DigibitsFX-Overview of Minimum Deposit, Leverage, Spreads

Extracto:Founded in 2021, DigibitsFX is offshore online forex broker registered in Saint Vincent and the Grenadines, specialized in FX trading services. Investors have the flexibility to choose from three different trading accounts on the DigibitsFX platform, and the maximum leverage available is up to 1:500. DigibitsFX is operated by Digibits Network Limited (26565 ibc2021) that is registered in Saint Vincent and licensed with the Financial Services Authority.

| Digibits | Basic Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Founded | 2021 |

| Regulation | Not Regulated |

| Company Name | Digibits |

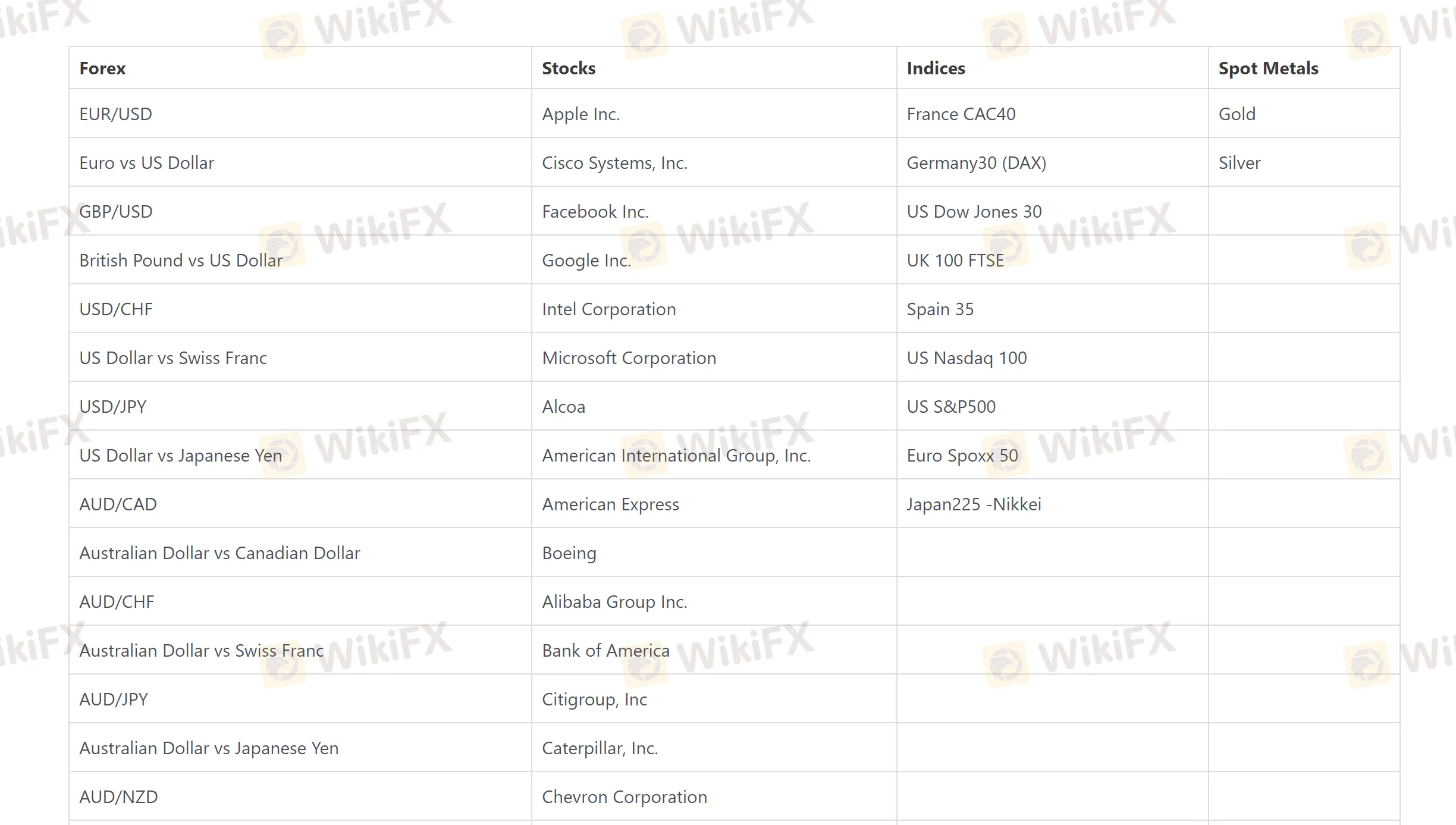

| Tradable assets | Forex, Stocks, Indices, Spot Metals |

| Minimum deposit | $100 (USD) |

| Spreads and Commission | Variable spreads, Commission vary depending on trading account |

| Account Types | Standard Account, VIP Account, Raw Account |

| Maximum leverage | Up to 1:500 |

| Trading platform | MetaTrader 4 |

| Mobile trading | Yes |

| Customer Support | 24/5 via Telephone, Email, Live Chat |

*Please note that the information provided on the table is based on the available details and general knowledge. It's always recommended to visit the broker's official website or contact them directly for the most accurate and up-to-date information.

Overview of Digibits

Founded in 2021, Digibits is a forex broker registered in Saint Vincent and the Grenadines, offering trading services to clients from all around the world. The broker provides several account types that cater to different trading styles and levels of expertise. The account types include Standard, VIP and Raw accounts, each with its unique features and trading conditions. The minimum deposit to open a standard account starts from $1000, which is much higher than most broker's requirements. In terms of leverage, Digibits provides traders with the option to choose their leverage level depending on the trading instrument. For Forex, gold, and silver, Digibits offers a maximum leverage of 1:500.

Digibits offers the MetaTrader 4 (MT4) trading platform to its clients, a reliable and user-friendly platform that traders can use on desktop, web and mobile devices, allowing them to access trading and analysis tools anytime and from anywhere.

Digibits offers customer support services to its clients via multiple channels, including telephone, email, live chat, and a web contact form. Their customer service team is available 24/5 to answer any questions or concerns that clients may have about trading or the services provided by the company.

DigibitsFX is operated by Digibits Network Limited (26565 ibc2021) that is registered in Saint Vincent and licensed with the Financial Services Authority.

Is Digibits legit or a scam?

Digibits is not currently regulated by any financial regulatory authority. While unregulated brokers can offer certain advantages, such as lower fees and more flexible account options, it's important to note that there may also be risks involved. Unregulated brokers do not have to follow certain strict guidelines and regulations, and may not necessarily provide the same levels of security and protection as regulated brokers.

Therefore, it is always recommended that traders do their own research and exercise caution when dealing with unregulated brokers like Digibits.

Pros and Cons

On the positive side, Digibits offers a variety of account types and competitive trading conditions, such as high leverage and access to a diverse range of trading instruments. The broker also provides an intuitive and user-friendly trading platform, efficient customer support and mobile trading capabilities. However, Digibits limitations include a relatively narrow range of tradable assets, high fees for bank transfers and withdrawals, lack of investor protection, and limited educational resources for traders.

| Pros | Cons |

| Multiple account types to choose from | Not regulated |

| Competitive trading conditions and leverage | Limited range of tradable assets |

| Wide range of trading instruments including forex, indices, commodities, and cryptocurrencies | No investor protection scheme |

| User-friendly trading platform, MetaTrader 4 | Limited educational resources |

| Mobile trading available | No social trading |

| Efficient and responsive customer support | High fees for bank transfers and withdrawals |

Market Intruments

Digibits offers a range of market instruments for trading, including forex, indices, commodities, and cryptocurrencies. Forex traders can trade on major, minor and exotic currency pairs, while the index trading options include the popular S&P 500, NASDAQ and the Dow Jones. The broker also provides access to a variety of commodities such as gold, oil, silver. Additionally, Digibits offers a growing selection of cryptocurrencies, including Bitcoin, Litecoin and Ethereum, among others. Traders can choose to trade these assets on either a standard or raw account, and the MetaTrader 4 trading platform provides a user-friendly interface for executing trades across all of these instruments.

Account Types

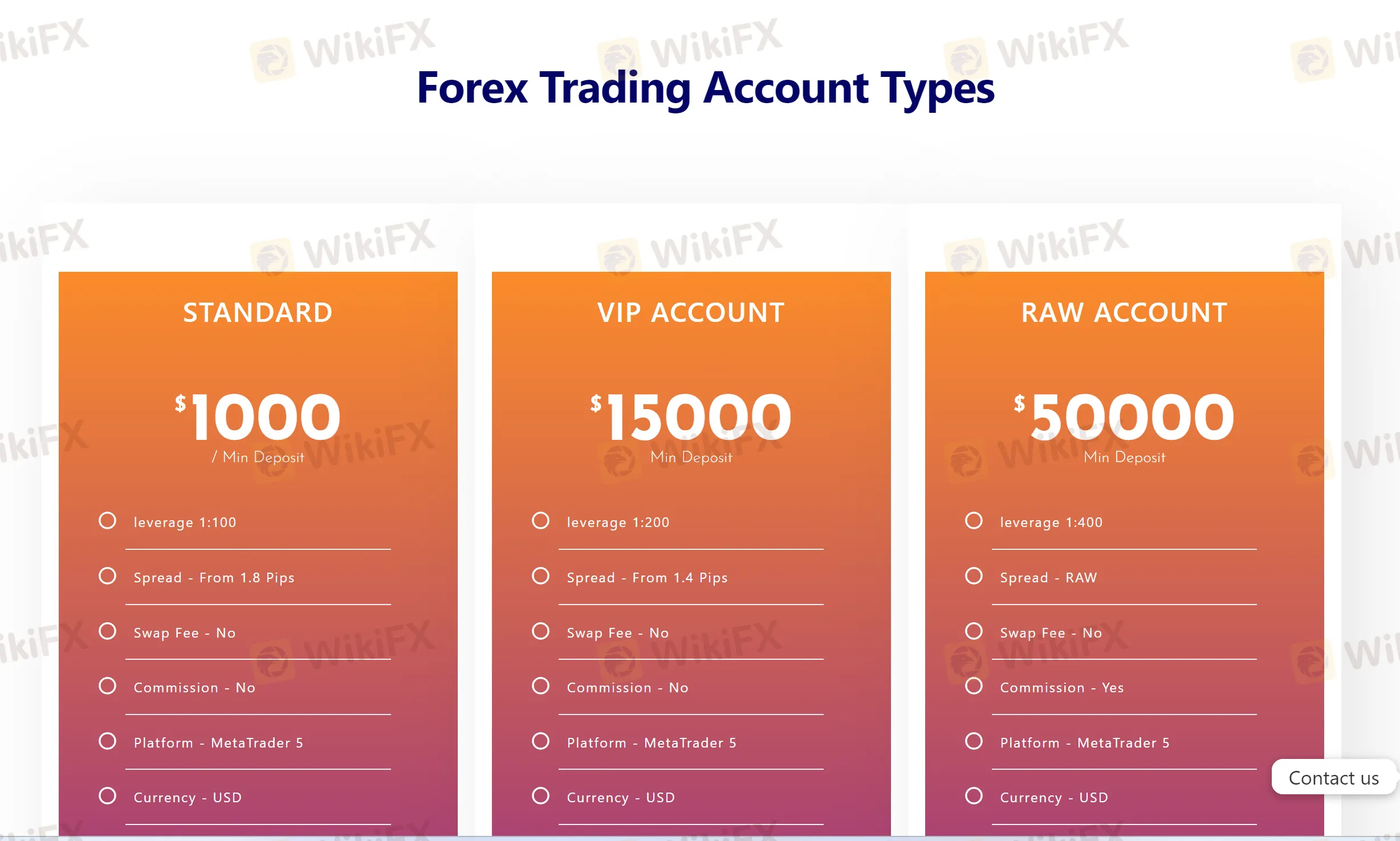

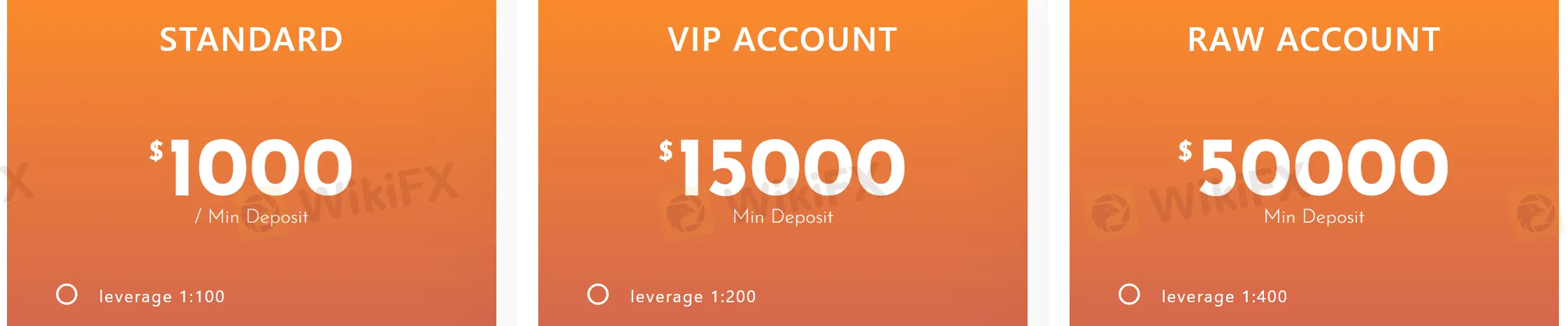

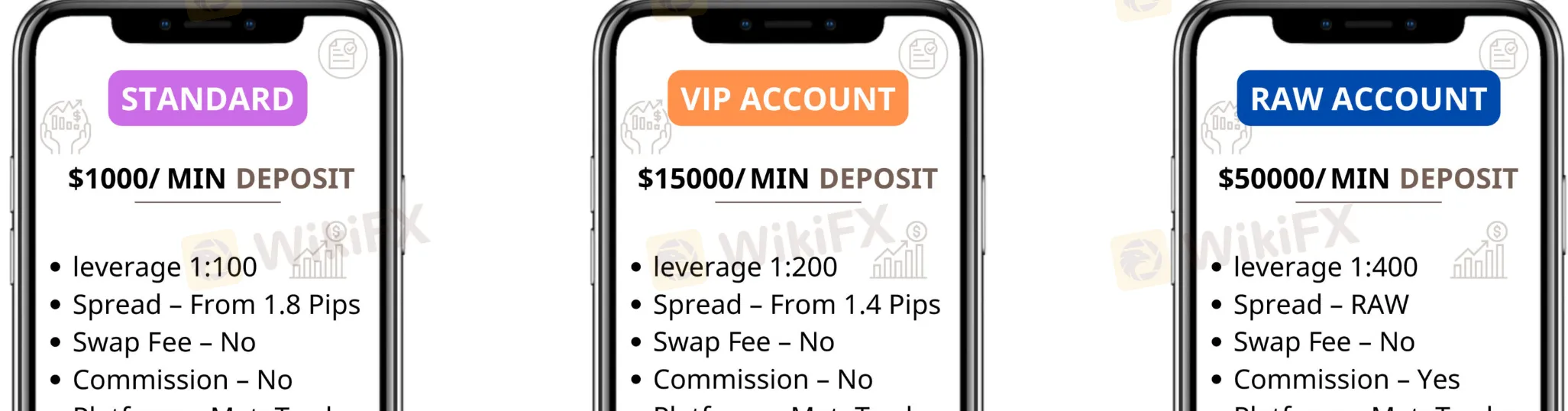

Digibits offers three main account types for its traders: the Standard account, the VIP account, and the RAW account. The Standard account requires a minimum deposit of $1,000 and offer variable spreads starting from 1.8 pips. Traders can acess all trading instruments and enjoy flexible leverage up to 1:500. On the other hand, the VIP account requires a minimum deposit of $15,000. and offers spreads starting from 1.4 pips. VIP account holders also get a personal account manager and can trade with up to 1:200 leverage. Finally, the RAW account is intended for serious and high-volume traders, requiring a minimum deposit of $50,000. This type of account offers the lowest spreads starting from 0 pips but charges commissions on every trade. RAW account holders can also trade with up to 1:200 leverage. All account types come with access to the MetaTrader 4 trading platform and other features, with higher-tier accounts offering additional perks and benefits.

How to open an account?

To open an account with, follow these simplified steps:

1. Visit the official website of Digibits, and locate the “Open Account” or “Register” button prominently displayed on the website's homepage.

2. Fill out the registration form accurately, providing your personal details, including your full name, valid email address, phone number, and country of residence.

3. Select the desired account type from the available options, such as a live account for real trading or a demo account for practicing with virtual funds. Carefully review and accept the terms and conditions, as well as any risk disclaimers stipulated by Rallyville Markets.

4. Submit your completed registration form for processing and verification, ensuring that all information provided is correct and matches your official identification documents.

5. Once your account is approved, you will receive login credentials to access the trading platform provided by Digibits. Deposit funds into your trading account using the available payment methods accepted by the broker, ensuring that you meet the specified minimum deposit requirement.

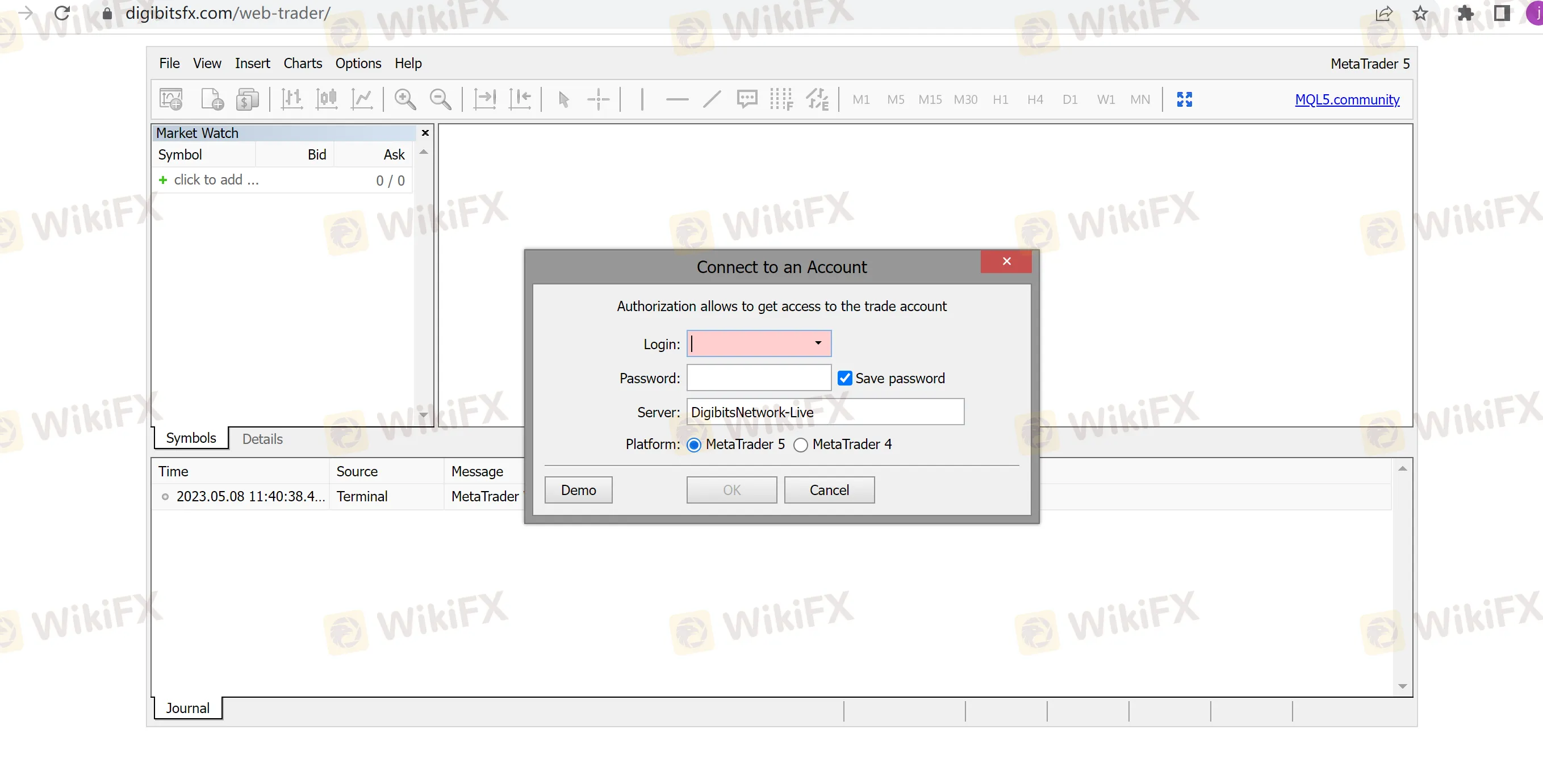

6. Download and install the trading platform, and log in using your account credentials to commence trading various financial instruments.

Keep in mind that you will need to complete the Know Your Customer (KYC) process before you can make any withdrawals. This involves submitting identification documents such as a passport or driver's license, and proof of address such as a utility bill or bank statement. Make sure to follow all instructions provided by Digibits to ensure a smooth account opening process.

Leverage

Digibits offers leverage up to 1:500 for the Standard account, up to 1:200 for the VIP account, and up to 1:200 for the RAW account. Leverage is a tool that allows traders to magnify their profits and losses, by allowing them to control larger positions with a smaller amount of capital. However, it's important to note that higher leverage also increases the risk of losing more than the initially invested capital. Digibits provides flexible leverage options, which traders can use according to their trading experience and risk preferences. It's essential to understand how leverage works and use it responsibly in order to stay within acceptable risk levels.

Spreads & Commissions (Trading Fees)

Digibits offers multiple account types, each with varying spreads and commissions. For the Standard account, the spread starts from 1.8 pips, and there is no additional commission charged. For the RAW account, the spread is from 0.0 pips, but there is a commission of $3.5 per lot. For the VIP account, spreads start from 1.4 pips, and there is no additional commission charged.

It's worth noting that spreads and commissions can vary depending on market conditions and the instrument being traded. Digibits strives to offer competitive pricing to its clients and provides transparent information on its website about the current spreads and commissions for each account type.

In addition to spreads and commissions, Digibits charges a withdrawal fee of $25 for wire transfers. Other payment methods, such as credit/debit cards or e-wallets, may have different fees associated with them. It's essential to review the fee schedule carefully and factor in all costs when evaluating the overall value of trading with Digibits.

Non-Trading Fees

In addition to the spreads, commissions, and withdrawal fees, Digibits charges some non-trading fees. These fees include:

Inactivity fee: A fee of $50 per month is charged if an account remains inactive for 90 days or more.

Overnight financing fee: This is a fee charged for positions that are held overnight. The fee varies based on the instrument being traded and depends on prevailing interest rates.

Conversion fee: For leverage accounts and accounts with a currency balance that is different from the base account currency, a conversion fee may be charged for converting currencies.

It's important to note that non-trading fees can sometimes have a significant impact on overall trading costs, especially for traders who hold positions for extended periods. Traders should make sure to review all the fees associated with their account type and factor them in when evaluating the overall value of trading with Digibits.

Trading Platform

Digibits actually offers multiple trading platforms, giving clients flexibility to select the one that suits them best. These platforms include:

MetaTrader 5 (MT5): This platform offers similar features to MT4 but comes with additional functionalities such as more technical indicators and order types. MT5 also has more advanced features for trading different asset classes, including stocks and futures.

WebTrader: The WebTrader is a web-based platform that does not require any installation. This allows traders to access their accounts and trade from any computer that has internet access.

Forex mobile trading platform: This is a mobile trading application that can be used on smartphones and tablets. It offers traders the ability to monitor their accounts, view charts, and place trades, all from the palm of their hand.

Deposit & Withdrawal

Digibits offers a range of deposit and withdrawal options, most of which are free, fast, and secure. These options include:

Bank/wire transfer: This is a traditional method of transferring funds that involves a bank-to-bank transfer. This option is free but may take up to 5 business days to process.

Credit/debit cards: Digibits accepts Visa, Mastercard, and Maestro cards. These payments are free and are processed instantly.

E-wallets: Digibits supports popular e-wallets such as Neteller, Skrill, and PayPal. These options are also free and are processed instantly.

Cryptocurrencies: Digibits is one of the few brokers that accepts Bitcoin and Ethereum as deposit methods. This option is free and is processed instantly.

Digibits does not charge any deposit or withdrawal fees, except for bank/wire transfers which may incur a fee from the sending or receiving bank. It is important to note that clients may be subject to fees by the payment service provider used.

The minimum deposit amount varies depending on different payment options, ranging from $100 to $500. Basically, funds will instantly arrive at your account after payment details are processed. No deposit fees are charged except Neteller, which asks for a service fee of 1.8%.

Customer Support

Digibits offers customer support via several channels, including email, Telegram, and social media platforms like Facebook, Twitter, Linkdedin and Instagram. The support team is available 24/5.

To contact the support team, clients can use the following methods:

Email: Clients can send an email to the support team at support@digibits.com. This channel is recommended for more detailed inquiries or complaints that require documentation.

Telegram: Digibits is a unique broker in that it only accepts communication via Telegram, a popular messaging app. Clients can message the customer support team directly through the Digibits Telegram channel @digibitsofficial.

Social media: Digibits maintains an active presence on social media platforms like Facebook and Instagram. Clients can reach out to the support team via these channels for quick responses to general inquiries.

FAQs: The FAQ section is an excellent resource for clients who may have basic questions or concerns about trading with Digibits.

Here is a table outlining the pros and cons of Digibits customer support based on the information provided:

| Pros | Cons |

| Telegram and some social media supported | Limited communication channels |

| A FAQs section available | No phone support available |

| No live chat support available | |

| Only recommended for general inquiries, not suitable for complicated problems | |

| No 24/7 customer support | |

| No multilingual support available |

Educational Resources

When it comes to educational resources, it seems that Digibits invests in educating their clients. Here are the educational resources that Digibits offers:

Daily Market Analysis: Digibits provides its clients with a daily market analysis that highlights significant movements in major markets, including stocks, currencies, and commodities.

Forex Glossary: The forex glossary is a dictionary of forex terms containing definitions and explanations of various forex terms used by traders. Clients can learn new terminologies and improve their understanding of trading language.

Economic Calendar: This calendar displays upcoming economic events, such as interest rate decisions, employment data releases, and other announcements that could influence market movements.

Conclusion

On the positive side, Digibits is a broker that offers a range of account types with competitive pricing, low spreads, and a variety of trading instruments, which includes Forex, stocks, indices, and spot metals. This broker also offers multiple trading accounts to choose from, favorable leverage up to 1:400.

On the other hand, Digibits has some drawbacks worth mentioning. The broker doesn't have any regulation, and this can raise concerns about the safety of clients' funds. Moreover, the broker's website lacks transparency regarding their fees and charges, and this can cause confusion for potential clients. Besides, its minimum deposit for some accounts is way too high. Finally, the broker's trading platforms are not as advanced as some of their competitors, and this may not suit advanced traders looking for sophisticated trading tools.

FAQ

Q: Is Digibits a regulated broker?

A: No, Digibits is not a regulated broker.

Q: What types of accounts does Digibits offer?

A: Digibits offers four types of trading accounts, namely, Standard, VIP and Raw.

Q: What trading platforms are available at Digibits?

A: Trading platforms offered by MetaTrader 5 (MT5), Forex mobile trading platform and webtrader.

Q: What is the maximum leverage offered by Digibits?

A: Digibits offers a maximum leverage of 1:400.

Q: What are the fees for trading at Digibits?

A: Digibits charges no commission fees for trading, but they make their profits from the spreads. The spreads are variable and start from 1.8 pips for the Standard account.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Brokers de WikiFX

últimas noticias

Axi Trader obtiene $1M de financiación con Axi Select

¿Pocket Option es una estafa? Un cliente denuncia problemas con pagos en Venezuela.

Rusia amplía su mercado de divisas a Argentina, México y otros países.

Desafío Post Carnaval 2025 (¡Gane hasta 250 USDT!)

La CNMV alerta de 2 entidades no registradas.

Análisis del dólar y su impacto en la economía Latinoamericana.

Análisis del par GBP/USD al 24 de febrero de 2025

Cálculo de tasa de cambio