Pocket Option Scam Alert: Real Trader Complaints

Abstract:Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Primary Keyword: Pocket Options

Secondary Keywords: Pocket Option withdrawal issues, Pocket Option scam reports 2025, Pocket Option trader complaints, Pocket Option fraud cases, Pocket Option fake verification

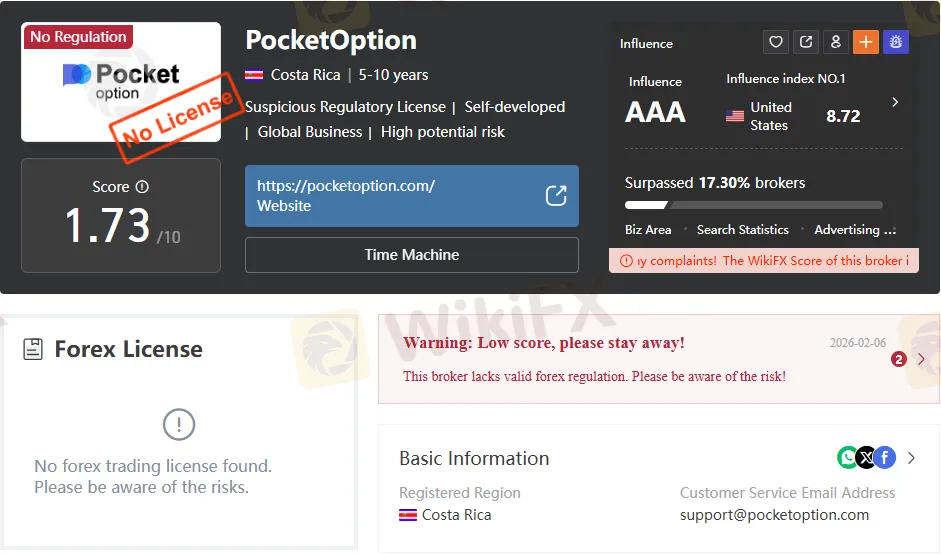

Pocket Options has been heavily marketed online as a “high‑tech, fast‑profit” trading platform targeting new crypto and forex traders. Its sleek interface, social trading features, and heavily promoted YouTube and TikTok videos have attracted thousands worldwide. But behind the polished marketing lies a growing wave of warnings from real traders who reported serious withdrawal issues, verification problems, and account freezes throughout 2025.

Reports from several countries—including Spain, Russia, Hong Kong, and Nigeria—show the same disturbing pattern: once users begin making a profit or attempting a withdrawal, their accounts are restricted or banned under vague clauses of the companys “public offer agreement.” These consistent red flags cast serious doubt on the safety and fairness of trading with Pocket Options, especially given its unregulated status and limited transparency.

The Illusion of Easy Money

For many beginners, Pocket Options seems like the perfect shortcut to financial freedom. The ads promise quick profits and make it sound easy to start—even with just $5. The platform looks convincing too, with bright charts, real‑time trades, and an active “trader community” that makes everything feel trustworthy. But as countless Pocket Option scam reports 2025 reveal, that excitement often turns to regret once real money is on the line.

One Colombian investor recounted how a YouTube ad painted a rosy picture of effortless returns. After depositing 100 USDT, he lost everything due to what he described as “clear price slippage.” His message ended with a desperate warning: “Do not deposit.”

Price slippage can occur in normal trading when market volatility causes different execution prices. However, repeated cases of severe slippage within a closed trading ecosystem—where the company controls the price feed—raise concerns about manipulated or opaque pricing, not just technical errors.

Pattern of Manipulation and Withdrawal Freezes

By late 2025, more than a dozen Pocket Option trader complaints highlighted alarming consistency. Heres the pattern repeatedly described:

- Profits trigger sudden “KYC checks.”

When traders attempt to withdraw funds, the platform demands verification, often with changing or unclear document requirements. Even after full compliance, verification is rejected with no clear reason.

- “Technical issues” always disadvantage the trader.

When trades move against the company, instruments reportedly become “disconnected,” or data feeds lag. Users noted significant discrepancies between Pocket Options price quotes and verified sources such as TradingView.

- Support offers endless delays.

Requests for withdrawal can drag on for up to 14 days with ever‑changing excuses—system updates, overloads, or “protocol reviews.”

- Account closure after profit.

Once users push their profits higher or report delays publicly, accounts are blocked for supposed violations of Article 2.9 of the public offer agreement—an intentionally vague clause that gives the company broad grounds to cancel activity it deems “fraudulent.”

In essence, Pocket Option fraud cases show a recurring pattern: let users win small sums, encourage more deposits, then restrict withdrawals once they grow profitable.

Real Trader Testimonies, Real Losses

Spain — October 2025:

A Spanish user documented transactional timestamp discrepancies between their bank and Pocket Options—differences of several minutes that couldnt be explained by time zones. When they demanded trading logs, the company provided incomplete, edited reports. This indicates potential manipulation of user balances after trades.

Russia — September 2025:

A Russian trader lost nearly $3,000 when their account was banned under Article 2.9. The platform cited “fraudulent activity” but provided no evidence. The trader had already submitted a withdrawal request three days prior, which was never processed.

Hong Kong — September 2025:

After growing an account from $600 to $1,400, a trader‘s KYC verification was repeatedly rejected. Soon after pressing for answers, Pocket Options blocked the account entirely. Support accused the user of violating policy clauses, but couldn’t specify which ones.

Nigeria — July 2025:

Multiple Nigerian users described identical situations: unexplained trade closures, blocked accounts, and denied withdrawals. One claimed their $31 deposit had grown to $3,800 USDT, only to have the funds frozen. Despite passing full verification, support cited “duplicate account violations” and refused payout.

Israel — March 2025:

A user described a more direct approach: “My money was stolen in a professional manner. They force you to trade, then steal your funds under impossible withdrawal conditions.”

The Fake KYC Trap

The Pocket Option fake verification issue deserves attention. Across reports, traders note that Pocket Option often conducts arbitrary KYC rechecks after successful verification or after profit gains. In regulated systems, KYC serves to protect investors. Here, however, traders describe it as a delay tactic designed to frustrate users into either giving up or continuing to trade, thereby losing the rest of their funds.

In many cases, when traders escalate or threaten public complaints, their accounts are suspended under standard “anti‑fraud” clauses. Documentation submitted through official ticket systems disappears, and error messages suddenly appear in withdrawal dashboards.

One key difference between Pocket Options and regulated brokers is the segregation and protection of client funds. On regulated platforms (such as those overseen by CySEC, ASIC, or FCA), client deposits are typically held in custodial accounts separate from the companys operating funds. Pocket Options offers no such clear transparency, making it impossible to know whether user deposits are held in secure, segregated accounts.

2025: A Surge in Global Complaints

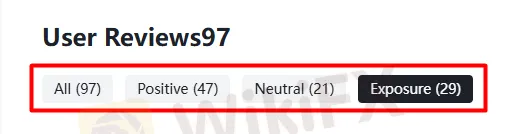

The volume of Pocket Option scam reports surged in 2025, appearing across trading forums, review portals, and consumer‑protection platforms like WikiFX and Trustpilot. The reports spanned over 30 countries, illustrating that the issue isnt isolated but systemic. Many victims share the same timeline: smooth deposits, small wins, account growth, then instant freezing upon withdrawal requests.

These are not isolated misunderstandings. The recurrence of these patterns—slippage, time manipulation, forced KYC resets, and term‑based bans—suggests a coordinated structure that favors the broker over the trader, especially in an unregulated environment.

What Traders Can Learn

For traders tempted by Pocket Options marketing or influencer endorsements, consider the following red flags before funding any account:

- Unregulated operations: Pocket Options is registered in Costa Rica and lacks licenses from top-tier regulators, including the FCA (UK), CySEC (EU), and ASIC (Australia).

- Limited corporate transparency: Ownership details are vague, and the company operates largely through offshore‑style registration.

- Social‑media PR masking as credibility: Paid YouTube tutorials and testimonials often disguise themselves as genuine reviews.

- Opaque pricing and execution: Trade outcomes are generated internally, meaning your “market” exists only inside their database.

Anyone discovering these traits in a platform should treat them as immediate warning signs.

The Shift to Safer Platforms

Many former users report switching to verified exchanges like Binance or Bybit, only to realize too late that unregulated binary‑style sites operate outside the reach of enforceable laws. One Colombian trader expressed his pain clearly: “When I switched to Binance and its alpha points, that‘s when it hurts the most. These people took advantage of the fact that I didn’t know anything.”

Although major exchanges also impose complex KYC checks, their processes are transparent, standardized, and backed by stronger oversight. The contrast underscores the difference between regulated friction and fraud‑like obstacles.

Final Warning: Think Before You Deposit

The growing body of Pocket Option trader complaints paints a clear picture: a platform exploiting unregulated loopholes while hiding behind vague service agreements. Withdrawals are delayed until traders give up. Profitable accounts are banned under loosely defined “violations.” Support offers little real accountability.

Before depositing a single dollar into Pocket Options, investors must pause and read the 2025 testimonies. The stories span continents but converge on one truth: Pocket Options structure benefits the company far more than the trader.

Dont be misled by flashy ads or social‑media influencers proclaiming fast wealth. In practice, Pocket Options has become a global case study in digital‑era financial risk, where the absence of strong regulation makes it easier for users to lose money with little recourse.

If you value your capital, keep your distance—and always verify regulation and fund‑protection practices before trading.

Read more

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

WikiFX Broker

Latest News

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Rate Calc