Ixxen

Extracto:Ixxen is a trading company based in Canada, established within the past year. As an unregulated entity, it offers access to a wide range of tradable assets, including currencies, shares, metals, indices, commodities, and digital currencies. Traders can choose from multiple account types, such as Beginner, Standard, Intermediate, Advanced, Integral, and VIP, each designed to cater to different trading needs. The minimum deposit required to start trading with Ixxen is $2,500, and traders can utilize leverage up to a ratio of 1:400. The company supports various deposit and withdrawal methods, including credit/debit cards, online wallets, and bank transfers. Ixxen provides customer support through phone and email, offering assistance to traders as needed. Additionally, the company offers educational resources such as free education tools, daily market analysis, and an economic calendar to help traders stay informed and make informed trading decisions. It is important to note that Ixxen op

| Information | Details |

| Company Name | Ixxen |

| Years Established | Within a year |

| Headquarters | Canada |

| Regulations | Unregulated |

| Tradable Assets | Currencies, Shares, Metals, Indices, Commodities, and Digital Currencies |

| Account Types | Beginner, Standard, Intermediate, Advanced, Integral, VIP |

| Minimum Deposit | $2,500 |

| Maximum Leverage Ratio | Up to 1:400 |

| Deposit/Withdraw Methods | Credit/debit cards, online wallets, bank transfers |

| Customer Support | Phone Support, Email Support |

| Educational Content | Free education tools, daily market analysis, economic calendar |

Overview of Ixxen

Ixxen is a trading company based in Canada, established within the past year. As an unregulated entity, it offers access to a wide range of tradable assets, including currencies, shares, metals, indices, commodities, and digital currencies. Traders can choose from multiple account types, such as Beginner, Standard, Intermediate, Advanced, Integral, and VIP, each designed to cater to different trading needs. The minimum deposit required to start trading with Ixxen is $2,500, and traders can utilize leverage up to a ratio of 1:400. The company supports various deposit and withdrawal methods, including credit/debit cards, online wallets, and bank transfers.

Ixxen provides customer support through phone and email, offering assistance to traders as needed. Additionally, the company offers educational resources such as free education tools, daily market analysis, and an economic calendar to help traders stay informed and make informed trading decisions. It is important to note that Ixxen operates as an unregulated entity, which may impact certain aspects of its operations and services. Traders should exercise caution and conduct thorough research before engaging in trading activities with the company.

Is Ixxen regulated?

There is no information provided regarding the specific regulations and regulatory authorities governing Ixxen. Therefore, it is not possible to provide details about the regulatory status of the company. To obtain accurate and up-to-date information about the regulatory framework of Ixxen, it is recommended to refer to the official Ixxen website or contact their customer support. Regulatory compliance is an important aspect to consider when choosing a trading company, and traders should ensure that the company operates under the necessary regulations to ensure transparency, security, and investor protection.

Pros and Cons

Ixxen offers excellent trading conditions, including transparent pricing and superior execution speed, providing traders with favorable conditions for their trading activities. The company prioritizes reliability and security, ensuring a safe trading environment. Traders also benefit from access to global markets, allowing them to explore diverse trading opportunities. Furthermore, Ixxen provides extensive educational materials and offers multiple account types to cater to different trading needs.

A notable concern is the lack of regulatory information provided about Ixxen. The absence of specific details regarding regulations and regulatory authorities overseeing the company raises questions about the level of oversight and investor protection. Additionally, the information available about Ixxen is relatively limited, with specific details about trading platforms, deposit/withdrawal methods, and bonus offerings not provided. Traders may need to conduct additional research or seek assistance from customer support to obtain comprehensive information.

| Pros | Cons |

| Diverse range of tradable assets | Unregulated entity |

| Various account types tailored to different trading needs | Limited information about establishment and headquarters |

| Relatively low minimum deposit requirement | Lack of clarity regarding withdrawal fees |

| Leverage up to 1:400 | |

| Customer support through phone and email | |

| Educational resources for traders |

Market Instruments

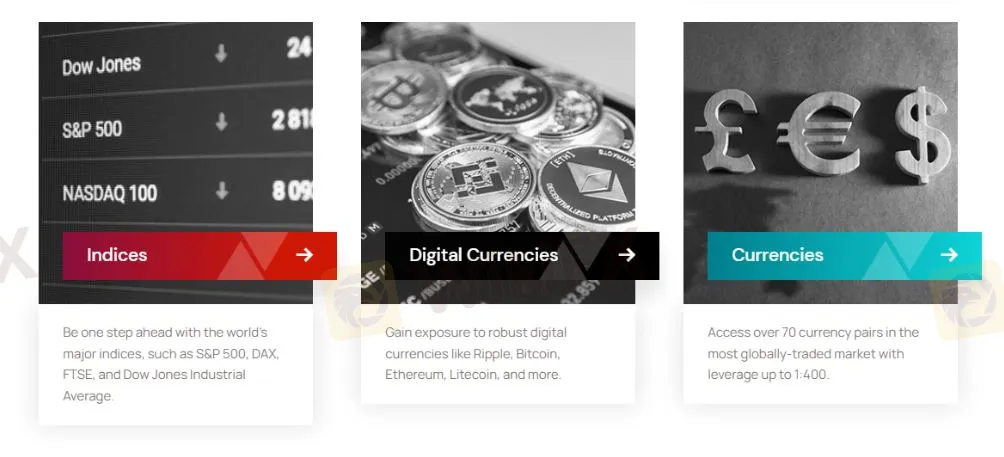

Ixxen offers a diverse range of market instruments for traders to engage in. With over 900+ tradable products, Ixxen provides access to various financial markets, allowing traders to diversify their portfolios and explore different investment opportunities.

Currencies: One of the key market instruments available on Ixxen is currencies. Traders can participate in the forex market and trade major, minor, and exotic currency pairs, taking advantage of the volatility and potential profit opportunities in the global currency markets.

Shares: Ixxen provides access to shares, allowing traders to invest in individual stocks of renowned companies. This enables traders to take positions on the performance of specific companies and benefit from potential price movements.

Metals: Ixxen also offers trading in metals, such as gold, silver, and platinum. Precious metals are known for their intrinsic value and are often considered a safe-haven asset during times of economic uncertainty. By trading metals, traders can diversify their portfolios and potentially hedge against market volatility.

Indices: Indices represent a basket of stocks from specific regions or sectors, providing traders with exposure to broader market movements. Trading indices allows traders to speculate on the overall performance of a specific market or sector without the need to trade individual stocks.

Commodities: Traders can trade commodities such as oil, natural gas, agricultural products, and more. Commodities are influenced by supply and demand dynamics and can provide opportunities for traders to profit from price fluctuations in these markets.

Digital Currencies: Ixxen offers trading in digital currencies, commonly referred to as cryptocurrencies. Traders can engage in the crypto market and trade popular digital currencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrencies have gained significant attention in recent years, offering traders the potential for high volatility and substantial returns.

Main Account Types

| Account Type | Features | Minimum Deposit |

| Beginner | Basic access to trading instruments, one-click trading, mobile trading capabilities, free educational tools, daily market analysis, economic calendar | $2,500 |

| Standard | All Beginner Account features + Islamic/Swap-free trading | $5,000 |

| Intermediate | All Standard Account features + financial markets coverage | $25,500 |

| Advanced | All Intermediate Account features + exclusive market updates | $50,000 |

| Integral | All Advanced Account features + private account management, key market SMS & push alerts | $100,000 |

| VIP | Custom access to trading instruments, best prices for trading, real-time priority support, exclusive access to events and promotions | $250,000 |

Ixxen provides traders with a range of account types, each designed to cater to different trading needs and experience levels. These account types offer varying features and benefits, allowing traders to choose the one that aligns with their preferences and trading goals.

Beginner Account:

The Beginner Account is suitable for new traders starting their trading journey. It offers basic access to trading instruments and enables one-click trading for faster execution. Traders can enjoy mobile trading capabilities and access free educational tools to enhance their trading knowledge. Additionally, daily market analysis and an economic calendar are provided to keep traders informed.

2. Standard Account:

The Standard Account is similar to the Beginner Account but offers an additional feature of Islamic/Swap-free trading. This account type caters to traders who adhere to Islamic principles and require swap-free trading conditions. It includes all the features of the Beginner Account, such as basic access to trading instruments and one-click trading.

3. Intermediate Account:

The Intermediate Account is designed for traders with some experience in the market. In addition to the features offered in the Beginner and Standard Accounts, the Intermediate Account includes financial markets coverage. Traders gain access to in-depth analysis and insights on various financial markets, helping them make more informed trading decisions.

4. Advanced Account:

The Advanced Account is tailored for seasoned traders who require advanced trading features and tools. Along with the features of the Intermediate Account, the Advanced Account offers exclusive market updates. This ensures that traders stay updated with the latest market trends and developments, enabling them to adjust their strategies accordingly.

5. Integral Account:

The Integral Account is a premium account type that provides full access to trading instruments and advanced features. It includes all the features offered in the Advanced Account, as well as additional benefits like private account management and key market SMS & push alerts. Traders with the Integral Account receive personalized support and timely notifications to stay ahead of market movements.

6. VIP Account:

The VIP Account is the highest-tier account offered by Ixxen, catering to high-net-worth individuals and experienced traders. It provides custom access to trading instruments and offers the very best prices for trading. Traders with a VIP Account can implement trading strategies, enjoy real-time priority support, and gain exclusive access to events and promotions.

Step-by-step on opening an account

Visit the Ixxen website: Go to the official Ixxen website using your preferred web browser.

2. Click on the “Open an Account” button: Look for the “Open an Account” button on the homepage or in the main navigation menu and click on it.

3. Fill out the registration form: You will be directed to the registration form where you need to provide your personal information. This may include your full name, email address, phone number, and country of residence. Ensure that you provide accurate and up-to-date information.

4. Choose an account type: Select the account type that best suits your trading needs and experience level. Consider factors such as trading conditions, minimum deposit requirements, and available features.

Leverage

Ixxen offers leverage to its traders, allowing them to potentially amplify their trading positions and exposure to the markets. Leverage is a tool that enables traders to trade larger positions with a smaller amount of capital. However, it is important to understand that leverage also increases both potential profits and potential losses, making it a double-edged sword.

The maximum leverage ratio provided by Ixxen is up to 1:400. This means that for every dollar in a trader's account, they can trade up to 400 times that amount. For example, with a $1,000 account balance, a trader can open trades with a maximum value of $400,000.

The availability of leverage allows traders to take advantage of market opportunities and potentially generate higher returns. However, it is crucial to use leverage responsibly and with proper risk management strategies in place. While leverage can magnify profits, it can also lead to significant losses if trades move against the trader's expectations.

Traders should consider their risk tolerance, trading experience, and market conditions when deciding the appropriate leverage level to use. It is advisable to start with lower leverage ratios and gradually increase them as traders become more experienced and comfortable with managing the associated risks.

It is worth noting that leverage availability and ratios may be subject to regulatory restrictions based on the trader's jurisdiction or the financial instruments being traded. Traders should always be aware of the specific leverage conditions and any limitations imposed by relevant regulatory authorities.

Spreads & Commissions (Trading Fees)

Ixxen offers transparent pricing with competitive spreads and commissions to facilitate trading activities. The spreads refer to the difference between the buying and selling prices of a particular financial instrument. It represents the cost of executing a trade and can vary depending on market conditions and the specific instrument being traded.

The spreads offered by Ixxen are designed to be competitive, allowing traders to access the markets at favorable rates. Tight spreads can potentially minimize trading costs and enhance profitability for traders. However, it is important to note that spreads can vary across different instruments and market conditions. Major currency pairs typically have tighter spreads compared to exotic currency pairs or other asset classes.

Regarding commissions, Ixxen provides trading conditions with no extra fees on transactions for certain account types. This means that traders can execute trades without incurring additional charges in the form of commissions. However, it is essential to review the specific account type and trading conditions to understand if any commissions are associated with the chosen account.

It's worth mentioning that trading fees, including spreads and commissions, may vary depending on factors such as the type of account, trading platform, liquidity providers, and market volatility. It is advisable for traders to carefully review the fee structure and trading conditions associated with their chosen account type before engaging in trading activities.

To obtain accurate and up-to-date information on spreads, commissions, and any other trading fees charged by Ixxen, it is recommended to visit their official website or contact their customer support directly. They will be able to provide you with detailed information regarding the specific fees and charges applicable to your trading activities.

Deposit & Withdrawal

Ixxen offers a variety of convenient and secure deposit and withdrawal methods to facilitate financial transactions for its clients. These methods include credit/debit cards, online wallets, and bank transfers.

For deposits, clients can use their credit or debit cards, providing a quick and instant way to fund their accounts. Online wallets, such as Skrill, Neteller, or PayPal, are also supported, offering an additional secure option for depositing funds. Bank transfers are available for those who prefer the traditional method of transferring funds directly from their bank accounts.

When it comes to withdrawals, clients have the option to request bank transfers, ensuring that funds are securely transferred to their designated bank accounts. In some cases, withdrawals may be processed back to the original credit/debit card used for depositing. Withdrawals to online wallets, if used for depositing, are also possible, providing a swift and convenient way to access funds.

Customer Support

Ixxen offers multiple channels through which clients can seek support and assistance:

1. Email Support: Clients can reach out to Ixxen's customer support team by email. They can send their inquiries, concerns, or requests to customercare@ixxen.com. The support team aims to respond promptly and provide detailed information or solutions.

2. Phone Support: Clients have the option to contact Ixxen's customer support team via phone. The provided phone number, +18007924699, allows clients to directly speak with a support representative who can address their queries, provide guidance, and offer assistance.

3. Live Chat: Ixxen provides a live chat feature on their website, enabling clients to engage in real-time conversations with customer support representatives. This allows for instant assistance, quick responses to inquiries, and immediate resolution of concerns.

Educational Resources

Ixxen is committed to empowering traders with knowledge and providing educational resources to enhance their trading skills and understanding of the financial markets. The company offers a range of educational materials to support clients in their trading journey. These resources include:

1. Free Educational Materials: Ixxen provides access to a variety of free educational materials, such as e-books, tutorials, articles, and videos. These resources cover various topics related to trading, including market analysis, trading strategies, risk management, and technical analysis. Clients can leverage these materials to expand their knowledge and improve their trading abilities.

2. Daily Market Analysis: Ixxen offers daily market analysis, providing clients with valuable insights into current market trends, news, and potential trading opportunities. This analysis helps clients stay informed about market developments and make well-informed trading decisions.

3. Economic Calendar: The economic calendar provided by Ixxen keeps traders updated on upcoming economic events, such as key economic indicators, central bank announcements, and geopolitical events. This calendar helps traders anticipate market movements and adjust their trading strategies accordingly.

By offering these educational resources, Ixxen aims to support clients in developing their trading skills, understanding market dynamics, and making informed trading decisions. Traders can access these resources at their convenience, empowering them to continuously learn and improve their trading strategies.

Conclusion

In conclusion, it is important to note that while Ixxen offers attractive trading conditions and a range of services, it currently operates without major regulatory licenses. The lack of regulation raises concerns about the safety and reliability of trading with the company. Traders should exercise caution and carefully consider the potential risks involved when choosing to trade with an unregulated broker.

While Ixxen provides access to international markets, a variety of trading instruments, and comprehensive customer support, the absence of regulatory oversight means that traders may not have the same level of protection and safeguards as they would with regulated brokers.

Therefore, it is crucial for traders to conduct thorough research, evaluate the risks involved, and consider their individual circumstances and risk tolerance before deciding to trade with Ixxen or any unregulated broker. It is always recommended to choose brokers that are properly regulated by reputable authorities to ensure the highest level of safety and security for trading activities.

FAQs

Q: Is Ixxen a regulated trading company?

A: No, Ixxen currently operates without major regulatory licenses.

Q: What trading instruments are available with Ixxen?

A: Ixxen offers a wide range of tradable instruments, including currencies, shares, metals, indices, commodities, and digital currencies.

Q: What are the account types offered by Ixxen?

A: Ixxen provides various account types to cater to different trading needs, including Beginner, Standard, Intermediate, Advanced, Integral, and VIP accounts.

Q: What is the minimum deposit required to start trading with Ixxen?

A: The minimum deposit required to open an account with Ixxen is $2,500 USD.

Q: What are the available deposit and withdrawal methods?

A: Ixxen offers multiple deposit methods, including credit/debit cards, online wallets, and bank transfers. Withdrawals can be made using the same methods.

Q: Does Ixxen provide educational resources for traders?

A: Yes, Ixxen offers free educational materials, daily market analysis, and an economic calendar to support traders in their learning and decision-making processes.

Brokers de WikiFX

últimas noticias

Revisión de la FCA destaca la necesidad de fortalecer defensas contra el lavado de dinero.

El comportamiento del dólar y las perspectivas económicas para América Latina en 2025

La CNMV alerta de 18 entidades no registradas.

¿Cuál broker es el mejor para principiantes en México?

Cálculo de tasa de cambio