Swan Bullion

Extracto:Based in Australia with Canada office openning soon, Swan Bullion is engaged in the trading and loaning of precious metals gold, silver, platinum and collectible coin. It's also a boutique retailer of precious metals products that include Jewellery, rounds, coin, bullion, nuggets and numismatics. However, it's crucial to note that the firm presently operates without any verified regulatory supervision.

| Swan Bullion Review Summary in 5 Points | |

| Founded | 2004 |

| Registered Country/Region | Australia |

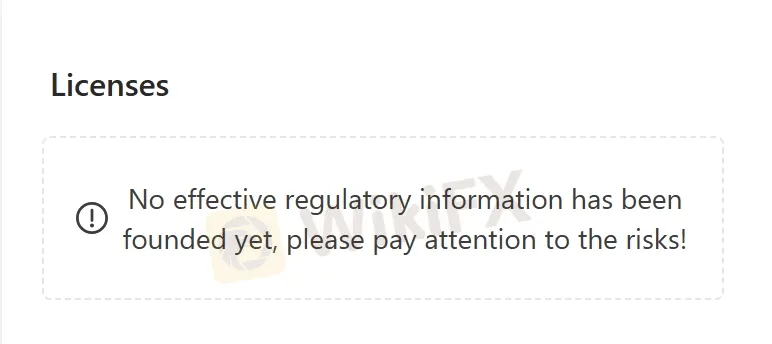

| Regulation | Unregulated |

| Services | Precious metal trading and loaning including gold, silver, platinum, collectible coin; retailing in precious metal products |

| Customer Support | Address, phone, email, social media |

What is Swan Bullion?

Based in Australia with Canada office openning soon, Swan Bullion is engaged in the trading and loaning of precious metals gold, silver, platinum and collectible coin. It's also a boutique retailer of precious metals products that include Jewellery, rounds, coin, bullion, nuggets and numismatics. However, it's crucial to note that the firm presently operates without any verified regulatory supervision.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the company's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the company for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Transparent fee structure | • Unregulated |

| • Deeply engaged in precious metal field |

Pros:

Transparent Fee Structure: Swan Bullion maintains a transparent fee structure, ensuring that clients are fully informed about the costs associated with their transactions.

Deeply Engaged in Precious Metal Field: Swan Bullion demonstrates a high level of engagement and expertise in the precious metals industry. Their extensive involvement in the field indicates a deep understanding of market dynamics, trends, and customer needs.

Cons:

Unregulated: Swan Bullion operates in an unregulated environment, meaning that it does not subject to oversight or compliance with industry standards set by regulatory authorities. This lack of regulation raises concerns about consumer protection, transparency, and accountability, exposing clients to higher risks and uncertainties.

Is Swan Bullion Safe or Scam?

When considering the safety of a brokerage like Swan Bullion or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial company:

Regulatory sight: The current modus operandi of Swan Bullion, without any established form of regulation, raises potential questions pertaining to its authenticity and reliability. The absence of such oversight implies inherent risks for its customers associated with precious metal dealings.

User feedback: One scam report filed on WikiFX should be taken into consideration as red flags for traders. We recommend you to do thorough research before engaging with any broker or investment platform.

Security measures: So far we have not found any security measures on Swan Bullion's website, you should be cautious and seek for such info with the company directly if you consider to trade with them.

Ultimately, the decision to trade with Swan Bullion lies with the individual. It's recommended that one meticulously weighs the potential risks against the projected benefits prior to initiating any actual trading transactions.

Products & Services

Swan Bullion Company offers a range of services within the precious metals sector, positioning itself as a significant player in the industry.

Serving as a boutique retailer, Swan Bullion provides customers with various precious metal products, including jewellery, bullion, and numismatics.

Additionally, the company facilitates transactions through buying and loaning services for precious metals including Precious metal trading and loaning including gold bullion, silver bullion, platinum bullion and collectible coins, providing clients with multiple channels to engage, such as in-store, online, or phone transactions.

For those in need of liquidity, Swan Bullion offers cash for precious metals through purchases or collateralized loans, with a standard 90-day loan period extendable through regular payments

Payment Methods

Swan Bullion offers multiple payment methods to accommodate client preferences. Options include Visa, PayPal, Mastercard, and bank transfer, facilitating smooth transactions for purchasing and selling precious metals through Swan Bullion's platform.

Fees

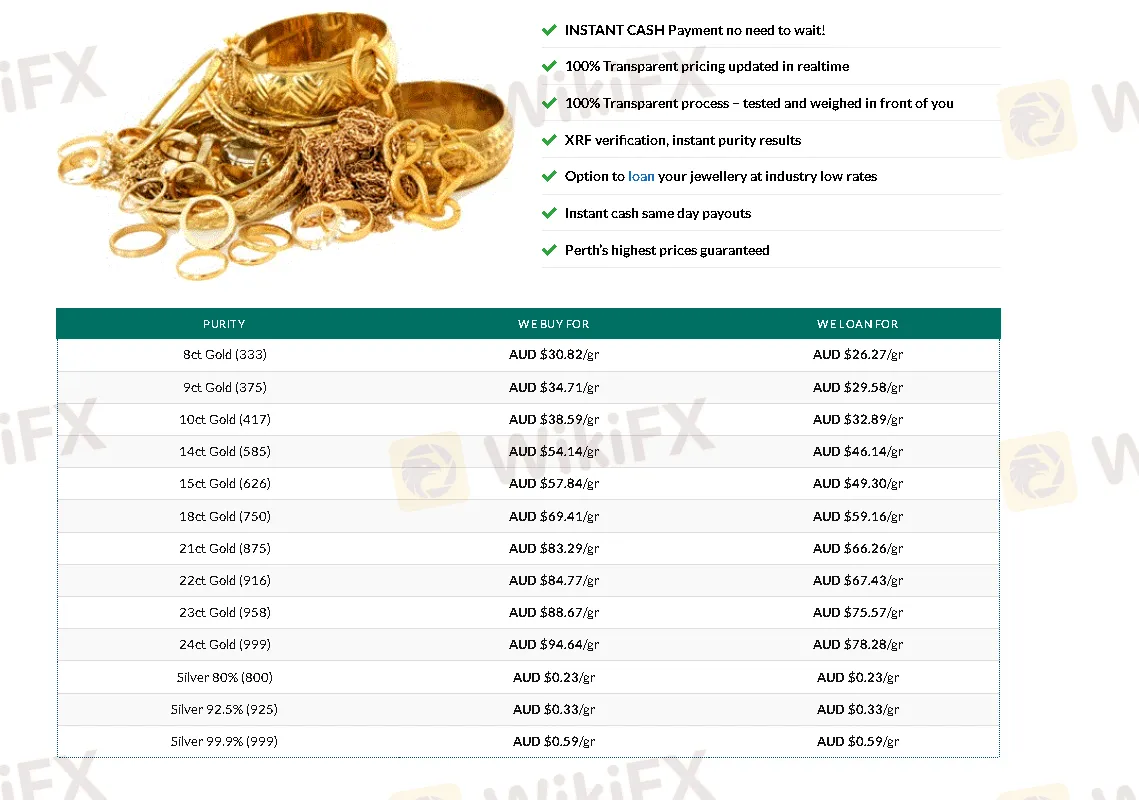

Swan Bullion meticulously determines buy and loan rates for its extensive range of bullion, jewelry, and coin products, tailored to the purity of gold and silver separately.

For example, for gold, rates span from AUD $30.82 to AUD $94.64 per gram, depending on the purity level (ranging from 8ct to 24ct).

Silver rates also vary based on purity, with rates ranging from AUD $0.23 to AUD $0.59 per gram for different purities (80%, 92.5%, and 99.9%).

These detailed pricing structures ensure transparent transactions for clients, allowing them to accurately assess the value of their items and make informed decisions regarding their precious metal investments.

For more details regarding other products such as bullion, coins etc, you can visit https://swanbullion.com/precious-metal-pricing/.

User Exposure on WikiFX

On our website, you can see that there is a report regarding scam which is an alaring red flag. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

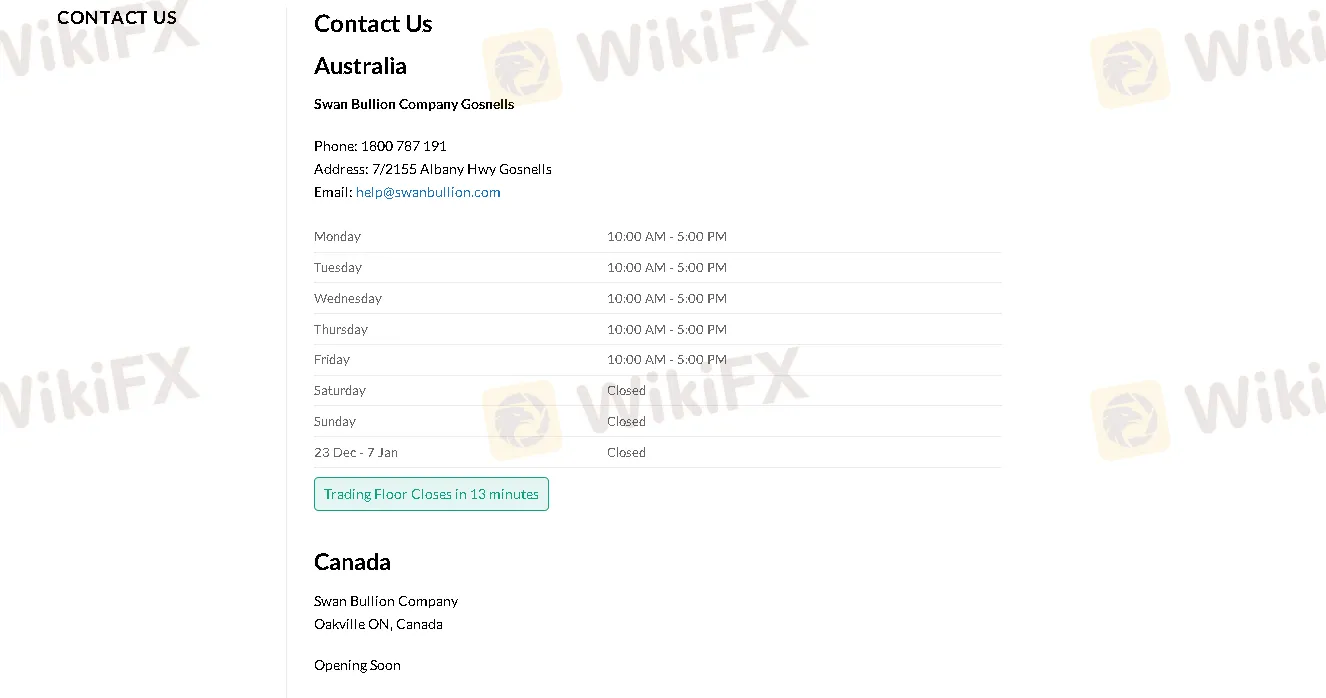

Swan Bullion offers extensive customer support through various channels including their physical address, phone, email, and social media including Facebook, Twitter, YouTube and Instagram, ensuring comprehensive and accessible support for their customers.

Australian Office (working time from Mon to Fri):

Phone: 1800 787 191.

Address: 7/2155 Albany Hwy Gosnells.

Email: help@swanbullion.com.

Canada office (Opening Soon)

Address: Oakville ON, Canada.

Conclusion

Swan Bullion, a precious metal trading company hailing from Australia, offers a broad range of services - including precious metal trading and loaning such as gold, silver, platinum, collectible coin as well as retailing in precious metal products. Despite these offerings, the absence of official regulatory oversight raises valid concerns. This deficiency in regulation leads to questions concerning Swan Bullion's dedication to ethical practices and customer protection. Therefore, if you intend to trade with this company, you should be cautious and consider alternative companies who display identifiable adherence to transparency, regulatory compliance, and professional conduct.

Frequently Asked Questions (FAQs)

| Q 1: | Is Swan Bullion regulated? |

| A 1: | No. it‘s been confirmed that the company currently operates under no valid regulations. |

| Q 2: | Is Swan Bullion a good financial company for beginners? |

| A 2: | No, it’s not a good financial company for beginners because its not regulated by any recognized authorities. |

| Q 3: | What kind of products and services does Swan Bullion offer? |

| A 3: | Swan Bullion sets foot in precious metal trading including gold, silver, collectible coin, palladium/platinum, precious metal jewelry as well as precious metal storage etc. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Brokers de WikiFX

últimas noticias

Piscina de Deseos de Año Nuevo ¡Publica tus deseos para recibir la buena fortuna del 2026!

¿PMXECUTE es un bróker confiable en 2025? Análisis completo 2025.

¿Cómo se moverán las monedas latinoamericanas en el mercado Forex en 2026?

¿IQ Option es una estafa con los retiros de dinero?

¿BitPania es una estafa? Cliente no puede retirar su dinero.

¿OANDA es un broker confiable o una estafa? Análisis completo 2025.

Cálculo de tasa de cambio