FXPN

Extracto:FXPN, a forex and CFD broker registered in Belarus, offer its clients a wide range of tradable financial instruments with leverage up to 1:200, a floating spread of 0.2 points on SIRIX network traders and mobile trading platforms, and four different real account types to choose from.

| FXPN Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | Belarus |

| Regulation | Exceeded |

| Market Instruments | Forex & CFDs on stocks, precious metalscommodities, ndices, cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:200 |

| Spread | Silver: from l.l pips Gold: from 0.8 pips Platinum: from 0.5 pips VIP: from 0.2 pips |

| Trading Platform | SIRIX Web Trader & Mobile trading |

| Min Deposit | $/€/£ 500 |

| Customer Support | Telephone number: +357 29 369 80 87 (Monday-Friday 9 AM-6 PM)Email: support@fxpn.by |

FXPN Information

FXPN, a forex and CFD broker registered in Belarus, offer its clients a wide range of tradable financial instruments with leverage up to 1:200, a floating spread of 0.2 points on SIRIX network traders and mobile trading platforms, and four different real account types to choose from.

Pros and Cons

| Pros | Cons |

| Demo accounts available | Exceeded and suspicious clone |

| Multiple account types | Commission charged |

| Variable spreads from 0.2 pips | MT4 & MT5 unavailable |

| High minimum deposit |

Is FXPN Legit?

FXPN has an Exceeded license from the Financial Sector Conduct Authority (FSCA) and a license from the suspicious clone Cyprus Securities and Exchange Commission (CYSEC).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| FSCA | Financial Sector Conduct Authority | Financial Service Corporate | 51545 |

| CYSEC | WGM Services Ltd | Market Making(MM) | 160/11 |

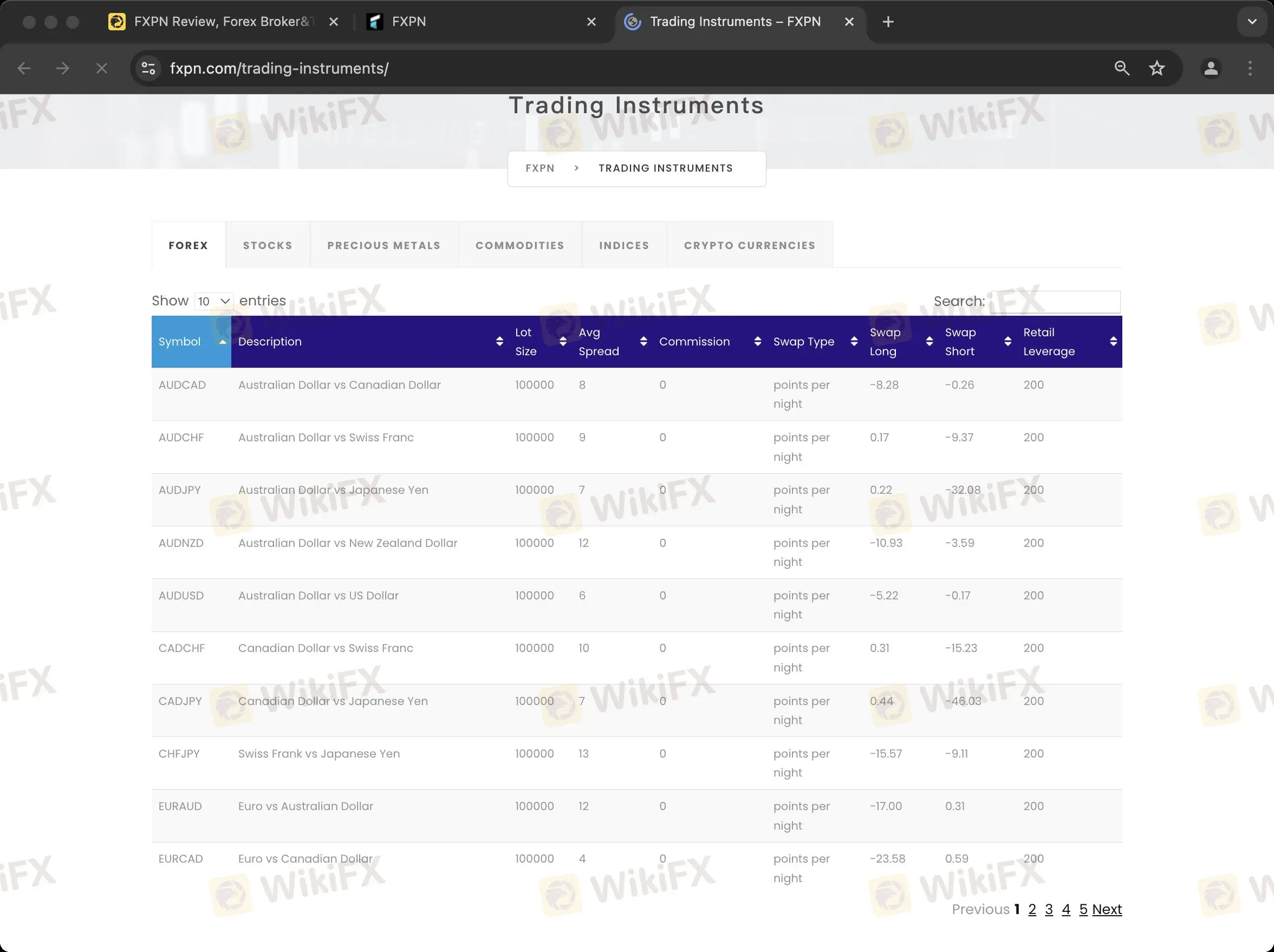

What Can I Trade on FXPN?

FXPN offers trading instruments such as forex and CFDS for stocks, precious metals, commodities, indices and cryptocurrencies.

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Stocks | ✔ |

| Currencies | ❌ |

| Crypto currencies | ✔ |

| Indices | ✔ |

| Precious metals | ✔ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

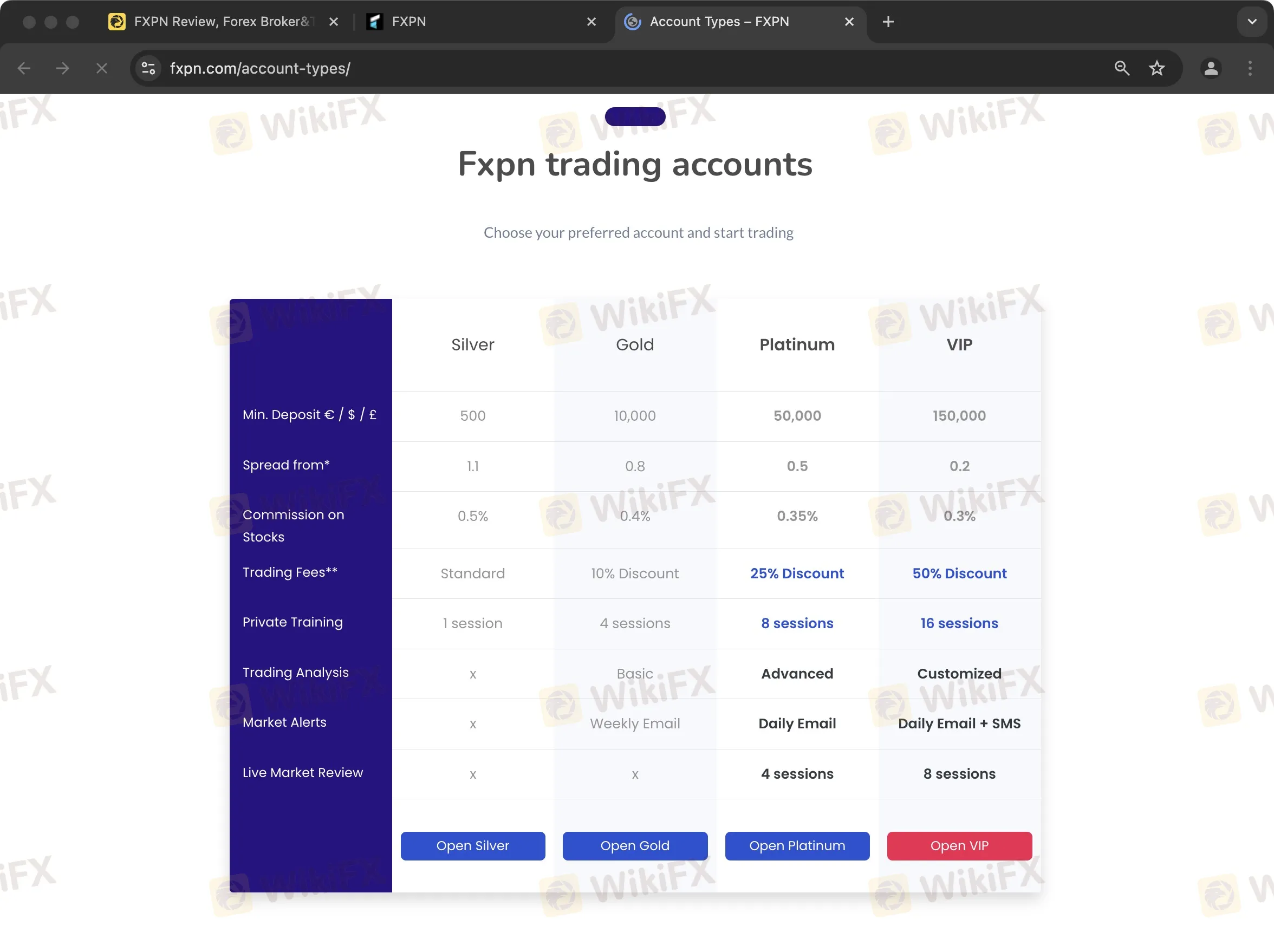

Account Types

FXPN offers four types of real trading accounts, namely Silver, Gold, Platinum and VIP, with minimum initial deposit requirements of $/€/£500,$/€/£10,000,$/€/£50,000 and $/€/£150,000 respectively.

Demo accounts with no maturity date are available. Demo accounts that have not been activated for more than 90 days since the last login will be closed. A maximum of 5 active demo accounts are allowed.

Leverage

The maximum leverage ratio offered by FXPN is 1:200.

FXPN Fees

Customers with silver accounts can enjoy a spread of 1.1 pips, while customers with the other three accounts can enjoy a spread of 0.8, 0.5 and 0.2 pips respectively.

Stock commission: Silver account 0.5%, Gold account 0.4%, Platinum account 0.35%, VIP account 0.3%.

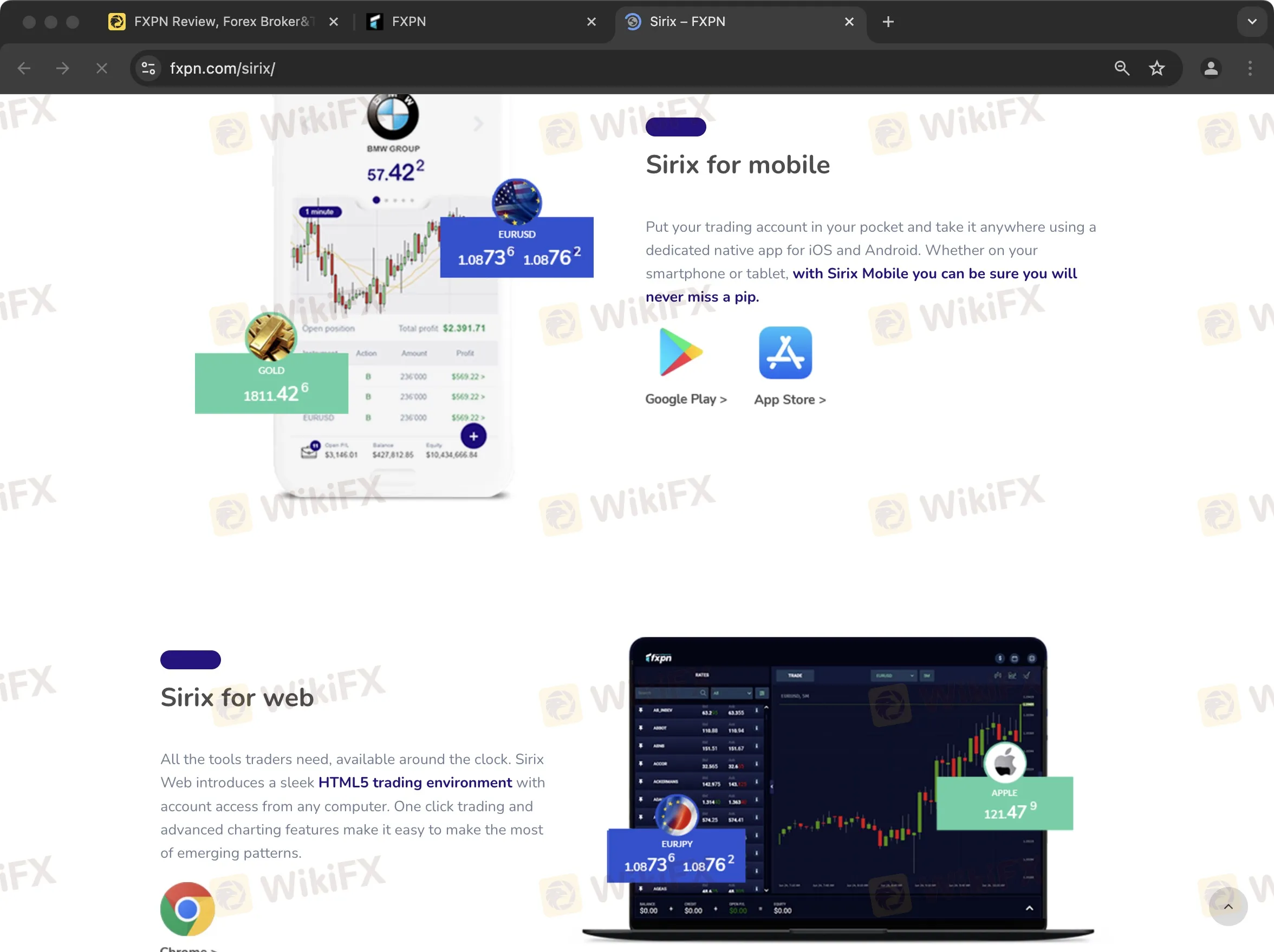

Trading Platform

SIRIX Web Trader and Mobile Trading apps on iOS and Android are chosen by FXPN to serve clients.

| Trading Platform | Supported | Available Devices | Suitable for |

| SIRIX Web Trader | ✔ | Website | Investors of all experience levels |

| Mobile Trading app | ✔ | IOS, Android | Investors of all experience levels |

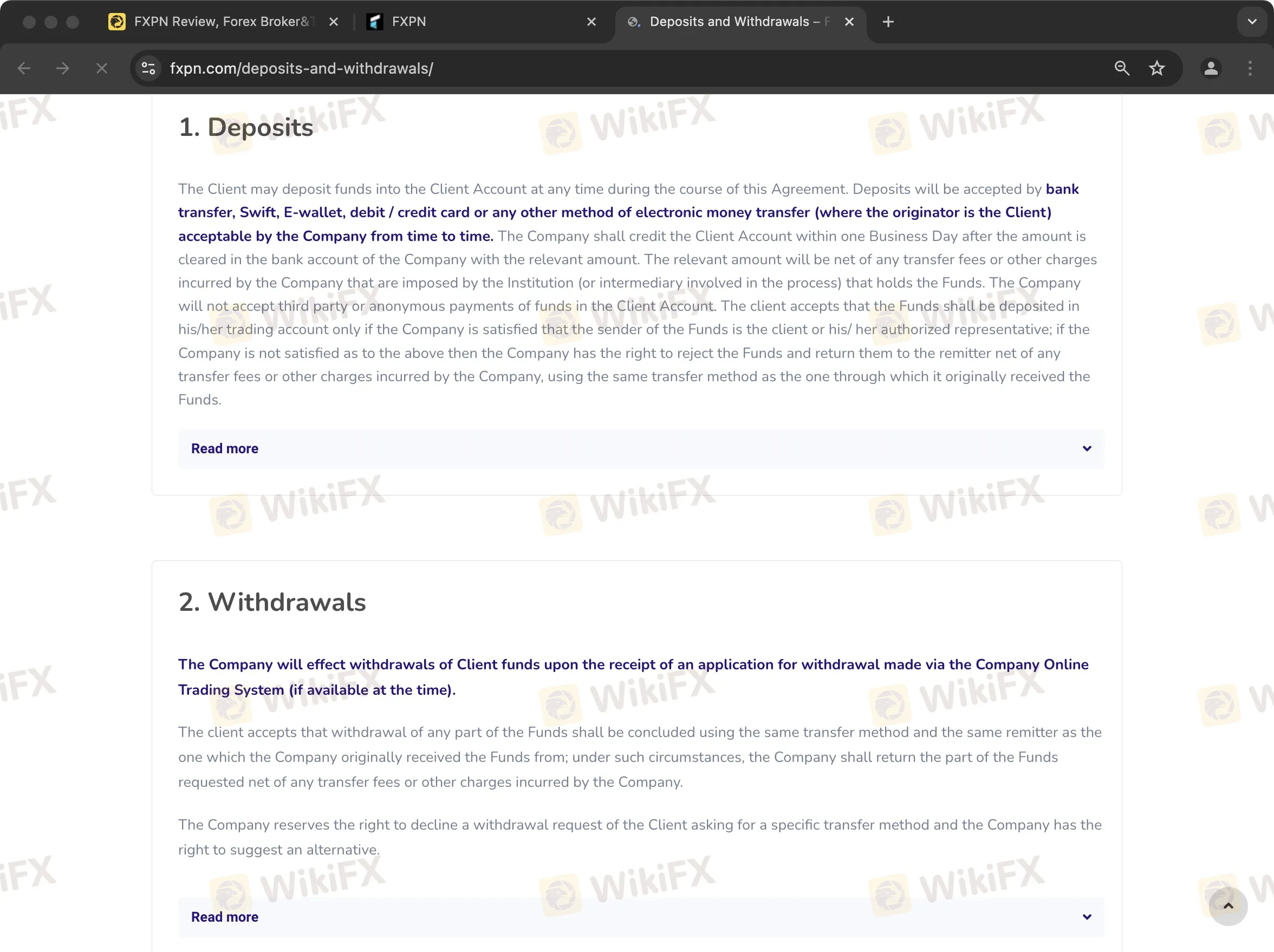

Deposit and Withdrawal

FXPN supports bank transfer, Swift, e-wallet, debit/credit card or any other electronic money transfer method.

The minimum initial deposit requirement is said to be $/€/£500.

FXPN charges a transaction fee, a standard fee charged for silver accounts, a 10% discount for gold accounts, a 25% discount for platinum accounts, and a 50% discount for VIP accounts.

leer más

Bitcoin podría 'consolidarse hasta 2022' después de que el barrido masivo enviara el precio

Bitcoin (BTC) cotizaba cerca de USD 47,000 el 4 de diciembre después de que una caída repentina confirmara las peores pesadillas de los toros con un 22% de pérdidas diarias.

Bitcoin, Ethereum, y Otras Criptomonedas Cryptos Se Desploman 15%+

El Bitcoin se desplomó en las operaciones de la madrugada del sábado, siguiendo una semana de “risk-off” en los mercados en general. A las 6:15 am ET, la criptomoneda líder se negociaba justo por debajo de los $47,000, bajando más del 16% en las últimas 24 horas, la mayor caída de la criptomoneda desde el 7 de septiembre.

El Bitcoin pierde un 11% en un día de ventas masivas

El Bitcoin cotiza a $50.340,3 hoy a las 06:02 (05:02 GMT) en el Investing.com Index, lo que representa una caída diaria del 11,06%. Se trata de la mayor pérdida porcentual en un día desde el pasado 7 de septiembre.

Ojo al Bitcoin: A por nuevo ATH en 68.000, en zona de ‘euforia alta’

El sector de las criptomonedas recupera su senda alcista esta semana. VanEck lanzará estos días su ETF de futuros de Bitcoin, tras tumbar la SEC su ETF de Bitcoin al contado.

Brokers de WikiFX

últimas noticias

easyMarkets optimiza su plataforma para traders de todos los niveles.

FxPro agrega 10 criptomonedas a su línea de instrumentos de inversión.

¡ALERTA! Siguen aumentando las estafas de REALHX.

Análisis del par de Divisas AUD/USD al 12 de Marzo de 2025.

¿Axi es un bróker seguro? Análisis 2025.

Anuncio del Lanzamiento de la Versión 3.6.4 de WikiFX App

La CNMV alerta de 10 entidades no registradas.

Cálculo de tasa de cambio