BT Markets

Extracto:BT Markets, owned by Botanica Glow(Pty)Ltd. It is a South African-registered brokerage established in 2019. It offers 500 trading instruments for traders and offers 4 account types with the MT5 trading platform. At present, the brokerage is in an abnormal state of supervision and has been characterized as exceeded, with insufficient security.

| BT MarketsReview Summary | |

| Founded | 2019 |

| Registered Country/Region | South Africa |

| Regulation | Exceeded |

| Market Instruments | ForexCommoditiesIndicesShares |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 1.5 pips |

| Trading Platform | MT5MetaTrader 5 web platformMeta rader 5 Mopie patform |

| Min Deposit | $100 |

| Customer Support | Phone: +66983334235 |

| Email: support@btmarkets.com | |

| 24/7 Online Chat | |

| Physical Address: W633 Umlazi Durban Kwa-Zulu Natal South Africa 4031Regus Business Centre, 2nd Floor, West Tower, Nelson Mandela Square, Maude Street, Sandton 2196Rm 11/12 8th Flr. Building B The Cube Ramkamhaeng 89/2 Alley Khwaeng Hua Mak, Bangkok, Thailand 10240 | |

BT Markets Information

BT Markets, owned by Botanica Glow(Pty)Ltd. It is a South African-registered brokerage established in 2019. It offers 500 trading instruments for traders and offers 4 account types with the MT5 trading platform. At present, the brokerage is in an abnormal state of supervision and has been characterized as exceeded, with insufficient security.

Pros and Cons

| Pros | Cons |

| Spreads starting at 0.0 | Exceeded regulatory state |

| 500 instruments | |

| Supporting MT5 | |

| 4 account types | |

| 11 deposit methods and 7 withdrawal methods |

Is BT Markets Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| FSCA | Botanica Glow (Pty) Ltd | Financial Service Corporate | 52243 | Exceeded |

What Can I Trade on BT Markets?

BT Markets says it offers 500 trading instruments. It allows you to trade CFDs on the world's leading indices such as the S&P 500, FTSE and Dow Jones. Commodities such as oil and precious metals; Easy CFDs for the world's largest brands such as Amazon, Meta Platforms, Inc., Apple, Microsoft and Alphabet. In addition, it offers more than 50 major, minor and foreign currency pairs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

BT Markets has four account types: STANDARD Account, ECN Account, PRO Account and ISLAMIC Account.

They differ in the minimum deposit requirements ranging from $100 to $5,000; commission from $0 to $10.

BT Markets Fees

The four account types have different starting spreads ranging from 0.1 to 1.5; Commission from $0 to $10.

There are no fees for credit card deposits or withdrawals, and BTMarkets charges a flat fee of $10 for bank wire withdrawals of $100 or less;

An overnight position will incur a swap or overnight fee waiver;

If the trading account is inactive for more than 90 days, a $30 monthly fee is deducted from the balance.

Trading Platform

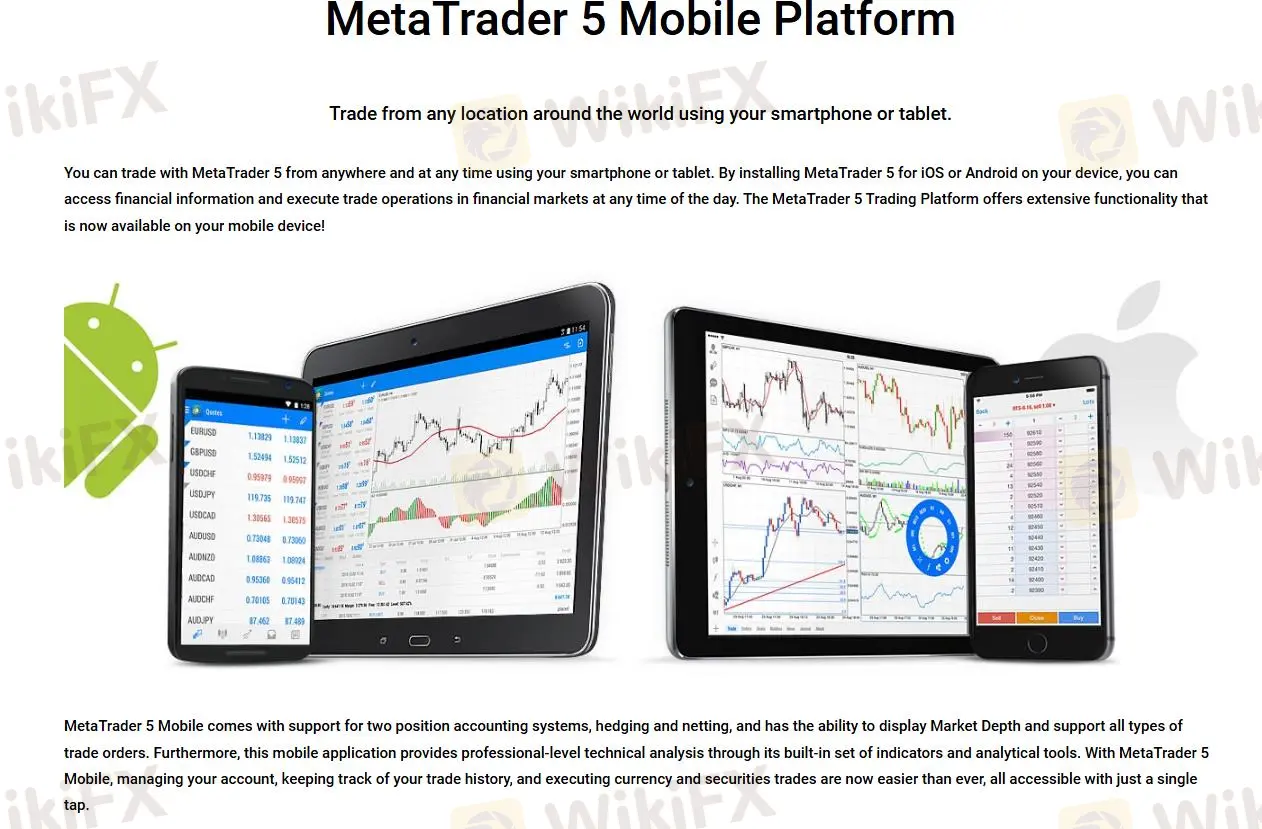

The main trading platform offered by BT Markets is MT5, which is available on desktop, web and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile | Skilled trader |

| MetaTrader 5 web platform | ✔ | Web | Skilled trader |

| Meta rader 5 Mopie patform | ✔ | Mobile | Skilled trader |

| MT4 | ❌ |

Deposit and Withdrawal

BTMarkets supports 11 deposit methods and 7 withdrawal methods. Fees are borne by BTMarkets.

Brokers de WikiFX

últimas noticias

Axi Trader obtiene $1M de financiación con Axi Select

eToro agrega acciones de ADX para ampliar las oportunidades de inversión.

¿Pocket Option es una estafa? Un cliente denuncia problemas con pagos en Venezuela.

Análisis del dólar y su impacto en la economía Latinoamericana.

Cálculo de tasa de cambio