BPS Capital-Overview of Minimum Deposit, Spreads & Leverage

Extracto:BPS Capital is an unregulated online broker founded in 2019 and established in Liverpool Street, London, offering brokerage services in forex, commodities, indices, stocks, cryptocurrencies and CFD Trading. The broker operates with no dealing desk (NDD) and offers both STP and ECN trading models. BPS Capital claims that the operation of its website is managed by BFS Capital, registered in Marshall Islands.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| BPS CAPITAL Review Summary in 10 Points | |

| Founded | 2019 |

| Registered Country/Region | United Kingdom |

| Regulation | NFA (unauthorized) |

| Market Instruments | Forex, metals, energies, commodities, cryptos & index CFDs, stocks |

| Demo Account | Available |

| Leverage | 500:1 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 live chat, phone, email |

What is BPS CAPITAL?

BPS Capital is an unregulated online broker founded in 2019 and established in Liverpool Street, London, offering brokerage services in forex, commodities, indices, stocks, cryptocurrencies and CFD Trading. The broker operates with no dealing desk (NDD) and offers both STP and ECN trading models. BPS Capital claims that the operation of its website is managed by BFS Capital, registered in Marshall Islands.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

BPS CAPITAL offers a range of trading instruments with competitive trading conditions on MT4 platform, as well as a variety of educational resources. Additionally, the broker offers a 24/5 live chat support and deposits and withdrawals are free of charge. However, BPS CAPITAL is currently unregulated, which may be a concern for some traders. The limited customer service channels and lack of regulatory oversight are notable drawbacks to consider when choosing this broker.

| Pros | Cons |

| • Wide range of tradable instruments | • Unregulated |

| • Secure segregated trust accounts with top-tier banks | • Limited account types |

| • No deposit or withdrawal fees | • Regional restrictions |

| • Low minimum deposit requirement of $50 | |

| • Demo accounts available | |

| • Competitive spreads starting from 0.0 pips | |

| • MT4 trading platform |

Note that these pros and cons are based on the information provided and may not be exhaustive or applicable to all individual situations. It's important to conduct thorough research and due diligence before making any investment decisions.

BPS CAPITAL Alternative Brokers

FXTM: FXTM is a regulated broker with a wide range of account types and trading instruments, suitable for both beginner and advanced traders.

FBS: FBS is a popular broker with competitive trading conditions, multiple account types, and a range of educational resources for traders.

Trade Nation: Trade Nation is a regulated broker with a focus on providing a simple and transparent trading experience, offering tight spreads, no commission fees, and a user-friendly platform.

There are many alternative brokers to BPS CAPITAL depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is BPS CAPITAL Safe or Scam?

As BPS CAPITAL is currently unregulated, there is a higher risk involved when trading with them. However, the fact that they keep client funds in secure segregated trust accounts with top-tier banks is a positive indication. It is essential to do your due diligence and carefully consider the risks before deciding to trade with an unregulated broker like BPS CAPITAL.

Market Instruments

BPS CAPITAL provides its clients with 100+ financial instruments to trade on its platform. Traders can access the global financial markets and trade Forex, metals, energies, commodities, cryptocurrencies, and index CFDs. The broker also offers clients the ability to trade stocks of leading companies from various markets such as the US, European, and Asian markets. With such a broad range of instruments, traders have the opportunity to diversify their portfolios and take advantage of different market conditions.

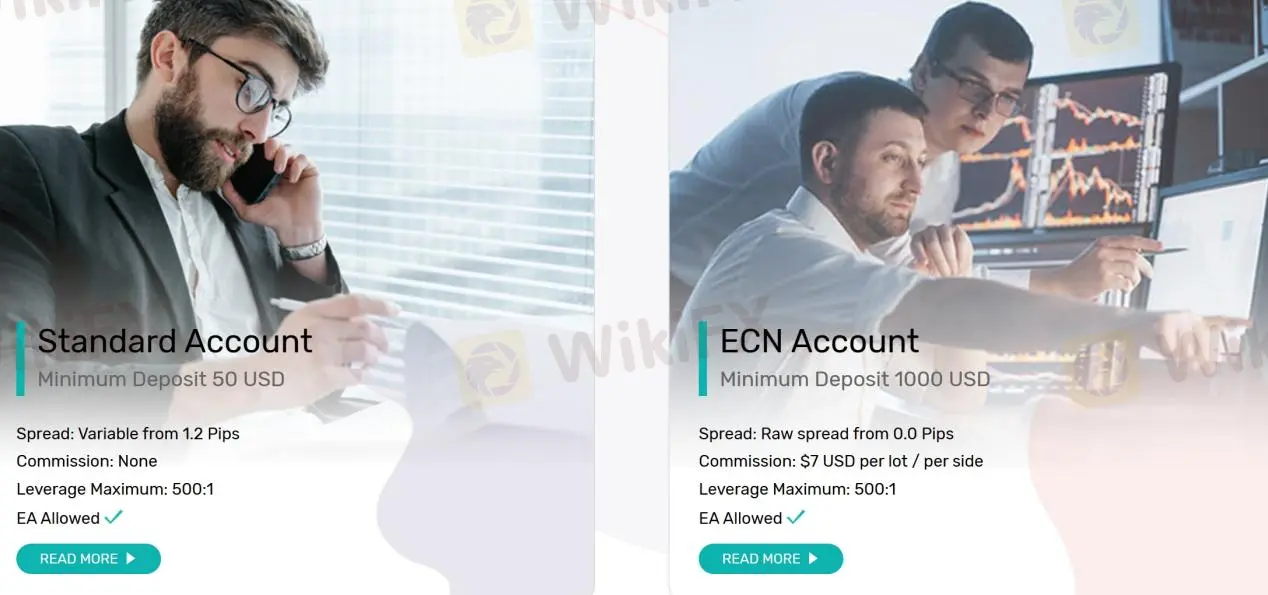

Accounts

Two trading accounts are offered on the BPS Capital platform, Standard and ECN, with different requirements for opening accounts varied. The minimum initial deposit for the Standard account is as low as $50, while the requirement for the ECN accounts soars to $1000. Demo accounts are also available.

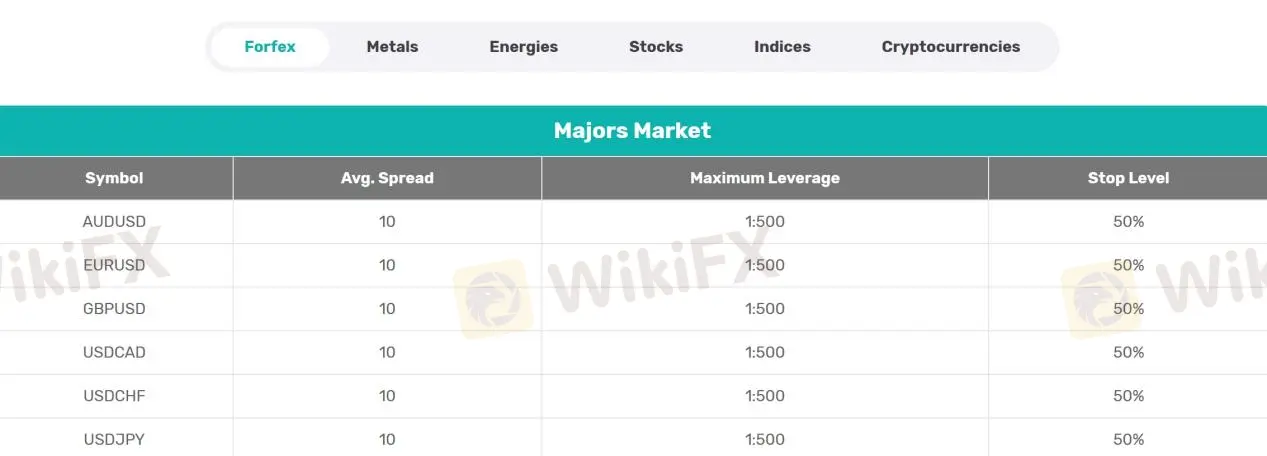

Leverage

BPS Capital provides access to a leverage of up to 500:1 – this is, of course, much higher than what most regulatory bodies have deemed appropriate for retail traders, and yet BPS Capital offers it, in a bid to attract more people.

Spreads & Commissions

Spreads and commissions vary depending on different trading accounts. The minimum spreads in the Standard account start from 1.2 pips with no commissions charged, while from 0.0 pips on the ECN account with a commission of $7 USD per lot per side.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| BPS CAPITAL | From 0.0 pips | No |

| FXTM | From 0.1 pips | No |

| FBS | From 0.5 pips | No |

| Trade Nation | From 0.6 pips | No |

Note that these spreads and commissions are subject to change and may vary depending on the account type, trading instrument, and market conditions. It's important to check with each broker for the most up-to-date information.

Trading Platforms

BPS Capital provides access to a distribution of the Metatrader 4 platform - the most revered piece of trading software out there, preferred by the majority of traders for its combination of sleek and user-friendly interface and powerful trading features.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| BPS CAPITAL | MetaTrader 4 |

| FXTM | MetaTrader 4, MetaTrader 5, FXTM Trader |

| FBS | MetaTrader 4, MetaTrader 5, FBS Trader |

| Trade Nation | Trade Nation platform |

Note: It's worth mentioning that some brokers may offer additional trading platforms that are not included in the table.

Trading Tools

BPS Capital offers a trader's calculator, which is a useful tool for traders to calculate important parameters such as pip value, margin requirements, and profit and loss potential. The calculator is easy to use, and traders can input the trade size, account currency, and currency pair to get an accurate calculation of the potential risk and reward. This can be especially helpful for new traders who are still learning about risk management and money management in the forex market. The trader's calculator is just one of the many trading tools that BPS Capital offers to its clients to help them make informed trading decisions.

Deposits & Withdrawals

You can make deposits via telegraphic transfer, Bank Transfer or Crypto wallets via the Client portal. The minimum deposit amount is $50 and minimum withdraw amount is $10. There are no fees for deposits or withdrawals.

BPS CAPITAL minimum deposit vs other brokers

| BPS CAPITAL | Most other | |

| Minimum Deposit | $50 | $100 |

Deposits are usually credited to the trading account immediately, while withdrawal requests are processed immediately, with bank transfer funds expected to be returned within 1-3 natural days. Telegraphic transfers may take up to 5 days.

Fees

BPS CAPITAL offers trading with competitive pricing and low transaction costs. The broker charges no deposit or withdrawal fees. There is also no inactivity fee charged by BPS Capital. However, there are fees for overnight positions, such as swaps or rollover fees. Swap details can be found in the product information page of a particular product. Swap rates are normally daily and are based on prevailing market rates.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| BPS CAPITAL | No | No | No |

| FXTM | No | No | $5/month after 6 months of inactivity |

| FBS | No | No | $10/month after 180 days of inactivity |

| Trade Nation | No | No | £10/month after 12 months of inactivity |

Please note that these fees may be subject to change and you should always check with the broker directly for the most up-to-date information.

Customer Service

BPS Capital offers the 24/5 customer service support, and they can be reached through live chat, telephone (+84 0869 916 959), and email (support@bpscap.com). There is also a FAQ section available. You can also follow them on social networks including Facebook and LinkedIn.

| Pros | Cons |

| • 24/5 multi-channel customer support | • No 24/7 support service |

| • Social media support available | • Callback request service unavailable |

| • Live chat doesnt work |

Note: These pros and cons are subjective and may vary depending on the individual's experience with BPS CAPITAL's customer service.

Education

BPS Capital offers various educational resources that can be accessed via their website. These resources include market news, trading signals, webinars, and trading rank. The market news provides up-to-date information on global markets and their impact on trading instruments. The trading signals provide a set of instructions to help traders make informed trading decisions. The webinars are hosted by industry experts who provide valuable insights on market trends and trading strategies. The trading rank is a tool that ranks the performance of traders based on their profitability, which can be used to identify successful trading strategies. These educational resources can help traders improve their trading skills and make more informed decisions.

Conclusion

All in all, BPS Capital offers a good range of trading instruments with competitive spreads and high leverage. Their educational resources and trading tools are also helpful for traders of all levels. However, the broker's lack of regulation raises some concerns about the safety of client funds. Additionally, the customer support team can be slow to respond, and their live chat doesnt work currently.

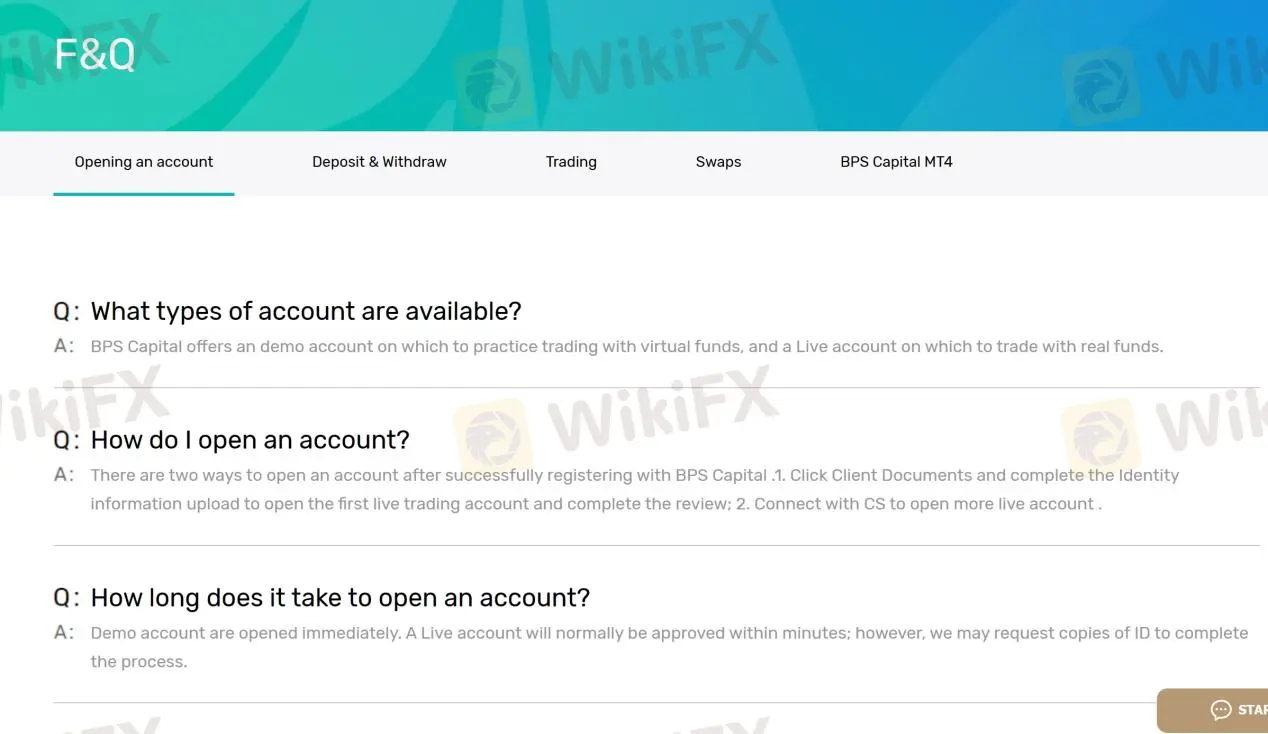

Frequently Asked Questions (FAQs)

| Q 1: | Is BPS CAPITAL regulated? |

| A 1: | No. It only holds an unauthorized National Futures Association (NFA) license. |

| Q 2: | At BPS CAPITAL, are there any regional restrictions for traders? |

| A 2: | Yes. The information on their site is not directed at residents of the United States, Belgium or any particular country which is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Q 3: | Does BPS CAPITAL offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does BPS CAPITAL offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for BPS CAPITAL? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is BPS CAPITAL a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. We dont advise any traders trade or invest with unregulated brokers. |

Brokers de WikiFX

últimas noticias

Revisión de la FCA destaca la necesidad de fortalecer defensas contra el lavado de dinero.

El comportamiento del dólar y las perspectivas económicas para América Latina en 2025

La CNMV alerta de 18 entidades no registradas.

¿Cuál broker es el mejor para principiantes en México?

Cálculo de tasa de cambio