Rolvi Trading Information Revealed

Extracto:Rolvi Trading is an unregulated brokerage firm, operating without oversight from a recognized governing body. The absence of regulation raises concerns about the legitimacy and security of the broker's operations. The platform offers a variety of market instruments for trading, including cryptocurrencies, precious metals, oil and natural gas, futures, bonds, and forex. It provides different account types and investment plans with varying returns and terms. Rolvi Trading offers referral and binary commissions as incentives for user participation. Clients can withdraw funds through supported cryptocurrencies and various wallets, with minimum withdrawal amounts and fees. The platform also offers trading tools such as market analysis and a calculator to assist users in making informed investment decisions. Rolvi Trading accepts multiple payment methods and provides customer support through email, phone, social media, and physical office addresses.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | Within 1 year |

| Company Name | Rolvi Trading |

| Regulation | Suspicious Regulatory License |

| Minimum Investment | $50 |

| Maximum Leverage | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Cryptocurrencies, Precious Metals, Oil & Natural Gas, Futures, Bonds, Forex |

| Account Types | STARTER Account, INVESTOR Account, PLANNER Account, RESEARCHER Account, POPULAR Account |

| Demo Account | Not specified |

| Customer Support | Email, Phone, Social Media, Physical Office Addresses |

| Payment Methods | Cryptocurrencies (Bitcoin, Ethereum, Ripple, Tron, Tether, Litecoin, Dogecoin, Dashcoin), Perfect Money |

| Trading Tools | Market Analysis, Calculator |

Overview of Rolvi Trading

Rolvi Trading is an unregulated brokerage firm operating in the United Kingdom. As an unregulated entity, it lacks oversight from a recognized regulatory authority, raising concerns about the legitimacy and security of its operations. Regulation is crucial in the financial industry to ensure transparency, fairness, and the protection of clients' funds. Regulated brokers are subject to specific guidelines and standards that provide safeguards for investors.

Despite the lack of regulation, Rolvi Trading offers a range of market instruments for trading. These include cryptocurrencies, precious metals, oil and natural gas, futures, bonds, and forex. The specific details about available cryptocurrencies are not provided in the available information. The platform provides current price information, changes in price, percentage changes, and price ranges for the different market instruments.

Rolvi Trading offers different account types and investment plans to cater to various investor preferences and investment amounts. The account types include STARTER, INVESTOR, PLANNER, RESEARCHER, and POPULAR, each with its own features and associated return on investment (ROI). The investment plans have fluctuating returns and terms, with varying minimum investment amounts. Referral and binary commissions are available for investors.

To withdraw funds, clients must meet a minimum withdrawal amount and are subject to a withdrawal fee. Withdrawals are processed in supported cryptocurrencies such as Bitcoin (BTC), Perfect Money, and USDT (TRC20). The platform provides different wallets for various purposes, including the Account Wallet, ROI Wallet, Purchase Wallet, and Rolvi Wallet, each serving specific functions within the platform.

Rolvi Trading offers trading tools to assist users in making informed investment decisions. The Market Analysis tool provides real-time market data charts for tracking price movements and monitoring the performance of various assets. The Calculator tool helps users estimate potential profits and returns on investment based on their desired investment amount and selected package.

Payment methods accepted by Rolvi Trading include various cryptocurrencies and Perfect Money. The platform operates within specific withdrawal gate timings and provides customer support through email, phone, social media platforms, and physical office addresses in the United Kingdom and the United States.

It's important to note that investing in an unregulated brokerage firm carries higher risks, as the absence of regulation means there are no established mechanisms for investor protection or dispute resolution. Potential investors should carefully consider these risks before engaging with Rolvi Trading or any other unregulated brokerage firm.

Pros and Cons

Rolvi Trading, a brokerage firm operating without regulation, has its fair share of pros and cons. On the positive side, the platform offers a diverse range of market instruments, including cryptocurrencies, precious metals, oil and natural gas, futures, bonds, and forex. This provides users with a variety of options for investment and trading. Additionally, Rolvi Trading provides different account types and investment plans to cater to various investor preferences and capital amounts, allowing for flexibility and customization. The platform also offers trading tools like Market Analysis and a Calculator, empowering users to make informed investment decisions. Moreover, multiple payment methods, including various cryptocurrencies, are accepted, providing choice to clients. On the downside, the absence of regulation raises concerns about the legitimacy and security of the broker's operations. Furthermore, the fluctuating investment plans may pose risks and uncertainties for investors. It's important for individuals to carefully evaluate these pros and cons before engaging with Rolvi Trading.

| Pros | Cons |

| Diverse range of market instruments | Not regulated by a valid regulatory authority |

| Different account types and investment plans | Fluctuating investment plans with varying returns and terms |

| Trading tools for market analysis and calculation | Potential risks and uncertainties associated with the investment plans |

| Acceptance of multiple payment methods, including cryptocurrencies | Lack of transparency due to limited information provided |

| Customer support available through email, phone, and social media platforms | Withdrawal fees and minimum withdrawal amounts apply |

| Physical office addresses in the UK and US for correspondence or visits | Limited information about the company's background and team |

Is Rolvi TradingLegit?

Rolvi Trading is a brokerage firm that is not regulated by any valid regulatory authority. This means that the company operates without oversight from a recognized governing body that sets standards and safeguards for financial services providers. The absence of regulation raises concerns regarding the legitimacy and security of the broker's operations.

Regulation in the financial industry is crucial as it helps ensure transparency, fairness, and the protection of clients' funds. Regulated brokers are required to adhere to specific guidelines, including maintaining segregated client accounts, implementing risk management protocols, and providing dispute resolution mechanisms.

Market Instruments

Rolvi Trading offers a range of market instruments for trading, including:

1. Cryptocurrencies: Rolvi Trading allows trading in cryptocurrencies, although specific details about the available cryptocurrencies are not provided in the information provided.

2. Precious Metals: Gold is one of the precious metals available for trading with Rolvi Trading. The information shows the current price of gold, along with other data such as the change in price, percentage change, and the range of prices.

3. Oil & Natural Gas: Crude oil and natural gas are included in the market instruments offered by Rolvi Trading. The information shows the current prices, along with the change in price, percentage change, and the price range.

4. Futures: The information includes details about futures contracts for various instruments such as the S&P 500, Euro, Corn, and various indices like S&P 500, US 100, Dow 30, Nikkei 225, DAX Index, and UK 100. The data provided includes the current prices, change in price, percentage change, and price range.

5. Bonds: Rolvi Trading offers trading in bond instruments such as Eurodollar, T-Bond, Ultra T-Bond, Euro Bund, Euro BTP, and Euro BOBL. The information includes current prices, change in price, percentage change, and price range.

6. Forex: Rolvi Trading provides trading in various currency pairs, including EUR/USD, GBP/USD, USD/JPY, USD/CHF, and AUD/USD. The information displays the current exchange rates for these pairs, along with the change in rates and percentage change.

| Pros | Cons |

| Wide range of market instruments available | Limited information on available cryptocurrencies |

| Current prices and comprehensive data provided | Potential volatility and risks associated with trading |

| Opportunity to diversify investment portfolio | Limited information on trading platform and tools |

| Access to popular currency pairs for forex trading | Lack of transparency in fees and trading conditions |

| Potential for profit through trading in different markets | Limited information on the trading process and execution |

Account Types / Investment Plans

Rolvi Trading offers different account types and investment plans to cater to various investor preferences and investment amounts. Here's a breakdown of the account types and their associated features:

1. STARTER Account: This account type is available for investors with a capital ranging from $50,000 to $149,999. The ROI (Return on Investment) for the Starter Account is not specified in the information provided.

2. INVESTOR Account: The Investor Account is designed for investors with a capital between $150,000 and $300,000. It offers a 2.55% ROI. In addition, investors in this account type can earn direct commissions of 7% and binary commissions of 10%. The binary capping, or the maximum amount eligible for binary commissions, is set at $15,000. The investment duration for this account type is not mentioned.

3. PLANNER Account: The Planner Account is suitable for investors with a capital between $50 and $9,999. It offers a 1.65% ROI. Direct commissions of 7% and binary commissions of 10% are available to investors in this account type. The binary capping is set at $1,000, and the investment duration is 150 days.

4. RESEARCHER Account: The Researcher Account is aimed at investors with a capital ranging from $10,000 to $24,999. It offers a 1.95% ROI. Direct commissions of 7% and binary commissions of 10% can be earned in this account type. The binary capping is set at $3,000, and the investment duration is 140 days.

5. POPULAR Account: The Popular Account is designed for investors with a capital between $25,000 and $49,999. It offers a 2.25% ROI. Investors in this account type can earn direct commissions of 7% and binary commissions of 10%. The binary capping is set at $7,500, and the investment duration is 130 days.

| Pros | Cons |

| Offers a range of account types to cater to different investor preferences and investment amounts | Lack of specific information about the ROI for the Starter Account |

| Provides a variety of investment durations for investors to choose from | Limited information provided about the investment duration for the Investor Account |

| Direct commissions and binary commissions available, providing potential additional earnings for investors | Lack of clarity on the investment durations for the Planner and Researcher Accounts |

| Offers ROI rates for each account type | Binary capping limits the maximum amount eligible for binary commissions in each account type |

| Accepts a wide range of investment capital amounts | Limited information provided about the company's background and team |

Fluctuating Plans

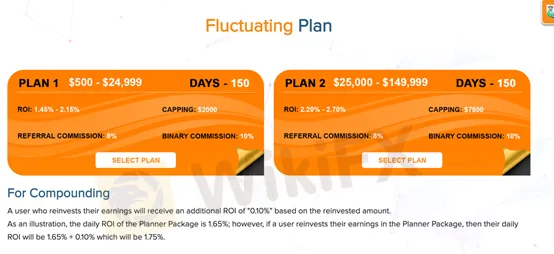

Rolvi Trading offers fluctuating investment plans with varying returns and terms. Here's an overview of the fluctuating plans:

PLAN 1: This plan is available for investments ranging from $500 to $24,999. The ROI (Return on Investment) for this plan fluctuates between 1.45% and 2.15%. Referral commissions of 8% can be earned. Investors have the option to compound their earnings. The investment duration for this plan is 150 days.

PLAN 2: The second plan is for investments between $25,000 and $149,999. It also has a duration of 150 days. The ROI for this plan fluctuates between 2.20% and 2.70%. There is a capping limit of $2,000 for this plan. Investors can earn referral commissions of 8% and binary commissions of 10%. Additionally, if a user reinvests their earnings, they will receive an additional ROI of 0.10% based on the reinvested amount. The binary capping for this plan is set at $7,500.

How to Open an Account?

Opening an account with Rolvi Trading is a straightforward and hassle-free process. Here's a step-by-step guide on how to get started:

Step 1: Visit the Rolvi Trading website and locate the “Get Started” button. It is usually prominently displayed on the homepage or in a designated section for account registration.

Step 2: Click on the “Get Started” button to initiate the account registration process. This action will lead you to a form that needs to be filled out with the required information.

Step 3: Fill in the necessary details in the registration form. This typically includes providing your personal information, such as your full name, email address, and contact information. Additionally, you may be asked to create a password for your account. Ensure that the information you provide is accurate and up to date.

Step 4: Once you have completed filling in the form, review the information to ensure its accuracy. Double-check that all the fields are correctly filled.

Step 5: After reviewing the information, click on the “Register” or “Sign Up” button to submit your registration request.

Step 6: A verification process may be required to confirm your email address. Check your inbox for an email from Rolvi Trading and follow the instructions provided to verify your email. This step is important to validate your account and ensure the security of your information.

Step 7: Once you have successfully verified your email, your account will be created, and you will be ready to start using the services provided by Rolvi Trading.

Commissions

Rolvi Trading offers different types of commissions to incentivize user participation and promote growth within the platform. Here is a brief description of the commissions provided by Rolvi:

1. REFERRAL COMMISSION: When a user refers someone to join Rolvi Trading using their referral link, they can earn a referral commission. This commission is a percentage (usually 7%) of the amount invested by the referred person. It serves as a reward for bringing in new users to the platform.

2. BINARY COMMISSION: Rolvi Trading utilizes a binary compensation plan, where users build a binary tree structure within their downline. Users earn binary commissions based on the sales volume or investment activity of their weaker leg within the binary structure. The commission is typically a percentage (such as 10%) of the sales volume generated by the weaker leg.

| Pros | Cons |

| Referral Commission rewards for user referrals | Lack of information on specific commission percentages |

| Binary Commission structure for earning | Potential complexities in understanding the binary system |

| Incentives to promote user participation | Dependency on the sales volume of the weaker leg |

| Growth opportunities within the platform | Potential variations in commission calculations |

| Rewards for bringing in new users | Potential limitations in commission earning potential |

Withdrawal

Rolvi Trading offers clients a range of wallets and withdrawal options to facilitate access to their funds. The different wallets serve distinct purposes within the platform. The Account Wallet serves as a centralized account where referral, binary, and other types of income are credited. The ROI Wallet is specifically designed to receive daily ROI earnings. When clients deposit funds through the payment gateway, they are credited to the Purchase Wallet. Lastly, the Rolvi Wallet is available for external transfers, albeit with a 1% fee applied to each transaction.

To initiate a withdrawal, clients must meet a minimum withdrawal amount of $20. It's important to note that a withdrawal fee of 8% is charged for each transaction. Withdrawals from the ROI Wallet can be made on the 7th, 17th, and 27th of each month, while withdrawals from the Account Wallet are processed every Monday. Internal transfers between the different wallets do not incur any fees.

Withdrawals are processed in several supported cryptocurrencies, including BTC (Bitcoin), Perfect Money, and USDT (TRC20). Clients have the flexibility to merge the amounts from their ROI Wallet and Account Wallet into the Rolvi Wallet. This merging option allows for consolidated access to funds and simplifies the withdrawal process.

| Pros | Cons |

| Range of wallets and withdrawal options | Withdrawal fee of 8% charged for each transaction |

| Different wallets serving distinct purposes within the platform | Minimum withdrawal amount of $20 required |

| Withdrawals from ROI Wallet available on specific dates (7th, 17th, and 27th of each month) | Limited supported cryptocurrencies for withdrawals (BTC, Perfect Money, USDT) |

| Withdrawals from Account Wallet processed every Monday | 1% fee applied to each transaction for external transfers to the Rolvi Wallet |

| Internal transfers between wallets do not incur any fees | Limited information provided regarding withdrawal processing times and procedures |

| Merging option to consolidate funds from ROI and Account Wallets into Rolvi Wallet |

Trading Tools

Rolvi Trading offers a range of trading tools to assist users in making informed investment decisions. Two notable tools provided by Rolvi Trading are Market Analysis and a Calculator.

MARKET ANALYSIS:

The Market Analysis tool provides valuable insights into market trends and conditions. Users can access real-time market data charts, including cryptocurrency market charts, to track price movements and monitor the performance of various assets. This tool enables traders to analyze market trends, identify potential trading opportunities, and make informed decisions based on market data.

CALCULATOR:

The Calculator tool is designed to help users estimate their potential profits and returns on investment. Users can input their desired investment amount and select the investment package they are interested in. The Calculator then provides information on various aspects, such as binary commissions, referral commissions, capping limits, daily profits, monthly profits, and total profits. This tool allows users to evaluate different investment options and understand the potential returns they can expect based on their investment amount and the selected package.

By utilizing these trading tools, users of Rolvi Trading can access market analysis data and gain valuable insights into market trends, enabling them to make informed investment decisions. The Calculator tool further assists users in understanding potential profits and returns, allowing them to plan and manage their investments effectively.

Payment Methods

When it comes to payment methods, Rolvi Trading accepts a variety of cryptocurrencies, including Bitcoin, Ethereum, Ripple, Tron, Tether, Litecoin, Dogecoin, Dashcoin, and Perfect Money. Clients can choose the payment method that best suits their needs and preferences.

It's worth noting that withdrawal gates, or the designated time period for withdrawals, are open from 5:00 AM to 3:00 PM UK timing. This ensures that clients have a specific window to request their withdrawals within the platform's operational hours and according to the UK time server.

Customer Support

Rolvi Trading offers customer support to address any inquiries or concerns users may have. Users can reach out to the customer support team through various channels:

EMAIL: Users can contact customer support by sending an email to support@rolvitrade.com. This allows users to communicate their questions or issues in writing and receive assistance from the support team.

PHONE: Users can contact Rolvi Trading's UK office directly at +44 1248562072. The phone number provides a direct line of communication for users who prefer to speak with a representative over the phone.

SOCIAL MEDIA: Rolvi Trading maintains a presence on various social media platforms, including Twitter (https://twitter.com/RolviTrading), Facebook (https://www.facebook.com/RolviTrading/), Instagram (https://www.instagram.com/rolvitrading/), and YouTube (https://www.youtube.com/channel/UCUZ95ILVP3hqrUErxsil4BQ). Users can connect with Rolvi Trading through these platforms, stay updated on company news and announcements, and reach out to the support team if needed.

PHYSICAL OFFICE ADDRESSES: Rolvi Trading has office locations in both the United Kingdom and the United States. The UK office address is 128 City Rd, London, United Kingdom, EC1V 2NX. The US office address is 30 N Gould St Ste R Sheridan, WY 82801 USA. Users can visit these offices in person or use the addresses for correspondence.

Overall, Rolvi Trading provides multiple avenues for users to seek assistance and support. Whether it's through email, phone, social media platforms, or physical office addresses, users can reach out to the customer support team to address their queries and receive the necessary help.

Conclusion

In conclusion, Rolvi Trading is a brokerage firm that operates without regulation from a recognized governing body, which raises concerns about its legitimacy and security. While it offers a range of market instruments for trading, such as cryptocurrencies, precious metals, and forex pairs, the lack of regulation may pose risks to investors. Rolvi Trading provides different account types and investment plans with varying returns, but the absence of specific ROI information and limited details on investment durations may make it challenging for investors to make informed decisions. The platform offers trading tools like Market Analysis and a Calculator to assist users, but it's important to note that Rolvi Trading lacks regulation, and its commissions, withdrawal fees, and payment methods have certain limitations and charges. It's crucial for individuals considering Rolvi Trading to conduct thorough research and carefully evaluate the potential risks and benefits before engaging with the platform.

FAQs

Q: Is Rolvi Trading regulated?

A: No, Rolvi Trading is not regulated by any valid regulatory authority. This lack of regulation raises concerns about the legitimacy and security of the broker's operations.

Q: What market instruments can I trade with Rolvi Trading?

A: Rolvi Trading offers trading in cryptocurrencies, precious metals (such as gold), oil and natural gas, futures contracts, bonds, and various forex currency pairs.

Q: What are the different account types offered by Rolvi Trading?

A: Rolvi Trading offers several account types, including Starter Account, Investor Account, Planner Account, Researcher Account, and Popular Account. Each account type has its own features, investment requirements, and ROI percentages.

Q: How do I open an account with Rolvi Trading?

A: To open an account with Rolvi Trading, visit their website and click on the “Get Started” button. Fill out the registration form with the required information, review it for accuracy, and submit the registration request. You may need to verify your email address during the process.

Q: What commissions does Rolvi Trading offer?

A: Rolvi Trading offers referral commissions and binary commissions. Referral commissions are earned when you refer someone using your referral link and they invest. Binary commissions are based on the sales volume or investment activity of your weaker leg within the binary structure.

Q: What are the withdrawal options and fees at Rolvi Trading?

A: Rolvi Trading offers withdrawal options in supported cryptocurrencies like Bitcoin (BTC), Perfect Money, and USDT (TRC20). A minimum withdrawal amount of $20 is required, and an 8% withdrawal fee is charged for each transaction.

Q: What trading tools does Rolvi Trading provide?

A: Rolvi Trading offers trading tools such as Market Analysis, which provides real-time market data charts for tracking price movements, and a Calculator for estimating potential profits and returns on investment.

Q: What payment methods are accepted by Rolvi Trading?

A: Rolvi Trading accepts various cryptocurrencies like Bitcoin, Ethereum, Ripple, Tron, Tether, Litecoin, Dogecoin, Dashcoin, and Perfect Money as payment methods.

Q: How can I contact customer support at Rolvi Trading?

A: You can contact Rolvi Trading's customer support through email (support@rolvitrade.com), phone (+44 1248562072), social media platforms, or visit their physical office addresses in the United Kingdom and the United States.

Brokers de WikiFX

últimas noticias

Axi Trader obtiene $1M de financiación con Axi Select

¿Pocket Option es una estafa? Un cliente denuncia problemas con pagos en Venezuela.

Rusia amplía su mercado de divisas a Argentina, México y otros países.

La CNMV alerta de 2 entidades no registradas.

Desafío Post Carnaval 2025 (¡Gane hasta 250 USDT!)

Análisis del dólar y su impacto en la economía Latinoamericana.

Análisis del par GBP/USD al 24 de febrero de 2025

Cálculo de tasa de cambio