RW Markets

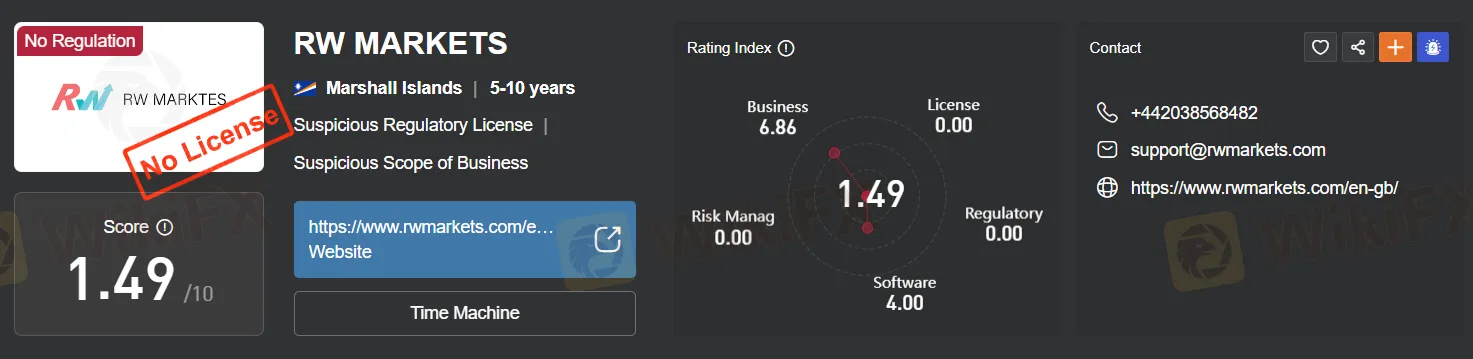

Extracto:RW Markets, operating out of the Marshall Islands, is an unregulated broker with a questionable reputation. The company offers a range of account types, including a Mini Account with a minimum deposit of $100 and a maximum leverage of up to 1:400. However, traders should be wary of the potentially high spreads, which can impact trading costs significantly, especially during market volatility. While the broker provides access to MetaTrader 4 (MT4) and ParagonEx Web Trader platforms, its unregulated status raises concerns about investor protection and accountability. Additionally, RW Markets offers limited educational resources, only offering coaching by a personal coach. Furthermore, there have been reports of the broker's website being down, along with allegations of it being involved in scams. Traders should approach RW Markets with extreme caution and conduct thorough research before considering it as a trading platform.

| Aspect | Information |

| Registered Country | Marshall Islands |

| Company Name | RW Markets |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Mini Account) |

| Maximum Leverage | Up to 1:400 |

| Spreads | Variable, potentially high |

| Trading Platforms | MetaTrader 4 (MT4) and ParagonEx Web Trader |

| Tradable Assets | Currencies, Commodities, ETFs, Indices, Stocks |

| Account Types | Mini Account, Standard Account, Gold Account, Islamic Account |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | English contact number, Email support |

| Payment Methods | MasterCard Debit/Credit cards, Visa Debit/Credit cards, Bank Wire Transfers |

| Educational Tools | Limited to coaching by a personal coach |

| Website Status | Reported as down and associated with scam allegations |

| Reputation | Reports of being a scam and website issues |

Overview

RW Markets, operating out of the Marshall Islands, is an unregulated broker with a questionable reputation. The company offers a range of account types, including a Mini Account with a minimum deposit of $100 and a maximum leverage of up to 1:400. However, traders should be wary of the potentially high spreads, which can impact trading costs significantly, especially during market volatility.

While the broker provides access to MetaTrader 4 (MT4) and ParagonEx Web Trader platforms, its unregulated status raises concerns about investor protection and accountability. Additionally, RW Markets offers limited educational resources, only offering coaching by a personal coach.

Furthermore, there have been reports of the broker's website being down, along with allegations of it being involved in scams. Traders should approach RW Markets with extreme caution and conduct thorough research before considering it as a trading platform.

Regulation

RW MARKETS is an unregulated broker, which means it operates without oversight from financial regulatory authorities. Investing with unregulated brokers can expose individuals to higher risks, as there may be no safeguards in place to protect their investments or ensure fair trading practices. Investors should exercise caution and carefully research any broker they consider working with, prioritizing those regulated by reputable authorities to minimize the potential for fraud or misconduct. It's essential to prioritize safety and security when engaging in financial transactions.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

In summary, RW Markets, an unregulated broker, presents both pros and cons for traders. On the positive side, it offers a diverse range of trading instruments, multiple account types, high leverage, and no direct commissions. However, its unregulated status raises concerns about investor protection. Potentially high spreads, limited educational resources, reported website issues, and cautious customer support add further complexities for traders. When considering RW Markets, traders should weigh these factors carefully, prioritize safety, and conduct thorough research.

Market Instruments

RW Markets offers a variety of trading instruments, catering to both novice and experienced traders. These instruments can be categorized into several key asset classes, each providing opportunities for diversification and trading strategies:

Currencies: RW Markets provides access to a range of currency pairs, including major and minor pairs. Examples of currency pairs available for trading include AUD/CHF, EUR/CAD, GBP/AUD, and EUR/USD. These forex pairs allow traders to speculate on the exchange rate movements between different currencies.

Commodities: Traders can also participate in the commodities market, with offerings such as Gold, Natural Gas, Oil, Platinum, and Silver. Commodity trading allows investors to take positions on the price movements of these physical assets.

ETFs (Exchange-Traded Funds): RW Markets offers ETF trading through instruments like FEZ, GDX, QQQ, SMOG, SPY, UNG, USO, XLE, XLF, XLK, and XLV. ETFs provide exposure to a basket of underlying assets, making them a versatile choice for diversification.

Indices: The broker provides access to major stock indices, including DAX 30, Dow Jones, Nasdaq, Nikkei, and S&P 500. Index trading allows investors to speculate on the overall performance of stock markets.

Stocks: RW Markets offers a broad selection of individual company stocks for trading. Popular stocks like Apple, Facebook, Tesla, and Amazon are among the options. Trading individual stocks allows investors to take positions on the performance of specific companies.

To provide a clearer overview of the available trading instruments, here is a detailed table:

| Asset Class | Examples of Instruments |

| Currencies (Forex) | AUD/CHF, EUR/CAD, GBP/AUD, EUR/USD, etc. |

| Commodities | Gold, Natural Gas, Oil, Platinum, Silver |

| ETFs | FEZ, GDX, QQQ, SMOG, SPY, UNG, USO, XLE, XLF, XLK, XLV |

| Indices | DAX 30, Dow Jones, Nasdaq, Nikkei, S&P 500 |

| Stocks | Apple, Facebook, Tesla, Amazon, and more |

Please note that while RW Markets offers a diverse range of trading instruments, it's essential for traders to thoroughly research and understand the specific characteristics, risks, and market conditions associated with each asset class before engaging in trading activities. Additionally, trading conditions such as spreads and minimum trade sizes may vary depending on the chosen account type, so traders should consider their individual preferences and risk tolerance when selecting an account.

Account Types

RW Markets offers a tiered approach to trading accounts, providing traders with flexibility and options to suit their specific needs. These three distinct account types cater to traders of various experience levels and financial capacities:

Mini Account: The Mini Account is an entry-level option requiring a minimum deposit of

Standard Account: The Standard Account is designed for traders looking to step up their trading activities. It necessitates a minimum deposit of

Gold Account: The Gold Account is tailored for experienced traders with a minimum deposit requirement of

Islamic Account: RW Markets also offers an Islamic Account for traders who prefer to avoid interest charges (swap charges) related to holding trades overnight, in compliance with Islamic finance principles. This account type requires a minimum deposit of

To provide a clearer overview of the account types and their features, here is a detailed table:

| Account Type | Minimum Deposit | Minimum Trade Volume | Additional Features |

| Mini Account | $100 | $250 | Daily market reviews, video library, daily recommendations, 24-hour support |

| Standard Account | $1,000 | $10,000 (0.1 lots) | Personal trading coach, VIP trading support, exclusive updates, access to MetaTrader 4 |

| Gold Account | $5,000 | $50,000 (0.5 lots) | SMS trading alerts, access to MetaTrader 5 |

| Islamic Account | $1,000 | $10,000 (0.1 lots) | Interest-free (swap-free) trading, daily market reviews, video library, daily recommendations, 24-hour support |

RW Markets' tiered account system ensures that traders can select an account type that aligns with their trading goals, experience level, and financial capabilities, enhancing their overall trading experience. However, traders should carefully review the specific terms and conditions associated with each account type to make an informed choice based on their preferences and objectives.

Leverage

RW Markets offers its traders leverage with a maximum limit of up to 1:400. Leverage allows traders to control a more substantial position size with a relatively small amount of capital. In this case, a leverage ratio of 1:400 means that for every $1 in the trader's account, they can control a position worth up to $400 in the financial markets.

While leverage can amplify potential profits, it also significantly increases the level of risk. Traders must exercise caution when using high leverage, as it can lead to substantial losses if the market moves against their positions. It's crucial for traders to have a solid risk management strategy in place and to consider their risk tolerance and trading objectives carefully when utilizing leverage. Additionally, traders should be aware that different trading instruments or account types may have varying leverage limits, and they should check the specific terms and conditions with RW Markets for precise information on leverage for their chosen assets or accounts.

Spreads and Commissions

RW Markets employs a fee structure that includes spreads and, notably, does not appear to charge commissions on its trading accounts. However, it's important to note that spreads and commissions can vary depending on the chosen trading account type. Here's a breakdown of how this broker handles spreads and commissions:

Spreads: Spreads refer to the difference between the buying (ask) and selling (bid) prices of a financial instrument. In the case of RW Markets, spreads appear to be variable or floating, meaning they can fluctuate in response to market conditions. This means that during periods of higher market volatility, spreads may widen, potentially impacting trading costs. While the precise spread values for each account type are not explicitly mentioned in the provided information, traders can typically expect higher spreads for accounts with no added commissions.

Commissions: Notably, RW Markets does not seem to impose direct commissions on trades for any of its trading accounts. Instead, the broker primarily relies on spreads as a source of revenue. This can be advantageous for traders who prefer fee-free trading, as they can execute trades without incurring additional costs in the form of commissions.

It's worth mentioning that while RW Markets may not charge commissions, traders should carefully consider the impact of spreads on their overall trading costs. Spreads can significantly affect profitability, especially for high-frequency or scalping strategies. Traders should evaluate their trading style, account type, and the specific spreads associated with the assets they intend to trade to make informed decisions about their trading costs.

For precise details on spreads and commissions for each trading account type and asset, traders should refer to the broker's official website or contact RW Markets directly. Additionally, traders should be aware that spreads can vary between different financial instruments, so it's essential to understand the pricing structure for the specific assets they plan to trade.

Deposit & Withdrawal

RW Markets provides traders with several methods for both depositing funds into their trading accounts and withdrawing profits. Here's a description of the deposit and withdrawal processes based on the information provided:

Deposit Methods:

RW Markets offers the following deposit methods for traders to fund their accounts:

MasterCard Debit and Credit Cards: Traders can use MasterCard debit and credit cards to make deposits into their trading accounts. These transactions typically offer a convenient and secure way to fund accounts.

Visa Debit and Credit Cards: Visa debit and credit cards are also accepted as a deposit method. Visa is widely used worldwide, making it a convenient option for many traders.

Bank Wire Transfers: For those who prefer traditional bank transfers, RW Markets allows deposits via bank wire transfers. This method is suitable for larger deposits and international transactions.

Deposit Costs:

RW Markets states on its website that there are no added fees or commissions for deposits made through the mentioned methods. However, it's important for traders to check with their own banks or card processors to determine if any fees may be incurred on their end during the deposit process.

Withdrawal Methods:

RW Markets offers the same methods for withdrawals as it does for deposits, ensuring flexibility for traders:

MasterCard Debit and Credit Cards: Traders can use their MasterCard debit and credit cards to withdraw funds from their trading accounts.

Visa Debit and Credit Cards: Withdrawals can also be made using Visa debit and credit cards.

Bank Wire Transfers: The broker supports withdrawals through bank wire transfers, allowing traders to transfer their profits directly to their bank accounts.

Withdrawal Processing & Wait Time:

RW Markets aims to process withdrawal requests within 24 to 48 hours. Once processed, the actual withdrawal time may vary depending on the chosen withdrawal method. Typically, it can take between 3 to 5 business days for the withdrawn funds to clear and appear in the trader's bank account.

It's important for traders to note that while RW Markets may not impose fees for deposits or withdrawals, there may be potential fees associated with the chosen payment method or charges applied by intermediary banks or financial institutions. Therefore, it's advisable for traders to review the specific terms and conditions related to deposits and withdrawals, as well as to inquire with their payment service providers regarding any potential fees that may apply.

Trading Platforms

RW Markets offers its traders access to multiple trading platforms, providing them with diverse options to execute their trades efficiently. Here's a description of the available trading platforms:

MetaTrader 4 (MT4): RW Markets offers the popular MetaTrader 4 (MT4) trading platform, which is renowned in the industry for its comprehensive features and user-friendly interface. MT4 provides traders with advanced charting tools, technical analysis capabilities, customizable indicators, and automated trading options through Expert Advisors (EAs). This platform is ideal for traders who prefer a robust and widely recognized trading environment. It is important to note that MT4 appears to be available exclusively to Premium account holders.

ParagonEx Web Trader: RW Markets also provides access to the ParagonEx Web Trader platform. This platform is designed to deliver a user-friendly and intuitive trading experience. It operates directly in web browsers, making it accessible from any internet-connected device without the need for downloads or installations. ParagonEx Web Trader offers a range of trading tools, real-time market data, and an easy-to-navigate interface, making it suitable for traders seeking simplicity and convenience in their trading activities.

Additionally, RW Markets offers mobile trading applications for both Android and iOS-powered devices, allowing traders to stay connected to their accounts and trade on the go.

These trading platforms cater to a wide range of trader preferences, from those who prefer advanced charting and automation features to those seeking a more straightforward and accessible trading experience through a web-based platform. Traders can choose the platform that best aligns with their trading strategies and needs to optimize their trading activities on RW Markets.

Customer Support

RW Markets provides contact options for its customers, but it's important to approach its customer support with a degree of caution due to its status as an unregulated broker. Here's a description of the contact information in a negative tone:

Contact Number (English):

RW Markets offers an English contact number, +442038568482. However, given the broker's unregulated status, traders should be wary when attempting to contact them through this phone line. The absence of regulatory oversight means that there may be limited recourse in the event of disputes or issues, making it crucial for traders to exercise caution and thoroughly research the broker's credibility.

Other Ways of Contact (Email):support@rwmarkets.com. While email communication can be convenient, it's important to note that, as an unregulated broker, RW Markets may not be subject to the same standards and protections as regulated counterparts. Traders should be aware that disputes or inquiries may not be addressed with the same level of accountability or transparency as they would with regulated brokers.

Overall, it's advisable for traders to proceed with caution when contacting RW Markets and to consider the potential risks associated with dealing with an unregulated broker. Conducting thorough due diligence and considering the broker's regulatory status is essential to safeguarding their interests in the volatile world of online trading.

Educational Resources

Based on the information provided, it appears that RW Markets does not offer substantial educational resources to its traders. The absence of educational materials or resources can be a limitation for traders, especially those who are new to the financial markets or seeking to enhance their trading knowledge and skills.

Traders often rely on educational resources such as webinars, tutorials, articles, and video content to deepen their understanding of trading strategies, technical analysis, risk management, and market dynamics. Without access to these resources, traders may find it more challenging to develop their trading expertise and make informed decisions.

It's important for potential traders to consider their own level of experience and whether they require educational support when choosing a broker. Traders who prioritize learning and education may want to explore brokers that offer comprehensive educational resources as part of their services to help them develop as successful traders.

Summary

In summary, RW Markets, as an unregulated broker, raises significant concerns regarding investor protection and fair trading practices. While it offers a variety of trading instruments and account types, these offerings come with notable drawbacks. The absence of regulatory oversight means that investors may lack essential safeguards and avenues for recourse in case of disputes or fraudulent activities.

The broker's spreads, while variable, can be relatively high, potentially impacting traders' overall trading costs. Moreover, the lack of commissions may not fully offset the impact of these spreads, particularly for those employing high-frequency or scalping strategies.

RW Markets' customer support, while available, should be approached with caution due to the broker's unregulated status. Disputes or inquiries may not receive the same level of accountability or transparency as with regulated brokers.

Furthermore, the absence of substantial educational resources limits the broker's ability to support traders in developing their skills and knowledge.

Lastly, the reported issues with the broker's website being down and allegations of it being a scam raise significant red flags about its reliability and credibility.

In conclusion, investors should exercise extreme caution and thoroughly research any broker, especially unregulated ones like RW Markets, to prioritize their safety and security when engaging in financial transactions.

FAQs

Q1: Is RW Markets a regulated broker?

A1: No, RW Markets is an unregulated broker, which means it operates without oversight from financial regulatory authorities. Investors should be aware of the potential risks associated with trading through unregulated entities.

Q2: What is the maximum leverage offered by RW Markets?

A2: RW Markets offers a maximum leverage of up to 1:400, allowing traders to control larger positions with a relatively small amount of capital. However, it's important to use leverage cautiously due to its potential for increased risk.

Q3: Are there any educational resources provided by RW Markets?

A3: Based on available information, RW Markets does not appear to offer substantial educational resources. Traders seeking educational support may need to consider alternative brokers with comprehensive educational materials.

Q4: What are the available methods for depositing and withdrawing funds with RW Markets?

A4: RW Markets provides several deposit and withdrawal methods, including MasterCard Debit/Credit cards, Visa Debit/Credit cards, and Bank Wire Transfers. The broker states that there are no added fees for deposits or withdrawals, but traders should verify with their payment service providers for potential fees on their end.

Q5: Can I contact RW Markets' customer support for assistance?

A5: Yes, RW Markets offers contact options, including an English contact number and email support. However, given the broker's unregulated status and reported issues, traders should exercise caution and conduct thorough research before seeking assistance.

Brokers de WikiFX

últimas noticias

Aviso: La competencia semanal de Demo Trading de WikiFX se ha suspendido por una semana.

Cálculo de tasa de cambio