SurgeTrader

Extracto:SurgeTrader is an unregulated forex broker founded within the past 1-2 years. It offers trading services in a wide range of instruments, including forex pairs, cryptocurrencies, metals and energy, stock indices, and individual stocks. The platform operates on the MT4 and MT5 trading platforms. The maximum leverage available is up to 1:20, allowing traders to amplify their positions. However, specific details about minimum deposits and spreads are not provided. SurgeTrader supports various payment methods for deposits and withdrawals, including credit cards, debit cards, PayPal, cryptocurrencies, and Direct Wire Payments. Customer support can be reached via phone and email. Additionally, SurgeTrader provides educational resources such as articles, videos, and webinars on its website. It's important to note that SurgeTrader is not regulated, which entails potential risks and considerations for traders.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investment objectives and level of experience.

| Aspect | Information |

| Company Name | SurgeTrader |

| Registered Country/Area | N/A (Unregulated) |

| Founded Year | 1-2 years |

| Regulation | Not regulated |

| Minimum Deposit | N/A |

| Maximum Leverage | Up to 1:20 |

| Spreads | N/A |

| Trading Platforms | MT4 and MT5 |

| Tradable Assets | Forex pairs, cryptocurrencies, metals and energy, stock indices, and individual stocks |

| Account Types | N/A |

| Demo Account | N/A |

| Customer Support | Phone: 866-998-0883, 239-944-5317,Email: info@surgetrader.com |

| Deposit & Withdrawal | Credit cards, debit cards, PayPal, cryptocurrencies, and Direct Wire Payments |

| Educational Resources | Articles, videos, and webinars on the SurgeTrader website |

Overview of SurgeTrader

SurgeTrader is an unregulated forex broker founded within the past 1-2 years. It offers trading services in a wide range of instruments, including forex pairs, cryptocurrencies, metals and energy, stock indices, and individual stocks.

The platform operates on the MT4 and MT5 trading platforms. The maximum leverage available is up to 1:20, allowing traders to amplify their positions. However, specific details about minimum deposits and spreads are not provided. SurgeTrader supports various payment methods for deposits and withdrawals, including credit cards, debit cards, PayPal, cryptocurrencies, and Direct Wire Payments. Customer support can be reached via phone and email. Additionally, SurgeTrader provides educational resources such as articles, videos, and webinars on its website.

It's important to note that SurgeTrader is not regulated, which entails potential risks and considerations for traders.

Is SurgeTrader legit or a scam?

Please be aware that SurgeTrader operates without any regulatory licensing, indicating that it is not subject to regulatory oversight.

It is important to note that without regulation, SurgeTrader lacks the supervision and safeguards typically provided by regulatory authorities. The absence of regulatory licensing brings about the following potential concerns and risks:

1. Lack of Investor Protection: Regulation is in place to provide protection for investors and ensure fair trading practices. Regulated brokers are obligated to follow specific standards and regulations that safeguard the interests of their clients. With an unregulated broker, there may be a lack of such protection.

2. Risk to Fund Safety: Regulatory bodies impose strict financial requirements on regulated brokers, including measures such as client fund segregation and safety protocols. When using an unregulated broker, the safety and reliability of funds may not be guaranteed.

3. Lack of Transparency: Regulatory bodies demand transparency from brokers, including fair pricing and clear trading conditions. Unregulated brokers may lack the transparency assurances that ensure fair and transparent trading practices.

4. Absence of Remedial Measures: In the event of disputes or conflicts, regulatory bodies provide channels for arbitration and resolution. However, unregulated brokers may lack effective remedial measures, leaving investors without proper recourse.

Therefore, choosing a regulated broker is important as regulatory oversight provides additional protection and supervision, ensuring the safety and transparency of trades.

Pros and Cons

SurgeTrader offers a diverse range of trading instruments, including forex pairs, cryptocurrencies, metals and energy, stock indices, and individual stocks. Traders have access to popular trading platforms like MT4 and MT5, providing them with familiar and robust tools for their trading activities. The platform also offers high leverage of up to 1:20, allowing traders to amplify their positions and potentially increase their returns. Multiple payment options are available, providing convenience and flexibility for depositing and withdrawing funds. In addition, SurgeTrader provides free educational resources such as articles, videos, and webinars.

However, it is important to note that SurgeTrader operates without any regulatory licensing, indicating that it is not subject to regulatory oversight. This lack of regulation raises concerns about investor protection and the absence of safeguards typically provided by regulatory authorities. There is a potential risk to fund safety, as unregulated brokers may not adhere to strict financial requirements such as client fund segregation. The transparency of trading practices may also be compromised, as regulatory bodies demand transparency in areas such as pricing and trading conditions. Moreover, the absence of effective remedial measures in the event of disputes or conflicts may leave investors without proper recourse. Therefore, it is crucial to consider these risks and exercise caution when engaging with an unregulated broker like SurgeTrader.

| Pros | Cons |

| Diverse range of trading instruments | Lack of regulatory oversight |

| Availability of popular trading platforms (MT4/MT5) | Potential lack of investor protection |

| Potential for high leverage (up to 1:20) | Risk to fund safety |

| Multiple payment options | Lack of transparency in trading practices |

| Free educational resources |

Market Instruments

SurgeTrader is a trading platform that provides a diverse range of trading instruments for its users. These instruments include:

1. Forex Pairs: SurgeTrader allows trading in various currency pairs, such as EUR/USD, GBP/USD, USD/JPY, and many others. Forex trading involves speculating on the exchange rate between two currencies.

2. Cryptocurrencies: SurgeTrader supports trading in cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). Cryptocurrency trading involves speculating on the price movements of digital currencies.

3. Metals and Energy: SurgeTrader enables trading in precious metals like gold and silver, as well as energy commodities like crude oil and natural gas. These markets allow traders to speculate on the price fluctuations of these valuable resources.

4. Stock Indices: SurgeTrader offers trading opportunities on various stock indices, such as the S&P 500, NASDAQ, FTSE 100, and DAX. These indices represent the performance of a basket of stocks from specific markets, allowing traders to speculate on the overall market movements.

5. Individual Stocks: SurgeTrader provides access to trading 90 individual stocks. These stocks could include companies from different industries and sectors, allowing traders to speculate on the price movements of specific companies.

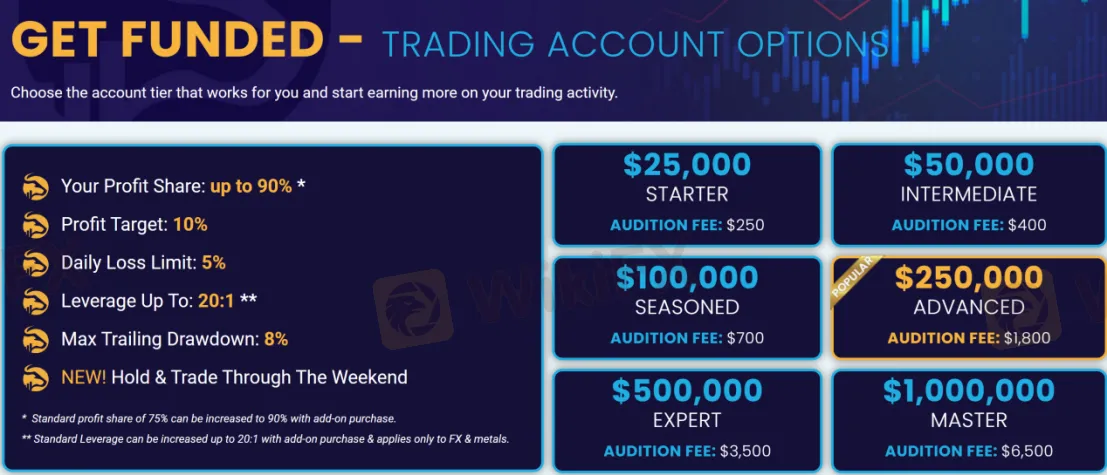

Account Types

SurgeTrader offers several advantages for its users. With a profit share of up to 90%, traders have the potential to earn a significant portion of their profits. The profit target of 10% provides a clear goal to strive for, ensuring a focused and disciplined approach to trading. The daily loss limit of 5% helps to manage risk and prevent excessive losses, promoting responsible trading practices. With leverage of up to 20:1**, traders can amplify their positions and potentially increase their returns. The max trailing drawdown of 8% acts as a safeguard, limiting the extent of potential losses and protecting the trader's capital. Overall, SurgeTrader's account features empower traders with the potential for high profits, risk management tools, and leverage options to optimize their trading strategies.

Different account levels and their associated details are as follows:

| Account Level | STARTER | SEASONED | EXPERT | INTERMEDIATE | ADVANCED | MASTER |

| Initial Capital | $25,000 | $100,000 | $500,000 | $50,000 | $250,000 | $1,000,000 |

| Audition Fee | $250 | $700 | $3,500 | $400 | $1,800 | $6,500 |

Please note that the profit share can be increased from the standard 75% to 90% with an add-on purchase. Additionally, the standard leverage can be increased up to 20:1 with an add-on purchase, and it applies only to FX and metals.

* The standard profit share of 75% can be increased to 90% with an add-on purchase.

** The standard leverage can be increased up to 20:1 with an add-on purchase and applies only to FX and metals.

How to Open an Account?

To open an account with SurgeTrader, follow these six steps:

1. Visit the official website of SurgeTrader at https://surgetrader.com/.

2. Look for the “START TRADING” button, typically located on the homepage.

3. Click on the button to start the account registration process.

4. Fill in the required information accurately and completely. This may include personal details such as your name, email address, contact number, and residential address.

5. Choose the type of account you wish to open. SurgeTrader may offer different account options tailored to various trading needs, such as a standard account or a premium account.

6. Agree to the terms and conditions of SurgeTrader and complete the verification process. This may involve providing necessary identification documents to verify your identity and comply with regulatory requirements.

Once you've completed these steps, your account with SurgeTrader will be created, and you can proceed to fund your account and start trading.

Leverage

SurgeTrader offers leverage of up to 1:20, allowing traders to amplify their trading positions. With a leverage ratio of 1:20, traders can control a position size that is up to 20 times larger than their initial investment.

It's important to note that leverage can significantly increase both potential profits and losses. While leverage can enhance potential gains, it also exposes traders to higher risks. Traders should exercise caution and have a solid understanding of leverage and risk management strategies when utilizing high leverage ratios like the one offered by SurgeTrader.

It's always advisable for traders to assess their risk tolerance, set appropriate stop-loss orders, and carefully manage their positions to mitigate potential losses when trading with leverage.

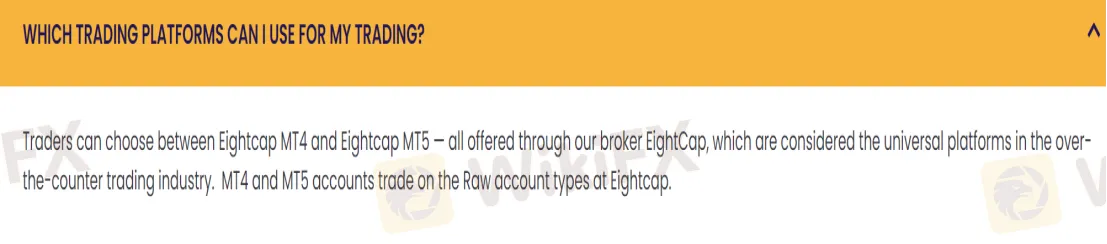

Trading Platform

Traders have the option to choose between Eightcap MT4 and Eightcap MT5, both of which are universally recognized platforms in the over-the-counter trading industry. These platforms are provided through the broker EightCap. Trading accounts on MT4 and MT5 are available on the Raw account types offered by EightCap.

Deposit & Withdrawal

SurgeTrader accepts all major credit cards, debit cards, PayPal, and cryptocurrencies (BTC, ETH, and USDC). They also provide the option for Direct Wire Payments. Customers can request wire instructions by contacting the SurgeTrader support team at support@surgetrader.com. The support team will provide the necessary details and instructions for completing the wire transfer process. SurgeTrader aims to offer a variety of payment methods to accommodate different preferences and ensure a smooth payment experience for users. For any further inquiries or assistance, customers are encouraged to reach out to the SurgeTrader support team.

Customer Support

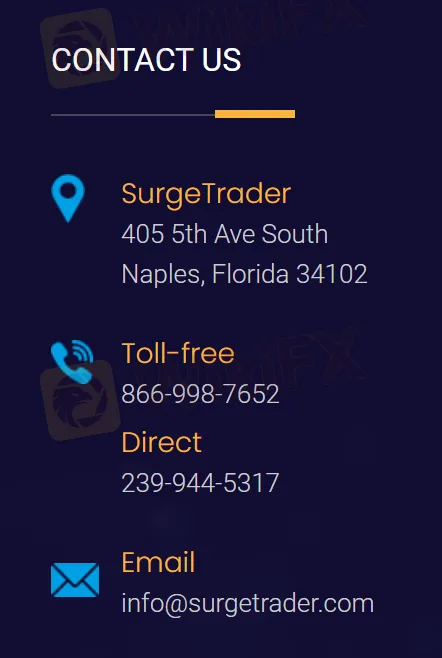

SurgeTrader offers customer support via phone, email, and live chat. Customers can reach SurgeTrader by calling the toll-free number 866-998-0883 or the direct number 239-944-5317. Alternatively, customers can send an email to info@surgetrader.com. The company's physical address is 405 5th Ave South, Naples, Florida 34102. SurgeTrader's customer support team is available during regular market hours, and the broker aims to respond to all customer inquiries promptly. Additionally, SurgeTrader offers a range of educational resources on its website, including articles, videos, and webinars, to help traders improve their skills and knowledge.

Conclusion

In conclusion, SurgeTrader offers a diverse range of trading instruments, popular trading platforms, high leverage, multiple payment options, and free educational resources. However, it is important to be aware of the disadvantages associated with SurgeTrader, such as the lack of regulatory oversight, potential lack of investor protection, risk to fund safety, and lack of transparency in trading practices. These factors pose potential risks for traders, highlighting the importance of careful consideration and risk assessment before engaging with an unregulated broker. While SurgeTrader provides certain advantages, traders should prioritize the safety, protection, and transparency provided by regulated brokers to ensure a secure and reliable trading experience.

FAQs

Q: Is SurgeTrader regulated?

A: No, SurgeTrader operates without regulatory oversight.

Q: What are the risks of trading with an unregulated broker?

A: Trading with an unregulated broker like SurgeTrader carries potential risks, including lack of investor protection and risk to fund safety.

Q: Can I trust SurgeTrader with my funds?

A: Without regulatory oversight, there is no guarantee of fund safety or adherence to strict financial requirements.

Q: Are SurgeTrader's trading practices transparent?

A: The absence of regulatory licensing raises concerns about the transparency of SurgeTrader's trading practices.

Q: What trading platforms does SurgeTrader offer?

A: SurgeTrader offers the popular trading platforms MT4 and MT5, which are widely recognized in the over-the-counter trading industry.

leer más

Instant Funding Integra MetaTrader 5 y refuerza su oferta para Prop Traders.

Instant Funding, una firma de trading propietario enfocada en los mercados de divisas (forex, FX), ha anunciado la incorporación de capacidades de trading directo a través de la aplicación MetaTrader 5 (MT5) tras obtener su propia licencia “main label”.

La CNMV alerta de 29 entidades no registradas.

La Comisión Nacional del Mercado de Valores (CNMV) ha publicado este miércoles advertencias sobre 29 entidades no autorizadas por parte de los supervisores de Chipre y Bélgica.

IC Markets Global nombrado "Mejor Broker Forex/CFD en APAC 2024".

Reconocido como un punto de referencia para la excelencia en la industria, el anual TradingView Broker Awards celebra el top de las worldwide brokers, mostrando sus capacidades en los últimos 12 meses. Los ganadores se seleccionan en función de los comentarios extensos de los trades, lo que hace que este galardón de gran prestigio sea un verdadero testimonio de los brokers que mantienen constantemente los más altos estándares de servicio. Refuerza nuestro compromiso de capacitar a los clientes con decisiones comerciales más informadas y ofrecer una experiencia comercial superior en índices, bonos, pares de Forex, materias primas, acciones, futuros y criptomonedas.

¿Qué es la Gestión de Riesgo y como dominarla?

La gestión de riesgo es uno de los pilares fundamentales del trading, y sin ella, incluso la mejor estrategia puede llevar al fracaso. Muchos traders novatos se concentran únicamente en encontrar la estrategia "perfecta" para ganar dinero, dejando de lado lo más importante: proteger su capital. En este artículo, te explicaremos en detalle cómo gestionar el riesgo en el trading, cuáles son las herramientas clave y cómo evitar los errores más comunes.

Brokers de WikiFX

últimas noticias

Análisis del Dólar y Perspectivas para la Economía Latinoamericana.

¿IQ Option es un bróker seguro? Análisis 2025.

WonderFi Expande sus Servicios Financieros con Eightcap y Embedded.

La CNMV alerta de 19 entidades no registradas.

Cálculo de tasa de cambio