Alpha Markets

Extracto:Alpha Markets is a global financial platform that offers Contract for Difference (CFD) trading, covering multiple asset classes such as foreign exchange, indices, precious metals, and energy. It is suitable for both novice and experienced traders.

| Alpha Markets Review Summary | |

| Registered On | 2022-06-07 |

| Registered Country/Region | Cyprus |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Metals, and Energies |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | / |

| Min Deposit | $5 |

| Customer Support | Phone: +27 81 482 6736 |

| WhatsApp, Facebook, Instagram, TikTok | |

| 5th Street, Sandton, South Africa | |

Alpha Markets Information

Alpha Markets is a global financial platform that offers Contract for Difference (CFD) trading, covering multiple asset classes such as foreign exchange, indices, precious metals, and energy. It is suitable for both novice and experienced traders.

Pros and Cons

| Pros | Cons |

| Spreads as low as 0.0 pips | Unregulated |

| Multiple trading instruments | Non-transparent leverage |

| Diverse payment methods | No 24/7 customer support |

| Educational resources | No clear bonus policy |

Is Alpha Markets Legit?

Alpha Markets is unregulated. It is recommended to prioritize brokers that indicate regulatory authorities and license numbers to enhance fund security.

What Can I Trade on Alpha Markets?

Alpha Markets offers various trading instruments, including forex, indices, metals, and energies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Cryptocurrencies | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Alpha Markets Fees

The minimum spread for forex is 0.0 pips. For more information about other fees, please contact customer service for consultation.

Deposit and Withdrawal

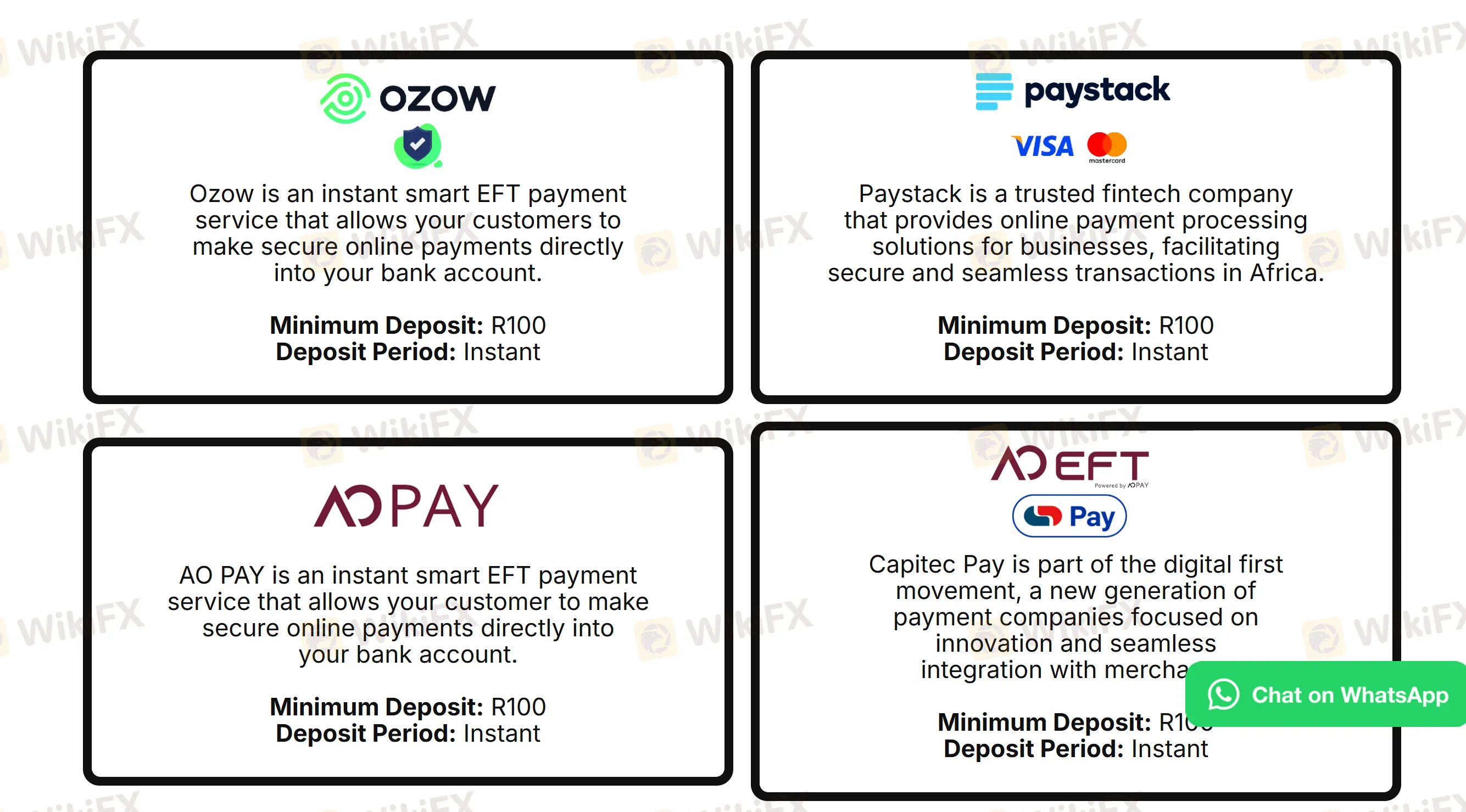

The minimum deposit is 100 South African Rand (R100). Payment methods of Alpha Markets include instant electronic payments (Ozow, OPAY, Capitec Pay), credit cards (VISA/Mastercard), and Paystack (for the African region).

Brokers de WikiFX

últimas noticias

¿Equiti es una estafa o un broker seguro? Análisis de regulación, opiniones y reportes

¡Las tareas del Points Mall ya se han actualizado!

¿Qué pasa con el dólar hoy y cómo afecta a la economía latinoamericana?

Voces del Jurado del Premio Golden Insight | Greg Matwejev, Director de Estrategia de Mercado de BCR

Cálculo de tasa de cambio