TheTrustCapitals

Extracto:TheTrustCapitals operates as a brokerage firm in United Kingdom, providing clients with access to various financial instruments such as Forex, Stocks, Indices and Commodities. Notably, TheTrustCapitals lacks regulatory oversight from established financial authorities at present.

| TheTrustCapitals Review Summary | |

| Registered Country/Region | United Kingdom |

| Founded | 2020 |

| Regulation | Unregulated |

| Market Instruments | Forex, Stocks, Indices, Commodities |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platform | MT5 |

| Minimum Deposit | $500 |

| Customer Support | Phone, email, address, social media, FAQ, live chat |

What is TheTrustCapitals?

TheTrustCapitals operates as a brokerage firm in United Kingdom, providing clients with access to various financial instruments such as Forex, Stocks, Indices and Commodities. Notably, TheTrustCapitals lacks regulatory oversight from established financial authorities at present.

In the following article, we will analyse the characteristics of this company in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

| Pros | Cons |

| Attractive bonus programs | Unregulated |

| Segregated client funds | High Minimum Deposit |

| Wide range of trading instruments | |

| MetaTrader 5 platform | |

| Flexible deposit and withdrawal options |

Pros:

Bonus Programs: TheTrustCapitals offers attractive bonus programs, including a 20% Tradable Bonus and a 100% Credit Bonus, allowing traders to boost their trading capital and potentially increase their profits.

Segregated Funds: Client funds are fully segregated from the company's own funds and kept in separate bank accounts, ensuring the security and safety of clients' investments.

Multiple Trading Instruments: Traders have access to a wide range of trading instruments, including currency pairs, stocks, commodities, and indices, providing ample opportunities for diversification and trading in various markets.

MetaTrader 5 Platform: The broker provides the popular MetaTrader 5 platform, renowned for its advanced charting tools, technical analysis capabilities, and automated trading features, offering pleasant trading experience for both beginners and experienced traders.

Flexible Deposit and Withdrawal Options: TheTrustCapitals offers various deposit and withdrawal methods, including bank wires, credit/debit cards, and e-wallets, with quick processing times and no additional fees for deposits.

Cons:

Unregulated: TheTrustCapitals operates without regulatory oversight, exposing clients to increased risks as there are no regulatory authorities ensuring compliance with industry standards and protecting clients' interests.

High Minimum Deposit: The broker requires a high minimum deposit from $500, which poses a barrier to entry for some traders, limiting accessibility to their services and excluding those with smaller trading capital from participating in the markets through their platform.

Is TheTrustCapitals Legit?

When considering the safety of a brokerage like TheTrustCapitals or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: The absence of valid regulations under which the broker operates signifies potential risks, as it lacks the guarantee of comprehensive protection for traders engaging on its platform.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: At TheTrustCapitals, client funds are segregated from company funds, stored in separate bank accounts, ensuring absolute security and preventing any misuse or diversion of client funds.

Ultimately, the choice to trade with TheTrustCapitals is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Market Instruments

TheTrustCapitals offers a diverse array of market instruments tailored to meet the dynamic needs of traders.

With over 55 currency pairs available, including majors, crosses, and exotics, traders can engage in forex CFDs with tight spreads and no requotes, ensuring optimal trading conditions.

Additionally, the platform facilitates stock and shares trading with low spreads and smooth execution on popular assets like Apple, Microsoft, Netflix, Amazon, and Alphabet, providing access to the world's leading companies.

For those interested in indices trading, TheTrustCapitals offers comprehensive opportunities to trade on various indices.

Moreover, the platform enables traders to explore the commodities market with CFDs on metals such as gold and silver, as well as oil, gas, coffee, cocoa, sugar, cotton, and more. Traders can take advantage of both rising and falling markets by choosing to go long or short, unlocking a myriad of trading possibilities.

Account Types

TheTrustCapitals offers a variety of account types tailored to different trading preferences and experience levels.

For those looking to explore the platform without financial risk, a demo account is available with no minimum deposit requirement.

The Standard account requires a minimum deposit of $500, providing traders access to a range of features and market instruments.

For traders seeking a swap-free option compliant with Islamic principles, the Swap-Free account requires a minimum deposit of $2000.

Those interested in zero spreads can opt for the Zero Spread account with a minimum deposit of $5000.

For experienced traders looking for advanced features and premium services, the PRO account demands a minimum deposit of $10,000.

| Account Type | Minimum Deposit |

| Standard | $500 |

| Swap-Free | $2,000 |

| Zero Spread | $5,000 |

| PRO | $10,000 |

How to Open an Account?

To open an account with TheTrustCapitals, you have to follow below steps:

Visit the TheTrustCapitals website, locate and click on the 'Register' button on the right corner of the mainpage.

Fill in the necessary personal details required and choose an account type.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

TheTrustCapitals offers competitive leverage options across its account types, allowing traders to amplify their positions in the market. With a leverage ratio of 1:500 for currencies, the Standard, Swap-Free, and Zero Spread accounts provide significant leverage for traders to maximize their trading potential.

Meanwhile, the PRO account offers a leverage ratio of 1:200 for currencies, providing a balance between leverage and risk management.

| Account Type | Leverage |

| Standard | 1:500 |

| Swap-Free | 1:500 |

| Zero Spread | 1:500 |

| PRO | 1:200 |

Spreads & Commissions

At TheTrustCapitals, traders can benefit from competitive spreads and transparent commission structures.

The Standard account features floating spreads starting from 1.2 pips, with no commissions and the option for SWAPS.

The Swap-Free account offers similar spreads starting from 1.5 pips, catering to traders adhering to Islamic finance principles with no commissions as well.

Traders seeking zero spreads can opt for the Zero Spread account, where spreads start from 0 pips, albeit with commissions starting from $15 per lot traded.

The PRO account offers spreads starting from 0.2 pips, with a commission of $5 per lot traded.

Additionally, all accounts except the Zero Spread account allow for SWAPS, while scalping is not permitted across all account types.

| Account Type | Spread Type | Spread from | Commission | SWAPS | Scalping |

| Standard | Floating | 1.2 pips | No | Yes | No |

| Swap-Free | Floating | 1.5 pips | No | Swap-Free | No |

| Zero Spread | Floating | 0 pips | From $15/lot | Yes | No |

| PRO | Floating | 0.2 pips | $5/lot | Yes | No |

Trading Platform

TheTrustCapitals offers its clients the MetaTrader 5 platform, renowned as the premier choice for traders across all asset classes.

With a plethora of accolades, it stands as the pinnacle of trading technology. Boasting a comprehensive suite of features, including bespoke data protection, clients can trade with confidence knowing their information is secure.

The platform supports a full range of trade orders, from pending to stop-orders, along with netting and hedging position accounting systems for optimal flexibility. Traders can delve into market analysis with ease, thanks to three chart types, nine timeframes, advanced market depth, and one-click trading functionality.

With access to 30 indicators and 24 graphical objects, technical analysis becomes intuitive and insightful. Real-time quotes in Market Watch keep traders informed, while multilingual support ensures accessibility for a global clientele.

Whether on Android, iPhone, Windows Desktop, or Mac OS, clients can easily access the platform and experience the unparalleled trading environment of TheTrustCapitals.

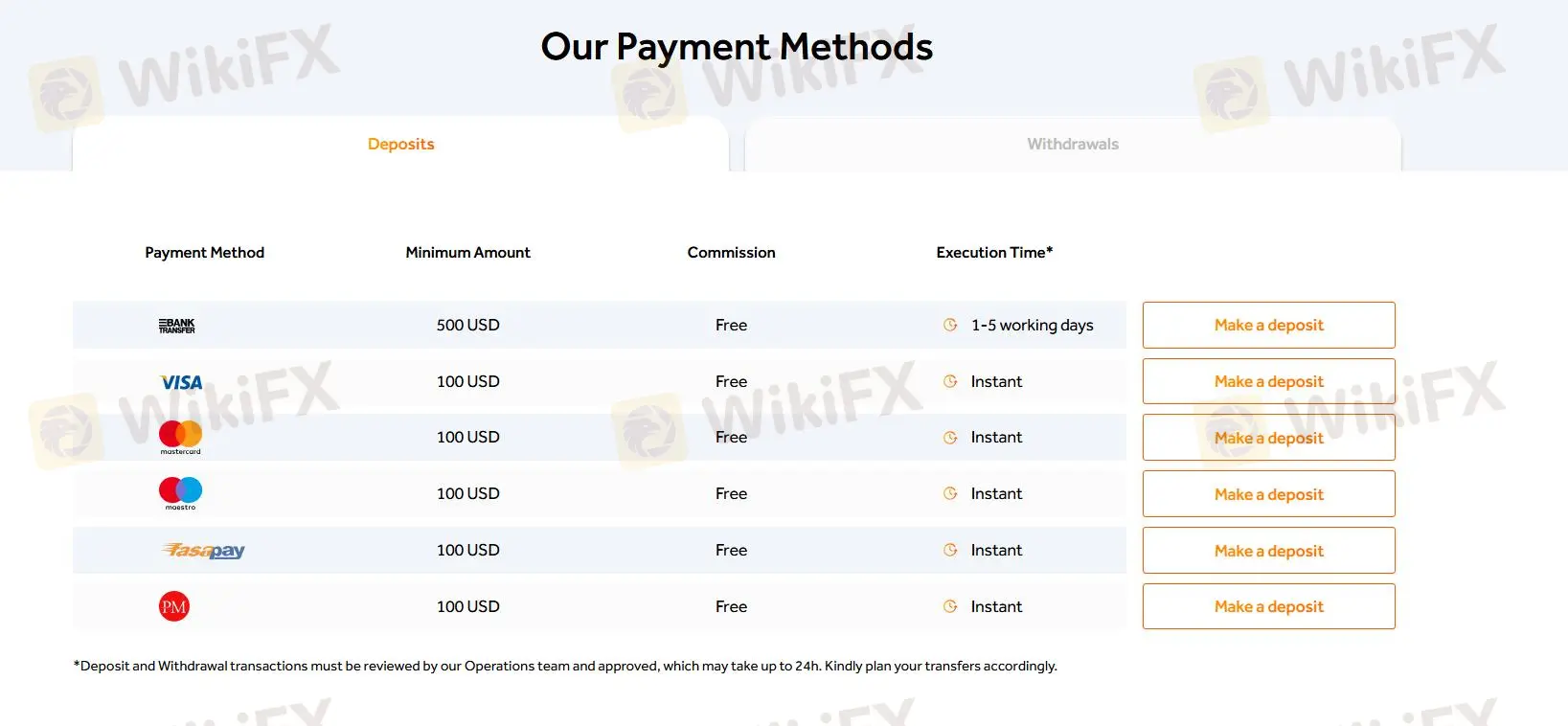

Deposit & Withdrawal

At TheTrustCapitals, depositing and withdrawing funds from your trading account is straightforward and convenient.

For deposits, funds are typically processed within 24 hours for most payment methods, with bank transfers taking 3-5 working days. They accept various payment methods, including bank wires, credit/debit cards, and E-Wallets such as Fasapay, allowing you to deposit in multiple international currencies, with your MT5 trading account being topped up in USD as the main trading currency.

Similarly, withdrawing funds is hassle-free. Once your trades are closed, you can withdraw your available balance by following the same procedure as depositing.

TheTrustCapitals does not charge any additional fees for deposits, though fees may be incurred on the payment provider's side, depending on the chosen method.

Bouns

TheTrustCapitals offers two enticing bonus programs for traders to boost their trading potential.

The 20% Tradable Bonus is available to both new and existing clients, providing a bonus of up to $2000 on deposits over $1000, tradable and withdrawable within 60 days.

Meanwhile, the 100% Credit Bonus doubles clients' equity on qualifying deposits of $500 or more, up to a cumulative maximum of $25,000.

With both bonuses applicable to trading accounts and transparent terms, traders can enhance their trading experience and seize more opportunities in the markets.

Customer Service

TheTrustCapitals ensures responsive customer support through phone, email, physical address and social media channels including Facebook, YouTube and LinkedIn. Traders can reach out for assistance or inquiries regarding trading or account-related matters.

Additionally, an FAQ section addresses common queries and live chat supports those needs immediate assistance.

Tel: +44 1157771006. (office hours: 10am - 7pm (GMT+4))

OFFICE: Holborn Viaduct EC1 City Of London, London, United Kingdom

Email: support@thetrustcapitals.com.

Conclusion

TheTrustCapitals, a brokerage firm registered in United Kingdom, offers Forex, Stocks, Indices and Commodities as market instruments to traders. However, the current lack of regulation from recognized authorities should prompt concerns for investors. Regulation typically ensures financial oversight, protecting clients from possible malpractices.

Therefore, individuals considering TheTrustCapitals as their broker should be cautious, do their own research and explore alternative, regulated brokers that prioritize transparency, security, and client protection

Frequently Asked Questions

Is TheTrustCapitals regulated?

No. It has been verified that this broker is currently under no valid regulation.

Does TheTrustCapitals offer demo accounts?

Yes.

Is TheTrustCapitals a good broker for beginners?

No. It is not a good choice for beginners because it is unregulated by any recognized financial authorities.

Does TheTrustCapitals offer the industry leading MT4 & MT5?

Yes, it offers MT5 on Android, iPhone, Windows Desktop, and Mac OS.

Whats the minimum deposit does TheTrustCapitals request?

TheTrustCapitals requires a minimum deposit from $500 in its Standard account.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Brokers de WikiFX

últimas noticias

Análisis del Dólar y Perspectivas para la Economía Latinoamericana.

¿IQ Option es un bróker seguro? Análisis 2025.

WonderFi Expande sus Servicios Financieros con Eightcap y Embedded.

La CNMV alerta de 19 entidades no registradas.

Cálculo de tasa de cambio