Just2Trade

Extracto:Just2Trade, short for Lime Trading (CY) Ltd, is an international brokerage firm based in Cyprus. It provides traders with access to market instruments including Forex, Stocks, Metals, Futures, CFD, Bonds as well as financial services including IPO Investment, Individual investment portfolio. It is currently under CYSEC (Cyprus Securities and Exchange Commission) regulation with license no. 281/15.

| Just2Trade Review Summary in 10 Points | |

| Founded | 2004 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC regulated |

| Financial Products & Services | Forex, Stocks, Metals, Futures, CFD, Bonds;IPO Investment, Individual investment portfolio |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| EUR/USD Spread | Start from 0.0 pips |

| Trading Platforms | MT4/5, CQG, Sterling Trader® Pro |

| Minimum Deposit | $100 |

| Customer Support | Phone, Address, Email, Live chat |

What is Just2Trade?

Just2Trade, short for Lime Trading (CY) Ltd, is an international brokerage firm based in Cyprus. It provides traders with access to market instruments including Forex, Stocks, Metals, Futures, CFD, Bonds as well as financial services including IPO Investment, Individual investment portfolio. It is currently under CYSEC (Cyprus Securities and Exchange Commission) regulation with license no. 281/15.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • CYSEC regulated | • FSPR revoked |

| • Multiple customer support channels | • No MT4/5 trading platform |

| • Multiple payment methods | |

| • Zero commissions | |

| • Tight spreads | |

| • Demo account available |

Just2Trade Alternative Brokers

There are many alternative brokers to Just2Trade depending on the specific needs and preferences of the trader. Some popular options include:

JFD- JFD is a well-regarded brokerage known for its transparency and diverse range of trading instruments, making it a strong choice for traders seeking a reliable and comprehensive trading experience.

Markets.com- Markets.com stands out for its user-friendly platform and extensive educational resources, making it an excellent option for traders, especially those new to the market.

NAGA- NAGA's innovative social trading platform and wide range of assets provide a unique and interactive trading experience, ideal for traders interested in a social community and the opportunity to follow experienced investors.

Is Just2Trade Safe or Scam?

When considering the safety of a brokerage like Just2Trade or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: It currently under CYSEC (Cyprus Securities and Exchange Commission) regulation with license no. 281/15. The regulation status makes it appears reliable, but it is important to note that experience alone does not guarantee the legitimacy or security of a brokerage.

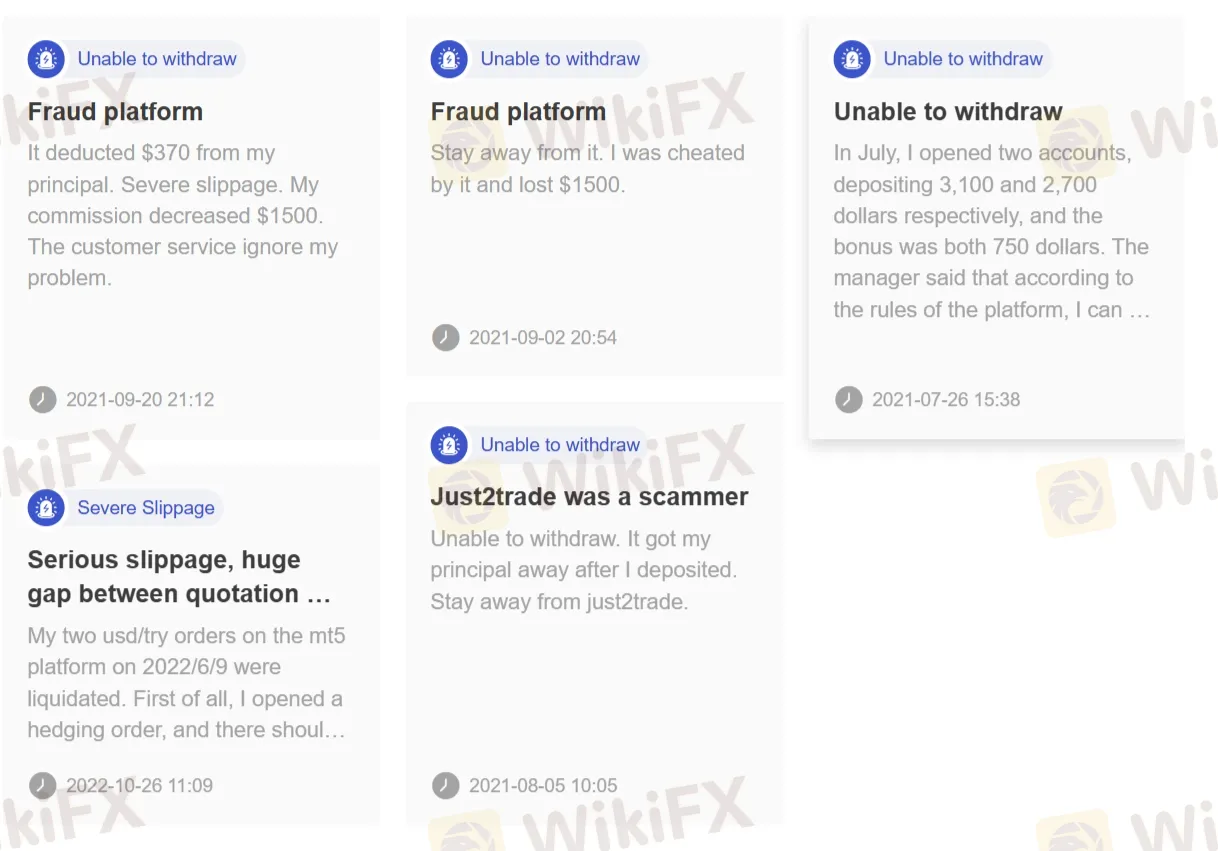

User feedback: Total 11 pieces of exposures on WikiFX of scam and unable to withdraw are red flags that cannot be overlooked, immediate attention and caution in any financial dealings with this company is suggested when traders consider trading.

Security measures: Just2Trade bolsters security by implementing a comprehensive privacy policy, elucidating the meticulous handling and protection of users' personal data.

Ultimately, the decision of whether or not to trade with Just2Trade is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Just2Trade provides brokerage services offering a diverse array of market instruments to cater to the multifaceted needs of traders.

With options spanning Forex, Metals, Stocks, Futures, CFDs, and Bonds, it provides traders with a comprehensive portfolio of assets to engage with. This breadth of offerings allows traders to diversify their portfolios, implement various trading strategies, and explore global markets, all within the same user-friendly trading platform.

In addition to providing a robust trading platform, Just2Trade also extends its offerings to incorporate comprehensive financial services such as IPO Investment and Individual Investment Portfolios.

Their IPO Investment service affords clients the exciting opportunity to invest in companies' initial public offerings, providing a unique avenue for potential growth.

Meanwhile, the Individual Investment Portfolio feature allows clients to create and manage personalized investment portfolios tailored to their financial goals and risk tolerance.

Account Types

Just2Trade offers a variety of account types to cater to the needs of different traders:

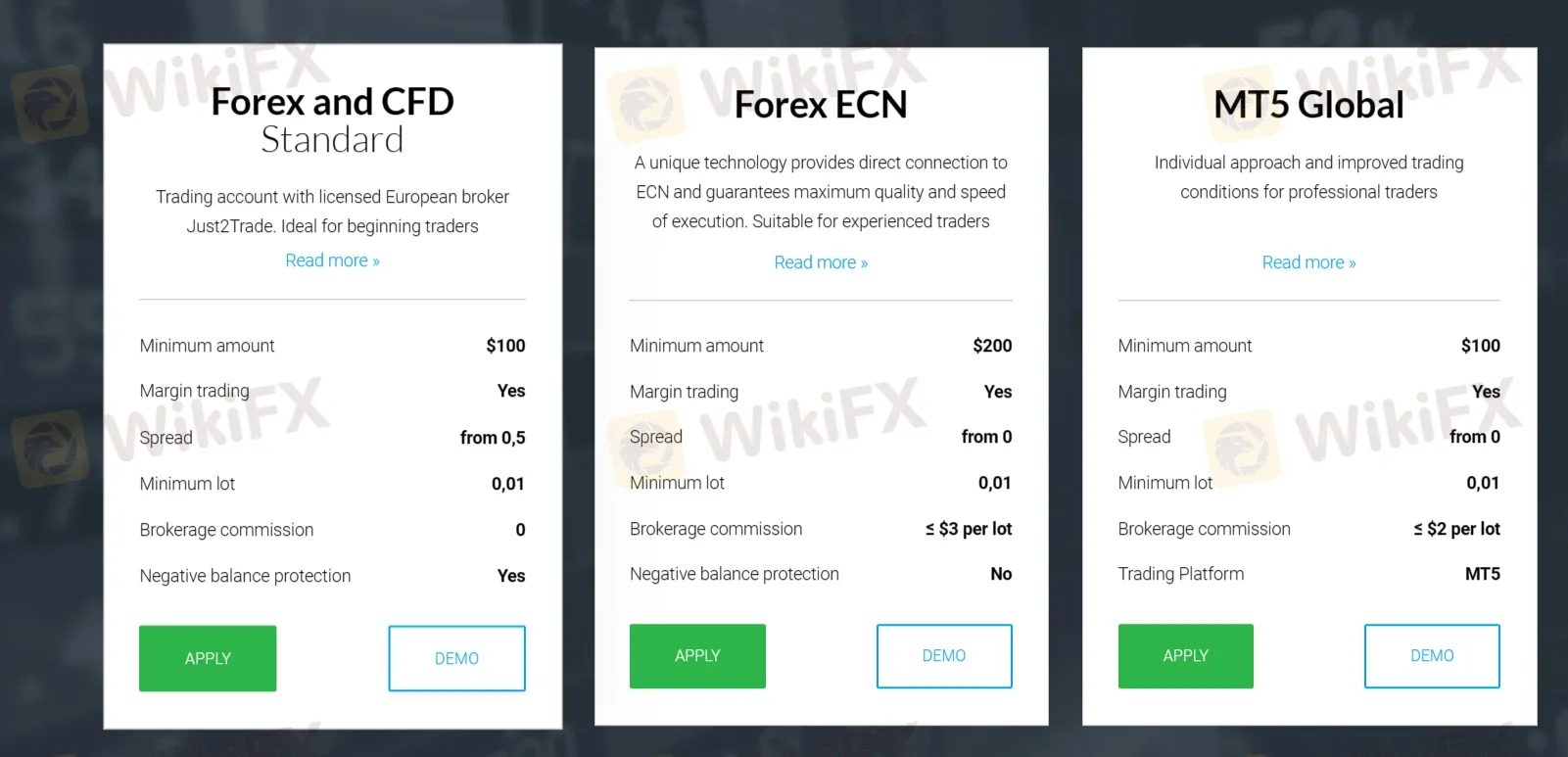

Demo Account: Just2Trade provides a Demo Account for traders who want to practice and familiarize themselves with the platform and trading strategies without risking real money. It's an excellent way for beginners to learn and for experienced traders to test their strategies.

Forex and CFD Standard Account: With a minimum deposit requirement of $100, the Forex and CFD Standard Account is designed for traders looking to trade a wide range of Forex currency pairs and Contracts for Difference (CFDs). This account type offers standard trading conditions with competitive spreads.

Forex ECN Account: For traders seeking enhanced trading capabilities, the Forex ECN Account requires a minimum deposit of $200. This account type offers access to an Electronic Communication Network (ECN), providing direct market access, tighter spreads, and faster execution speeds.

MT5 Global Account: Just2Trade's MT5 Global Account is an excellent option for traders who prefer the MetaTrader 5 (MT5) platform. With a minimum deposit of $100, traders can access a wide range of financial instruments, including Forex, stocks, commodities, and more, using the advanced features of the MT5 platform.

These diverse account options enable traders to choose the one that aligns best with their trading style, experience level, and financial goals.

Leverage

JUST2TRADE brokerage provides traders with maximum leverages of up to 1:500. Leverage allows traders to control larger positions in the market with a smaller amount of invested capital. With a leverage ratio of 1:500, traders can amplify their trading potential by effectively multiplying their trading capital.

It's important to note that while leverage can increase potential profits, it also amplifies potential losses, as traders are exposed to higher market risk. Therefore, it is crucial for traders to exercise prudent risk management practices, carefully consider their trading strategies, and be aware of the potential implications of using leverage.

Spreads & Commissions

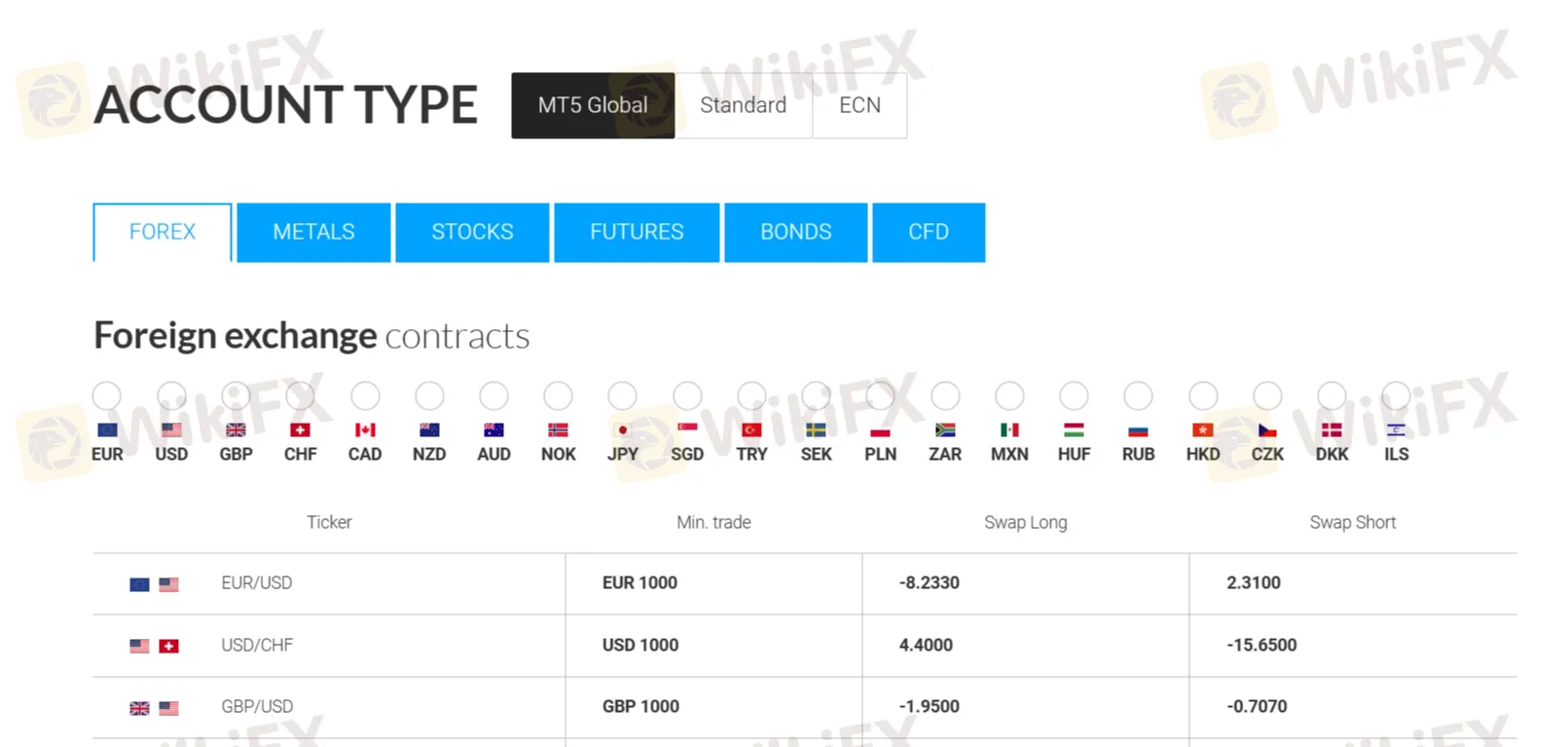

Just2Trade offers a range of account options to cater to various trader preferences.

The Forex and CFD Standard Account features spreads starting from 0.5 pips and boasts a commission-free structure, making it ideal for traders looking for cost-effective trading with no additional fees.

For those seeking even tighter spreads and faster execution, the Forex ECN Account offers spreads starting from 0.0 pips, coupled with a commission structure of less than or equal to $3 per lot, providing direct market access and a transparent fee model.

Meanwhile, the MT5 Global Account offers spreads from 0.0 pips and an even lower commission of less than or equal to $2 per lot, making it suitable for traders who prefer the advanced features of the MetaTrader 5 platform while optimizing their trading costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Just2Trade | From 0.0 pips | Variable (depending on account) |

| JFD | 0.3 pips | From £2.5 per lot |

| Markets.com | Not disclosed | Not disclosed |

| NAGA | From 0.7 pips | Variable (depending on product) |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Trading Platforms

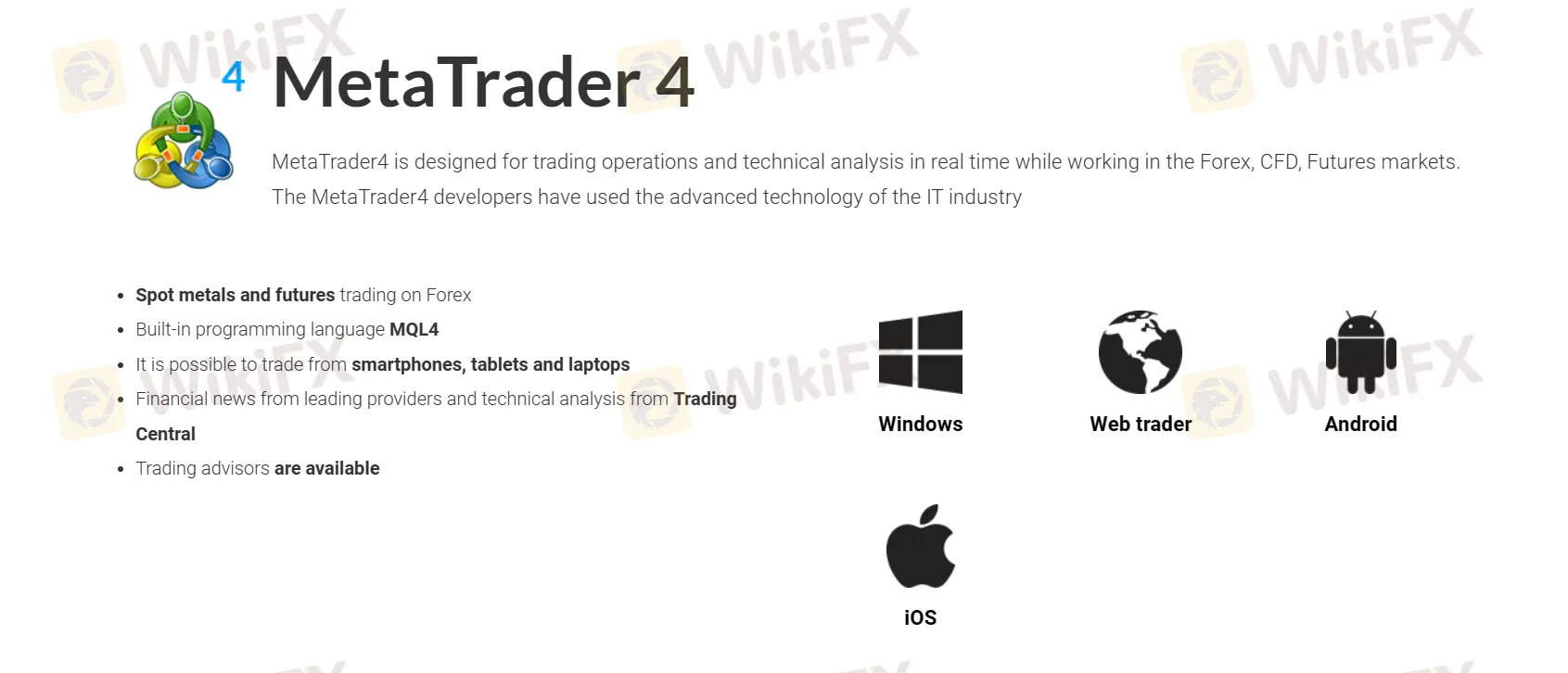

Just2Trade prioritizes accessibility and convenience for traders by offering a diverse selection of trading platforms compatible with various devices and operating systems.

Traders can choose between the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available on Windows, web traders, Android, and iOS devices, ensuring flexibility and continuity in their trading activities across multiple devices.

Furthermore, the availability of CQG, a comprehensive trading platform, on all key devices, operating systems, and browsers, provides direct access to more than 40 exchanges all over the world and a wide range of instruments traded on these exchanges — futures, options and their combinations. It enhances the accessibility and performance of trading for Just2Trade's clients.

Additionally, the web-based Sterling Trader® Pro platform offers traders another web-based option for seamless and efficient trading, providing a versatile and user-friendly trading experience across a range of technological preferences.

Overall, Just2Trade trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Just2Trade | MT4/5, CQG, Sterling Trader Pro |

| JFD | MT4+, MT5+, WebTrader, stock 3 |

| Markets.com | MT4, MT5, own platform |

| NAGA | NAGA Trader, MT4, MT5 |

Trading Tools

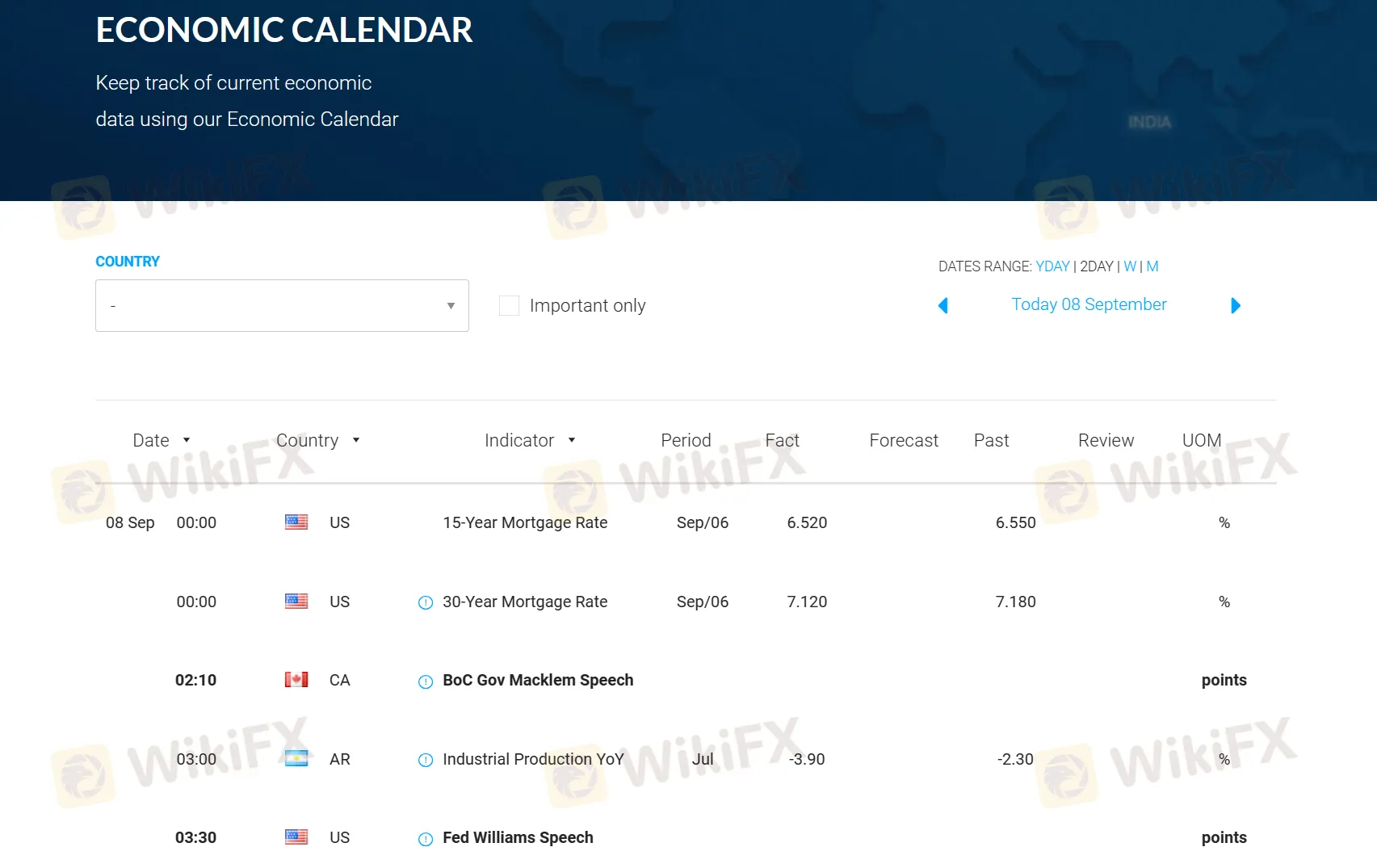

Just2Trade enhances its trading toolkit by providing an economic calendar to its clients. This economic calendar is a valuable trading tool that offers real-time information on important economic events, such as economic indicators, central bank announcements, and geopolitical events that can impact the financial markets. Traders can use this calendar to stay informed about scheduled events that may influence currency exchange rates, commodities, and other assets. By keeping track of these economic events, traders can make more informed decisions, manage risk effectively, and seize trading opportunities in the dynamic world of forex and financial markets.

Deposits & Withdrawals

Deposit Methods:

| Deposit Method | Commission | Currency | Transfer Time |

| Bank Transfer | Your bank's fee | EUR, USD, RUB | 2-3 business days |

| Credit Card | 2.25% | Instant | |

| PayPal | 3% | ||

| Skrill (Moneybookers) | 2.90% | USD, EUR | |

| Giropay (by Skrill) | |||

| iDeal (by Skrill) | |||

| Dankort (by Skrill) | |||

| Nordea (by Skrill) | |||

| POLi (by Skrill) | |||

| P24 (by Skrill) | |||

| Neteller | |||

| Klarna (by Skrill) | |||

| Alfa-bank | 2.50% | RUB | |

| Davivienda | 2.25% | COP | |

| OXXO | MXN | ||

| SPEI | |||

| 7eleven | |||

| Local Cards in Mexico |

Withdrawal Methods:

Withdrawals are handled efficiently:

Withdrawal Request: Initiate the withdrawal process by submitting a request through www.Just2Trade.club.

Return to Origin: Withdrawn funds are returned to the same source from which the initial deposit was made. This ensures security and compliance with withdrawal procedures.

User Exposure on WikiFX

Encountering a total of 11 pieces of exposures on WikiFX, most related to scams and unable to withdraw, these serve as an alarming signal that cannot be ignored when considering this particular platform. These serious red flags are indicative of potential risks and malpractices within the company's operations. Traders and investors must exercise extreme caution and conduct thorough due diligence before engaging with the company.

If you find such fraudulent financial company or have been a victim of one as well, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

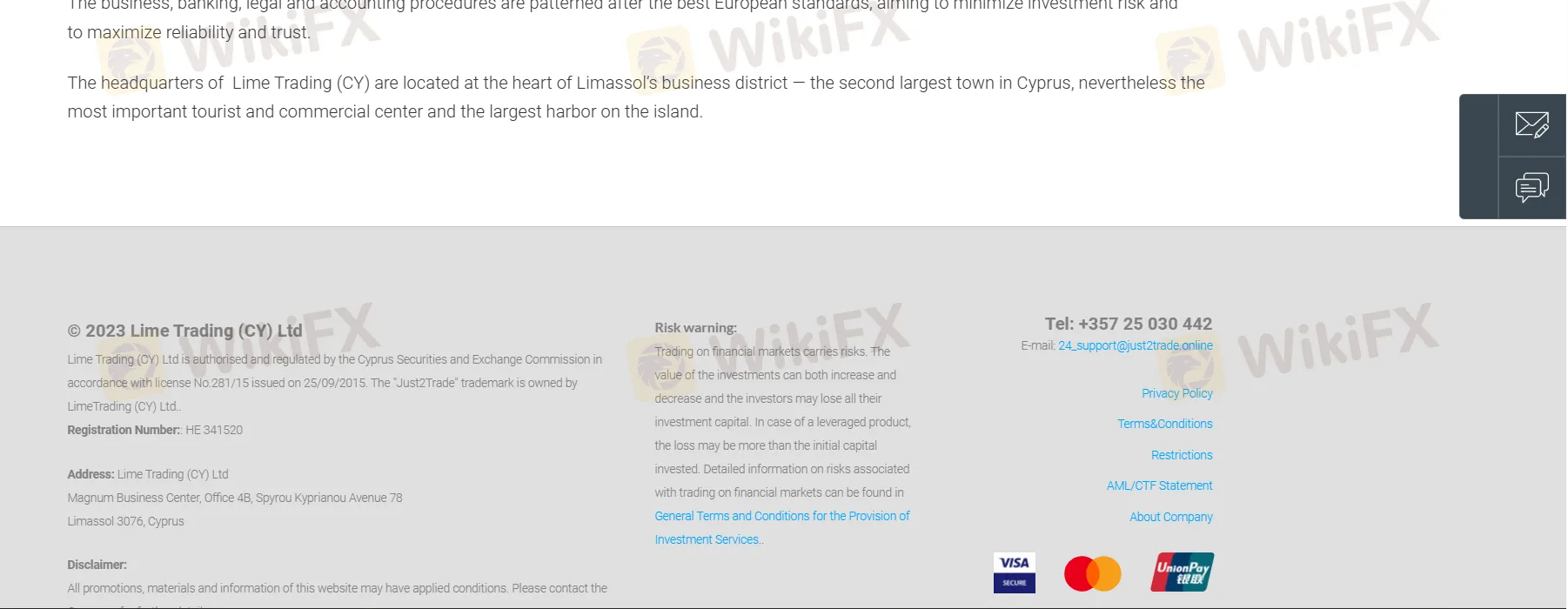

Customer Service

Just2Trade provides multiple customer service options to assist its clients. Customers can reach out to Just2Trade through various channels to address their queries and concerns as below:

Phone: +357 25 030 442.

Trading desk:+357 96 370 242.

Email:24_support@just2trade.online.

Address: Lime Trading (CY) Ltd, Magnum Business Center, Office 4B, Spyrou Kyprianou Avenue 78, Limassol 3076, Cyprus

Moreover, traders can access real-time assistance through live chat to address their questions immediately.

Education

Just2Trade is committed to the continuous learning and growth of its traders, which is reflected in their offering of a blog page as a key educational resource.

This blog acts as an informational hub, providing readers with regular insights into the world of trading, market analysis, key trends, and investment strategies. It equips them with industry knowledge that is crucial to informed trading decisions. The depth and breadth of topics covered within Just2Trade's blog make it a valuable learning tool, aiding beginner traders in developing their understanding of the market while also helping seasoned traders stay updated on market nuances.

Conclusion

According to available information, Just2Trade is a CYSEC-regulated Cyprus -based brokerage firm. While the firm offers brokerage services including market instruments such as Forex, Stocks, Metals, Futures, CFD, Bonds to traders as well as financial services such as IPO Investment, Individual investment portfolio, it is important to consider certain factors such as 11 pieces of exposure on WikiFX that might raise concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Just2Trade before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is Just2Trade regulated? |

| A 1: | Yes, it currently under CYSEC (Cyprus Securities and Exchange Commission) regulation with license no. 281/15. |

| Q 2: | Does Just2Trade offer the industry leading MT4 & MT5? |

| A 2: | Yes, the broker offers MT4/5 on WINDONW, IOS, WEB and ANDROID devices. |

| Q 3: | Is Just2Trade a good broker for beginners? |

| A3: | Yes, it‘s a good broker for beginners because it’s well regulated by CYSEC. |

| Q 4: | Does Just2Trade offer demo accounts? |

| A 4: | Yes. |

| Q 5: | What is the minimum deposit for REDSTONE? |

| A 5: | The minimum initial deposit is 100 USD. |

| Q 6: | At Just2Trade, are there any regional restrictions for traders? |

| A 6: | Yes. Just2Trades services are not directed to the United States. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Brokers de WikiFX

últimas noticias

Los precios del oro comienzan el nuevo año sin cambios.

Interactive Brokers ¿Es seguro para los traders? Análisis 2025.

XTB obtiene aprobación regulatoria en Indonesia y Emiratos Árabes Unidos.

¿Siguen las estafas de Warren Bowie & Smith? Inversores no pueden retirar.

Comparta la experiencia de la industria y explore el mercado de divisas

Pepperstone ¿Es seguro para los traders? Análisis 2025.

La verdadera cara de GO4REX: Falta de Transparencia y Tácticas Abusivas.

Cálculo de tasa de cambio