Xpoken

Extracto:Xpoken is an unregulated online forex broker registered in St. Vincent and the Grenadines, a notorious country for accommodating a lot of scam financial companies.

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, spot metals, indices, shares, cryptocurrencies and other derivatives |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | 1:400 |

| Minimum spread | Information not available |

| Trading platform | own platform |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/ phone number /live chat |

| Fraud Complaints Exposure | No for now |

General Information

Xpoken is an unregulated online forex broker registered in St. Vincent and the Grenadines, a notorious country for accommodating a lot of scam financial companies.

Xpoken provides traders with the opportunity to trade a wide range of instruments, including currency pairs, stocks, derivatives, commodities, spot metals, and indices. The platform boasts advanced functionality, offering powerful charting tools, indicators, and analytical resources to assist traders in making informed decisions.

However, it's important to note that Xpoken is an unregulated broker, which may pose potential risks for traders. The lack of regulatory oversight raises concerns about the safety and security of funds. Additionally, the website lacks detailed information regarding spreads, commissions, deposit and withdrawal methods, and other trading costs, which can impact profitability and should be considered when evaluating the platform.

While Xpoken offers leverage of up to 400:1 and multilingual customer support, it is crucial for traders to exercise caution and thoroughly research the platform before engaging in trading activities. Evaluating the potential risks and benefits is essential to make informed decisions about trading with Xpoken.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

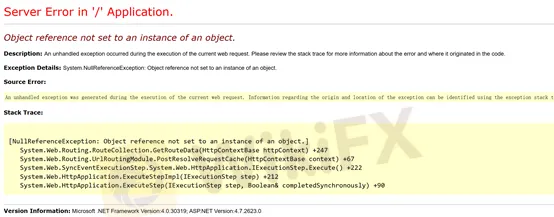

It's worth mentioning that while clicking some buttons on its website it will show an error instead of going to the correspondent page. As a result, some further information is currently unavailable.

Pros and Cons

Xpoken offers a range of advantages and disadvantages that should be carefully considered by potential traders. On the positive side, Xpoken provides access to a diverse range of financial instruments, including currency pairs, stocks, commodities, and indices, through its XPTrade Trading Platform. The platform offers advanced functionality, including powerful charting tools and indicators, to aid in technical and fundamental analysis. Additionally, Xpoken offers leverage of up to 400:1, allowing traders to potentially amplify their profits. On the downside, Xpoken is an unregulated broker, which raises concerns about the safety and security of funds. The lack of detailed information on spreads, commissions, deposit and withdrawal methods, and other trading costs is also a disadvantage, as these factors are crucial in assessing overall profitability. It is important for traders to carefully weigh the pros and cons before deciding to trade with Xpoken.

| Pros | Cons |

| Access to diverse financial instruments | Unregulated broker |

| Charting tools | Lack of transparency on trading costs |

| Leverage of up to 400:1 | Potential risks to funds |

| Multilingual customer support | Limited information on deposit and withdrawal methods |

Is Xpoken Legit?

Xpoken is an unregulated broker, as confirmed by the information provided. It lacks valid regulatory oversight, posing potential risks to traders. The regulatory disclosure indicates that there is no valid regulation for Xpoken. Additionally, the company is registered in Saint Vincent and the Grenadines, which is known for accommodating a high number of unregulated and potentially fraudulent financial entities. It is crucial to exercise caution and be aware of the risks associated with trading with an unregulated broker.

Market instruments

Xpoken offers a wide range of market instruments for clients to trade, providing a diverse array of opportunities for investment. With access to over 500 instruments, traders can engage in various markets and capitalize on different asset classes. Here are the key market instruments available on Xpoken:

1. Currencies: Trade on the world's largest exchange market, with over 90 currency pairs available. Major and exotic pairs are offered, allowing traders to take advantage of global currency fluctuations. Powerful trading tools and 24-hour live support are provided to assist traders in their currency trading endeavors.

2. Spot Commodities: Diversify your portfolio with spot commodities, including precious metals like gold, and other commodities. Traders can engage in trading these physical commodities and benefit from their price movements.

3. Spot Indices: Invest in different market segments with low fees, minimum margin requirements, and reasonable rates through spot indices. These indices represent a basket of stocks or other assets and provide traders with exposure to specific markets or sectors.

4. Spot Energies: Traders can invest in spot energies such as Brent and WTI crude oil, as well as natural gas. Competitive conditions and reliable execution ensure that traders can participate in energy markets effectively.

5. Digital Currencies: Take advantage of the growing popularity of digital currencies by investing in well-known cryptocurrencies like XRP, BTC, and ETH. Speculating on the price movements of these digital assets allows traders to potentially profit from their volatility.

6. Stocks: Xpoken provides access to more than 1,000 shares from leading global companies. With a single click, traders can buy and sell shares, allowing them to participate in the equity markets and potentially benefit from company performance.

Pros and Cons

| Pros | Cons |

| Range of market instruments (over 500) | Potential complexity for beginners to navigate diverse options |

| Access to major and exotic currency pairs | Volatility in currency markets may lead to higher risk |

| Diversification opportunities with spot commodities | Commodity prices can be influenced by external factors |

| Investment options in spot indices across different segments | Market fluctuations may impact the performance of spot indices |

| Opportunities to invest in spot energies, including oil and gas | Dependence on global energy market conditions |

| Access to popular digital currencies for speculative trading | Digital currencies are highly volatile and subject to regulatory risks |

| Wide selection of over 1,000 shares from global companies | Stock market performance can be influenced by various factors |

Spreads and Commissions

Xpoken does not detail on its website additional trading costs such as spreads, commissions, SWAPs, etc. These costs are very important when calculating profits and losses, and should be considered in aggregate and not chosen in isolation. If you want to trade with Xpoken, we recommend that you take the time to calculate these transaction costs.

Account Types for Xpoken

Xpoken offers a range of trading account types to cater to the diverse needs and preferences of traders. These account types provide different features, benefits, and requirements to suit various trading styles and levels of experience. Here are the account types offered by Xpoken:

1. Student Account:

The Student Account is designed for individuals who are new to trading and want to learn and practice in a controlled environment. It requires a minimum deposit of $100 and offers access to limited markets, specifically commodities. Traders with this account type gain access to weekly signals, multiple execution orders, and multi-language support.

2. Starter Account:

The Starter Account is suitable for traders who have gained some experience and are ready to explore more advanced markets such as stocks and indexes. It requires a minimum deposit of $10,000 and provides fundamental trading materials, access to multi-asset trading, low market pricing, multiple execution orders, and multi-language support.

3. Premium Account:

With a minimum deposit of $50,000, the Premium Account is designed for traders who require access to advanced markets, including stocks, currencies, and private markets. Traders with this account type receive daily technical and main materials, signals with comprehensive analysis, complex charting and indicators, low market pricing, and multiple execution orders.

4. Advanced Account:

The Advanced Account caters to experienced traders who demand a high level of customization and in-depth investing tools. It requires a minimum deposit of $100,000 and offers a customized trading portfolio, advanced global market instruments, in-depth investing tools for daily trading, daily technical and primary materials, live signals with analysis, low market pricing, and multiple execution orders.

5. Pro Account:

Designed for professional traders, the Pro Account requires a minimum deposit of $500,000. It offers Islamic accounts for traders who follow Shariah principles. Traders with this account type benefit from a customized trading portfolio, access to thousands of market products, in-depth investing tools for daily trading, daily technical and main trading materials, live signals with analysis, complex charting and indicators, low and allotted market pricing, and multiple execution orders.

6. VIP Account:

The VIP Account is the highest-tier account type offered by Xpoken. It requires a minimum deposit of $1,000,000 and provides an extensive range of features and services. Traders with a VIP Account receive a customized trading portfolio and investing materials, all-inclusive daily trading tools, daily technical and fundamental signals, daily comprehensive analysis, complex charting and indicators, low and allotted market pricing, sophisticated investment resources, advanced execution orders, and 24-hour multi-language assistance.

In addition to these account types, Xpoken also offers Islamic Accounts, which adhere to Islamic principles and are suitable for traders who require compliance with Shariah law.

Pros and Cons

| Pros | Cons |

| Versatile account options to cater to diverse trading needs | High minimum deposits for certain account types |

| Customization and in-depth investing tools available for advanced traders | Very high minimum deposits for Pro and VIP accounts |

| Islamic Accounts available for traders following Shariah principles |

How to Open an Account?

To open an account with Xpoken, follow these steps:

1. Visit the Xpoken website: Go to the Xpoken website using a web browser.

2. Access the account registration page: Look for the “Open Account” link/button on the website. Click on it to proceed.

3. Complete the registration form: Fill in the required information accurately in the registration form. The information typically includes your first name, last name, date of birth, email address, phone number, country of residence, address, city/town, state (if applicable), ZIP code, and base currency.

4. Optional referral number: If you have a referral number, you can enter it in the corresponding field.

5. Consent for information: Choose whether you wish to receive general information related to upcoming promotions and market news via email.

6. Agree to terms and conditions: Read and agree to the Terms and Conditions of Use, Conflict of Interests, Risk Disclosure, and Execution Orders. Ensure that you fully understand and agree to these policies before proceeding.

7. Submit the application: Double-check all the entered information to ensure its accuracy. Click on the submit or register button to send your account application.

8. Await verification: After submitting your application, you may need to wait for the verification process to be completed by Xpoken. This process typically involves verifying your identity and documentation.

9. Account approval and login: Once your account is approved, you will receive confirmation from Xpoken. You can then proceed to log in to your account using the provided credentials.

It's important to note that the account opening process may vary depending on the specific requirements and procedures of Xpoken. It is recommended to refer to Xpoken's official website or contact their customer support for any additional guidance or assistance during the account opening process.

Trading Platforms

Xpoken offers leverage of up to 400:1 to its traders, allowing them to magnify their trading positions and potentially amplify their profits. Leverage is a powerful tool that enables traders to control a larger position in the market with a smaller amount of capital. With a leverage ratio of 400:1, traders can invest in major currency pairs and have the ability to trade with significantly higher exposure than their initial investment.

The leverage of 400:1 means that for every unit of capital a trader has, they can trade with 400 units of the underlying asset. This allows traders to take larger positions in the market, potentially maximizing their profit potential. However, it's important to note that while leverage can enhance profits, it also increases the level of risk. Traders should exercise caution and employ risk management strategies when utilizing leverage to ensure they can manage potential losses effectively.

Leverage

Xpoken offers a maximum leverage of up to 1:400, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and Withdrawal

Xpoken is ambiguous about how deposits and withdrawals work. Wire transfers, MasterCard, VISA, Maestro and some e-wallet processors such as Skrill, Neteller, PayPal and others are some of the most frequent and popular payment methods handled by most Forex brokers. The speed of withdrawing funds from a forex broker is also one of the most important factors in building a broker's reputation.

Educational resources

There is no education section on the Xpoken website. Many brokers are able to provide a variety of educational resources such as video courses, seminars, e-books, related articles, glossaries that provide some basic knowledge about trading. This is not the case with Xpoken.

Customer Support of Xpoken

Xpoken offers customer support in multiple languages, including English, Spanish, Russian, German, Portuguese, French, and more. This multilingual support ensures that traders from various regions can communicate effectively with the customer service team.

For general inquiries, traders can reach out to Xpoken via email at info@xpoken.com. This email address serves as a contact point for addressing any questions or concerns related to trading on the platform.

In addition to email support, Xpoken provides a dedicated phone line for customer assistance. Traders can contact the support team by dialing +18008614098 to speak directly with a representative regarding their trading inquiries. It's worth noting that the phone support is likely available during specified hours.

For immediate assistance, Xpoken offers a live chat feature on their website. Traders can access the live chat support to engage in real-time conversations with the support team. This feature is particularly useful for urgent inquiries or when traders prefer immediate interaction.

Xpoken's customer support operates 24 hours a day, five days a week, ensuring that traders have access to assistance throughout the trading week. Whether it's account-related queries, technical issues, or general trading inquiries, the support team is available to provide guidance and resolve concerns.

To ensure a smooth trading experience, traders can utilize Xpoken's customer support channels to seek assistance, receive answers to their questions, and address any issues that may arise during their trading journey.

Below are the details about the customer service.

Language(s): English, Spanish, Russian, German, Portuguese, French, etcetera

Email: info@xpoken.com

Phone Number: +18008614098

Live chat

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time. However, this does not necessarily mean that this broker is safe and you should remain vigilant to prevent being scammed.

Conclusion

In conclusion, Xpoken is an unregulated broker that offers a variety of account types and access to multiple financial markets through the XPTrade Trading Platform. While the platform provides advanced functionality and a user-friendly interface, the lack of regulation raises potential risks for traders. Additionally, the absence of clear information regarding spreads, commissions, and deposit/withdrawal methods is a drawback. However, the availability of leverage up to 400:1 and multilingual customer support are notable advantages. Traders considering Xpoken should exercise caution, conduct thorough research, and carefully evaluate the potential risks and benefits before engaging in trading activities.

FAQs

Q: Is Xpoken a regulated broker?

A: No, Xpoken is an unregulated broker, lacking valid regulatory oversight. Traders should be cautious when dealing with unregulated brokers due to potential risks.

Q: What are the available account types on Xpoken?

A: Xpoken offers various account types, including Trading Account Plans, Student Account, Starter Account, Premium Account, Advanced Account, Pro Account, and VIP Account. Each account type caters to different trading needs and experience levels.

Q: How can I open an account with Xpoken?

A: To open an account with Xpoken, visit their website and navigate to the account registration page. Fill in the required information accurately, agree to the terms and conditions, and submit your application. After verification, you will receive confirmation and login credentials.

Q: What leverage does Xpoken offer?

A: Xpoken provides leverage of up to 400:1, allowing traders to control larger positions in the market with a smaller amount of capital.

Q: What are the spreads and commissions on Xpoken?

A: Xpoken does not disclose specific information about spreads and commissions on its website. Traders are advised to calculate these transaction costs as part of their overall trading strategy.

Q: What deposit and withdrawal methods does Xpoken offer?

A: Xpoken does not provide clear details about deposit and withdrawal methods on its website. Typically, forex brokers offer options such as wire transfers, credit cards (MasterCard, VISA), and e-wallet processors (Skrill, Neteller, PayPal).

Q: What trading platform does Xpoken use?

A: Xpoken utilizes the XPTrade Trading Platform, known for its advanced functionality, extensive market access, and user-friendly interface. It is available on desktop, mobile, and web.

Q: How can I contact Xpoken's customer support?

A: Xpoken offers customer support via email (info@xpoken.com), phone (+18008614098), and live chat on their website. The support team operates 24/5 to assist traders with their inquiries and concerns.

Q: What are the operating hours for trading on Xpoken?

A: Xpoken allows trading 24 hours a day, five days a week, enabling traders to participate in the markets at their convenience.

Q: Which markets can I trade on Xpoken?

A: Xpoken offers a range of markets, including currency pairs, stocks, derivatives, commodities, spot metals, and indices.

Q: How do I start trading on Xpoken?

A: After funding your account, you will receive new credentials for the XPTrade platform, enabling you to start trading in the markets provided by Xpoken.

Brokers de WikiFX

últimas noticias

¿Cómo impacta el dólar hoy en la economía latinoamericana?

¿Qué tan seguro es el bróker Valor en 2025 y cómo saber si es una opción confiable?

Cálculo de tasa de cambio