Smart FX Vest

abstrak:Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs on Shares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Note: Smart FX Vest's official website - https://smartfxvest.com/ is currently inaccessible normal.

| Smart FX Vest Review Summary | |

| Founded | / |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | 250+, Forex, CFDs on Shares, Futures, Indices, Metals, Energies |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 2 pips (Classic account) |

| Trading Platform | / |

| Min Deposit | $100 |

| Customer Support | Live chat, contact form |

| Email: support@SmartFxVest.com | |

| Regional Restrictions | The United States, Cuba, Iraq, Myanmar, North Korea, and Sudan |

Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs onShares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Pros and Cons

| Pros | Cons |

| Various market instruments | Unfunctional website |

| Three account types | Unregulated status |

| No commissions | High spreads on the Classic account |

| Flexible leverage ratios | Only email support |

| Multiple payment options | Regional restrictions |

| No deposit and withdrawal fees | |

| Live chat support |

Is Smart FX Vest Legit?

No, Smart FX Vest operates without valid regulation, which means trading on this platform your fund is not safe.

What Can I Trade on Smart FX Vest?

In its advertising, Smart FX Vest claims to provide access to more than 250 trading instruments, including Forex, CFDs on shares, futures, indices, metals, and energies.

| Trading Asset | Available |

| Forex | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Leverage/Fees

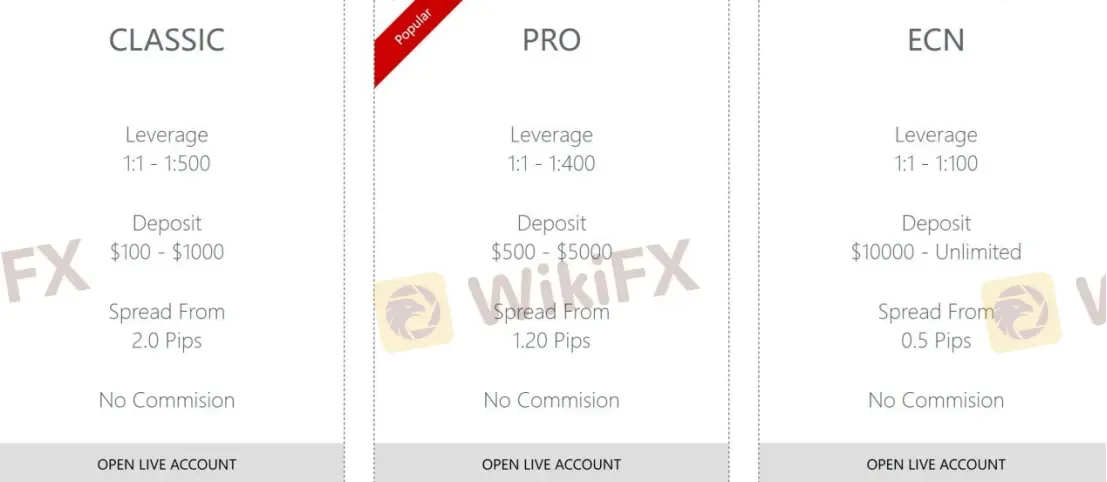

Smart FX Vest claims to offer 3 types of trading accounts - Classic, Pro and ECN, with minimum initial deposit requirements of $100, $500 and $10,000 respectively.

| Account Type | CLASSIC | PRO | ECN |

| Min Deposit | $100 | $500 | $10,000 |

| Max Deposit | $1,000 | $5,000 | Unlimited |

| Max Leverage | 1:1-1:500 | 1:1-1:400 | 1:1-1:100 |

| Spread | From 2 pips | From 1.2 pips | From 0.5 pips |

| Commission | ❌ | ||

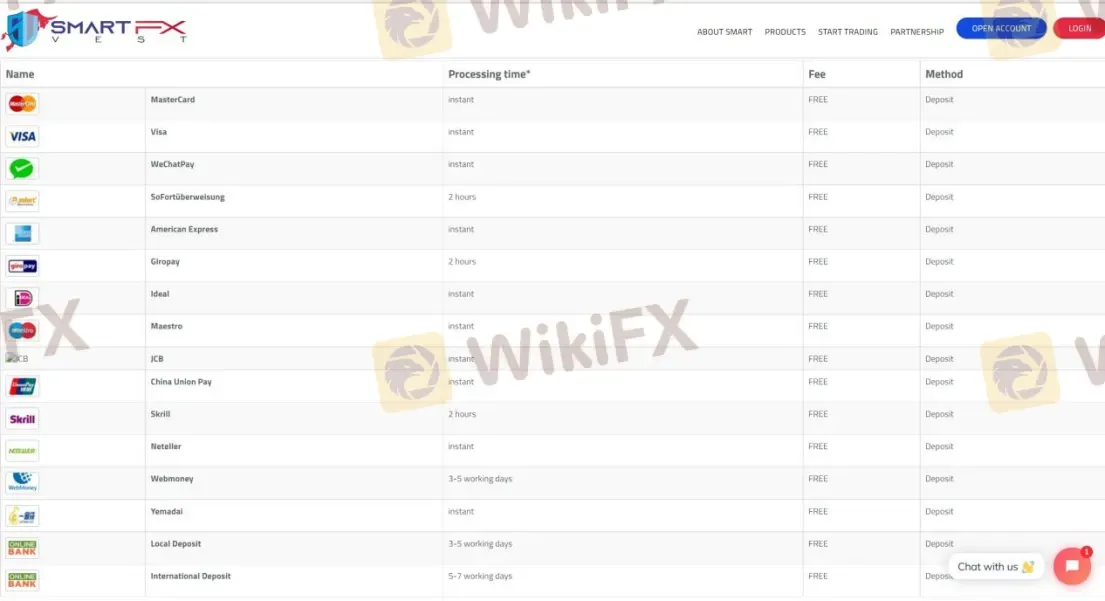

Deposit and Withdrawal

| Payment Option | Min Deposit | Deposit/Withdrawal Fee | Deposit/Withdrawal Time |

| MasterCard | $100 | ❌ | Instant |

| Visa | |||

| WeChatPay | |||

| SoFortüberweisung | 2 hours | ||

| American Express | Instant | ||

| Giropay | 2 hours | ||

| Ideal | Instant | ||

| Maestro | |||

| JCB | |||

| China Union Pay | |||

| Skrill | 2 hours | ||

| Neteller | Instant | ||

| WebMoney | 3-5 working days | ||

| Yemadai | Instant | ||

| Local Deposit and International Deposit | 5-7 working days |

Magbasa pa ng marami

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

IMF cuts global growth outlook, warns high inflation threatens recession

The International Monetary Fund cut global growth forecasts again on Tuesday, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Starting Forex Trading: Creating A Profit Plan

A key factor in building a successful and profitable trading career is making your own plans. Your transaction plan will provide a good framework for guiding ever-changing currency prices to profit.

Broker ng WikiFX

Exchange Rate