U Trade Markets

Extracto:U Trade Markets is a global brokerage firm based in Mauritius. It provides traders with access to market instruments including Forex, Stocks, Commodities, Indices. However, it is important to note U Trade Markets is currently not regulated by any recognized financial authorities which raises concerns when trading.

| U Trade Markets Review Summary in 10 Points | |

| Founded | 2023 |

| Registered Country/Region | Mauritius |

| Regulation | Not regulated |

| Market Instruments | Forex, Stocks, Commodities, Indices |

| Demo Account | Not Available |

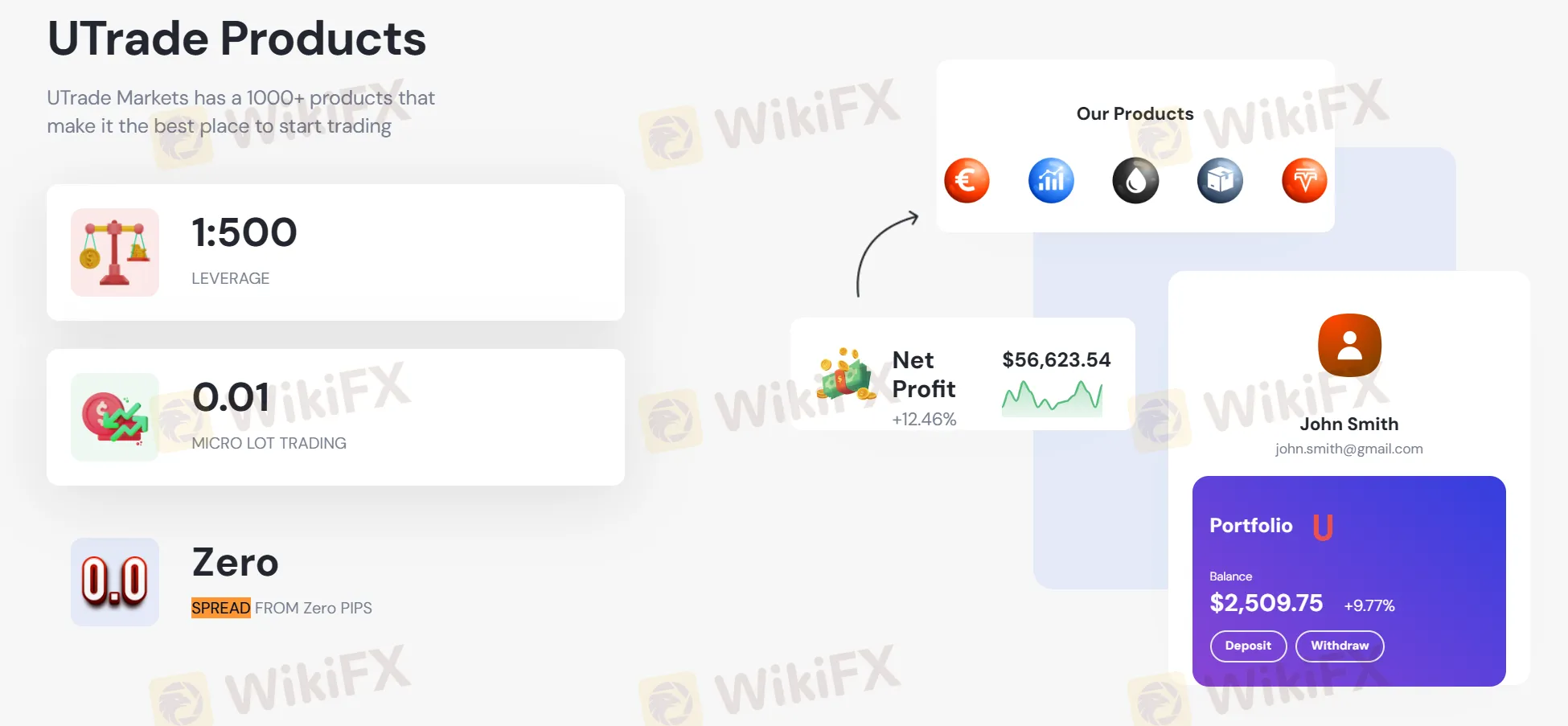

| Leverage | Up to 1:500 |

| EURUSD Spread | Start from 1.5 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | 1,000 USD |

| Customer Support | Phone, Address, Email, Social media, Enquiry form |

What is U Trade Markets?

U Trade Markets is a global brokerage firm based in Mauritius. It provides traders with access to market instruments including Forex, Stocks, Commodities, Indices. However, it is important to note U Trade Markets is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the forthcoming article, we will conduct a comprehensive analysis of this broker's traits, examining them from multiple perspectives, and presenting you with clear and well-structured information. If this topic intrigues you, we invite you to continue reading. Towards the end of the article, we will also provide a concise summary to offer you a quick overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| • MT5 trading platform | • Not regulated |

| • Multiple customer support channels | • High minimum deposit |

| • Zero commissions | • Not accept clients from some countries |

| • Flexible leverage ratios | |

| • No deposit/withdrawal fees |

U Trade Markets Alternative Brokers

There are many alternative brokers to U Trade Markets depending on the specific needs and preferences of the trader. Some popular options include:

Markets.com - Markets.com is a reputable online trading platform known for its user-friendly interface and a wide range of trading instruments, making it suitable for both novice and experienced traders.

NAGA - NAGA is a unique social trading platform that combines trading with a social network, allowing traders to follow and copy the strategies of experienced investors.

Rakuten Securities - Rakuten Securities is a well-established brokerage with a global presence, offering a comprehensive suite of trading services and a strong focus on customer satisfaction.

Is U Trade Markets Safe or Scam?

When considering the safety of a brokerage like U Trade Markets or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Its been verified that the broker is currently not regulated by any recognized financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the company. Look for reviews on reputable websites and forums.

Security measures: U Trade Markets bolsters security by implementing a comprehensive privacy policy, elucidating the meticulous handling and protection of users' personal data.

Ultimately, the choice of whether to engage in trading with U Trade Markets rests on your personal discretion. It is essential to conscientiously assess the associated risks and potential benefits before arriving at a decision.

Market Instruments

U Trade Markets offers a diverse range of market instruments to cater to the preferences of traders:

Forex (Foreign Exchange): This market allows traders to engage in currency pairs trading. Forex offers a high level of liquidity and is open 24/5, making it attractive to those who seek opportunities in currency fluctuations. Popular pairs include EUR/USD, GBP/USD, and USD/JPY.

Stocks: U Trade Markets provides access to a wide selection of individual stocks from various global stock exchanges. Traders can invest in shares of well-known companies, enabling them to participate in the equity markets and potentially benefit from stock price appreciation and dividends.

Commodities: Commodity trading involves the buying and selling of raw materials and resources such as precious metals, gold, oil, and agricultural products. These assets are popular for portfolio diversification and hedging against inflation or economic uncertainties.

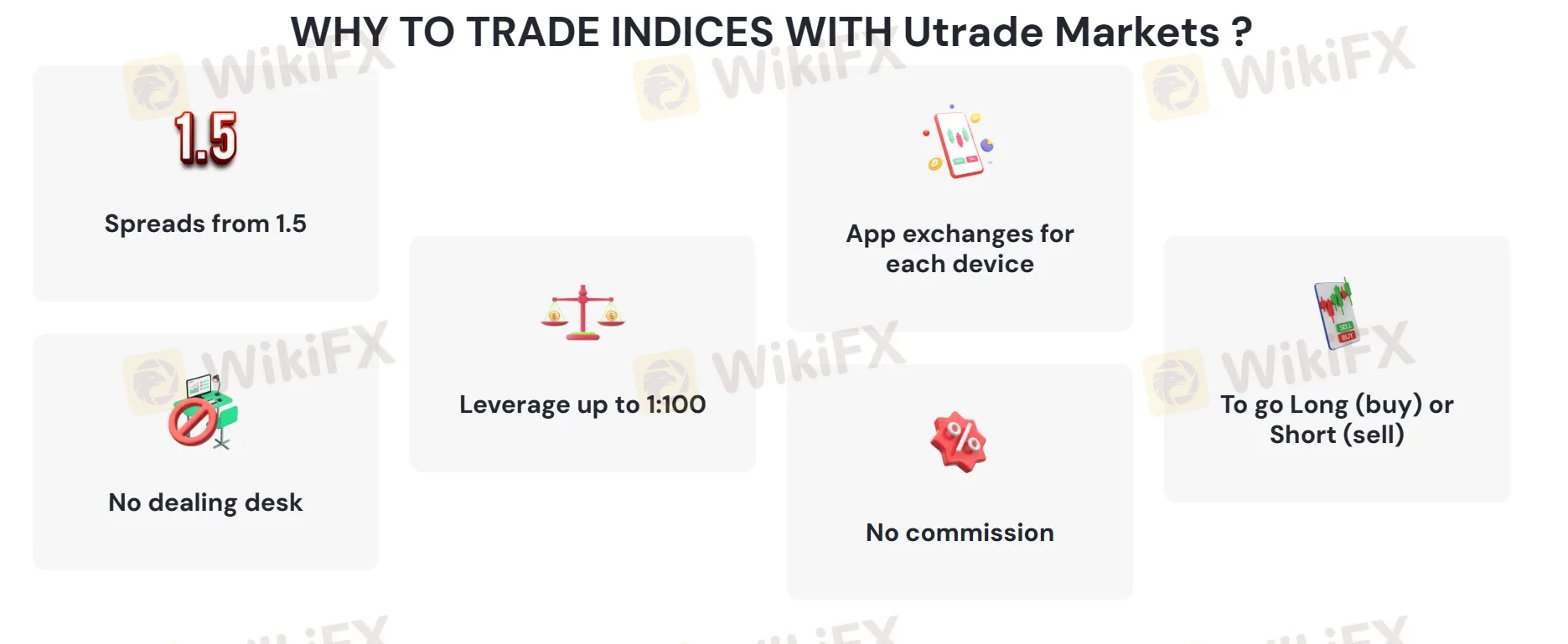

Indices: Trading indices involves speculating on the performance of stock market indices like the S&P 500, NASDAQ, or FTSE 100. Indices represent a basket of stocks, providing a convenient way to gain exposure to broader market trends rather than individual stocks.

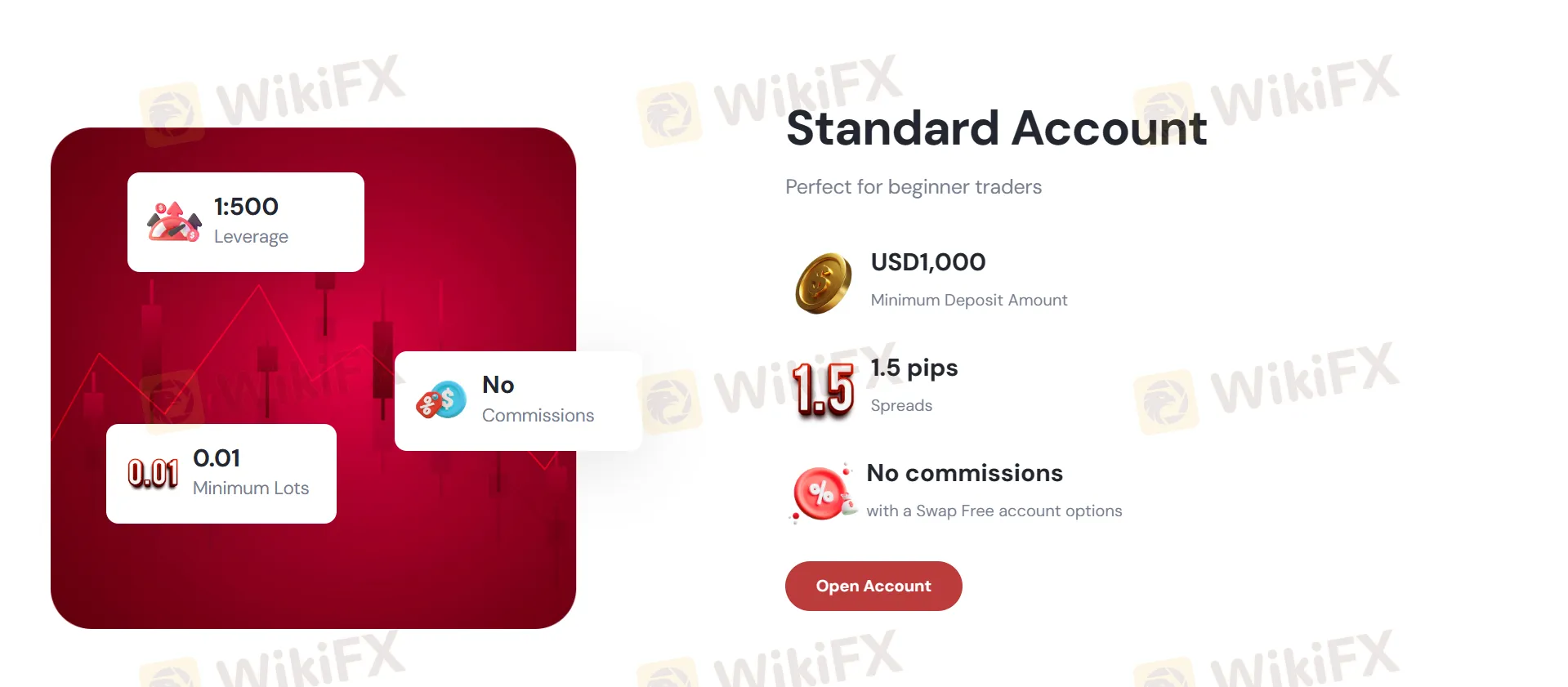

Accounts

U Trade Markets offers a Standard Account with a minimum deposit requirement of USD 1000. This account type provides traders with access to the broker's suite of trading instruments.

The minimum deposit, while not the lowest in the industry, allows traders to begin their trading journey with a moderate investment. It's suitable for individuals looking to explore various financial markets, including Forex, stocks, commodities, and indices, within a balanced trading environment.

Leverage

U Trade Markets offers a range of leverage options to accommodate traders with varying risk appetites.

Forex trading with leverage of up to 1:500, while potentially lucrative, demands a cautious approach due to heightened volatility and amplified risks.

Stocks with leverage up to 1:10 provide a more conservative stance, reducing exposure to significant price swings.

For commodities, leverage up to 1:200 offers flexibility but requires careful monitoring, especially given the inherent volatility of commodity markets.

Indices, with leverage up to 1:100, allow traders to tap into broader market movements but necessitate prudent risk management.

Regardless of the chosen asset class, traders should approach leverage with caution, employ effective risk management strategies, and thoroughly understand the potential impact on their trading positions and overall portfolio.

Spreads & Commissions

At U Trade Markets, traders can benefit from spreads starting at 1.5 pips without incurring any additional commissions. This pricing structure can be particularly attractive for traders looking to minimize their trading costs while participating in various financial markets, including Forex, stocks, commodities, and indices.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| U Trade Markets | From 1.5 pips | No commissions |

| Markets.com | Not disclosed | Not disclosed |

| NAGA | From 0.7 pips | Variable (depending on product) |

| Rakuten Securities | From 0.5 pips | No commissions |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Trading Platforms

U Trade Markets provides traders with access to the popular MetaTrader 5 (MT5) platform, which is available on multiple operating systems, including Microsoft for desktop users, iOS for Apple device enthusiasts, and Android for those using mobile devices. This extensive compatibility ensures that traders can engage in their preferred trading activities seamlessly, whether they are at their computer or on the go. The MT5 platform is known for its advanced charting tools, technical indicators, and expert advisors, making it a valuable tool for traders seeking a robust and versatile trading experience across different devices and operating systems.

Overall, U Trade Markets trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| U Trade Markets | MT5 |

| Markets.com | MT4/5, proprietary platform |

| NAGA | NAGA Trader Mobile, NAGA Trader for Web ,MT4/5 |

| Rakuten Securities | MT4 |

Deposits & Withdrawals

U Trade Markets facilitates deposit and withdrawal options including popular methods such as Mastercard, Visa card, and wire transfer. One notable advantage is that the broker does not impose any deposit or withdrawal fees, ensuring that traders can efficiently manage their funds without worrying about unnecessary charges.

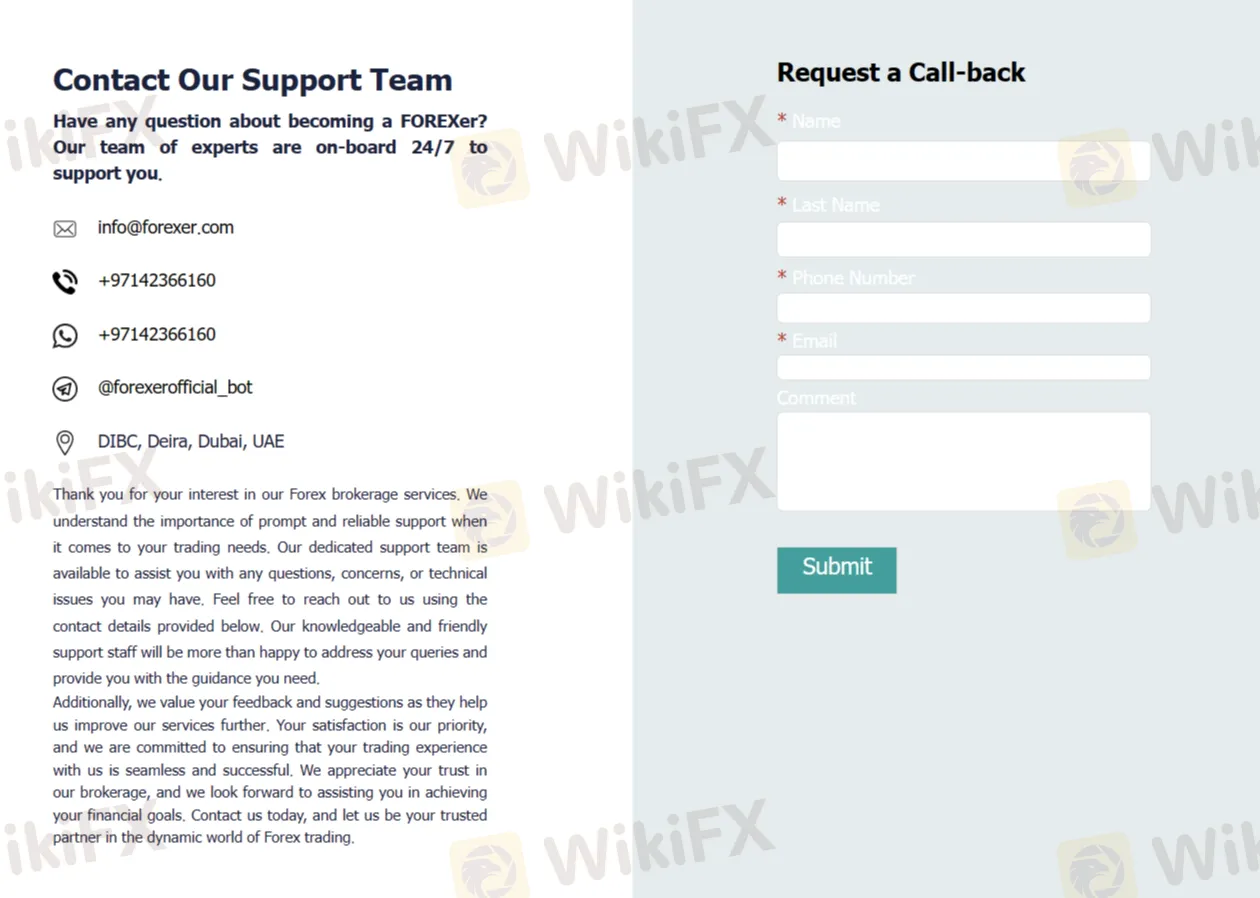

Customer Service

U Trade Markets provides multiple customer service options to assist its clients. Customers can reach out to U Trade Markets through various channels to address their queries and concerns as below:

Phone: +230 214 6826.

Email:info@utrademarkets.com.

Address: Suite 803, 8th floor, Hennessy tower, Pope Hennessy Street, port louis, 11328, Mauritius.

Moreover, traders can submit inquiries via a convenient enquiry form, or engage with the broker through social media platforms such as Instagram, Facebook, Twitter, Linkedin.

Conclusion

According to available information, U Trade Markets is a non-regulated Mauritius-based brokerage firm who offers a range of market instruments such as Forex, Stocks, Commodities, Indices as market instruments to traders, it is important to consider certain factors such as non-regulated status that might raise concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from U Trade Markets before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is U Trade Markets regulated? |

| A 1: | No, it‘s been verified the broker is currently under no valid regulations. |

| Q 2: | Does U Trade Markets offer the industry leading MT4 & MT5? |

| A 2: | Yes, it offers MT5 platform on windows, Android and iOS devices. |

| Q 3: | Is U Trade Markets a good broker for beginners? |

| A3: | No. it’s not a good broker for beginners because its not properly regulated. |

| Q 4: | Does U Trade Markets offer demo accounts? |

| A 4: | No. |

| Q 5: | What is the minimum deposit for U TRADE MARKETS? |

| A 5: | The minimum initial deposit is 1,000 USD. |

| Q 6: | At U TRADE MARKETS, are there any regional restrictions for traders? |

| A 6: | Yes. UTrade Markets does not provide services to residents of the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Libya, Cuba, Myanmar, Yemen, Afghanistan, Vanuatu and EEA countries. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Brokers de WikiFX

últimas noticias

La CNMV advierte un clon de Monex Europe y de 6 entidades no registradas

【Entrevistas a expertos globales de WikiEXPO】Ghadeer Ibrahim: Perspectiva de los medios responsables

Piscina de Deseos de Año Nuevo ¡Publica tus deseos para recibir la buena fortuna del 2026!

La CNMV alerta de 3 entidades no registradas

¿Cómo se moverán las monedas latinoamericanas en el mercado Forex en 2026?

¿SWALLFX es un bróker seguro y confiable en 2025?

¿OpenTrading es un bróker confiable? Análisis completo de su seguridad en 2025

BBVA impulsa el mercado Forex en LATAM con su integración a SGX FX

¿Libertex es una estafa? Denuncia de una clienta que alerta sobre posible fraude.

¿OneRoyal es estafa o realmente un broker confiable en 2025?

Cálculo de tasa de cambio