JAFCO Asia

Extracto:JAFCO Asia, established in 1990 and headquartered in the United States, operates without specific regulations. It offers a diverse range of tradable assets including cryptocurrencies, forex, gold, and indices, with a minimum deposit requirement of $100. The broker provides leverage up to 1:1000 and features tight spreads for cryptocurrencies, minimum spreads varying for forex, an average spread of 0.30 for gold, and minimum spreads for indices. Commission details are not specified. Deposit methods include crypto wallets and bank cards, and trading is accessible across multiple platforms including PC, Android, iPad, iPhone, or web browser. Customer support is available via email at support@jafcoinvestment.com, with a physical office located at 405 Lexington Ave, New York, NY 10174, United States.

| JAFCO Asia | Basic Information |

| Company Name | JAFCO Asia |

| Founded | 1990 |

| Headquarters | United States |

| Regulations | Not regulated |

| Tradable Assets | Cryptocurrencies, Forex, Gold, Indices |

| Account Types | Not specific |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:1000 |

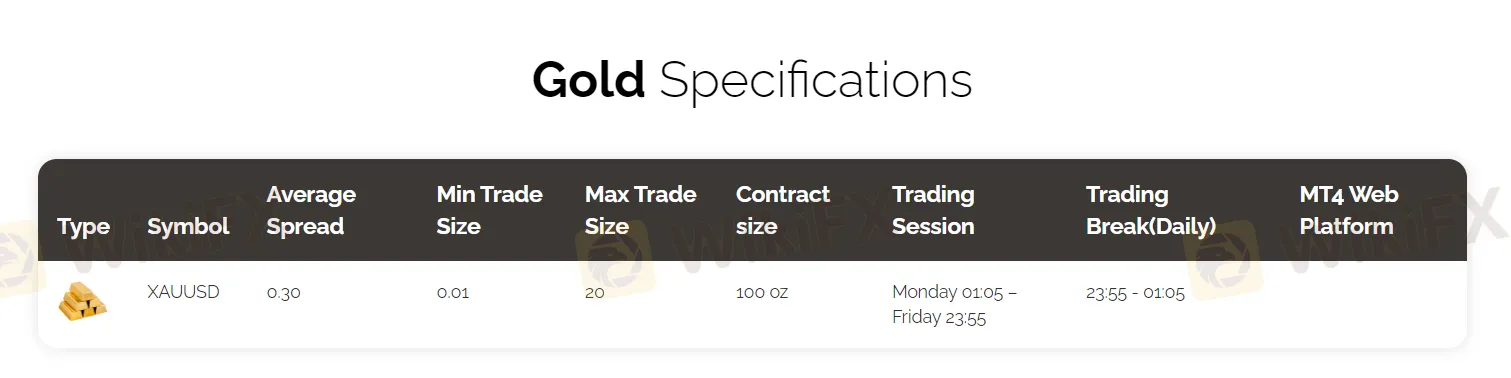

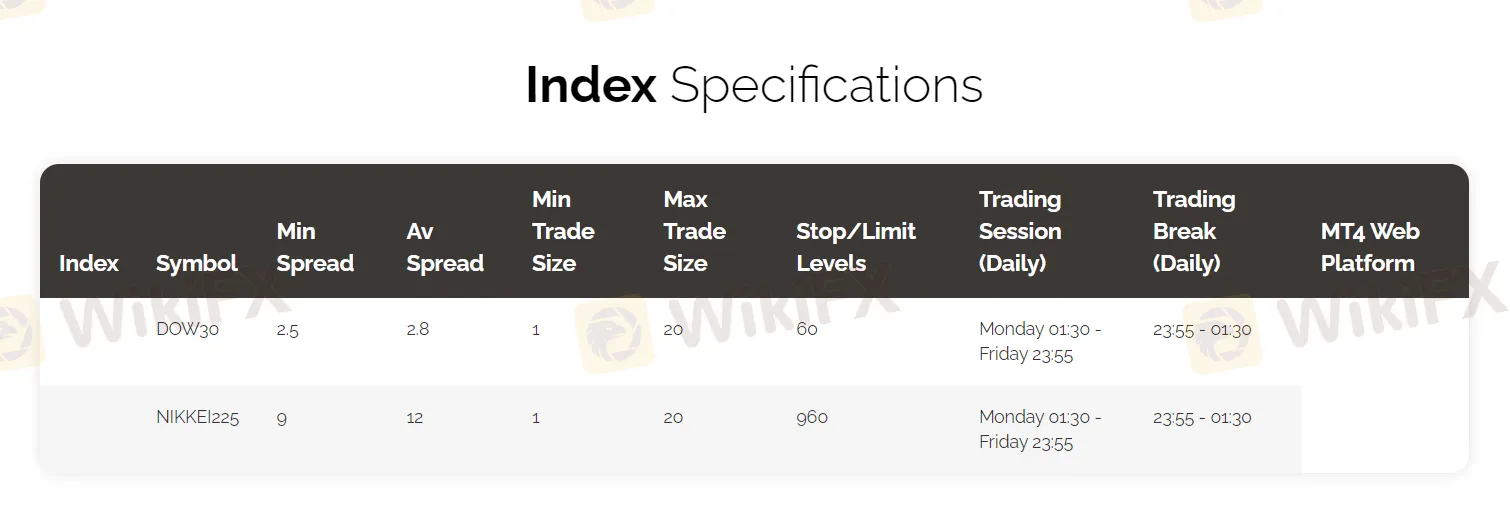

| Spreads | Cryptocurrency: Tight spreads, Forex: Minimum spreads ranging from 14 to 25 points, Gold: Average spread of 0.30, Indices: Minimum spreads of 2.5 to 9 |

| Commission | Not specific |

| Deposit Methods | Crypto wallets and Bank cards |

| Trading Platforms | PC, Android, iPad, iPhone, or web browser |

| Customer Support | Email: support@jafcoinvestment.com |

| Education Resources | Not specific |

| Bonus Offerings | None |

Overview of JAFCO Asia

JAFCO Asia, founded in 1990 and headquartered in the United States, operates as an unregulated broker offering a variety of tradable assets including cryptocurrencies, forex, gold, and indices. With a minimum deposit requirement of $100 and leverage up to 1:1000, it provides accessible trading opportunities to its clients. The broker features tight spreads for cryptocurrencies and varying spreads for forex, gold, and indices. Deposit methods include crypto wallets and bank cards, while trading is facilitated across multiple platforms including PC, Android, iPad, iPhone, or web browser. Customer support is available via email and a physical office in New York. However, educational resources and bonus offerings are not explicitly detailed.

Is JAFCO Asia Legit?

JAFCO Asia operates without regulation. This signifies that the broker lacks valid oversight from recognized financial regulatory bodies. Traders should proceed with caution and acknowledge the inherent risks when contemplating transactions with an unregulated broker such as JAFCO Asia. Potential concerns include limited channels for dispute resolution, uncertainties surrounding fund security, and opacity in the broker's operational procedures.

Pros and Cons

JAFCO Asia offers multiple deposit methods, accessible trading platforms, and high leverage options, enhancing user experience. However, its lack of regulation, varying spreads, and unclear commission structure raise concerns about transparency and reliability.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

JAFCO Asia offers trading instruments across CFDs, cryptocurrencies, forex, gold, and indices.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| JAFCO Asia | Yes | Yes | Yes | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

Leverage

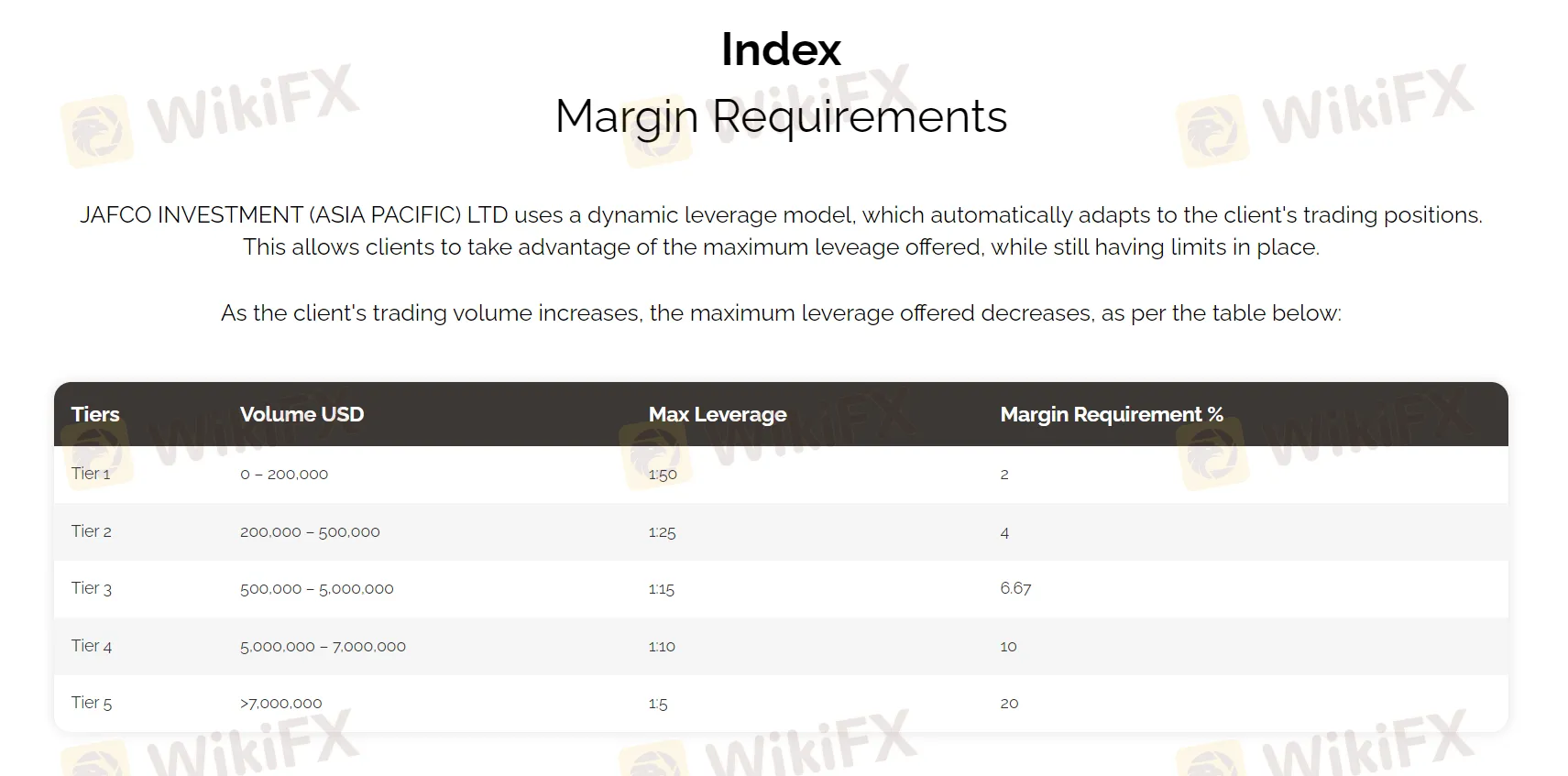

JAFCO Asia offers varying leverage levels depending on the trading instruments. The leverage is up to 1:1000 for Cryptocurrencies and Forex, 1:100 for Gold, 1:50 for Indices.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | JAFCO Asia | Libertex | XM | RoboForex |

| Maximum Leverage | 1:1000 | 1:30 | 1:888 | 1:2000 |

Spreads and Commissions

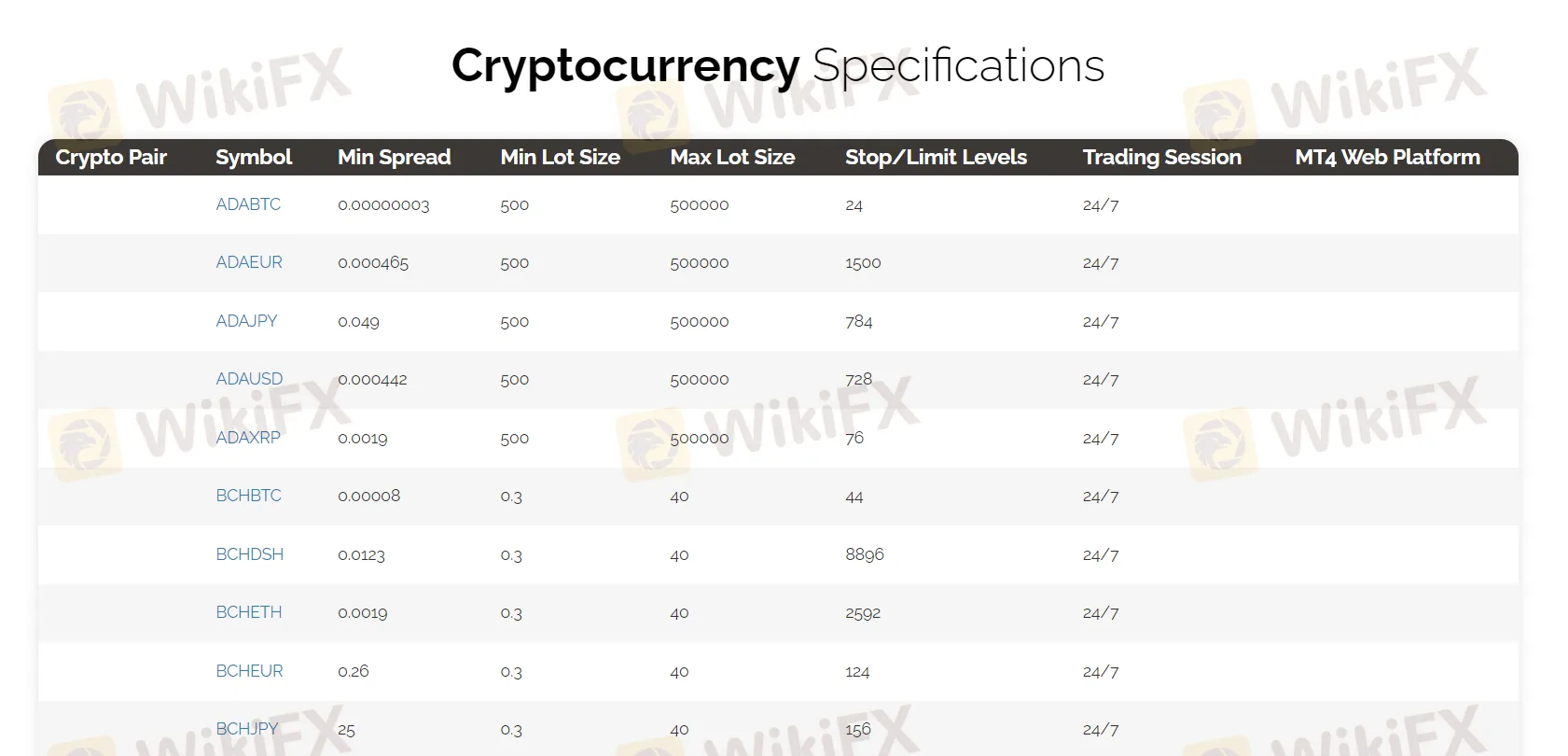

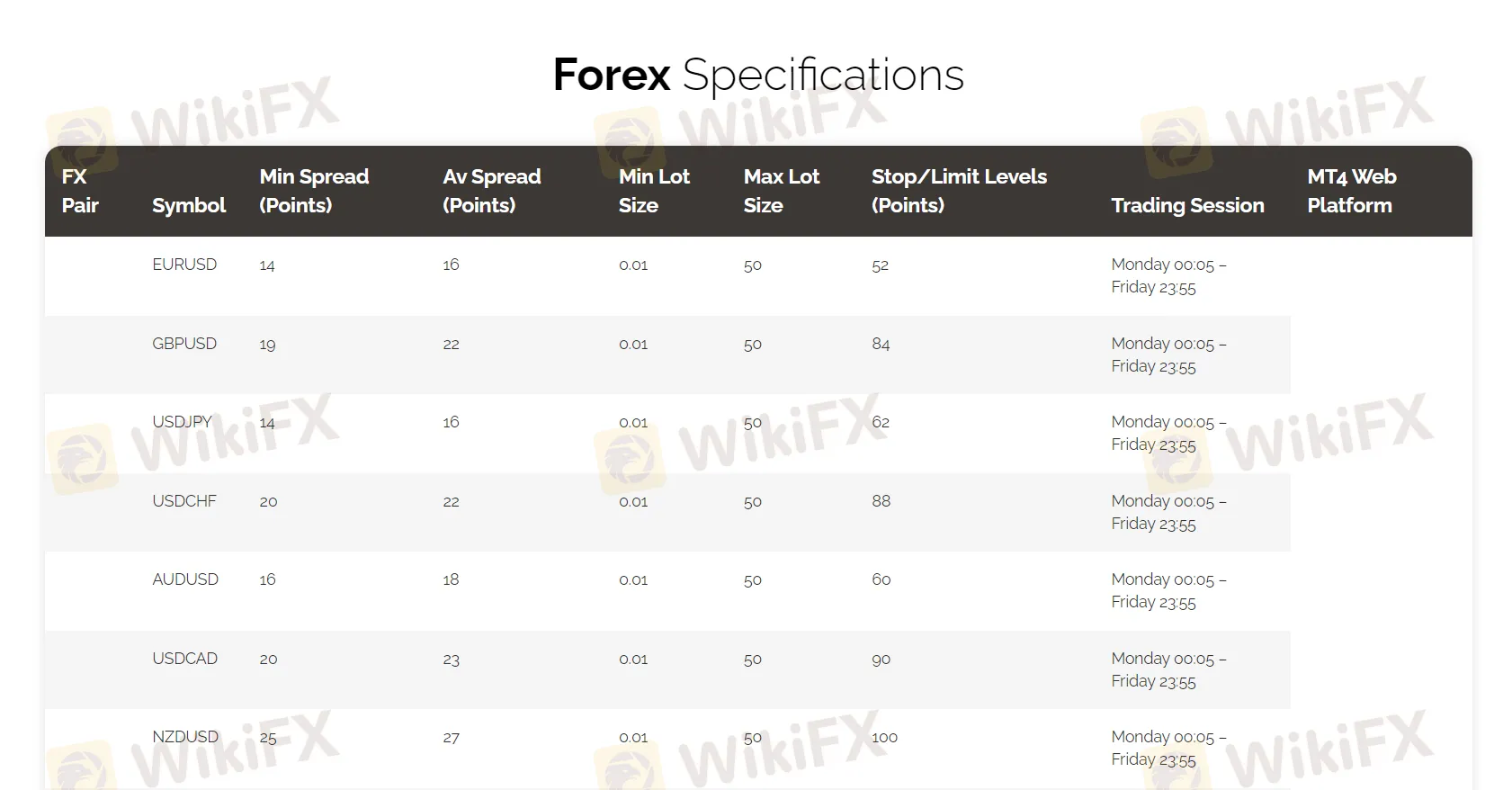

JAFCO Asia offers tight spreads close to 0 for cryptocurrencies, minimum spreads ranging from 14 to 39 points for forex, an average spread of 0.30 for gold, and minimum spreads of 2.5 to 9 for indices.

Deposit & Withdraw Methods

JAFCO Asia facilitates fast withdrawals and decent payouts to both cryptocurrency wallets and bank cards.

Trading Platforms

JAFCO Asia provides trading platforms accessible on various devices, including PC, Android, iPad, iPhone, and web browsers.

Customer Support

Customer support for JAFCO Asia is available via email at support@jafcoinvestment.com. Their physical office is located at 405 Lexington Ave, New York, NY 10174, United States.

Conclusion

In conclusion, JAFCO Asia presents a range of advantages including multiple deposit methods, accessible trading platforms, and high leverage options, catering to diverse trading needs and preferences. However, the absence of regulation, coupled with varying spreads and an unclear commission structure, poses notable disadvantages, potentially undermining trader confidence and transparency. While the platform offers accessibility and leverage benefits, its shortcomings in regulatory oversight and fee clarity warrant cautious consideration for traders seeking a balanced and secure trading environment.

FAQs

Q: What regulatory oversight does JAFCO Asia have in place?

A: JAFCO Asia operates without regulatory oversight, making it crucial for traders to be aware of the absence of recognized financial regulatory authorities.

Q: What trading instruments are available on JAFCO Asia?

A: JAFCO Asia offers a diverse range of trading instruments, including CFDs, cryptocurrencies, forex, gold, and indices.

Q: What is the minimum deposit required to start trading on JAFCO Asia?

A: The minimum deposit required to initiate trading on JAFCO Asia is $100, providing accessibility to a range of traders with different capital levels.

Q: How does JAFCO Asia handle deposit methods?

A: JAFCO Asia facilitates multiple deposit methods, including crypto wallets and bank cards, offering flexibility for traders to fund their accounts.

Q: What leverage options are available on JAFCO Asia?

A: JAFCO Asia provides leverage options up to 1:1000 for cryptocurrencies and forex, offering traders the potential to amplify their positions.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Brokers de WikiFX

últimas noticias

¿IQ Option es una estafa con los retiros de dinero?

¿OANDA es un broker confiable o una estafa? Análisis completo 2025.

Cálculo de tasa de cambio