Aspen Holding

Extracto:Aspen Holding, a trading name of Next Trade Ltd, is allegedly a forex and CFD broker registered in Vanuatu that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads on the web-based trading platform via six different live account types.

Note: Aspen Holding is to operate via the website - https://aspenholding.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | currency pairs and CFDs on oil, precious metals, stocks and cryptocurrencies |

| Account Type | Basic, Bronze, Silver, Gold, Platinum and Diamond |

| Demo Account | no |

| Maximum Leverage | 1:500 |

| Spread | Basic account: 3 pips fixed |

| Commission | N/A |

| Trading Platform | web |

| Minimum Deposit | $250 |

| Deposit & Withdrawal Method | VISA and MasterCard, bank wire, Neteller, BitSend and BPay |

Aspen Holding, a trading name of Next Trade Ltd, is allegedly a forex and CFD broker registered in Vanuatu that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads on the web-based trading platform via six different live account types. Here is the home page of this brokers official site:

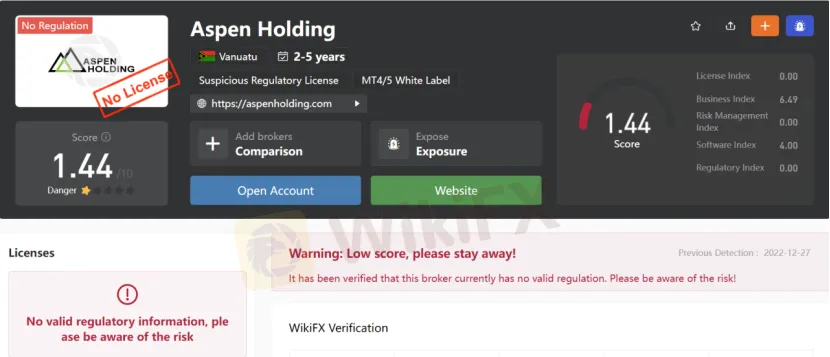

As for regulation, it has been verified that Aspen Holding currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.44/10. Please be aware of the risk.

Market Instruments

Aspen Holding advertises that it offers access to 200+ tradable assets, including currency pairs, as well as CFDs on oil, precious metals, stocks and even crypto coins including Bitcoin, Litecoin and Ethereum.

Account Types

Aspen Holding claims to offer six types of trading accounts, namely Basic, Bronze, Silver, Gold, Platinum and Diamond. The minimum initial deposit amount to open a Basic account is $250. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less. However, this broker doesnt offer demo accounts.

Leverage

The leverage provided by Aspen Holding is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

All spreads with Aspen Holding are a floating type and scaled with the accounts offered. The spread is fixed at 3 pips on the Basic account, while Silver, Gold, Platinum and Diamond account holders can enjoy Silver Spreads, Gold Spreads, Platinum Spreads and Diamond Spreads respectively.

Trading Platform Available

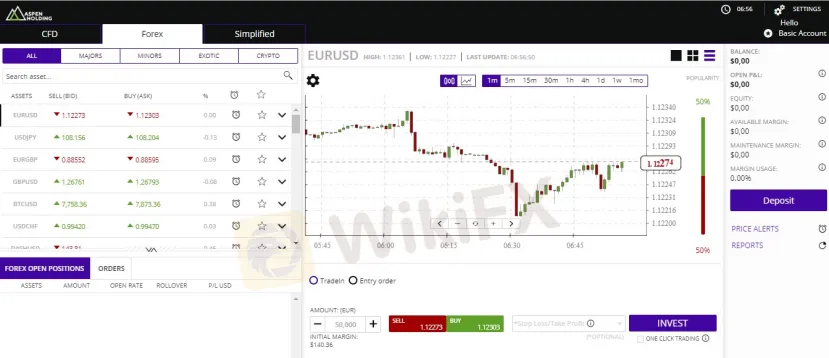

Aspen Holding claims to offer the industry-standard MT4 trading platform, however, it is not freely downloadable. Instead, it is just a web-based trading platform, as the below screenshot shows.

Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

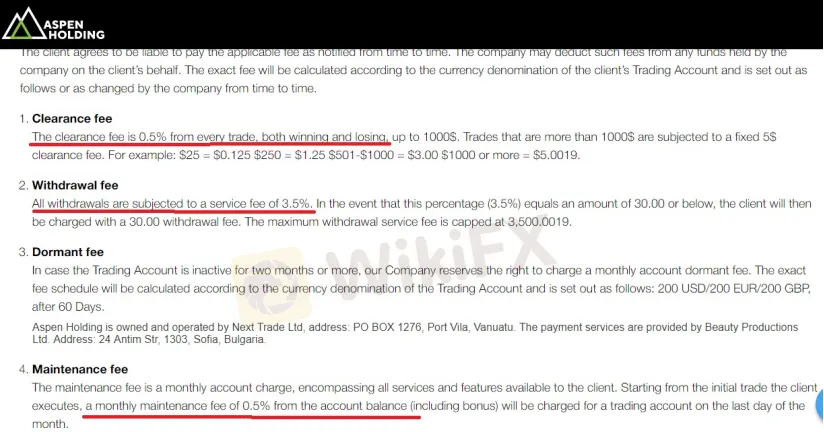

Aspen Holding says to work with numerous means of deposit and withdrawal choices, consisting of VISA and MasterCard, bank wire and several e-wallets among which Neteller, BitSend and BPay. The minimum initial deposit requirement is $250. All withdrawals are subjected to a service fee of 3.5%.

Fees

Aspen Holding charges various fees. Apart from the withdrawal fee that we have mentioned above, there is also a clearance fee of 0.5% charged on every trade, both winning and losing, up to 1000$. A monthly account dormant fee of $200 will also be charged if a clients trading account is inactive for two months or more, as well as a monthly maintenance fee of 0.5% and a 5% Swap fee for cryptocurrency trades.

Customer Support

Aspen Holdings customer support can be reached by telephone: +74993503964. +60392125781, email: support@aspenholding.com. You can also follow this broker on social networks such as Twitter and Facebook.

Pros & Cons

| Pros | Cons |

| • Multiple trading instruments, account types and payment options offered | • No regulation |

| • Website inaccessible | |

| • No demo accounts available | |

| • Tight spreads | |

| • High minimum deposit ($250) |

Frequently Asked Questions (FAQs)

| Q 1: | Is Aspen Holding regulated? |

| A 1: | No. It has been verified that Aspen Holding currently has no valid regulation. |

| Q 2: | Does Aspen Holding offer demo accounts? |

| A 2: | No. |

| Q 3: | Does Aspen Holding offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, Aspen Holding offers a web-based trading platform. |

| Q 4: | What is the minimum deposit for Aspen Holding? |

| A 4: | The minimum initial deposit at Aspen Holding to open a Basic account is $250. |

| Q 5: | Does Aspen Holdingcharge a fee? |

| A 5: | Like every forex broker, Aspen Holding charges a spread fee. It also charges some withdrawal fees, as well as other various fees. |

| Q 6: | Is Aspen Holding a good broker for beginners? |

| A 6: | No. Aspen Holding is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

leer más

Bitcoin podría 'consolidarse hasta 2022' después de que el barrido masivo enviara el precio

Bitcoin (BTC) cotizaba cerca de USD 47,000 el 4 de diciembre después de que una caída repentina confirmara las peores pesadillas de los toros con un 22% de pérdidas diarias.

Bitcoin, Ethereum, y Otras Criptomonedas Cryptos Se Desploman 15%+

El Bitcoin se desplomó en las operaciones de la madrugada del sábado, siguiendo una semana de “risk-off” en los mercados en general. A las 6:15 am ET, la criptomoneda líder se negociaba justo por debajo de los $47,000, bajando más del 16% en las últimas 24 horas, la mayor caída de la criptomoneda desde el 7 de septiembre.

El Bitcoin pierde un 11% en un día de ventas masivas

El Bitcoin cotiza a $50.340,3 hoy a las 06:02 (05:02 GMT) en el Investing.com Index, lo que representa una caída diaria del 11,06%. Se trata de la mayor pérdida porcentual en un día desde el pasado 7 de septiembre.

Ojo al Bitcoin: A por nuevo ATH en 68.000, en zona de ‘euforia alta’

El sector de las criptomonedas recupera su senda alcista esta semana. VanEck lanzará estos días su ETF de futuros de Bitcoin, tras tumbar la SEC su ETF de Bitcoin al contado.

Brokers de WikiFX

últimas noticias

Aviso: La competencia semanal de Demo Trading de WikiFX se ha suspendido por una semana.

M4Markets lanza app de Social Trading con Brokeree Solutions.

WonderFi Expande sus Servicios Financieros con Eightcap y Embedded.

Cálculo de tasa de cambio