Bigbull Markets

abstrak:Bigbull Markets is a global brokerage firm based in the United Kingdom. It provides traders with access to market instruments including Forex, Stocks, Commodities, Indices, Precious Metals, Cryptocurrencies, Futures. However, it is important to note Bigbull Markets is currently not regulated by any recognized financial authorities which may raise concerns when trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Bigbull Markets Review Summary in 10 Points | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Not regulated |

| Marke Instruments | Forex, Stocks, Commodities, Indices, Precious Metals, Cryptocurrencies, Futures |

| Demo Account | Available |

| Leverage | Up to 1:2000 |

| EUR/USD Spread | Start from 0.0 pips (ECN Pro Account) |

| Trading Platforms | MT5 |

| Minimum Deposit | USD 10 |

| Customer Support | Phone, Email, Address |

What is Bigbull Markets?

Bigbull Markets is a global brokerage firm based in the United Kingdom. It provides traders with access to market instruments including Forex, Stocks, Commodities, Indices, Precious Metals, Cryptocurrencies, Futures. However, it is important to note Bigbull Markets is currently not regulated by any recognized financial authorities which may raise concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments across multiple asset classes | • Not regulated |

| • Multiple payment methods supported | • Limited trading tools and educational resources |

| • Flexible leverage ratios | • Not accept clients from some countries |

| • MT5 platforms | • Limited research and analysis tools |

| • Multiple account types | |

| • 7x 24h support | |

| • Acceptable minimum deposit | |

| • Tight starting spreads |

Bigbull Markets Alternative Brokers

There are many alternative brokers to Bigbull Markets depending on the specific needs and preferences of the trader. Some popular options include:

IronFX- With a global presence and a wide range of trading instruments, IronFX offers a solid option for traders looking for a comprehensive brokerage service.

FxPrimus - FxPrimus is a trusted forex broker known for its reliable services and customer-centric approach, making it a recommended option for traders of all levels.

Valutrades- Valutrades is a reputable forex broker that offers a wide range of trading instruments and reliable trading conditions, making it a suitable choice for forex traders looking for a trustworthy platform.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Bigbull Markets Safe or Scam?

When considering the safety of a brokerage like Bigbull Markets or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Its been verified that the broker is currently not regulated by any recognized financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the brokerage. Look for reviews on reputable websites and forums.

Security measures: Bigbull Markets prioritizes the security of its clients' funds by implementing Segregation of funds, ensuring that client funds are kept separate from the company's operational funds.

Ultimately, the decision of whether or not to trade with Bigbull Markets is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Bigbull Markets offers a diverse range of trading instruments to cater to the varying needs of traders.

Clients have access to the dynamic and fast-paced forex market, allowing them to trade major and minor currency pairs to capitalize on global economic fluctuations.

Moreover, traders can explore the world of stocks, participating in the ownership of publicly listed companies and potentially benefiting from dividend payments and capital appreciation.

For those interested in the commodities market, Bigbull Markets enables trading in commodities like crude oil, natural gas, and metals.

Investors can also access indices, representing a basket of stocks from specific markets, and take advantage of market trends.

Additionally, Bigbull Markets provides opportunities to trade precious metals, including gold and silver, offering a hedge against economic uncertainties.

Cryptocurrencies have also become a prominent trading option, allowing clients to speculate on the price movements of digital assets like Bitcoin and Ethereum.

Lastly, for more advanced traders, futures contracts offer the chance to trade financial instruments at predetermined prices, allowing them to manage risk and hedge their positions effectively.

Accounts

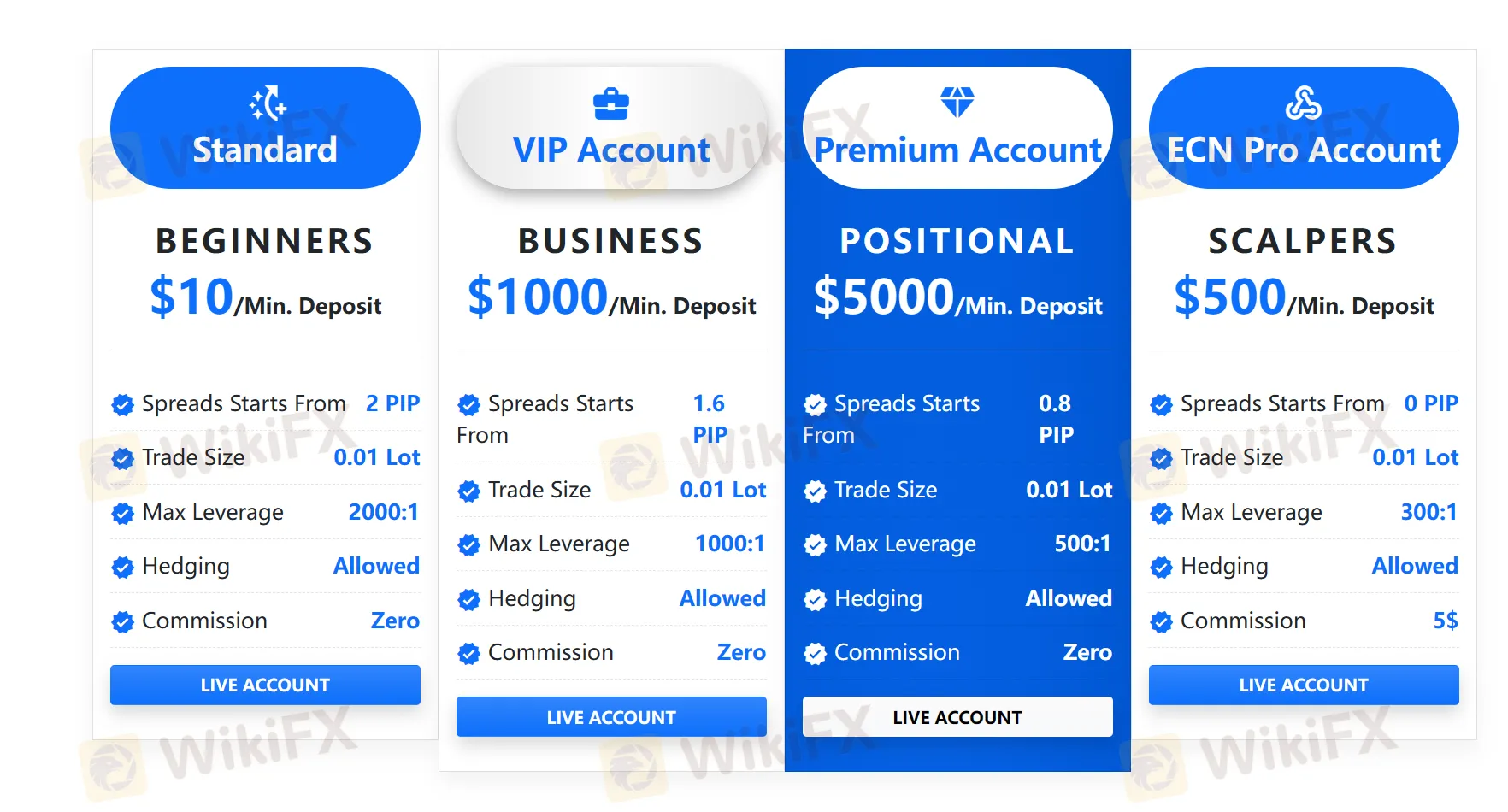

At Bigbull Markets, traders have the flexibility to choose from a variety of account types, each tailored to meet specific trading preferences and experience levels.

The Standard Account offers an accessible entry point with a minimum deposit of $10, making it suitable for beginners or those looking to test the waters of the financial markets.

For traders seeking enhanced trading conditions and additional benefits, the VIP Account requires a minimum deposit of $1000.

The Premium Account takes it up a notch, catering to intermediate traders, with a minimum deposit of $5000.

Lastly, for advanced traders looking for direct market access and ultra-tight spreads, the ECN PRO Account requires a minimum deposit of $500.

Leverage

Bigbull Markets provides a selection of account types, each offering varying leverage to cater to different trading preferences.

The Standard Account comes with a leverage of 1:2000, the VIP Account offers a leverage of 1:1000. The Premium Account, with a leverage of 1:500, strikes a balance between risk management and potential gains, appealing to intermediate-level traders. Lastly, the ECN PRO Account offers a leverage of 1:300, catering to advanced traders who prefer direct access to interbank liquidity and tighter spreads for more precise execution of their strategies.

While higher leverage allows traders to control larger positions with a smaller amount of capital, it also increases the level of risk involved. Traders should exercise caution and carefully manage their risk exposure when utilizing high leverage. It is important to fully understand how leverage works and its potential impact on trading positions before engaging in any trading activities. Traders should consider their risk tolerance and financial situation before deciding on an appropriate leverage level for their trading activities.

Spreads & Commissions

At Bigbull Markets, traders have the flexibility to choose from a range of account types, each tailored to cater to specific trading preferences.

The Standard Account offers a user-friendly option for those new to trading, with spreads starting from 2 pips and zero commission, allowing beginners to explore the markets without worrying about additional fees.

For more experienced traders seeking enhanced trading conditions, the VIP Account presents spreads starting from 1.6 pips, also with zero commission, providing a competitive and rewarding trading environment.

The Premium Account takes it a step further, offering tighter spreads starting from 0.8 pips, ensuring more cost-effective trading without any commission charges.

For advanced traders in pursuit of direct market access and ultra-tight spreads, the ECN PRO Account presents spreads starting from 0.0 pips, along with a commission of $5 per lot traded.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| Bigbull Markets | From 0.0 pips (ECN Pro Account) | $ 5/lot traded (ECN Pro Account) |

| IronFX | From 0.0 pips | Variable (depending on account) |

| FxPrimus | From 0.0 pips | Variable (depending on account) |

| Valutrades | From 0.0 pips | $3 per lot traded |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Trading Platforms

Bigbull Markets provides its clients with the widely acclaimed MetaTrader 5 (MT5) trading platform, available on various devices to ensure maximum accessibility and convenience.

Traders can access MT5 on Windows PCs, enjoying the comprehensive features and analytical tools that empower them to execute trades with precision.

Additionally, Bigbull Markets offers MT5 on iOS and Android devices, allowing traders to stay connected and manage their positions on-the-go through their smartphones or tablets.

Whether on a desktop or mobile device, the MT5 platform provides a seamless and user-friendly trading experience, enabling traders to access a wide range of financial instruments, conduct in-depth market analysis, and execute trades with speed and efficiency.

Overall, Bigbull Marketss trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Bigbull Markets | MT5 |

| IronFX | MT4, WebTrader |

| FxPrimus | MT4, MT5, cTrader, WebTrader |

| Valutrades | MT5, MT4 |

Deposits & Withdrawals

Bigbull Markets offers a comprehensive range of payment methods to facilitate easy deposits and withdrawals for its clients.

Traders can fund their accounts conveniently through bank wire transfer, Mastercard, Visa, Union Pay, American Express, Skrill and even Bitcoin, providing diverse options to suit individual preferences.

Notably, the platform supports 24/7 availability for deposits and withdrawals, allowing traders to access their funds at any time, even during weekends.

To initiate a withdrawal, clients need to fill out a withdrawal form and submit it through the platform, ensuring a secure and straightforward process.

Customer Service

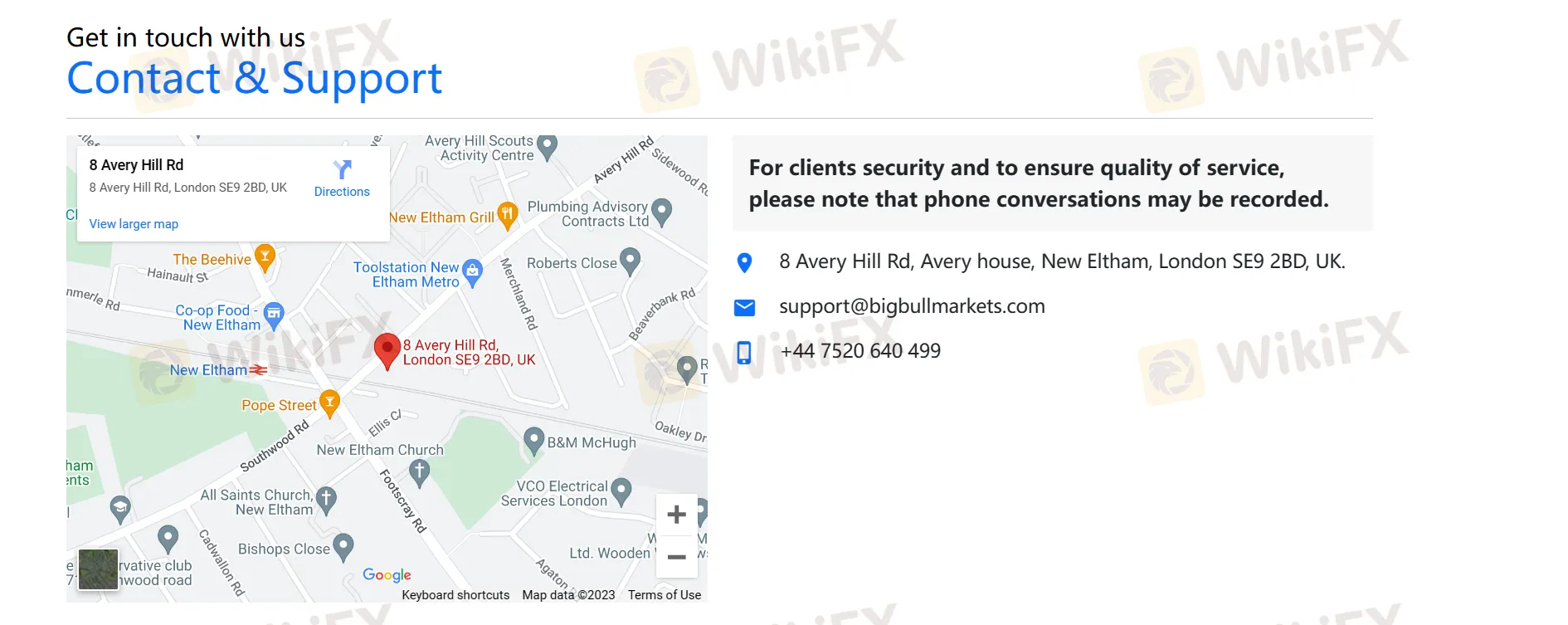

Bigbull Markets provides multiple customer service options to assist its clients. Customers can reach out to Bigbull Markets through various channels to address their queries and concerns as below:

E-mail:support@bigbullmarkets.com.

Phone: +44 7520 640 499

Address: 8 Avery Hill Rd, Avery house, New Eltham, London SE9 2BD, UK.

Conclusion

According to available information, Bigbull Markets is a non-regulated UK-based brokerage firm. While the firm offers a range of market instruments such as Forex, Stocks, Commodities, Indices, Precious Metals, Cryptocurrencies, Futures, it is important to consider certain factors such as lack of regulations that may raise concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Bigbull Markets before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is Bigbull Markets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does Bigbull Markets offer the industry leading MT4 & MT5? |

| A 2: | Yes, it offers MT5 platform on Window, iOS and Android devices. |

| Q 3: | Is Bigbull Markets a good broker for beginners? |

| A3: | No. It is not a good choice for beginners. Its been verified the broker currently has no valid regulations from recognized regulatory authorities. |

| Q 4: | Does Bigbull Markets offer demo accounts? |

| A 4: | Yes. |

| Q 5: | What is the minimum deposit for Bigbull Markets? |

| A 5: | The minimum initial deposit to open an account is $10. |

| Q 6: | At Bigbull Markets, are there any regional restrictions for traders? |

| A 6: | Yes. Bigbull Markets does not provide services to residents of jurisdictions of U.S.A, Cuba, Iran, Syria, Sudan, North Korea. |

Broker ng WikiFX

Pinakabagong Balita

Challenge Yourself: Transform from Novice to Expert

Exchange Rate