MHMarkets 3034332076

abstrak:MHMarkets is a reputable foreign exchange and CFD broker registered in the United Kingdom and regulated by ASIC. With a diverse range of trading instruments including forex, precious metals, energy, indices, and digital currencies, MHMarkets caters to traders worldwide. Offering multiple account types with varying minimum deposit requirements and leverage of up to 1:400, the company provides flexibility and potential trading power. Supported by the widely recognized MT4 platform, MHMarkets ensures a user-friendly trading experience. With customer support available 24/7 through live chat and social media channels, MHMarkets prioritizes client satisfaction and strives to meet their trading needs.

| Registered in | United Kingdom |

| Regulated by | ASIC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | CFDs in foreign exchange, precious metals, energy, index products, digital currencies, etc. |

| Minimum Initial Deposit | $50 |

| Maximum Leverage | 1:400 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | 24/7, social medias, address, live chat |

| Fraud Complaints Exposure | No for now |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of MHMarkets

Pros:

1. Wide range of trading instruments including forex, precious metals, energy, indices, and digital currencies.

2. Multiple account types with varying minimum deposit requirements, allowing flexibility for traders with different levels of experience and capital.

3. Availability of the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools and automated trading capabilities.

4. High maximum leverage of up to 1:400, providing the potential for increased trading power.

5. Possibility of accessing ultra-low spreads for the ECN Account, offering competitive pricing and potentially tighter bid-ask spreads.

6. Multiple customer support options, including 24/7 availability, live chat, and various social media channels for quick assistance.

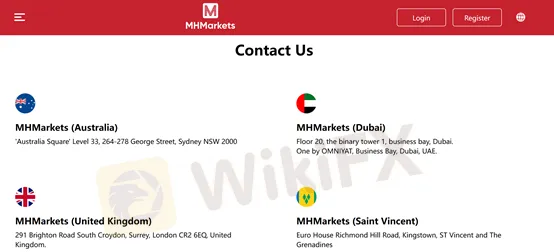

7. Global presence with offices in Australia, Dubai, the United Kingdom, and Saint Vincent.

Cons:

1. Lack of transparency regarding spreads between different instruments and accounts, as well as unknown information about commissions and other costs.

2. Limited information provided about deposit and withdrawal methods, which may cause uncertainty for potential clients.

3. Absence of specific margin call level details, requiring traders to seek clarification or consult the account terms and conditions.

4. Limited educational resources mentioned, with only an economic calendar and tutorials specified. More comprehensive educational materials could enhance the trading experience.

5. Unknown exposure to fraud complaints, as no information is provided regarding the company's history or current complaints.

6. Limited information available about regulatory bodies beyond being registered in the United Kingdom and regulated by ASIC, potentially raising questions about regulatory oversight in other jurisdictions.

7. Lack of information about the company's history, such as the number of years of establishment, which may affect some traders' confidence in the company.

What type of broker is MHMarkets?

MHMarkets operates as a Straight-Through Processing (STP) broker. As an STP broker, MHMarkets ensures that there is no dealing desk intervention, offering traders direct access to the market without any conflicts of interest. This means that trade orders are executed quickly and efficiently through the STP model, which connects traders to multiple liquidity providers. By accessing deep liquidity, traders can benefit from competitive pricing and potentially lower trading costs. However, during periods of high market volatility, spreads may widen, and there is a possibility of experiencing slippage. Additionally, STP brokers may not have full control over the execution speed and can experience occasional price requotes during fast market movements. Despite these limitations, MHMarkets' STP model provides traders with transparency, faster trade execution, and access to a diverse range of liquidity sources, enhancing the overall trading experience.

General information and regulation of MHMarkets

MHMarkets is a reputable foreign exchange and CFD broker registered in the United Kingdom and regulated by ASIC. With a diverse range of trading instruments including forex, precious metals, energy, indices, and digital currencies, MHMarkets caters to traders worldwide. Offering multiple account types with varying minimum deposit requirements and leverage of up to 1:400, the company provides flexibility and potential trading power. Supported by the widely recognized MT4 platform, MHMarkets ensures a user-friendly trading experience. With customer support available 24/7 through live chat and social media channels, MHMarkets prioritizes client satisfaction and strives to meet their trading needs.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| 1. Wide range of trading instruments | 1. Potential for increased complexity and risk |

| 2. Access to various asset classes | 2. Market volatility can lead to potential losses |

| 3. Opportunity to diversify investment portfolio | 3. Higher capital requirements for certain instruments |

| 4. Potential for profit in different market conditions |

MHMarkets offers a diverse range of trading instruments, including CFDs in foreign exchange, precious metals, energy, index products, digital currencies, and more. This extensive selection of instruments provides traders with ample opportunities to diversify their investment portfolios and access various asset classes. Traders can take advantage of different market conditions and potentially profit from price movements in these instruments. However, it is important to note that trading in multiple instruments can increase complexity and risk, requiring traders to stay informed and manage their positions effectively. Additionally, market volatility can lead to potential losses, and some instruments may have higher capital requirements. Nonetheless, the availability of a wide range of trading instruments allows traders to explore different markets and tailor their trading strategies to suit their preferences and goals.

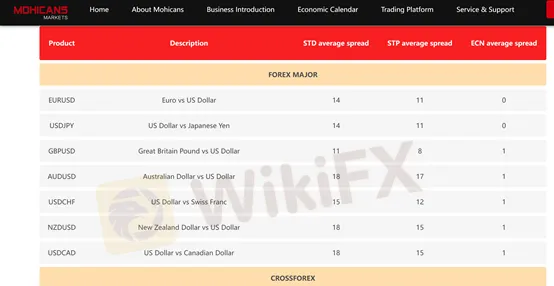

Spreads and commissions for trading with MHMarkets

| Advantages | Disadvantages |

| 1. Competitive spreads | 1. Lack of transparency regarding commissions |

| 2. Different spread options | 2. Potential variation in spreads for different accounts |

| 3. Potentially low or zero spreads |

MHMarkets offers competitive spreads for various instruments, allowing traders to access the markets with favorable trading conditions. The spreads may vary depending on the account type and the specific instrument being traded. For example, when considering the EURUSD pair, the STD Standard Account has an average spread of 14 pips, the STP Direct Account has an average spread of 10 pips, and the ECN Account has an average spread of 0 pips. This variation in spreads across different accounts provides traders with flexibility in choosing the trading conditions that best suit their needs. One of the advantages of trading with MHMarkets is the potential for low or even zero spreads, particularly for the ECN Account. However, it is important to note that the commissions associated with trading are unknown, which may pose a disadvantage for traders who prefer full transparency regarding costs. It is recommended that traders consider the spreads and potential costs associated with their preferred account type before making trading decisions.

Trading accounts available in MHMarkets

| Items | STD Standard Account | STP Direct Account | ECN Account |

| Minimum Deposit Requirements | 50 | 100 | 1000 |

| Spread | Low | Low | Ultra-low spread |

| Leverage | Up to 1:400 | Up to 1:400 | Up to 1:400 |

| Margin Call Level | 50% / 30% |

| Advantages | Disadvantages |

| 1. Account options | 1. Higher minimum deposit requirements for certain accounts |

| 2. Different spread options | 2. Potential confusion for traders |

| 3. Leverage up to 1:400 | |

| 4. Margin call level provided |

MHMarkets offers multiple account types to cater to the diverse needs of traders. The three available account types are the STD Standard Account, STP Direct Account, and ECN Account. Each account type has its own minimum deposit requirement, spread options, leverage, and margin call level. The STD Standard Account has a minimum deposit requirement of $50, while the STP Direct Account and ECN Account have higher minimum deposit requirements of $100 and $1000, respectively. Traders can choose the account type that aligns with their trading preferences and capital availability. Additionally, MHMarkets provides different spread options, with the STP Direct Account offering low spreads and the ECN Account providing ultra-low spreads. Traders can take advantage of leverage up to 1:400, allowing them to potentially amplify their trading positions. It is worth noting that different account types may have varying features and benefits, so traders should carefully consider their individual requirements when selecting an account type.

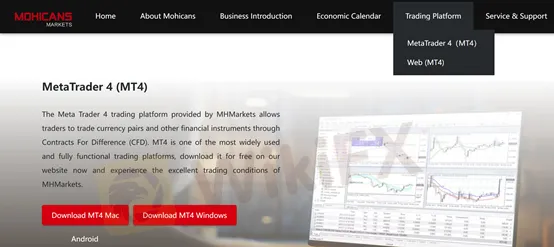

Trading platform(s) that MHMarkets offers

| Advantages | Disadvantages |

| 1. User-friendly interface | 1. Limited charting capabilities compared to newer platforms |

| 2. Wide range of indicators | 2. Not as visually appealing as some modern platforms |

| 3. Customizable features | 3. May require additional plugins for certain functionalities |

| 4. Extensive community support |

MHMarkets offers the popular MetaTrader 4 (MT4) platform to its clients. MT4 is widely recognized in the industry for its user-friendly interface, making it accessible for traders of all experience levels. The platform provides a wide range of technical indicators, allowing traders to conduct thorough analysis and make informed trading decisions. MT4 also offers customizable features, enabling traders to adapt the platform to their individual preferences. Additionally, the platform benefits from an extensive community support network, with numerous online resources, forums, and expert advisors available to assist traders. However, it is important to note that MT4 has certain limitations compared to newer platforms. For instance, its charting capabilities may be more limited, and the platform may not be as visually appealing as some modern alternatives. Additionally, certain functionalities may require the installation of additional plugins. Despite these disadvantages, MT4 remains a popular choice for many traders due to its familiarity, reliability, and the vast array of tools it provides.

Maximum leverage of MHMarkets

| Advantages | Disadvantages |

| 1. Higher potential returns | 1. Increased risk of significant losses |

| 2. Greater trading flexibility | 2. Potential for overleveraging and margin calls |

| 3. Ability to control larger positions | |

| 4. Increased profit opportunities |

MHMarkets offers a maximum leverage of up to 1:400, providing traders with the opportunity to control larger positions in the market. This high leverage ratio offers several advantages. Firstly, it allows for potentially higher returns on investment as traders can amplify their trading positions. Secondly, it provides greater flexibility, enabling traders to take advantage of various market opportunities and strategies. With higher leverage, traders can potentially generate increased profits from smaller market movements. However, it is crucial to consider the disadvantages associated with high leverage. One significant disadvantage is the increased risk of significant losses. Higher leverage amplifies both profits and losses, and traders should be cautious about the potential for substantial drawdowns. Additionally, the possibility of overleveraging and margin calls is a concern. Overextending leverage beyond one's risk tolerance can lead to margin calls, where traders are required to deposit additional funds to maintain their positions. It is essential for traders to carefully manage their risk and use leverage responsibly to mitigate the potential downsides of high leverage.

Deposit and Withdrawal: methods and fees

MHMarkets is ambiguous about how deposits and withdrawals work. Wire transfer, MasterCard, VISA, Maestro and some e-money processors such as Skrill, Neteller, PayPal and others are some of the most frequent and popular payment methods handled by most forex brokers. The speed of withdrawing funds from a forex broker is one of the most important factors in building a broker's reputation.

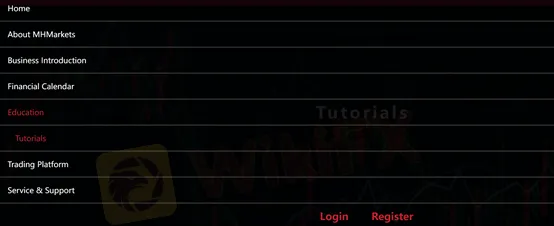

Educational resources in MHMarkets

| Advantages | Disadvantages |

| 1. Access to market insights | 1. Limited variety of educational resources |

| 2. Helps in understanding market trends | 2. Lack of interactive learning opportunities |

| 3. Enables informed trading decisions | |

| 4. Enhances trading skills |

MHMarkets provides educational resources to support traders in their journey. These resources include an economic calendar and tutorials to assist traders in staying informed about important market events and understanding market trends.

You may also visit their official YouTube channel to watch more videos. Here is a video tutorial of theirs.

Customer service of MHMarkets

| Advantages | Disadvantages |

| 1. Multiple channels for customer support | 1. Limited availability of live chat |

| 2. Easy accessibility through popular social media platforms | 2. Potential delay in response time |

| 3. Physical office locations for face-to-face assistance | 3. Language barriers for non-English speaking customers |

MHMarkets offers a variety of customer care options to cater to the needs of its clients. Traders can reach out to the customer support team through various channels, including Facebook, YouTube, Twitter, Instagram, and LinkedIn. These popular social media platforms provide an accessible and convenient means of communication. Additionally, MHMarkets has physical office locations in different regions, such as Australia, Dubai, the United Kingdom, and Saint Vincent, which allow for face-to-face assistance if needed. However, there are a few disadvantages to consider. Firstly, the availability of live chat may be limited, as it is stated to be accessible after logging in. This could pose a challenge for potential or non-registered customers seeking immediate assistance. Secondly, response times may vary, potentially leading to delays in receiving support. Lastly, customers who do not speak English as their primary language might encounter language barriers when interacting with the support team. Nonetheless, the multiple customer care channels and physical office locations contribute to a comprehensive customer support system offered by MHMarkets.

Conclusion

MHMarkets is a well-established forex and CFD broker, regulated by ASIC and headquartered in the United Kingdom. With a strong reputation and a range of trading instruments, including forex, precious metals, energy, indices, and digital currencies, MHMarkets offers diverse opportunities for traders. The company provides various account types, allowing traders to choose the one that suits their needs and preferences. With the popular MT4 platform as its trading software, MHMarkets ensures a seamless and efficient trading experience. The maximum leverage of up to 1:400 offers traders the potential for increased profitability, although it's important to consider the associated risks. The customer support provided by MHMarkets is readily available 24/7 through live chat and social media platforms, ensuring prompt assistance to clients. While the spreads and commissions information is not explicitly provided, MHMarkets strives to offer competitive pricing. Overall, MHMarkets aims to cater to the trading requirements of both novice and experienced traders, providing them with a reliable and regulated platform to participate in the global financial markets.

Frequently asked questions about MHMarkets

Question: What financial instruments can I trade with MHMarkets?

Answer: MHMarkets provides a wide range of trading instruments, including CFDs in foreign exchange, precious metals, energy, index products, digital currencies, and more.

Question: What are the minimum deposit requirements for opening an account with MHMarkets?

Answer: The minimum deposit requirements vary depending on the account type. For the STD Standard Account, the minimum deposit is $50, while the STP Direct Account and ECN Account require a minimum deposit of $100 and $1000, respectively.

Question: What is the maximum leverage offered by MHMarkets?

Answer: MHMarkets offers a maximum leverage of up to 1:400, allowing traders to potentially amplify their trading positions.

Question: Can I trade with MHMarkets using the MT4 platform?

Answer: Yes, MHMarkets supports the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface, advanced charting tools, and automated trading capabilities.

Question: Are there any restrictions on margin call levels with MHMarkets?

Answer: MHMarkets has not specified any specific margin call levels. It is recommended to refer to the account terms and conditions or contact customer support for detailed information.

Question: Does MHMarkets offer ultra-low spreads?

Answer: Yes, MHMarkets offers ultra-low spreads for the ECN Account, providing traders with potentially tighter bid-ask spreads and competitive pricing.

Question: What are the available deposit and withdrawal methods with MHMarkets?

Answer: Unfortunately, the specific deposit and withdrawal methods have not been provided. It is advisable to refer to the MHMarkets website or contact customer support for detailed information regarding funding and withdrawal options.

Broker ng WikiFX

Exchange Rate