OpenTrading

Extracto:OpenTrading is an unregulated financial brokerage firm established in 2016 and registered in Anguilla. It offers a diverse range of tradable instruments, including shares, ETFs, ADRs, indices, cryptocurrencies, forex, and commodities. The firm provides both live and demo accounts. What's more, OpenTrading uses the MT5 trading platform.

| OpenTrading Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Anguilla |

| Regulation | No Regulation |

| Market Instruments | Shares, ETFs, ADRs, indexes, cryptocurrencies, forex, commodities |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Contact form (24/5 support) |

| Phone: +562 2993 6700 | |

| Email: info@opentrading.org | |

| Address: Spencer House, P.O. Box 821, The Valley, Anguilla | |

OpenTrading is an unregulated financial brokerage firm established in 2016 and registered in Anguilla. It offers a diverse range of tradable instruments, including shares, ETFs, ADRs, indices, cryptocurrencies, forex, and commodities. The firm provides both live and demo accounts. What's more, OpenTrading uses the MT5 trading platform.

Pros and Cons

| Pros | Cons |

| Demo accounts available | No regulation |

| A wide range of trading products | Limited info on trading fees |

| MT5 platform | Unknown payment methods |

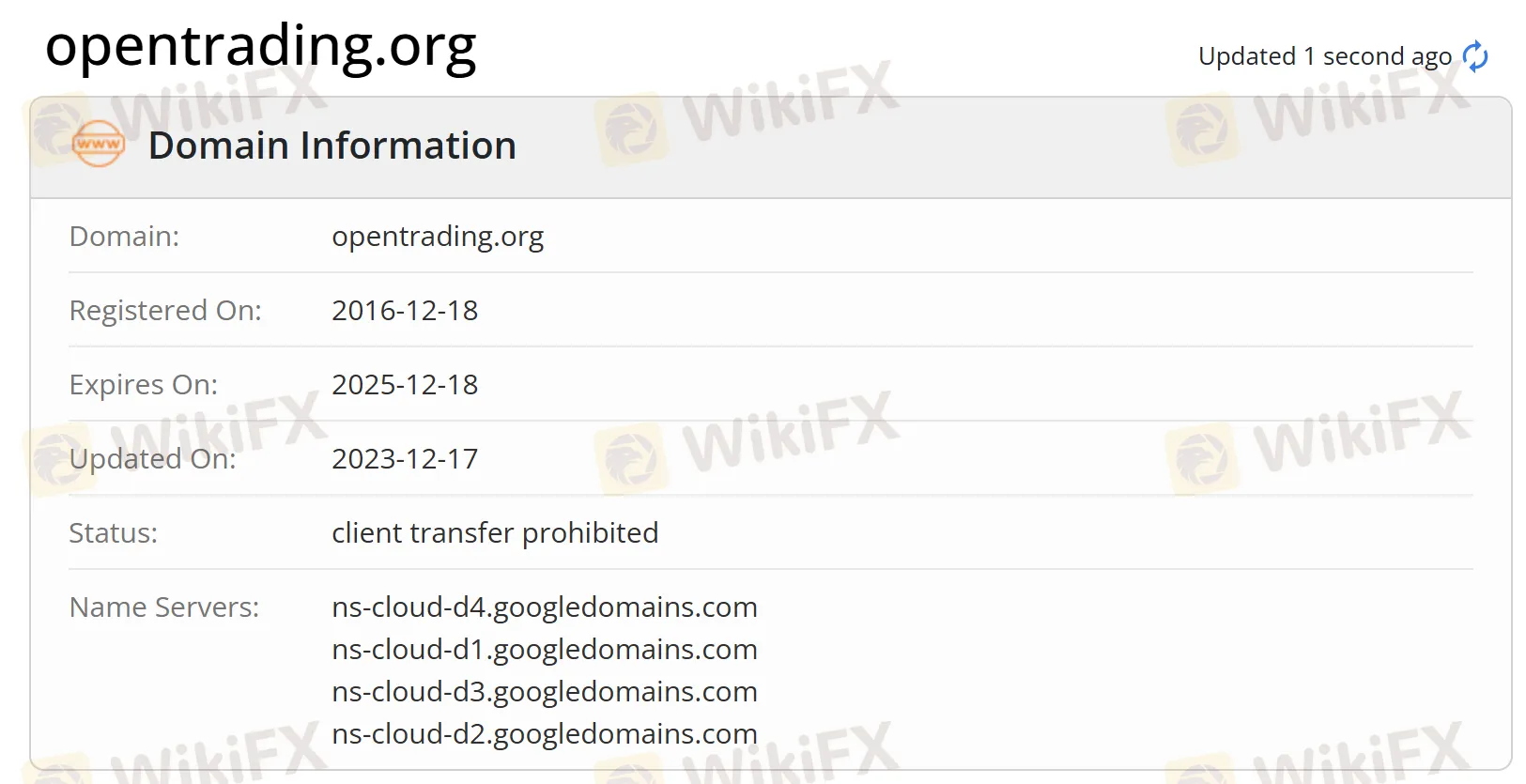

Is OpenTrading Legit?

At present, OpenTrading lacks valid regulation.

Its domain was registered on Dec 18, 2016, and the current status is “client transfer prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

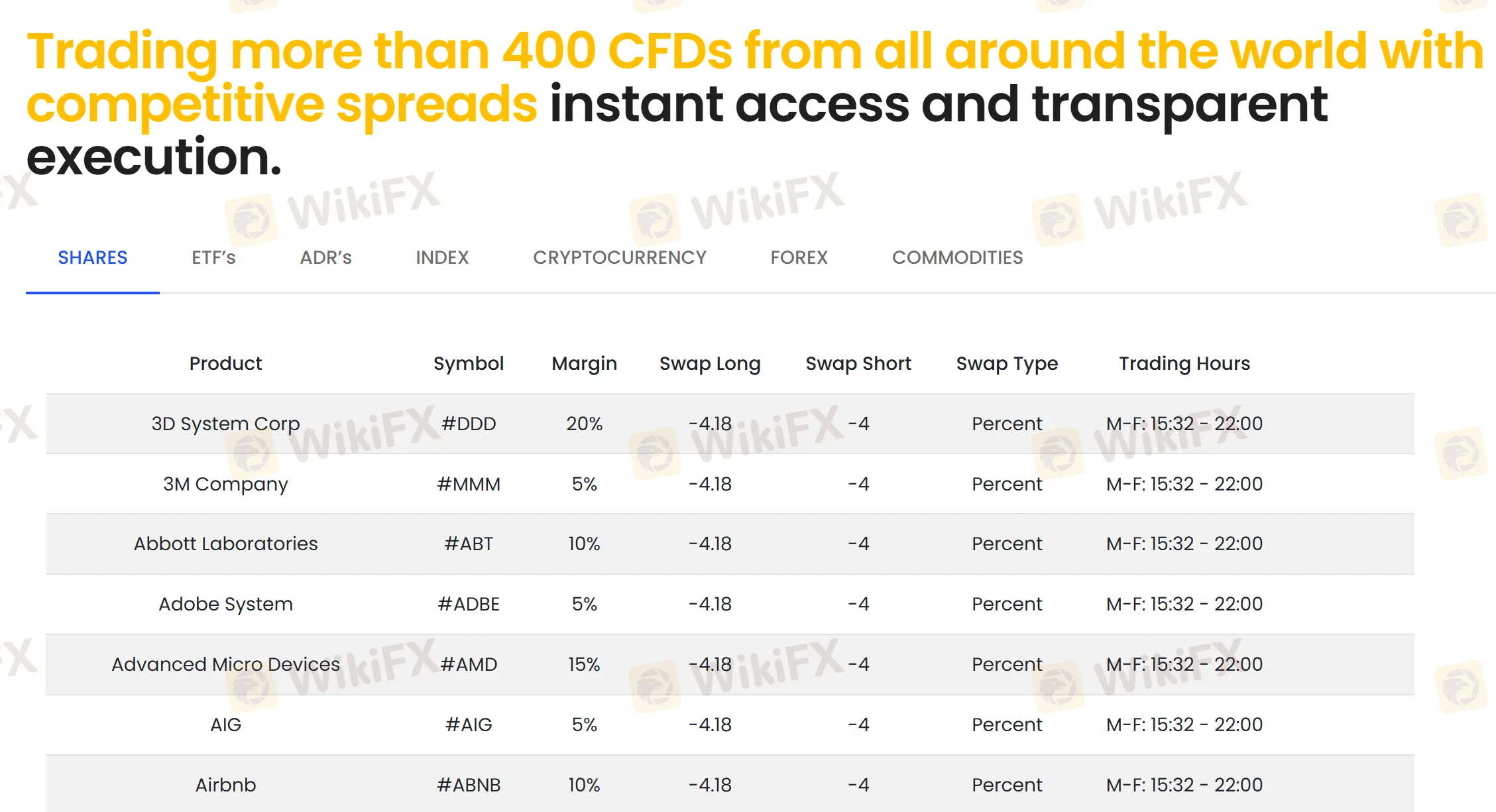

What Can I Trade on OpenTrading?

On OpenTrading, you can trade with shares, ETFs, ADRs, indexes, cryptocurrencies, forex, and commodities.

| Tradable Instruments | Supported |

| Shares | ✔ |

| ETFs | ✔ |

| ADRs | ✔ |

| Indexes | ✔ |

| Cryptocurrencies | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, iOS, iMac, Android, Web Terminal | Experienced traders |

| MT4 | ❌ | / | Beginners |

leer más

Bitcoin podría 'consolidarse hasta 2022' después de que el barrido masivo enviara el precio

Bitcoin (BTC) cotizaba cerca de USD 47,000 el 4 de diciembre después de que una caída repentina confirmara las peores pesadillas de los toros con un 22% de pérdidas diarias.

Bitcoin, Ethereum, y Otras Criptomonedas Cryptos Se Desploman 15%+

El Bitcoin se desplomó en las operaciones de la madrugada del sábado, siguiendo una semana de “risk-off” en los mercados en general. A las 6:15 am ET, la criptomoneda líder se negociaba justo por debajo de los $47,000, bajando más del 16% en las últimas 24 horas, la mayor caída de la criptomoneda desde el 7 de septiembre.

El Bitcoin pierde un 11% en un día de ventas masivas

El Bitcoin cotiza a $50.340,3 hoy a las 06:02 (05:02 GMT) en el Investing.com Index, lo que representa una caída diaria del 11,06%. Se trata de la mayor pérdida porcentual en un día desde el pasado 7 de septiembre.

Ojo al Bitcoin: A por nuevo ATH en 68.000, en zona de ‘euforia alta’

El sector de las criptomonedas recupera su senda alcista esta semana. VanEck lanzará estos días su ETF de futuros de Bitcoin, tras tumbar la SEC su ETF de Bitcoin al contado.

Brokers de WikiFX

últimas noticias

¿Cómo impacta el dólar hoy en la economía latinoamericana?

La CNMV advierte un clon de Monex Europe y de 6 entidades no registradas

¿Zaffex es una estafa o un broker confiable? Cliente le bloquearon su retiro.

¿SWALLFX es un bróker seguro y confiable en 2025?

Cálculo de tasa de cambio