Real FX

abstrak:Real FX, launched in 2023 and operating from Saint Vincent and the Grenadines, provides trading services in multiple markets, including Forex and Commodities. The brokerage accommodates a range of traders with accounts starting at $10 and offering high leverage. Utilizing the MT4 platform, it appeals to those interested in automated trading. Nevertheless, the absence of regulatory oversight and limited educational and support options present notable drawbacks, especially for inexperienced traders.

| Aspect | Information |

| Company Name | Real FX |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2023 |

| Regulation | No Regulation |

| Tradable Assets | Forex, Commodities, Indices, Stocks |

| Account Types | Standard Account, ECN Account, Premium Account |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:500 |

| Spreads | Standard: 20, ECN: 0, Premium: 1.2 |

| Trading Platforms | MT4 |

| Demo Account | Available |

| Customer Support | Phone: +31 23 456 789, Email: info@realforexr.com |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Card, E-Wallet |

| Educational Resources | No Educational Resources |

Overview of Real FX

Founded in 2023 and based in Saint Vincent and the Grenadines, Real FX is a forex broker that attends to global clientele. The broker offers trading in Forex and a variety of other financial markets, suitable for different trader profiles through its Standard, ECN, and Premium Accounts. Real FX is characterized by its competitive trading conditions, including low minimum deposits beginning at just $10 and high leverage options reaching 1:500, appealing to both new and seasoned traders. Operating on the popular MT4 platform, Real FX ensures a reliable trading experience. While the broker excels in providing effective customer support and a variety of payment methods for easy transactions, it distinguishes itself by not offering educational resources, positioning as a more suitable option for traders who already possess trading knowledge or prefer a direct, no-frills trading experience.

Pros and Cons

Real FX, established in 2023 in Saint Vincent and the Grenadines, offers various account types, including Standard, ECN, and Premium, with low initial deposits. The availability of EA support appeals to traders interested in automated trading strategies. The provision of the MT4 platform aligns with the preferences of many experienced traders.

However, the lack of regulatory oversight is a significant concern, as it implies less protection for traders funds and potential risks in fair trading practices. The limited disclosure about spreads, commissions, and trading conditions hinder informed decision-making for potential clients. Also, Real FX does not offer comprehensive educational materials, which are crucial for beginners.

Moreover, their customer support is restricted to phone and email, lacking the immediacy of live chat services. The operational base in Saint Vincent and the Grenadines often indicates less stringent regulatory standards, which can be a red flag for risk-averse traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Is Real FX legit or a scam?

Real FX is not governed by any financial regulatory authority. This unregulated status means that Real FX is not subject to the financial norms and monitoring usually enforced by such bodies. Consequently, trading with Real FX involves substantial risks. The dangers include a lack of financial security and transparency, and the possibility of unresolved disputes or loss of funds owing to the absence of regulatory protection.

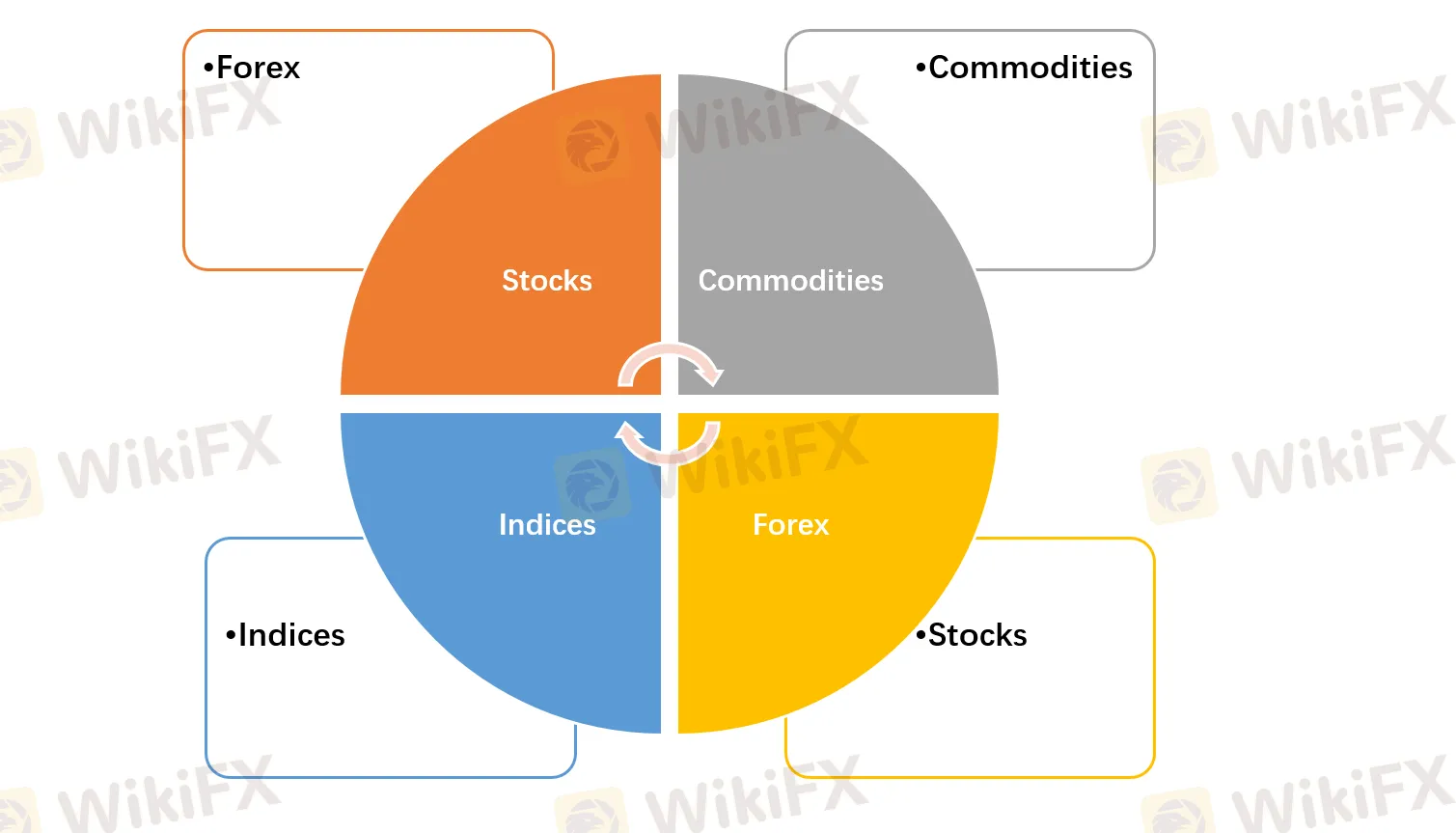

Market Instruments

Real FX provides its clients with an array of trading instruments, encompassing Forex, Commodities, Indices, and Stocks. This various selection is created to suit various trading styles and objectives:

Forex Trading: Real FX offers a comprehensive range of currency pairs, encompassing major, minor, and potentially exotic pairs for different forex trading opportunities.

Commodity Trading: Traders have access to a selection of key commodities such as gold, silver, and oil, which can be crucial for portfolio diversification.

Indices Trading: Access to significant global indices is available, allowing traders to engage with broader market trends.

Stock Trading: A varied collection of stocks from multiple sectors are offered, appealing to traders interested in equity markets.

Account Types

Real FX offers three distinct types of trading accounts, fulfilling different needs:

Standard Account:

Minimum Deposit: $10

Minimum Spread: 20

Maximum Leverage: 1:100

Commission: No

Supported EA (Expert Advisor): Yes

ECN Account:

Minimum Deposit: $1000

Minimum Spread: 0

Maximum Leverage: 1:500

Commission: No

Supported EA: Yes

Premium Account:

Minimum Deposit: $100

Minimum Spread: 1.2

Maximum Leverage: 1:500

Commission: No

Supported EA: Yes

These account types are intended to serve a wide spectrum of trading strategies and capital requirements, from entry-level traders to more experienced ones seeking higher leverage or tighter spreads. The ECN account, with its higher deposit requirement, offers tighter spreads, making it suitable for high-volume, experienced traders. In contrast, the Standard and Premium accounts offer more flexibility for those with lower capital investment or different trading strategies.

| Feature | Standard Account | ECN Account | Premium Account |

| Minimum Deposit | $10 | $1,000 | $100 |

| Minimum Spread | 20 | 0 | 1.2 |

| Maximum Leverage | 1:100 | 1:500 | 1:500 |

| Commission | No | No | No |

| Supported EA | Yes | Yes | Yes |

How to Open an Account with Real FX?

Real FX streamlines the process of opening an account for traders.

Initially, prospective clients should visit Real FX's website and register. This is followed by filling out a registration form with personal details and creating login credentials.

The next step involves email verification, which is a standard security measure.

After verifying their email, clients are required to provide additional documentation for identity and address verification.

Upon successful verification, clients can fund their account using various payment options provided by Real FX.

Finally, clients are equipped to begin trading, with a recommendation for beginners to utilize the demo account for practice and acclimation to the platform.

Leverage

Real FX offers different leverage options across its various account types:

Standard Account:

Maximum Leverage: 1:100

ECN Accounts:

Maximum Leverage: 1:500

Premium Account:

Maximum Leverage: 1:500

Spreads & Commissions

Real FX presents a varied spread and commission structure across its account offerings, satisfying distinctive trading needs. The broker's account types include Standard, ECN, and Premium.

The Standard Account is beginner-friendly, offering spreads starting from 20 pips and no commission charges.

The ECN Account is developed for seasoned traders, benefits from ultra-tight spreads starting at 0.0 pips and remains commission-free.

The Premium Account, suitable for intermediate traders, strikes a balance with competitive spreads beginning at 1.2 pips and no commission.

This structure ensures that Real FX can accommodate a wide range of trading preferences, from novices to veterans, aligning with individual risk appetites and trading strategies.

Other Fees

Real FX's fee structure, beyond trading costs, includes several non-trading fees that traders need to be mindful of:

Overnight Interest Fees: These fees apply to positions held overnight, with rates depending on the specific currency pair and trade direction.

Inactivity Fees: Accounts dormant for a certain period attract a monthly inactivity fee, deducted from the account balance.

No Account Maintenance Fees: Real FX ensures transparent cost structures by not charging account maintenance fees, thereby focusing costs primarily on actual trading activities.

Trading Platform

Real FX utilizes the MetaTrader 4 (MT4) platform, meeting the needs of a broad spectrum of traders through its versatile features:

Intuitive Design: MT4's straightforward interface is suitable for traders of all experience levels, offering ease of navigation and use.

Sophisticated Charting: The platform's advanced charting tools enable deep market analysis, aiding traders in making well-informed trading decisions.

Automated Trading Support: With the integration of Expert Advisors (EAs), MT4 facilitates automated trading, allowing for the implementation of complex strategies with minimal manual intervention.

Customization Options: Traders can tailor their experience with various indicators, adapting the platform to their unique trading styles.

Cross-Platform Trading: The availability of MT4 on multiple devices, including desktops and mobiles, ensures that traders can stay connected to the markets and their trades at all times.

Deposit & Withdrawal

Real FX offers a variety of deposit and withdrawal methods with a notably low minimum deposit of just $10 for its Standard Account. Others are $1000 for ECN Account and $100 for Premium Account.This approach is particularly appealing for new traders or those hesitant to invest large sums initially. Available methods include:

Bank Transfers: Ideal for clients preferring traditional banking methods, particularly for substantial transfers.

Credit/Debit Cards: This method provides a swift and straightforward way to handle transactions, favored for its ease of use.

E-Wallets: A modern alternative for electronic transactions, adding an extra layer of convenience.

Customer Support

Real FX provides customer support through the following methods:

Phone Assistance: Clients can contact the support team directly at +31 23 456 789, offering a straightforward approach for immediate queries or urgent issues.

Email Correspondence: For detailed inquiries or when clients require written documentation of their interactions, Real FX can be reached atinfo@realforexr.com. This method is particularly beneficial for complex questions that need in-depth responses.

The lack of a live chat feature is notable, as this could affect the response time and immediacy for clients preferring instant communication.

Conclusion

Real FX, inaugurated in 2023 and based in Saint Vincent and the Grenadines, offers a mixed experience for traders. Its advantages include a low entry barrier with a $10 minimum deposit and varied account types such as Standard, ECN, and Premium, suited for different trading preferences. The broker's support for automated trading via Expert Advisors and the provision of the widely-used MT4 platform add to its appeal. Moreover, Real FX facilitates various deposit and withdrawal options, enhancing transactional ease.

Conversely, the broker's unregulated nature is a significant drawback, entailing heightened risks stemming from the lack of oversight by financial authorities. This could impact financial security and the integrity of trading practices. The absence of educational materials limits its suitability for novice traders. Additionally, the limited scope of customer support, coupled with opaque trading conditions and a narrow range of instruments. Operating from a jurisdiction with less rigorous regulatory standards and lacking negative balance protection further amplifies concerns, particularly for cautious traders.

FAQs

Q: Regulation status of Real FX?

A: Real FX operates without regulatory oversight, being based in Saint Vincent and the Grenadines, a region with less stringent financial regulations.

Q: Account varieties at Real FX?

A: Real FX appeals to distinctive trading needs through its Standard, ECN, and Premium accounts, each tailored to different trading styles.

Q: Minimum deposit for Real FX trading?

A: A minimal investment of $10 is required to start trading with Real FX, making it accessible to various traders.

Q: Trading platform used by Real FX?

A: Real FX employs the MT4 platform, renowned for its ease of use and automated trading capabilities through Expert Advisors.

Q: Educational support at Real FX?

A: Real FX does not appear to emphasize educational support, which could be a shortfall for traders new to forex.

Q: Risks with unregulated brokers like Real FX?

A: Engaging with an unregulated broker like Real FX carries risks such as diminished fund security, potential unfair trading practices, and limited dispute resolution options.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

Broker ng WikiFX

Exchange Rate