OctaFX -Some Important Details about This Broker

abstrak:OctaFX, headquartered in Saint Lucia, serves as an online trading platform offering an extensive array of financial instruments to traders. Through OctaFX, traders gain access to a diverse range of tradable assets, including currency pairs, stock derivatives, indices, commodities, cryptocurrencies, and shares. The platform provides flexibility and accessibility with its selection of account types, which include OctaTrader, MetaTrader 5, MetaTrader 4, Islamic, and demo accounts. However, it's important to acknowledge that OctaFX operates without regulatory oversight, emphasizing the need for caution due to the potential risks associated with unregulated trading.

| OctaFX | Basic Information |

| Company Name | OctaFX |

| Headquarters | Saint Lucia |

| Regulations | Not regulated |

| Tradable Assets | Currency pairs, Stock derivatives, Indices, Commodities, Cryptocurrencies, Shares |

| Account Types | OctaTrader, MetaTrader 5, MetaTrader 4, Islamic, demo accounts |

| Minimum Deposit | $25 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.6 pips |

| Commission | $0 |

| Payment Methods | Neteller, Skrill, Litecoin, Dogecoin, Tether, visa, mastercard, and more |

| Trading Platforms | OctaTrader platform, MetaTrader 4, MetaTrader 5 |

| Trading Tools | Trading calculator, Pip calculator, Profit calculator, live quotes, account monitoring |

| Customer Support | Email (support@octafx.com) |

| Education Resources | Webinars, articles, video courses, trading strategies, glossary, FAQ |

| Bonus Offerings | 50% deposit bonus |

Overview of OctaFX

OctaFX, headquartered in Saint Lucia, serves as an online trading platform offering an extensive array of financial instruments to traders. Through OctaFX, traders gain access to a diverse range of tradable assets, including currency pairs, stock derivatives, indices, commodities, cryptocurrencies, and shares. The platform provides flexibility and accessibility with its selection of account types, which include OctaTrader, MetaTrader 5, MetaTrader 4, Islamic, and demo accounts. However, it's important to acknowledge that OctaFX operates without regulatory oversight, emphasizing the need for caution due to the potential risks associated with unregulated trading.

Is OctaFX Legit?

OctaFX is not regulated. It's essential to highlight that OctaFX operates without any valid regulation, indicating a lack of oversight from established financial regulatory bodies. Traders should proceed with caution and fully understand the potential risks when contemplating trading with an unregulated broker like OctaFX. Unregulated brokers may offer limited avenues for dispute resolution, raising concerns about the safety and security of funds, as well as transparency in their business practices. To ensure a safer and more secure trading experience, traders are strongly advised to conduct thorough research and carefully assess the regulatory status of a broker before engaging in any trading activities.

Pros and Cons

OctaFX stands out with its diverse range of tradable assets, offering traders ample opportunities to diversify their portfolios and explore various market segments. The platform's utilization of the popular MetaTrader 4 and MetaTrader 5 platforms further enhances its appeal, providing traders with access to advanced trading features and tools. However, it's important to note that OctaFX operates without regulatory oversight, which may pose risks for traders due to the lack of regulatory safeguards. Additionally, the platform's limited customer support options, primarily through email, may hinder timely assistance for traders in need. On a positive note, OctaFX offers multiple deposit and withdrawal methods, enhancing convenience and accessibility for traders.

| Pros | Cons |

|

|

|

|

|

Trading Instruments

OctaFX offers multiple classes of trading instruments to cater to the needs of traders across various markets.

Currency pairs form a significant part of their offerings, featuring the 35 most volatile pairs with a maximum leverage of 1:500.

Stock derivatives are another prominent asset class, comprising 150 stocks from 16 exchanges, with a maximum leverage of 1:20.

Indices trading is also available, with access to up to 10 of the most popular indices and a maximum leverage of 1:200.

For commodities, OctaFX provides trading opportunities in gold, silver, United States Natural Gas, Brent Crude Oil, and West Texas Intermediate crude oil, all with a maximum leverage of 1:200.

Cryptocurrency enthusiasts can trade 34 well-known cryptocurrencies with a maximum leverage of 1:100.

Additionally, OctaFX offers shares of over 100 public companies, with no leverage available for this asset class.

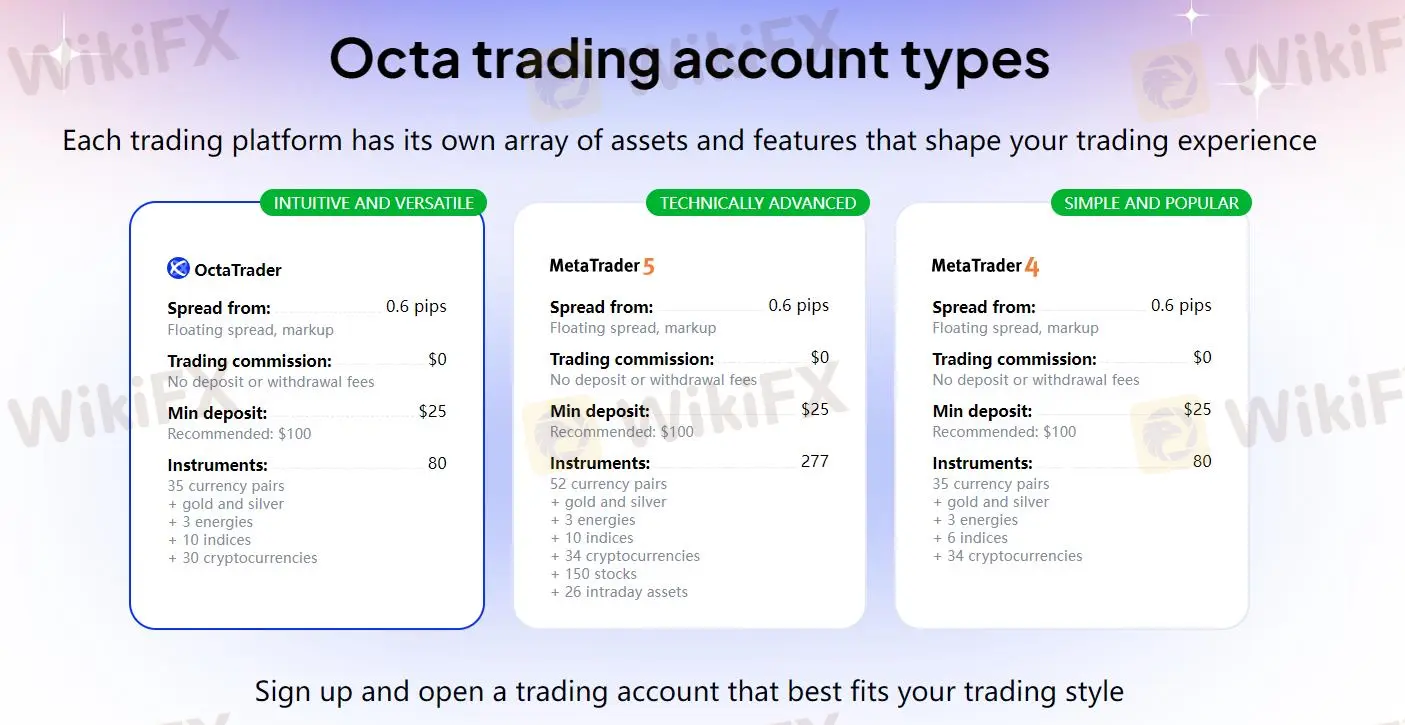

Account Types

OctaFX offers a range of account types tailored to meet the diverse needs of traders.

The demo account provides users with a full trading experience using virtual funds, allowing them to practice and familiarize themselves with the platform's features and functionalities without risking any real money.

Additionally, OctaFX offers Islamic accounts, which adhere to Islamic Sharia principles, allowing traders of the Muslim faith to participate in online trading while complying with their religious beliefs.

For those seeking a live trading experience, OctaTrader, MetaTrader 5, and MetaTrader 4 accounts are available, each offering unique features and capabilities to suit different trading preferences and styles.

| Account Type | Trading Platforms | Minimum Deposit | Maximum Leverage | Commissios | Spreads | Trading Instruments |

| OctaTrader Account | OctaTrader | $25 | Forex 1:500(ZARJPY 1:100)Metals 1:200Energies 1:200Indices 1:200Crypto 1:100 | $0 | From 0.6 pips | 35 currency pairs+ gold and silver+ 3 energies+ 10 indices+ 30 cryptocurrencies |

| MetaTrader 5 Account | MT5 | $25 | Forex 1:500(ZARJPY 1:100)Metals 1:200Energies 1:200Indices 1:200Crypto 1:100Stocks 1:20Intraday assets 1:500 | $0 | From 0.6 pips | 52 currency pairs+ gold and silver+ 3 energies+ 10 indices+ 34 cryptocurrencies+ 150 stocks+ 26 intraday assets |

| MetaTrader 4 Account | MT4 | $25 | Forex 1:500(ZARJPY 1:100)Metals 1:200Energies 1:200Indices 1:200Crypto 1:100 | $0 | From 0.6 pips | 35 currency pairs+ gold and silver+ 3 energies+ 6 indices+ 34 cryptocurrencies |

Leverage

OctaFX offers varying levels of leverage across different account types to accommodate the trading preferences and risk tolerance of traders. For OctaTrader accounts, MetaTrader 5 accounts, and MetaTrader 4 accounts, the maximum leverage for Forex trading is 1:500, except for ZARJPY pairs which have a leverage of 1:100. When trading metals and energies, the maximum leverage is 1:200, while for indices and cryptocurrencies, it is also set at 1:200. However, for stocks, the leverage is capped at 1:20. Intraday assets enjoy a leverage of up to 1:500 across all account types.

Spreads and Commissions

For OctaTrader accounts, MetaTrader 5 accounts, and MetaTrader 4 accounts, there are no commissions charged, making trading cost-effective. Additionally, the spreads are kept low, starting from 0.6 pips, providing traders with tight spreads for enhanced trading efficiency.

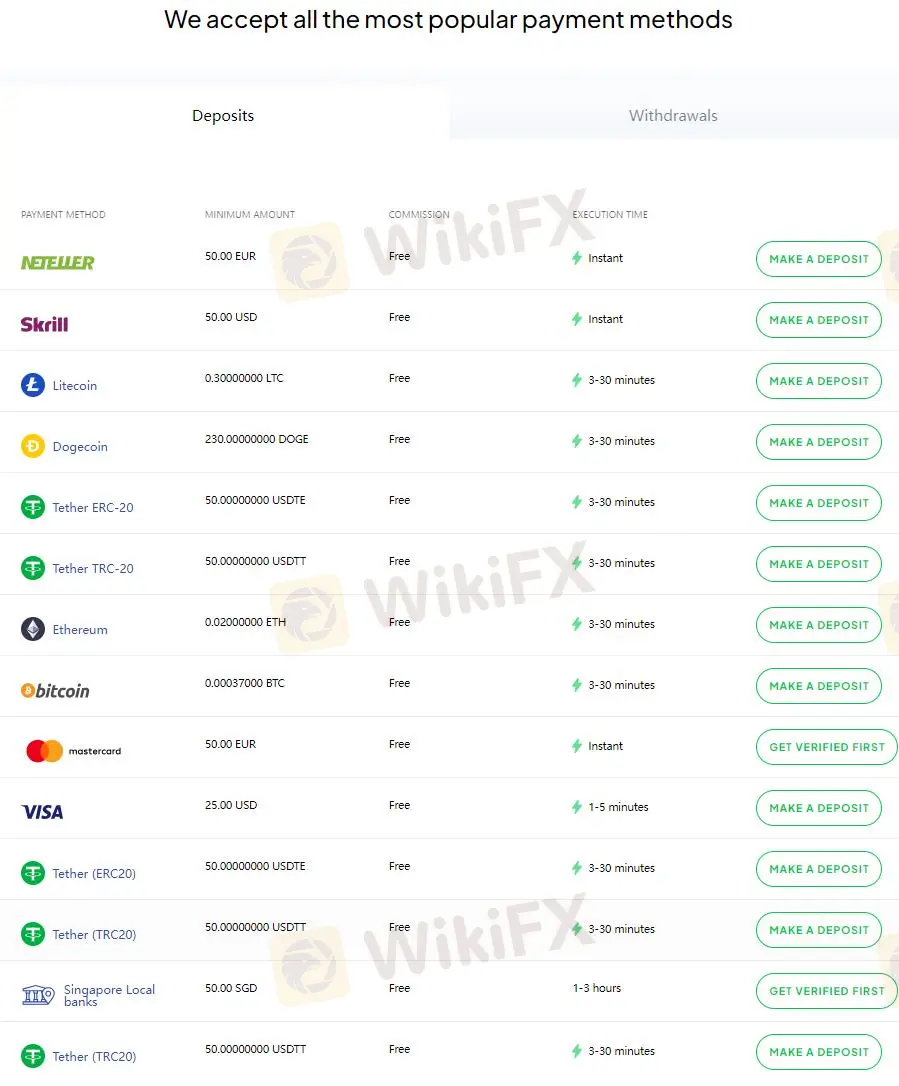

Deposit & Withdraw Methods

OctaFX offers a wide range of popular payment methods to cater to the diverse needs of its clients, ensuring convenient and hassle-free transactions. Among the accepted payment methods are Neteller, Skrill, Litecoin, Dogecoin, Tether, Visa, Mastercard, and more.

Depending on the country of residence, OctaFX offers several instant deposit methods, ensuring swift and seamless transactions. Withdrawals are typically processed promptly, with most transactions completed within three hours, providing traders with quick access to their funds.

Trading Platforms

OctaFX offers a versatile selection of trading platforms tailored to meet the diverse needs of traders across different skill levels and preferences.

The OctaTrader platform is designed with traders in mind, providing flexibility and convenience. With fresh analytics and a set of tools accessible through a simple interface, the OctaTrader platform caters to both beginners and experienced traders alike.

Additionally, OctaFX provides access to MetaTrader 5, a robust trading platform equipped with advanced tools for technical and fundamental analysis, Expert Advisors (EAs), and copy trading features. With 21 timeframes available, MetaTrader 5 is suitable for traders of all levels, offering a wide choice of assets and comprehensive trading functionalities across various devices, including web trader, desktop, android, and iOS.

Lastly, MetaTrader 4, known for its simplicity and functionality, features charting tools, market indicators, scripts, and EAs, along with advanced risk management tools and real-time market execution. Available on web trader, desktop, android, and iOS platforms, MetaTrader 4 provides traders with a reliable and efficient trading experience.

Trading Tools

OctaFX offers a suite of trading tools designed to enhance traders' experience and facilitate informed decision-making in the financial markets. These tools include a trading calculator, pip calculator, profit calculator, live quotes, and account monitoring.

The trading calculator is a versatile tool that assists traders in determining the margin size needed to support an open position, calculating pip values, and optimizing leverage to manage risks effectively.

With the pip calculator, traders can accurately assess the value of a pip for any currency pair, crucial for risk management strategies.

The profit calculator enables traders to calculate potential profits and losses of their orders, empowering them to trade with confidence and precision.

Additionally, account monitoring allows traders to track the performance, charts, profits, orders, and history of their accounts, providing valuable insights and learning opportunities.

Educational Resources

OctaFX offers a range of educational resources designed to empower traders with the knowledge and skills needed to succeed in the financial markets. These resources include webinars, articles, video courses, trading strategies, glossary, and frequently asked questions (FAQs).

The trading tutorials cover various topics such as ECN trading, risk management, and technical analysis, providing valuable insights and practical guidance to traders of all levels.

Additionally, platform tutorials offer step-by-step instructions on essential tasks like making deposits and withdrawals from trading accounts, ensuring a seamless trading experience.

The Forex basics video course is specifically tailored for beginners, offering a comprehensive overview of the Forex market, including fundamental concepts, terminology, and trading strategies.

Platform tutorials in video format further enhance traders' understanding of key trading platforms like Metatrader, enabling them to navigate and utilize these platforms effectively.

Customer Support

OctaFX offers comprehensive customer support services to ensure accessibility and assistance for clients around the clock. Traders can reach out to the support team via email at support@octafx.com at any time, 24/7, for prompt assistance with their queries and concerns. Additionally, OctaFX provides various communication options through social media platforms such as Facebook, Twitter, Instagram, and YouTube, enhancing convenience and accessibility for clients worldwide.

Conclusion

In conclusion, OctaFX offers traders a diverse range of tradable assets, providing ample opportunities to diversify their portfolios and explore various market segments. The platform's utilization of the popular MetaTrader 4 and MetaTrader 5 platforms further enhances its appeal, providing traders with access to advanced trading features and tools. However, it's important to note that OctaFX operates without regulatory oversight, which may pose risks for traders due to the lack of regulatory safeguards. Additionally, the platform's limited customer support options, primarily through email, may hinder timely assistance for traders in need. On a positive note, OctaFX offers multiple deposit and withdrawal methods, enhancing convenience and accessibility for traders.

FAQs

Q: Is OctaFX regulated?

A: No, OctaFX operates without regulation, which means it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on OctaFX?

A: OctaFX offers a range of trading instruments, including currency pairs, stock derivatives, indices, commodities, cryptocurrencies, and shares.

Q: What account types does OctaFX offer?

A: OctaFX provides various account types, including OctaTrader, MetaTrader 5, MetaTrader 4, Islamic, and demo accounts, catering to different trading preferences and experience levels.

Q: How can I contact OctaFX's customer support?

A: You can reach OctaFX's customer support primarily through email at support@octafx.com. Traders can expect prompt assistance with their queries and concerns, as support is available 24/7 via email.

Risk Warning

Trading online comes with inherent risks, and there's a possibility of losing all your invested capital. It's essential to understand that online trading may not be suitable for everyone. It's crucial to be aware that the information provided in this review could change due to updates in the company's services and policies. Additionally, the review's generation date is significant, as information may have evolved since then. Hence, it's advisable for readers to verify the most recent information directly with the company before making any decisions or taking action. Ultimately, the responsibility for using the information provided in this review lies solely with the reader.

Magbasa pa ng marami

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

IMF cuts global growth outlook, warns high inflation threatens recession

The International Monetary Fund cut global growth forecasts again on Tuesday, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Starting Forex Trading: Creating A Profit Plan

A key factor in building a successful and profitable trading career is making your own plans. Your transaction plan will provide a good framework for guiding ever-changing currency prices to profit.

Broker ng WikiFX

Exchange Rate