GX

Extracto:GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

Note: GX's official website - https://www.gxbrokers.com/ is currently inaccessible normally.

| GX Review Summary | |

| Founded | / |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Market Instruments | 2,100+, forex, CFDs, stocks and commodities |

| Demo Account | ❌ |

| Spread | From 0.2 pips (Forex) |

| From 0.4 pips (CFDs) | |

| Leverage | Up to 1:500 |

| Trading Platform | / |

| Min Deposit | USD 200 |

| Customer Support | Email: tradetoolspro@company.com |

| Address: 38 Ropery Rd Gateshead NE8 2HP United Kingdom | |

GX Information

GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

The company offers trading services in CFDs, stocks and commodities. Minimum dpeosit is a little high at USD 200, with a tight spread from 0.2 pips.

However, it cannot be negleceted that the broker currently operates without any valid regulation, which indicates possible less compliance to industry and customer protection.

What's worse, there are two complaints on WIkiFX about withdrawal issues, indicating unpleasant customer experience with this broker.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Inaccessible website |

| Tight starting spreads | No regulation |

| No demo accounts | |

| High minimum deposit | |

| WikiFX exposures about withdrawal issues |

Is GX Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of GX, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on GX?

GX claims to offer access to 2,100+ tradable assets to trade, including Forex, CFDs, stocks and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

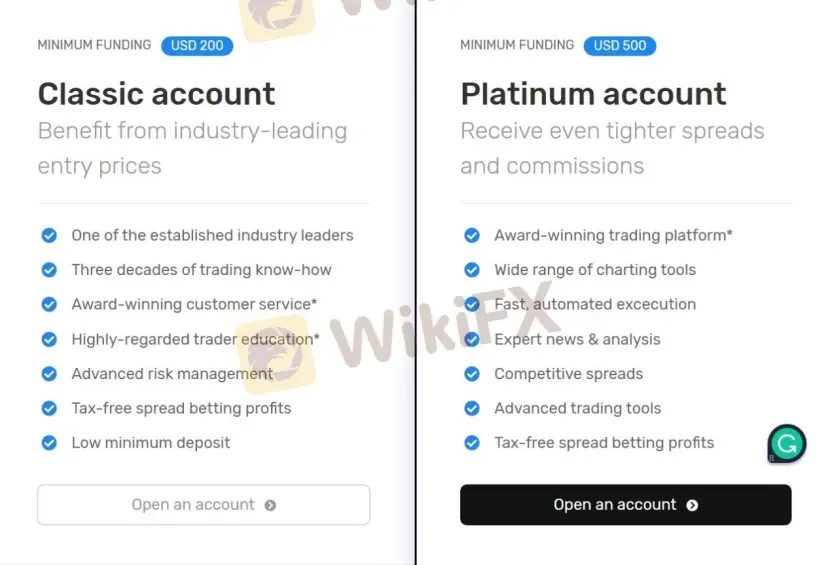

GX claims to offer two types of trading accounts, namely Classic and Platinum, with minimum initial deposit requirements of $200 and $500 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

| Account Type | Min Deposit |

| Classic | USD 200 |

| Platinum | USD 500 |

While spread and commission vary depending on the trading asset. For example, the spread is as low as 0.2 pips on forex, and from 0.4 pips on the CFDs. The commission is from $3 on US stocks and $1.25 per lot on commodities.

| Asset Class | Spread | Commission |

| Forex | From 0.2 pips | / |

| CFDs | From 0.4 pips | / |

| US stocks | / | From $3 |

| Commodities | / | From $1.25 per lot |

Leverage

The leverage provided by GX is capped at 1:500. Nevertheless, you should keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

leer más

Bitcoin podría 'consolidarse hasta 2022' después de que el barrido masivo enviara el precio

Bitcoin (BTC) cotizaba cerca de USD 47,000 el 4 de diciembre después de que una caída repentina confirmara las peores pesadillas de los toros con un 22% de pérdidas diarias.

Bitcoin, Ethereum, y Otras Criptomonedas Cryptos Se Desploman 15%+

El Bitcoin se desplomó en las operaciones de la madrugada del sábado, siguiendo una semana de “risk-off” en los mercados en general. A las 6:15 am ET, la criptomoneda líder se negociaba justo por debajo de los $47,000, bajando más del 16% en las últimas 24 horas, la mayor caída de la criptomoneda desde el 7 de septiembre.

El Bitcoin pierde un 11% en un día de ventas masivas

El Bitcoin cotiza a $50.340,3 hoy a las 06:02 (05:02 GMT) en el Investing.com Index, lo que representa una caída diaria del 11,06%. Se trata de la mayor pérdida porcentual en un día desde el pasado 7 de septiembre.

Ojo al Bitcoin: A por nuevo ATH en 68.000, en zona de ‘euforia alta’

El sector de las criptomonedas recupera su senda alcista esta semana. VanEck lanzará estos días su ETF de futuros de Bitcoin, tras tumbar la SEC su ETF de Bitcoin al contado.

Brokers de WikiFX

últimas noticias

Axi Trader obtiene $1M de financiación con Axi Select

¿Pocket Option es una estafa? Un cliente denuncia problemas con pagos en Venezuela.

Rusia amplía su mercado de divisas a Argentina, México y otros países.

La CNMV alerta de 2 entidades no registradas.

Desafío Post Carnaval 2025 (¡Gane hasta 250 USDT!)

Análisis del dólar y su impacto en la economía Latinoamericana.

Análisis del par GBP/USD al 24 de febrero de 2025

Cálculo de tasa de cambio