Fx-Capital-Some important Details about This Broker

Extracto:Fx-Capital is allegedly a forex broker based in the USA that provides its clients with forex and bitcoin trading with a choice of three different investment plans, as well as 24/7 customer support service.

| Aspect | Information |

| Company Name | Fx-Capital |

| Registered Country/Area | United States |

| Founded Year | 2019 |

| Regulation | Unregulated |

| Minimum Deposit | $500 |

| Maximum Leverage | Up to 1:500 |

| Spreads | As low as 0.0 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex and Cryptocurrencies |

| Account Types | Silver, Gold, Premium account |

| Customer Support | Phone: +44 75 8447, Email: Dan.Beckerleg@fxcapital.co.uk |

| Deposit & Withdrawal | Credit/debit cards, bank transfer, e-wallets, cryptocurrencies |

| Educational Resources | Basic trading guide and video tutorial |

Overview of Fx-Capital

Fx-Capital, established in the United States in 2019, is an online trading platform. The platform offers diverse financial instruments, allowing traders to diversify portfolios. Competitive spreads and commissions aim to reduce trading costs, and the user-friendly platform suits traders of all levels. However, it's important to note that Fx-Capital operates without regulatory oversight, raising concerns about transparency. While Fx-Capital has advantages, trading on an unregulated platform carries risks, and traders should assess their risk tolerance and investment goals carefully.

Is Fx-Capital legit or a scam?

Fx-Capital is not regulated by any regulatory authority, which may raise concerns about the transparency and oversight of the exchange.

Unregulated exchanges lack the oversight and legal protections provided by regulatory authorities. This can lead to a higher risk of fraud, market manipulation, and security breaches. Without proper regulation, users may also face challenges in seeking recourse or resolving disputes. Additionally, the absence of regulatory oversight can contribute to a less transparent trading environment, making it difficult for users to assess the legitimacy and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| Wide variety of financial instruments | Unregulated |

| Competitive spreads and commissions | Some allegations of fraud and scams |

| User-friendly trading platform | Limited educational resources |

| 24/7 customer support | High minimum deposit requirements |

Pros:

Wide Variety of Financial Instruments: FX Capital offers a diverse range of financial instruments, allowing traders to diversify their portfolios across various markets. This diversity can help manage risk and explore different trading opportunities.

Competitive Spreads and Commissions: The platform provides competitive spreads and charges zero commissions for every 1,000 traded units. This can translate to cost savings for traders, especially for high-frequency or large-volume trading.

User-Friendly Trading Platform: FX Capital offers a user-friendly trading platform that is accessible to traders of all experience levels. An intuitive interface can streamline the trading process, making it easier to execute trades and manage investments.

24/7 Customer Support: FX Capital ensures round-the-clock customer support, allowing traders to seek assistance or resolve issues at any time. This accessibility can be crucial in the fast-paced world of trading.

Cons:

Unregulated: FX Capital operates without regulatory oversight, which can be a significant concern for traders. The absence of regulation raises questions about the security of funds and investor protection, potentially exposing traders to greater risks.

Some Allegations of Fraud and Scams: There have been allegations of fraud and scams associated with FX Capital. These allegations can impact the platform's credibility and reputation in the industry, leading traders to exercise caution.

Limited Educational Resources: FX Capital provides limited educational resources. For traders looking to enhance their knowledge and skills, the lack of educational materials and support can be a drawback.

High Minimum Deposit Requirements: The platform sets relatively high minimum deposit requirements, which may be a barrier for traders with limited capital. This can limit accessibility to certain account types and features, potentially excluding smaller investors.

Market Instruments

Fx-Capital provides access to a select range of market instruments, catering primarily to forex and cryptocurrency trading. The platform focuses on empowering traders to navigate the dynamic financial markets effectively.

Forex, which stands for foreign exchange, involves the trading of major currency pairs like the US dollar, euro, Japanese yen, and more. This market is renowned for its liquidity and offers opportunities for traders to speculate on currency price movements.

In addition to forex, Fx-Capital places significant emphasis on cryptocurrency trading, with a particular focus on Bitcoin. As a pioneer in the world of digital currencies, Bitcoin presents traders with unique opportunities for investment and speculation. Its volatile nature can lead to potential profits for those who can navigate its price fluctuations effectively.

Overall, Fx-Capital's specialization in forex and Bitcoin trading allows traders to explore these diverse and dynamic markets, providing a comprehensive platform to pursue their financial goals.

Account Types

FX-Capital offers three distinct account types to cater to the diverse needs of traders: Silver, Gold, and Premium.

Silver Account:The Silver Account offered by FX-Capital is an excellent choice for traders who are just starting their journey or those who prefer a lower initial investment. With leverage of up to 1:500 and spreads as low as 0.0 pips, this account provides competitive trading conditions. What's more, there are no commissions for every 1,000 traded units.

Gold Account:For traders with a higher risk tolerance and a more substantial initial investment, the Gold Account by FX-Capital is a compelling choice. This account type retains the advantageous features of leverage up to 1:500, spreads as low as 0.0 pips, and zero commissions for 1,000 traded units. With a minimum deposit requirement of $5,000, it caters to more experienced traders.

Premium Account:FX-Capital's Premium Account is tailored for seasoned traders and investors with a substantial capital commitment. With the same competitive leverage, spreads, and commission structure as the other account types, the Premium Account requires a minimum deposit of $10,000.

| Silver | Gold | Premium | |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Spread | As low as 0.0 pips | As low as 0.0 pips | As low as 0.0 pips |

| Commission | $0.00 per 1,000 traded units | $0.00 per 1,000 traded units | $0.00 per 1,000 traded units |

| Deposit | $500 | $5,000 | $10,000 |

| Demo Account | Yes | Yes | Yes |

| Trading Tool | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

| Customer Support | 7/24 | 7/24 | 7/24 |

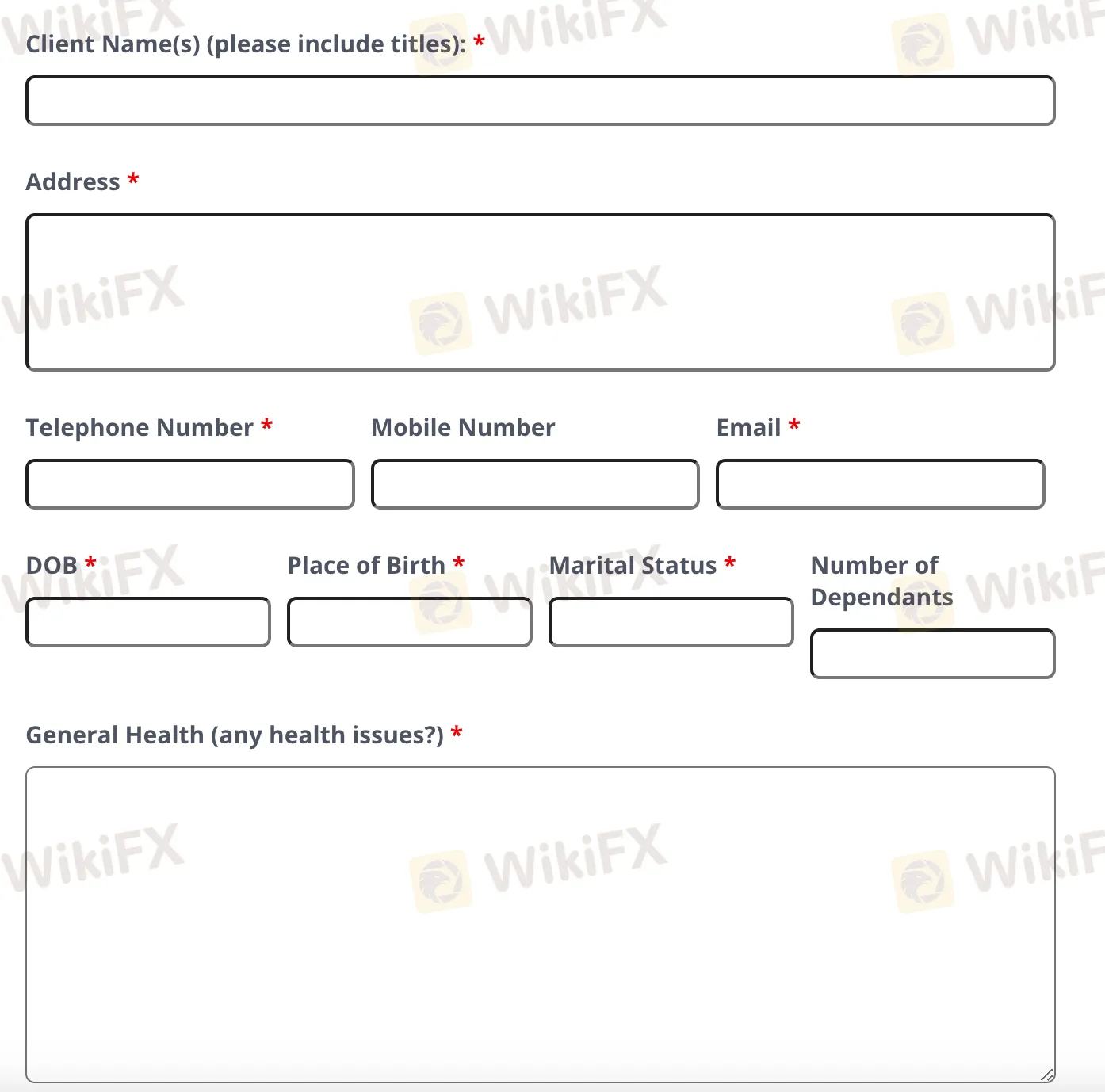

How to Open an Account?

Opening an account with FX Capital is a straightforward process, which can be broken down into five clear steps:

Visit the FX Capital Website:

Go to the official FX Capital website (www.fxcapital.co.uk) using your web browser.

Click on “Open an Account”:

Look for the “Open an Account” or similar button on the website's homepage and click on it to start the registration process.

Provide Personal Information:

Fill out the registration form with your personal details. This typically includes your full name, email address, phone number, and residential address. Ensure that all information is accurate and up to date.

Complete Identity Verification:

FX Capital may require you to verify your identity. This typically involves providing valid identification documents such as a passport or driver's license, as well as proof of address (e.g., a utility bill).

Fund Your Account:

Once your account is verified, you can deposit funds into your trading account. FX Capital accepts various payment methods, including credit/debit cards, bank transfers, and e-wallets. Choose the method that suits you best and fund your account.

Leverage

Fx-Capital provides traders with flexible leverage options across its account types, including Silver, Gold, and Premium, all of which offer leverage of up to 1:500. This generous leverage allows traders to control larger positions with a relatively smaller amount of capital.

| Silver | Gold | Premium | |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

Spreads & Commissions

Fx-Capital offers competitive spreads and commission structures across its account types, namely Silver, Gold, and Premium. Traders can benefit from some of the tightest spreads available in the industry, with spreads as low as 0.0 pips for all three account types. This narrow spread minimizes the cost of entering and exiting trades, potentially enhancing profitability.

| Silver | Gold | Premium | |

| Spread | As low as 0.0 pips | As low as 0.0 pips | As low as 0.0 pips |

| Commission | $0.00 per 1,000 traded units | $0.00 per 1,000 traded units | $0.00 per 1,000 traded units |

Trading Platform

The platform operates on the MetaTrader 4 (MT4) trading software, a globally recognized and trusted platform in the industry. MT4 offers advanced charting tools, technical indicators, and customizable features, empowering traders to conduct in-depth analysis and execute trades with precision.

Advanced Charting Tools for Insightful Analysis:MT4 on FX-Capital offers an extensive suite of advanced charting tools that empower traders to gain invaluable insights into market dynamics. These tools allow for the creation of highly customizable charts, enabling users to visualize price movements, trends, and patterns with exceptional clarity.

Comprehensive Technical Indicators:Within the MT4 platform, traders gain access to an extensive library of technical indicators. These indicators are pivotal for conducting in-depth market analysis. From moving averages to oscillators and beyond, FX-Capital's platform ensures that traders have the tools they need to interpret market signals accurately. These indicators enhance traders' ability to spot potential entry and exit points for their trades.

Tailored Customizable Features:Traders can personalize their trading environment to align with their specific strategies and preferences. From setting up alerts for price movements to automating trading with expert advisors (EAs), the platform's flexibility empowers traders to tailor their trading experience to their exact requirements.

Deposit & Withdrawal

Fx-Capital offers a variety of payment methods, including:

Credit and debit cards (Visa, Mastercard, Maestro)

Bank transfer

E-wallets (Neteller, Skrill, PayPal)

Cryptocurrencies (Bitcoin, Ethereum, Litecoin)

Fx-Capital does not charge any deposit fees. However, there may be fees charged by your bank or payment provider. Fx-Capital also does not charge any withdrawal fees, with the exception of a $30 fee for bank transfers to accounts outside of the United Kingdom.

Fx-Capital offers three investment plans, each have different minimum deposit requirement:

Silver account: Minimum deposit of $500

Gold account: Minimum deposit of $5,000

Premium account: Minimum deposit of $10,000

Customer Support

For any inquiries or support needs, clients can easily reach out to FX Capital.

Contact Information:

You can reach out to Dan Beckerleg, who is available via:

Office Number: +44 208 145 3199

Mobile: +44 75 8447 4498

Email: Dan.Beckerleg@fxcapital.co.uk

Company Address:

The company is located at:

Suite 3, The Hamilton Center,

Rodney Way, Chelmsford,

Essex, CM1 3BY.

FX Capital is dedicated to providing accessible and responsive support, ensuring that clients can connect with them effectively for assistance or inquiries.

Educational Resources

FX-Capital offers a valuable educational resource in the form of a comprehensive FAQ section. This FAQ section addresses common trading questions, providing assistance to traders who may encounter confusion or uncertainties.

Conclusion

In conclusion, Fx-Capita operates as an online trading platform. Fx-Capital offers a diverse range of financial instruments, promoting portfolio diversification. Competitive spreads and commissions aim to enhance cost-efficiency, and their user-friendly platform accommodates traders of all experience levels. However, trading on an unregulated platform entails inherent risks, necessitating careful consideration of individual risk tolerance and investment objectives. As such, Fx-Capital presents opportunities, but prudent evaluation and due diligence are essential for potential investors.

FAQs

Q: How long should I keep my account for?

A: Our trading strategy is medium to long term. An investor should be prepared to maintain their account for a minimum of two years from the date opened.

Q: Are my funds segregated at the broker?

A: You will be treated as a retail client by the broker; therefore, your account will be segregated from their own funds.

Q: Can I add/withdraw my funds from my account?

A: It is your account; therefore, you can add or remove funds as you please. However, a certain amount of funds will need to remain in the account if you still wish to receive all of the trades.

Q: What investment product will be traded on my account?

A: The CFD product provided by the broker will be traded.

Q: Who can witness the Power of Attorney form (POA)?

A: Any person can witness the POA. Please note that the date you complete the form and the date your chosen witness completes the form must be the same.

Q: When will my account start?

A: Once the account opening process is completed and your account is funded, your trading can begin.

Brokers de WikiFX

últimas noticias

¡ALERTA! ¿Es REALHX una estafa? Testimonios de inversores afectados

¿Es TradeEU Global una estafa? ¿Cuántas plataformas hay?

eToro añade cinco nuevos criptoactivos a su plataforma.

¿Cuáles son los mejores brokers para operar en México en 2025?

¡FBS lanza un concurso para IB con premios exclusivos!

Análisis del par de Divisas GBP/USD al 05 de Marzo de 2025.

SkyLine Guía en Malasia: Estableciendo una "Guía Michelin" Local para la Industria Forex

Cálculo de tasa de cambio