), license no. 417727.

- Cyprus: Licensed by the Cyprus Securities and Exchange Commission (CySEC), license no. 250/14.

- Singapore: Regulated by the Monetary Authority of Singapore (MAS).

- Japan: Oversen by the Financial Services Agency (FSA).

- Canada: regulated by the Investment Industry Regulatory Organization of Canada (CIRO).

Other Regulatory Bodies

- New Zealand: Financial Markets Authority (FMA).

- UAE: Capital Markets Authority (CMA).

- Offshore: Regulated in Seychelles (FSA) and the Bahamas (SCB).

Risk Warning: Clone Firms

Regulatory disclosure data indicates the existence of “Clone Firms” attempting to impersonate this broker (e.g., “p500.online” or “Plus 500 UK”). Investors must ensure they are interacting with the official entity and not a fraudulent copycat.

Real User Feedback and Complaints

Despite its strong regulatory backing, Plus500 broker has faced a surge in complaints, with 34 cases logged recently. Below are summaries of specific user experiences:

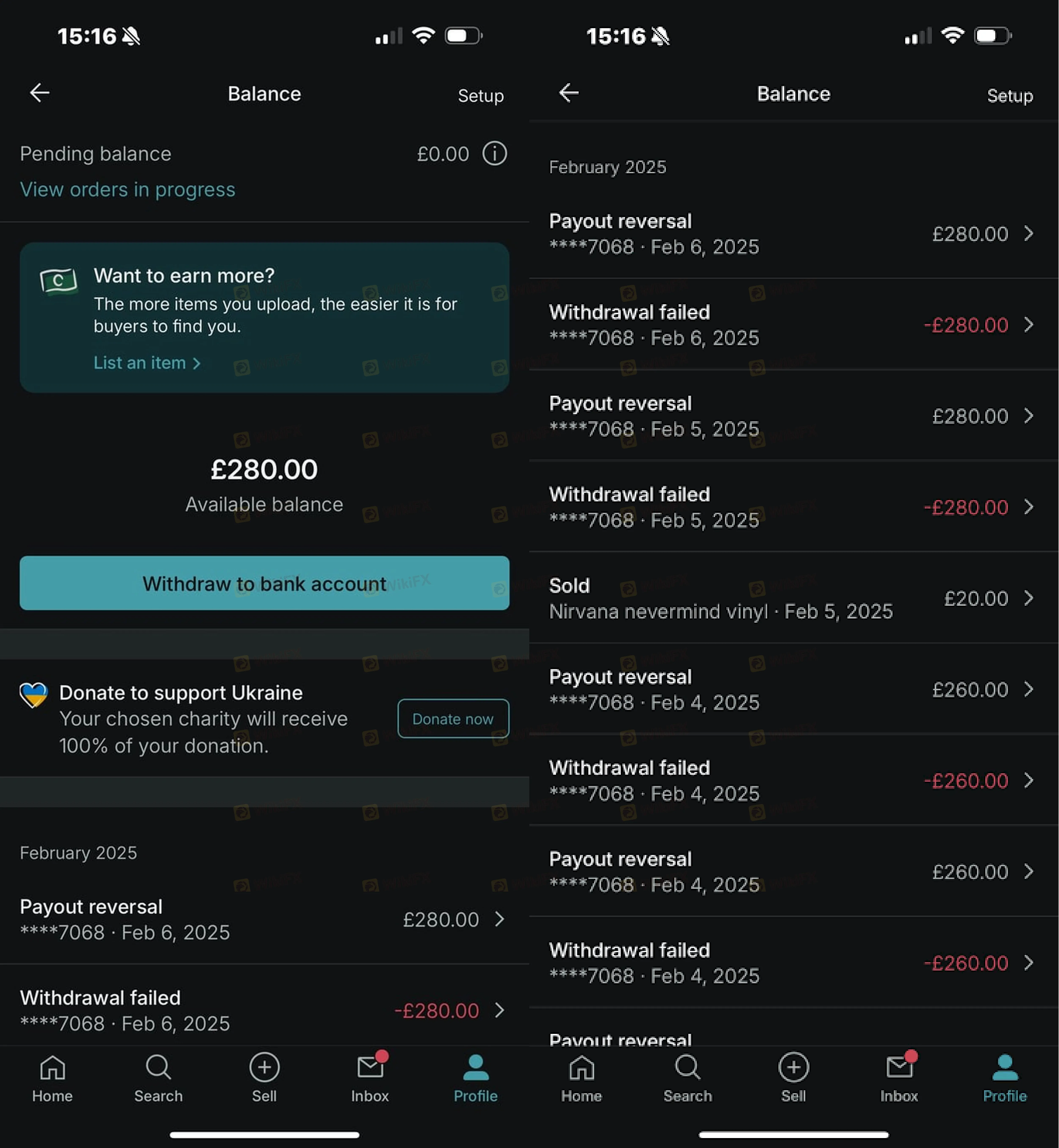

- Withdrawal Disputes (USA/UK): A user reported being unable to withdraw or spend a balance of £280 despite passing verification checks, receiving no response to multiple statements.

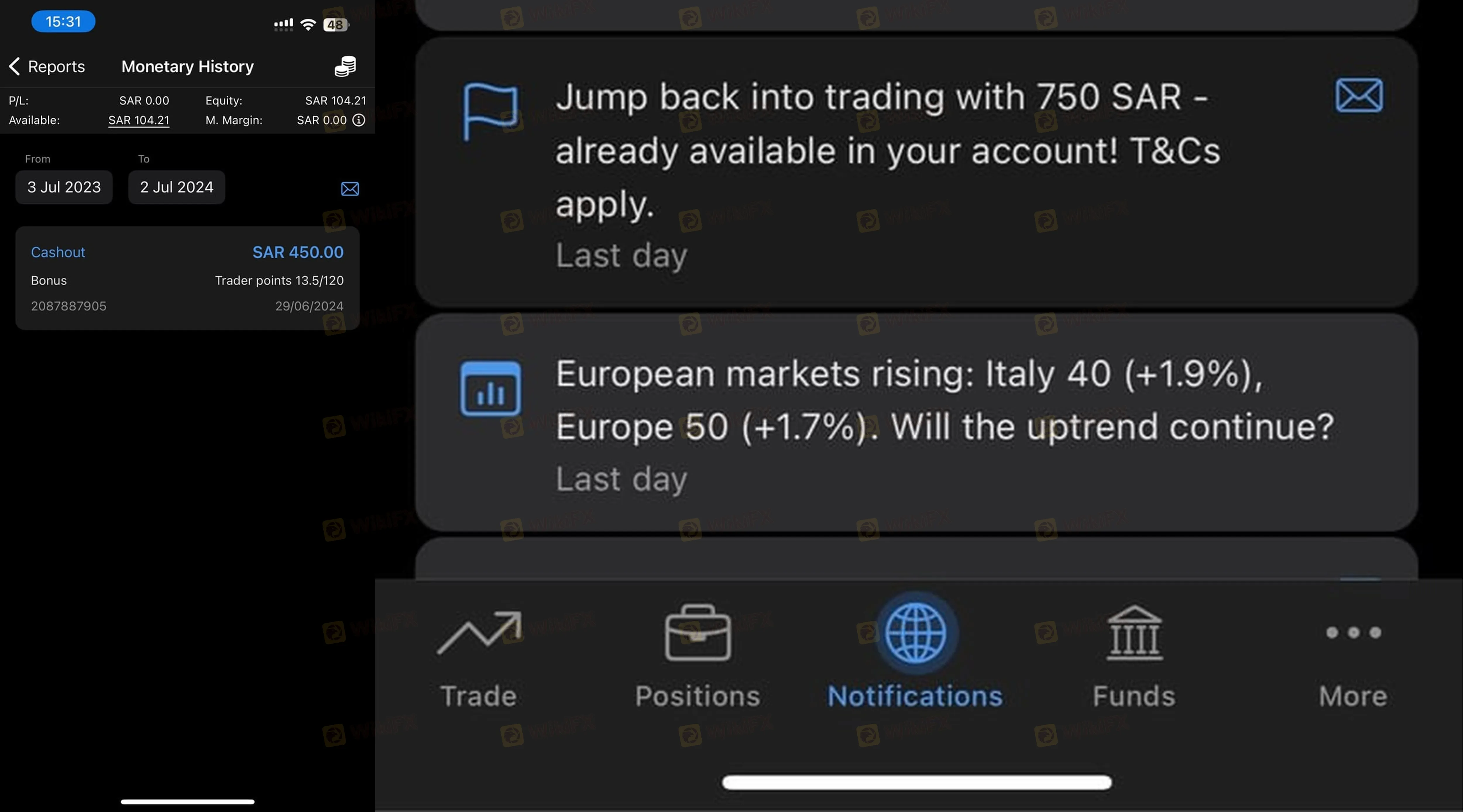

- Bonus and Funding Discrepancies: Another trader claimed the broker promised a 750 Sr deposit but only credited 450, labeling the broker a “scam” after failing to resolve the difference.

- Excessive Verification (China/HK): One severe complaint detailed a withdrawal process stalled for over a month. The user provided income proof, wage flows, and address proof, yet the request remained in an indefinite “audit” status.

Forex Trading Conditions and Fees

Platforms and Usability

Plus500 utilizes a self-developed trading platform rather than third-party solutions like MetaTrader. The platform is designed for mobile users (iOS and Android) and offers customization and clear fee reporting. However, the available data suggests the platform may lack two-step verification for the Plus500 login, which is a security feature traders often request.

Trading Environment

The platform does not support automated trading (EAs) or copy trading. While the proprietary system is rated “Good” for its search functions, the limitation to a specific app environment means traders must adapt to Plus500's unique interface rather than industry standards.

Final Verdict

Plus500 stands out as a highly regulated broker with a solid reputation in the UK, Australia, and beyond. Its WikiFX score of 7.99 is a testament to its legal compliance. However, the recent spike in complaints regarding withdrawal delays and rigorous document verification cannot be ignored.

Traders should appreciate the safety provided by top-tier licenses but remain aware of strict internal procedures that may affect fund access. To stay safe and view the latest regulatory certificates, check Plus500 on the WikiFX App.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Rate Calc