Vergomarkets

Extracto:Vergomarkets is an online CFD trading platform that offers a variety of assets and markets to trade. They emphasize security with 256-bit AES encryption and a user-friendly platform designed for easy access. Vergomarkets highlights its competitive spreads, fast execution, and advanced trading tools for risk management.

| Vergomarkets Review Summary in 8 Points | |

| Registered Country/Region | United Kingdom |

| Regulation | Not regulated |

| Market Instruments | Forex, cryptocurrencies, indices, commodities, and stocks |

| Demo AccounUnt | Unavailable |

| Max. Leverage | 1:200 |

| Trading Platforms | Web-based Vergomarkets platform |

| Minimum Deposit | $250 |

| Customer Support | Address: 15 Cabot Square, London E14 4QT, United Kingdom |

| Phone: Support - +442038666796; Trading - +442038666799 | |

What is Vergomarkets?

Vergomarkets is an online CFD trading platform that offers a variety of assets and markets to trade. They emphasize security with 256-bit AES encryption and a user-friendly platform designed for easy access. Vergomarkets highlights its competitive spreads, fast execution, and advanced trading tools for risk management.

Pros & Cons

| Pros | Cons |

| Advanced Technology | Not regulated |

| Safety | |

| Diversification |

Pros:

Advanced Technology: Enabling traders to access the platform from any device, anywhere in the world, at any time. Whether using a computer, tablet, or smartphone, traders have the flexibility to engage in trading activities according to their preferences.

Safety: The platform prioritizes safety with top-notch security measures, including two-factor authentication, monitoring features, and encryption, ensuring a secure trading environment at all times.

Diversification: Vergomarkets offers diversification opportunities, allowing traders to expand their portfolios by trading in various asset classes such as commodities, forex, crypto, and stocks.

Cons:

Not regulated: One notable drawback of Vergomarkets is its lack of regulation. Despite the platform's technological advancements and security measures, the absence of regulation may raise concerns for some traders regarding the oversight and protection of their investments.

Is Vergomarkets Legit?

Vergomarkets is an online CFD trading platform that currently has no valid regulation. They claim to be in the process of obtaining a license but do not currently have one. Regulation is important to ensure the safety of investors. Ultimately, the decision of whether or not to trade with Vergomarkets is up to users, but users should be aware of the risks involved in trading with an unregulated platform.

Market Instruments

Vergomarkets offers more than just forex trading. They provide access to a diverse range of instruments including indices, commodities, and stocks. This allows traders to build a well-rounded portfolio tailored to their individual needs and risk tolerance. Recognizing the growing interest in cryptocurrency, Vergomarkets also facilitates investments in this burgeoning market. They even go the extra mile by offering educational resources to help investors understand complex cryptocurrency concepts, empowering them to make informed investment decisions.

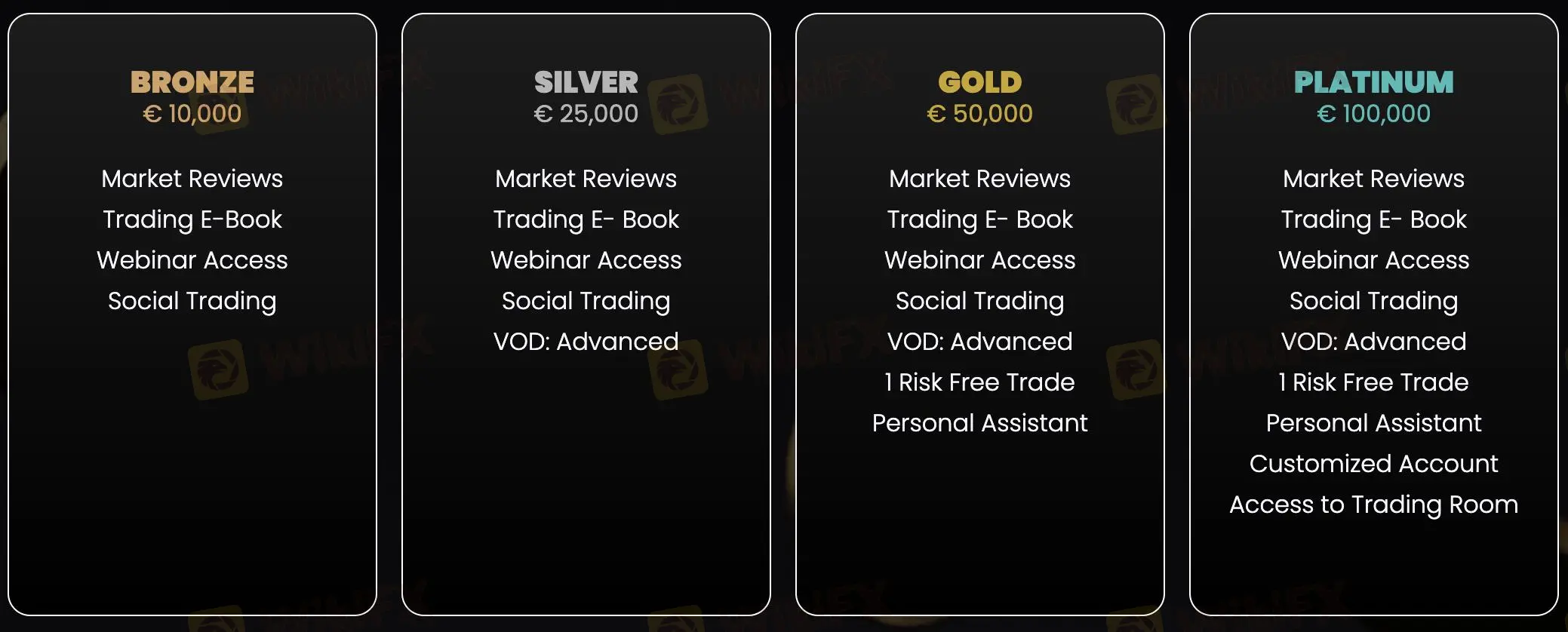

Account Types

Vergomarkets provides a diverse range of trading account options tailored to meet the needs and investment capacities of various traders.

The account tiers begin with the Bronze Account, which has a minimum deposit requirement of €10,000, making it accessible for those new to trading or with limited capital. As traders increase their investment and seek more advanced features and benefits, they can opt for higher-tier accounts such as the Silver and Gold Accounts, requiring minimum deposits of €25,000 and €50,000 respectively.

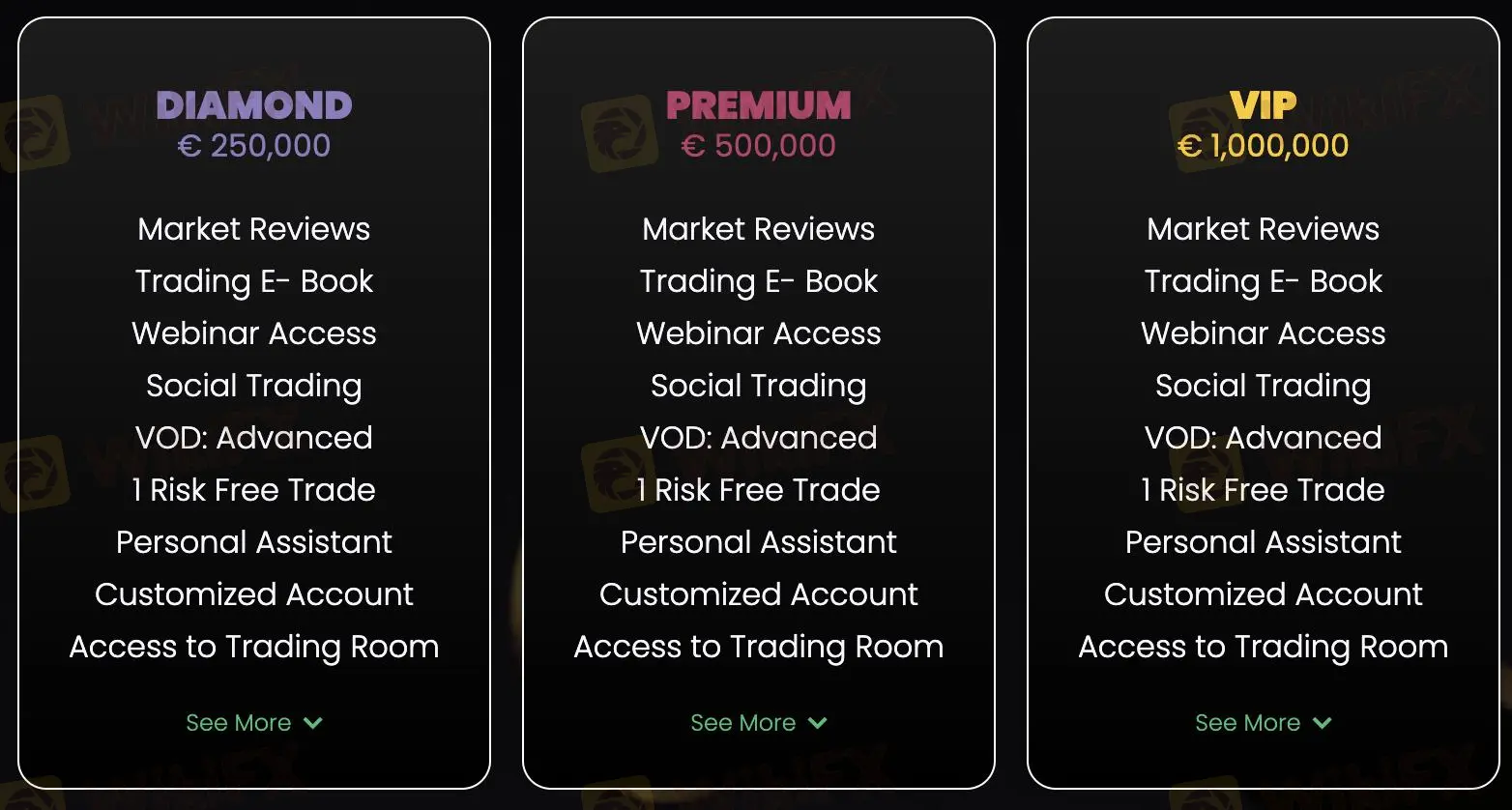

For more seasoned traders or institutional clients, Vergomarkets offers Platinum and Diamond Accounts with minimum deposits of €100,000 and €250,000, offering enhanced trading conditions and exclusive services. The most premium tiers, the Premium and VIP Accounts, demand minimum deposits of €500,000 and €1,000,000 respectively, catering to high-net-worth individuals who require a highly personalized trading experience with top-tier resources and support.

But if you choose a basic or simple account, you can start with a smaller deposit of as little as $250.

Leverage

In addition to offering a variety of investment options, Vergomarkets allows traders to magnify their potential returns through leverage of up to 1:200. This means that traders can control a much larger position size than their initial investment, potentially leading to significant gains. However, it's important to remember that leverage can also amplify losses, so it should be used cautiously and with a clear understanding of the risks involved.

Spreads & Commissions

Vergomarkets prides itself on transparent pricing with no commissions charged on deposits, withdrawals, or trades. This eliminates the worry of hidden fees and ensures you only pay the spread on your investments. The spread, representing the difference between the buying and selling price, is constantly adjusted to reflect current market conditions.

Trading Platforms

Vergomarkets offers a web-based trading platform, eliminating the need for downloads or installations. This allows users to access their accounts and make trades from any device with an internet connection, including laptops, desktops, phones, and tablets. Regardless of location or time of day, Vergomarkets' platform ensures access and minimal downtime. Furthermore, the web-based platform prioritizes speed and reliability by only updating with a stable internet connection, unlike mobile apps that can display outdated information.exclamation This advantage provides traders with more accurate data and reduces the risk of delayed trades due to connectivity issues.

Deposits & Withdrawals

Vergomarkets offers a diverse range of deposit and withdrawal options to ensure efficient transactions for its users. Whether utilizing traditional methods like wire transfers, the instantaneous nature of credit or debit card transactions, or the convenience of internet fund transfers through Skrill and Neteller, users have a variety of choices to suit their preferences. Additionally, the inclusion of crypto wallet transfers enables traders to leverage their digital assets directly in their trading activities, mitigating the hassle of conversion rates and fees.

Customer Service

Vergomarkets accepts contact through website, phone and physical address.

Address: 15 Cabot Square, London E14 4QT, United Kingdom

Phone: Support - +442038666796; Trading - +442038666799

Education

Vergomarkets prides itself on delivering top-notch trading education, aiming to equip traders with essential knowledge and convenient features for a seamless trading experience. The company is committed to providing traders with access to industry experts through personalized one-on-one sessions and a variety of educational resources. These resources encompass a range of mediums, including informative videos, insightful blogs, and in-depth articles, covering various aspects of trading theory.

Conclusion

In conclusion, Vergomarkets presents itself as a comprehensive online CFD trading platform, offering a diverse range of assets and markets for traders to explore. With an emphasis on advanced technology, stringent security measures, and user-friendly features, the platform strives to provide a seamless trading experience accessible from any device, anywhere in the world.

While the absence of regulation may raise concerns for some traders, Vergomarkets compensates with competitive spreads, fast execution, and advanced trading tools for risk management. Moreover, the platform's commitment to education and customer support underscores its dedication to empowering traders with the knowledge and resources needed to navigate the financial markets effectively.

Frequently Asked Questions (FAQs)

| Question 1: | Is Vergomarkets regulated? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | At Vergomarkets, are there any regional restrictions for traders? |

| Answer 2: | No. |

| Question 3: | Does Vergomarkets offer demo accounts? |

| Answer 3: | No. |

| Question 4: | What is the minimum deposit for Vergomarkets? |

| Answer 4: | The minimum initial deposit to open an account is $250. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Brokers de WikiFX

últimas noticias

Voces del jurado Golden Insight | Nattachai Chalermwat, Jefe de Análisis de Mercados en MH Markets.

¿Qué es el Stop Loss y Cómo Funciona en el Trading? Estrategias Básicas para Principiantes

Voces del jurado del Premio Golden Insight - Simon So, Director de Experiencia de Hantec Financial

¿TradeEU Global es una estafa o un bróker confiable?

La CNMV alerta de 9 entidades no registradas

¿MarketsVox es una estafa o un broker confiable? Análisis 2025.

¿2BFX Trading es una estafa o un bróker confiable? Testimonio revela un posible fraude financiero

WikiFX celebra la Navidad con un sorteo especial de 200 USDT para su comunidad de traders.

¿Niyafa FX es una estafa o un bróker seguro? Opiniones y análisis 2025

Cálculo de tasa de cambio