Excent Capital

abstrak:Excent Capital is a trading platform founded in 2021, registered in the United Kingdom. It is offshore regulated by The Seychelles Financial Services Authority. The platform offers access to a diverse range of market instruments, including forex, indices, ETFs, US stocks, and commodities. Excent Capital provides a proprietary trading platform. Traders can benefit from leverage of up to 1:150, with spreads starting at 1.1 pips (for EUR/USD). A demo account is available for practice trading, but details about the minimum deposit requirement are not provided.

| Excent CapitalReview Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, Indices, ETFs, US Stocks, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:150 |

| Spread | 1.1 pips (EUR/USD) |

| Trading Platform | Excent Capital platform |

| Minimum Deposit | / |

| Customer Support | Live Chat |

| Email: support@excent.capital | |

| Phone: +248 437 3651, +44 2038 403 680 | |

| Social Media: LinkedIn, YouTube, Twitter, Instagram, Facebook, Telegram | |

| Regional Restrictions | USA, Iran, Spain, North Korea |

Excent Capital Information

Excent Capital is a trading platform founded in 2021, registered in the United Kingdom. It is offshore regulated by The Seychelles Financial Services Authority. The platform offers access to a diverse range of market instruments, including forex, indices, ETFs, US stocks, and commodities. Excent Capital provides a proprietary trading platform. Traders can benefit from leverage of up to 1:150, with spreads starting at 1.1 pips (for EUR/USD). A demo account is available for practice trading, but details about the minimum deposit requirement are not provided.

Pros & Cons

| Pros | Cons |

| Demo account available | Offshore regulation risks |

| Commission-free | Limited account info |

| Multiple tradable products | Regional restriction |

| Transparent spreads | Limited payment options |

| Live chat support |

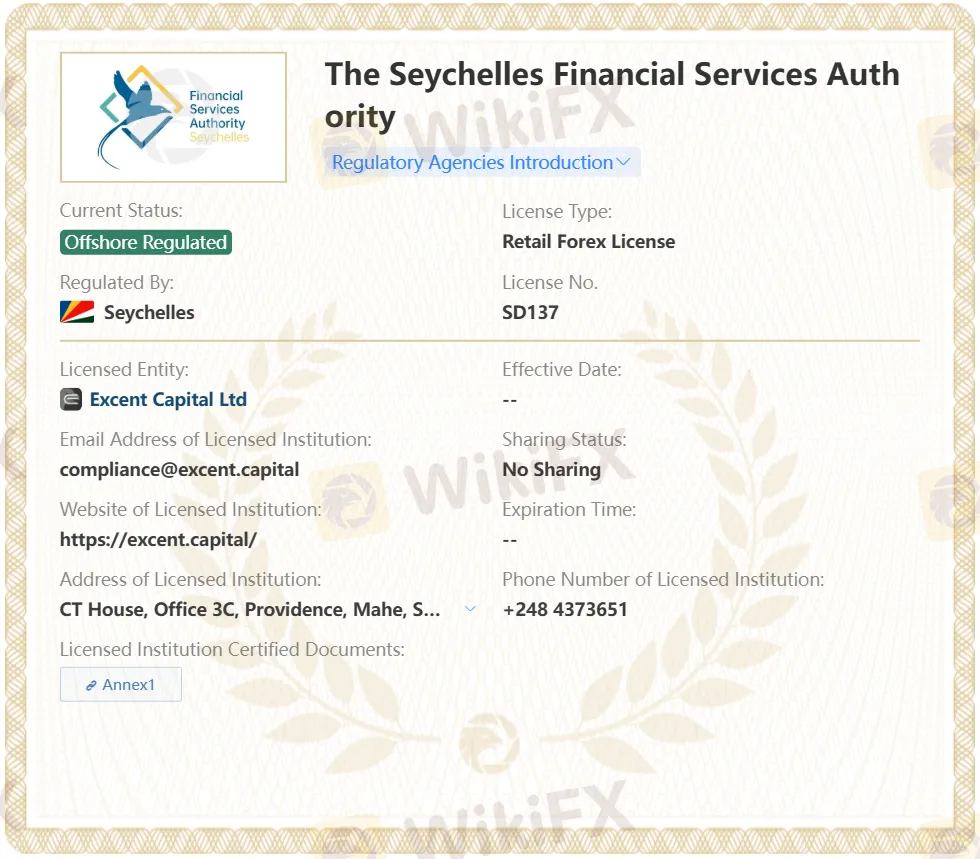

Is Excent Capital Legit?

Excent Capital is Offshore Regulated by the Seychelles Financial Services Authority, holding a retail forex license (SD137). You still need to be cautious, since offshore regulation may pose potential risks.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles | The Seychelles Financial Services Authority (FSA) | Offshore Regulated | Excent Capital Ltd | Retail Forex License | SD137 |

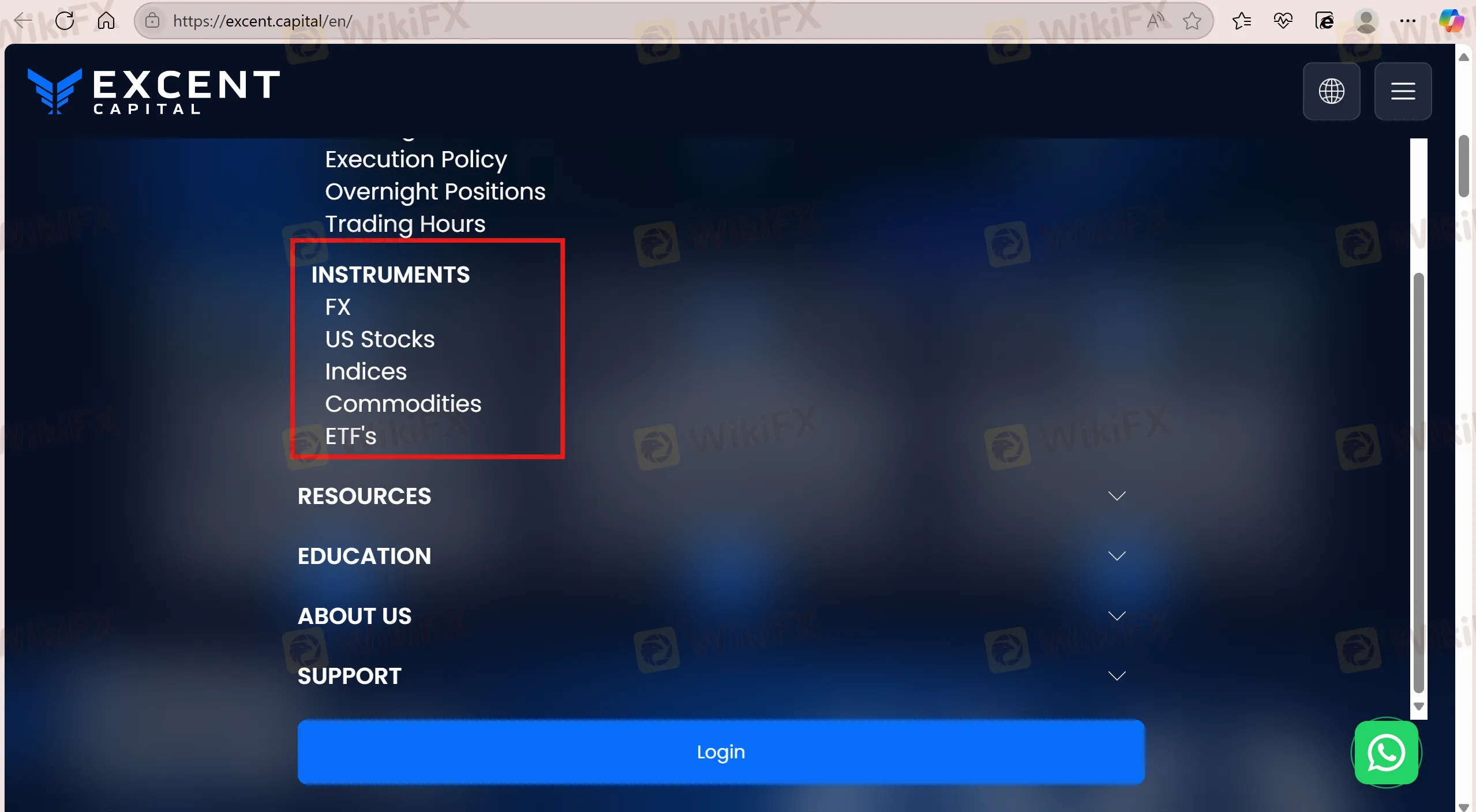

What Can I Trade on Excent Capital?

Traders on Excent Capital get access to market instruments like forex, ETFs, commodities, US stocks, and indices.

| Tradable Instruments | Supported |

| forex | ✔ |

| ETFs | ✔ |

| commodities | ✔ |

| stocks | ✔ |

| indices | ✔ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| futures | ❌ |

Account Types

A demo account is available on this platform. However, there is minimal information regarding live accounts.

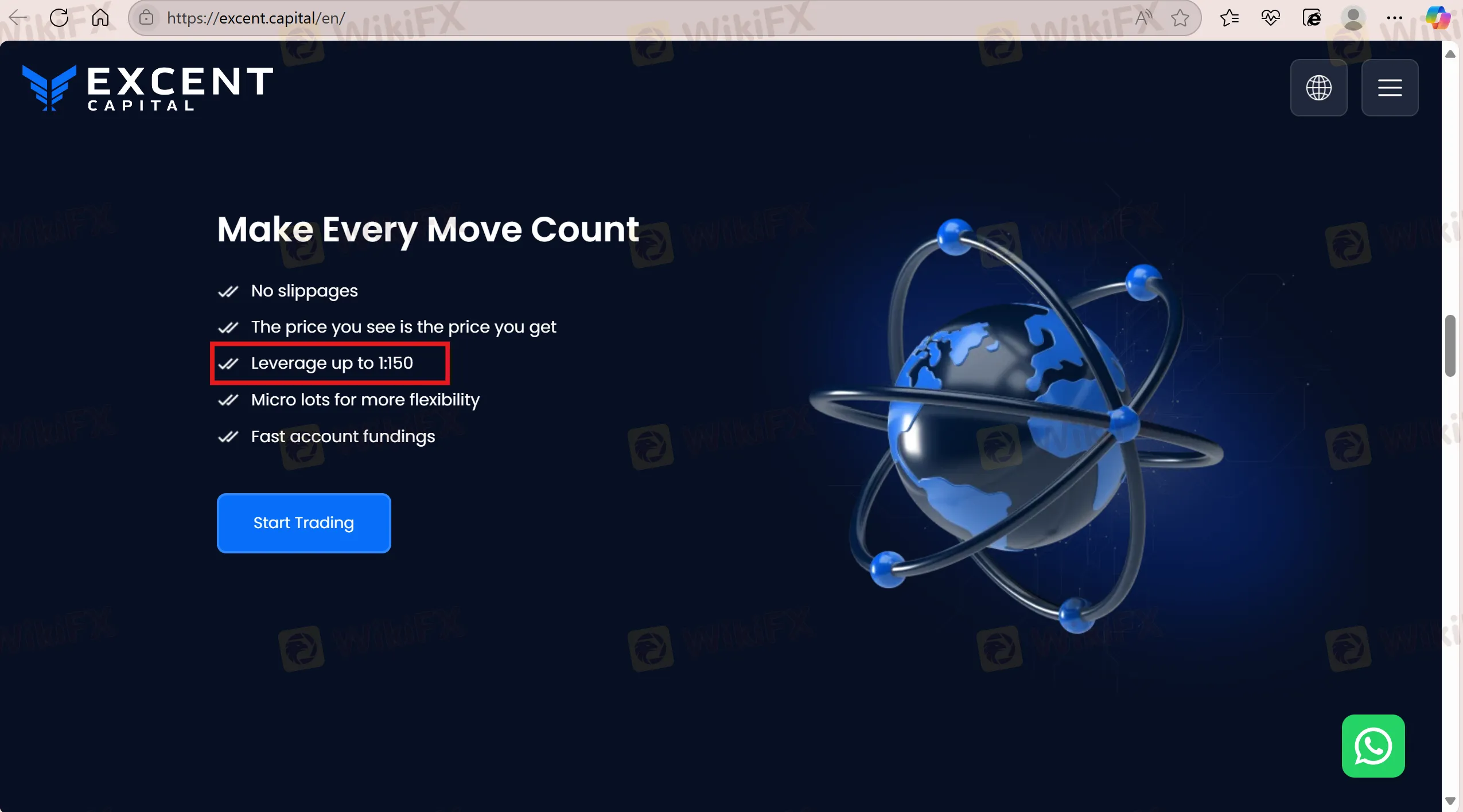

Leverage

Excent Capital offers leverage up to 1:150 on this platform.

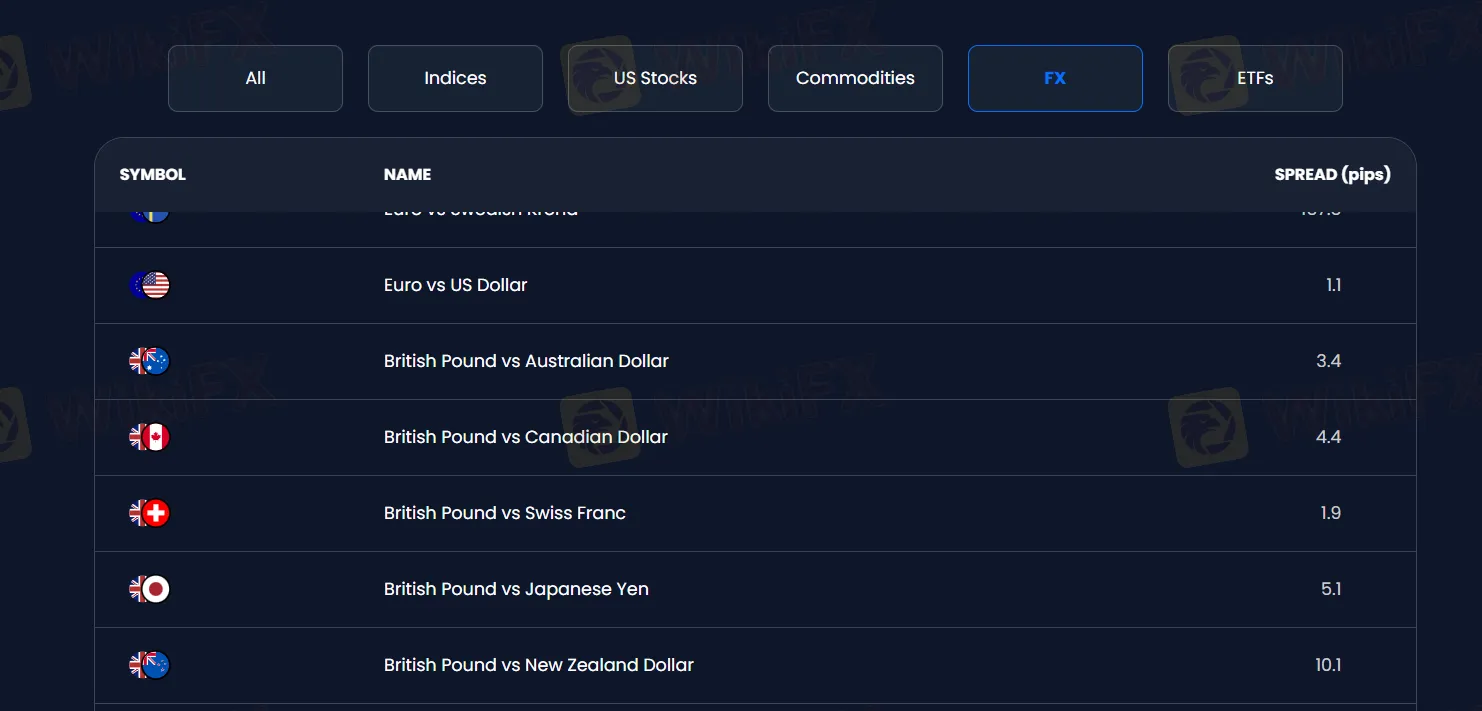

Fees

Excent Capital offers a transparent breakdown of spreads for each asset type and various currency pairs. For instance, in the forex category, the EUR/USD spread is 1.1 pips. In terms of fees, Excent Capital claims to prioritize transparency and fairness, offering a commission-free trading experience.

| Currency Pairs | Spread (pips) |

| Euro vs Japanese Yen | 2.5 |

| Euro vs Norwegian Krone | 23.1 |

| Euro vs New Zealand Dollar | 2.8 |

| Euro vs Polish Zloty | 50.3 |

| Euro vs Swedish Krona | 157.5 |

| Euro vs US Dollar | 1.1 |

| British Pound vs Australian Dollar | 3.4 |

| British Pound vs Canadian Dollar | 4.4 |

| British Pound vs Swiss Franc | 1.9 |

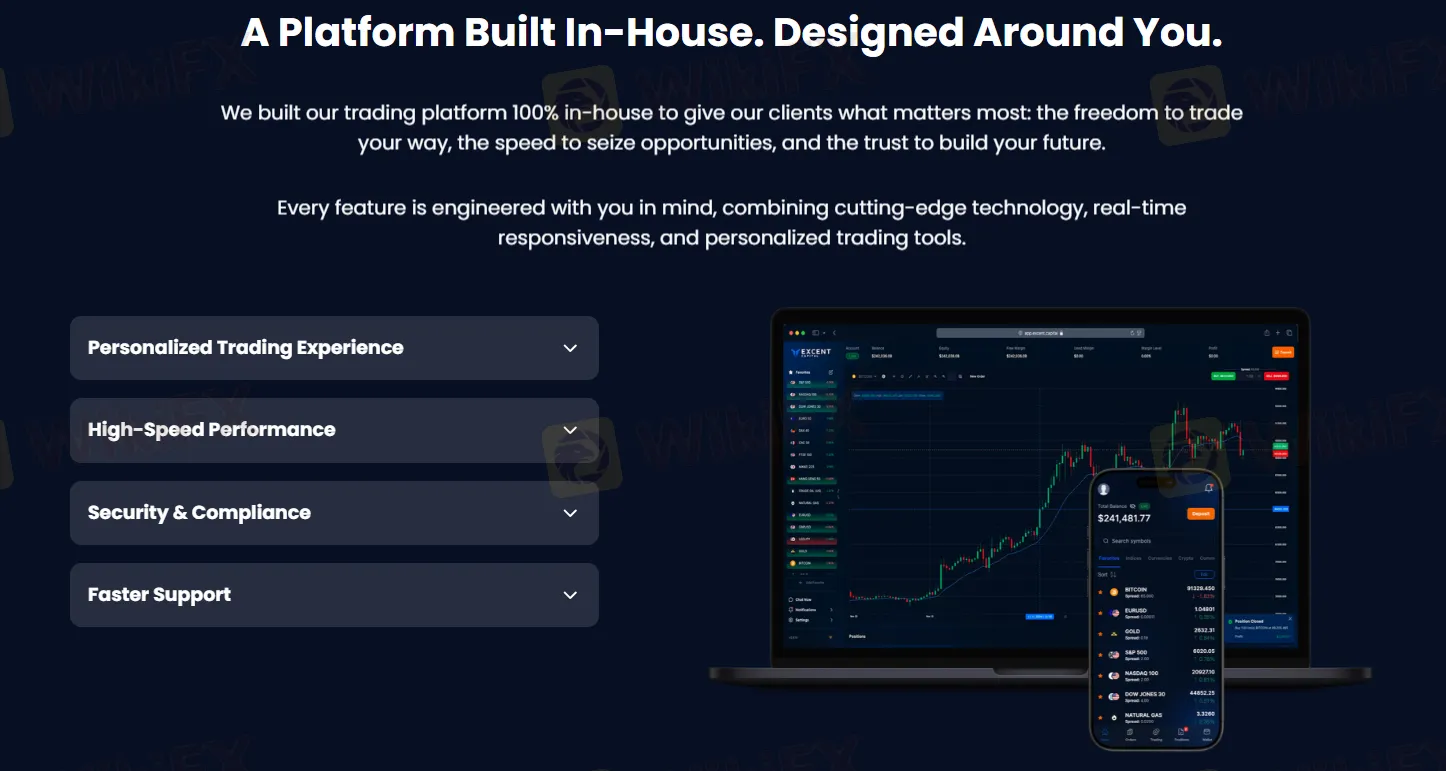

Trading Platform

Excent Capital claims to provide a 100% in-house platform. It is said to have features like Personalized Trading Experience, High-Speed Performance, Security & Compliance, and Faster Support.

| Trading Platform | Supported | Available Devices | Suitable for |

| Excent Capital platform | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders on Excent Capital get access to two payment options:

Credit/Debit Cards: Use a major credit or debit card for an immediate deposit.

Bank Transfers:

- Equals Money: Directly transfer funds from your local bank to Excent Capitals custodian bank in London, UK.

- Local Payment Partners: Use trusted local payment agents for easier local transactions, especially if international transfers are unfamiliar.

Magbasa pa ng marami

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

IMF cuts global growth outlook, warns high inflation threatens recession

The International Monetary Fund cut global growth forecasts again on Tuesday, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Starting Forex Trading: Creating A Profit Plan

A key factor in building a successful and profitable trading career is making your own plans. Your transaction plan will provide a good framework for guiding ever-changing currency prices to profit.

Broker ng WikiFX

Exchange Rate