Weltrade

abstrak:Weltrade is an unregulated brokerage established in 2006 offering a range of trading assets on MetaTrader 4 and MetaTrader 5 platforms. The firm provides several account options suitable for traders at various skill levels, accompanied by competitive leverage and spread options. Weltrade also emphasizes the quick and varied deposit and withdrawal methods, along with a comprehensive educational and bonus system to assist and incentivize its users. However, potential traders should be cautious due to the lack of regulatory oversight, which could imply risks not present with regulated brokers.

| Weltrade | Basic Information |

| Company Name | Weltrade |

| Founded | 2006 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Unregulated |

| Tradable Assets | Forex, Metals, Index CFDs, Commodities, Crypto CFDs, Stock CFDs, Exotics |

| Account Types | Micro, Pro, Premium |

| Minimum Deposit | Micro: 1 USD, Pro: 100 USD, Premium: 25 USD |

| Maximum Leverage | 1:1000 for all account types |

| Spreads | Floating from 0.5 pips for Pro and Premium accounts, and from 1.5 pips for Micro account |

| Commission | None |

| Deposit Methods | Credit/Debit Cards, E-Wallets, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Email(info@weltrade.com), Phone(+44-20-34116458), Live Chat, Message, Call Back Request |

| Education Resources | Webinars, Seminars, MetaTrader Guide, Demo Account, MQL5 Signals, Robots, Indicators |

| Bonus Offerings | WelBox Quests, Dividends on Margin, First Deposit Bonus, ASTROCARDS, SPINNER, Credit Bonus 100%, No-Commission Deposit |

Overview of Weltrade

Weltrade is an unregulated brokerage established in 2006 offering a range of trading assets on MetaTrader 4 and MetaTrader 5 platforms. The firm provides several account options suitable for traders at various skill levels, accompanied by competitive leverage and spread options. Weltrade also emphasizes the quick and varied deposit and withdrawal methods, along with a comprehensive educational and bonus system to assist and incentivize its users. However, potential traders should be cautious due to the lack of regulatory oversight, which could imply risks not present with regulated brokers.

Is Weltrade Legit?

Weltrade is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like Weltrade, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices.

Pros and Cons

Weltrade boasts a comprehensive selection of trading instruments, catering to a broad audience with three distinct trading accounts tailored to different expertise levels. The brokerage provides the widely-used MetaTrader platforms and is dedicated to supporting traders with a variety of educational resources and attractive bonus offerings. Moreover, clients can benefit from a customer support team that is available around the clock through multiple communication channels. However, potential clients should approach with caution, as Weltrade operates without regulation, which can introduce significant risks. Additionally, there is scant information available regarding the company's ownership and financial stability, and services might not be consistent across different geographical locations.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

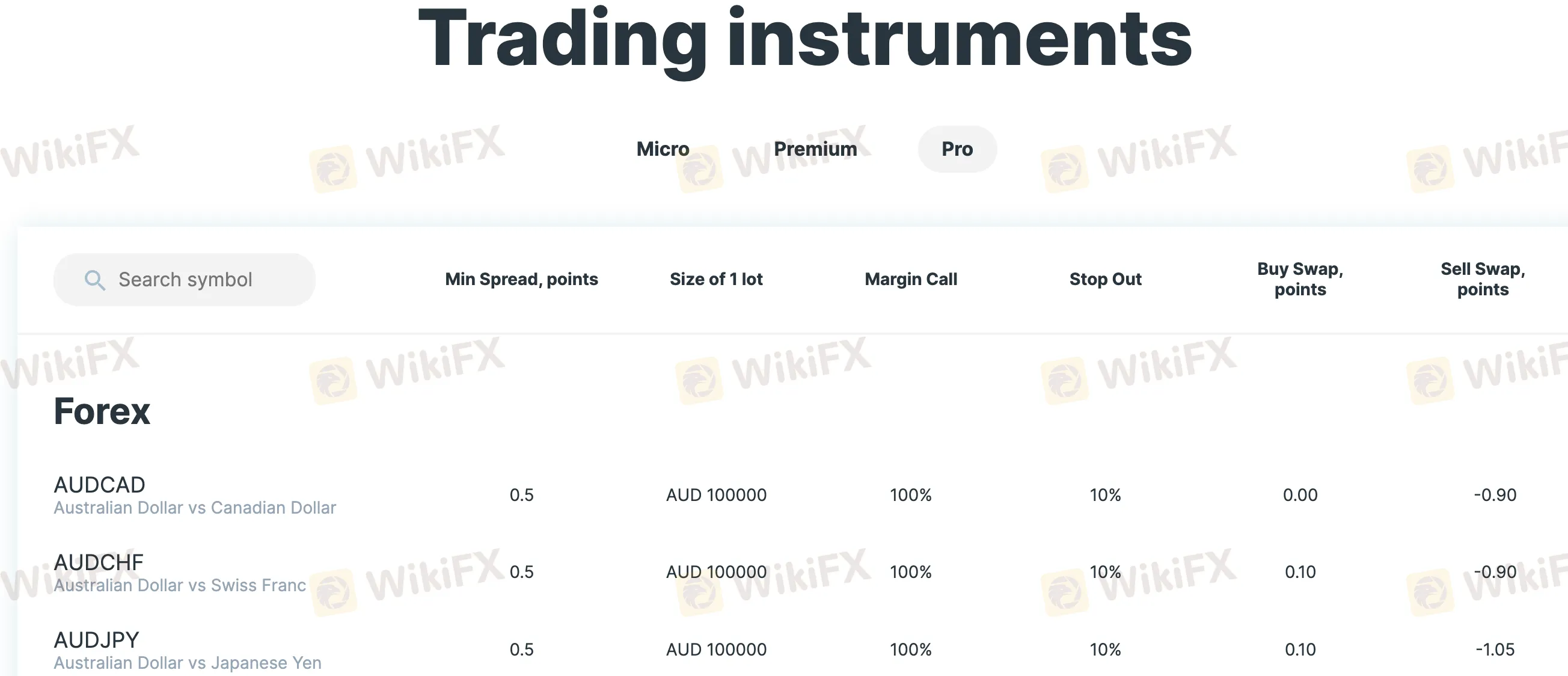

Trading Instruments

Weltrade offers a broad range of trading instruments across different categories, including:

Forex: Offers major pairs like AUDCAD, AUDCHF, and exotic pairs, each with specific spreads, lot sizes, and swap points.

Metals: Trades in precious metals like Gold (XAUUSD), Silver (XAGUSD), Palladium (XPDUSD), and Platinum (XPTUSD) with defined lot sizes and swap points.

Index CFDs: Provides trading in various global indices such as Dow Jones (DJIUSD), Nikkei 225 (JPXJPY), and S&P 500 (SPXUSD) with specific index sizes and swap percentages.

Commodities: Offers trading in Brent (XBRUSD) and Crude Oil (XTIUSD) with set barrel sizes and swap points.

Crypto CFDs: Includes a variety of cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), and Litecoin (LTCUSD) with distinct lot sizes and annual swap percentages.

Stock CFDs: Facilitates trading in stocks from major companies such as Apple, Amazon, and Tesla, indicating the unit size and swap percentages per annum.

Exotics: Features unique pairings like Bitcoin versus Thai Baht (BTCTHB) and Gold versus Silver (XAUXAG), highlighting the unit sizes and swap points.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Weltrade | RoboForex | FxPro | IC Markets |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | Yes |

| Options | No | No | Yes | No |

Account Types

Micro Account: Suitable for beginners and offers micro lots in cents USD/EUR with a starting deposit as low as 1 USD. Spreads start from 1.5 pips, and it supports up to 1000 open orders without commissions. Leverage can go up to 1:1000, and trading is executed on the MetaTrader 4 and 5 platforms.

Pro Account: Designed for more seasoned traders and requires a starting deposit of 100 USD. It provides tighter spreads starting from 0.5 pips and allows up to 150 open orders. This account also offers leverage up to 1:1000 and no commission on trades.

Premium Account: Aimed at advanced traders and has a starting deposit requirement of 25 USD. Spreads begin at 1.5 pips, and similar to the Pro account, it allows up to 100 open orders with a leverage of up to 1:1000. There is no commission on trades, and it uses the MetaTrader platforms.

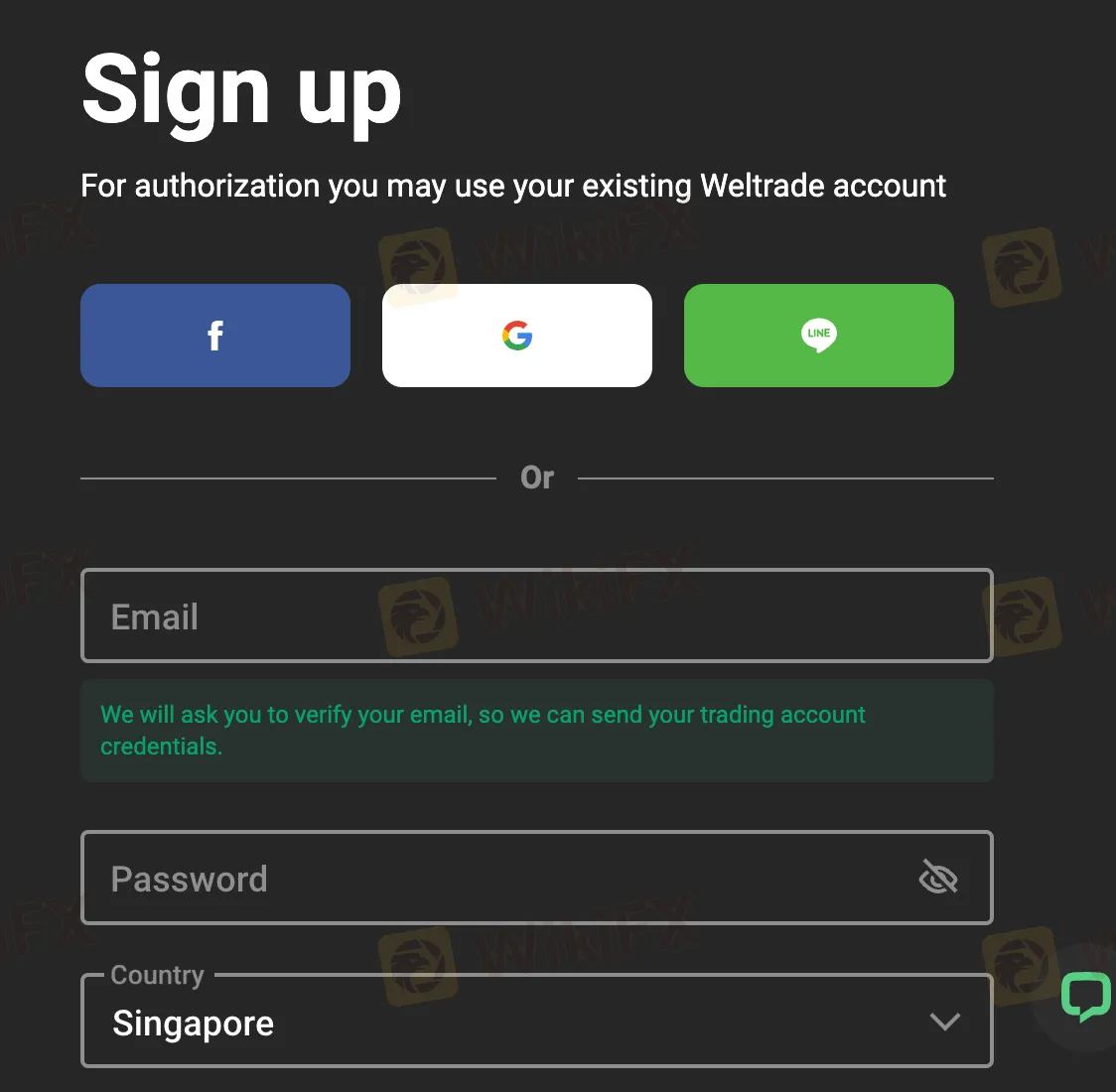

How to Open an Account

To open an account with Weltrade, follow these steps.

Visit the Weltrade website. Look for the “REGISTRATION” button on the homepage and click on it.

2. Sign up on websites registration page.

3.Receive your personal account login from an automated email

4.Log in

5.Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

Weltrade offers leverage up to 1:1000 for all its account types, including Micro, Pro, and Premium.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Weltrade | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:1000 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions

Weltrade offers floating spreads starting from as low as 0.5 pips for the Pro and Premium accounts, and from 1.5 pips for the Micro account. There are no commission charges on trades across all account types.

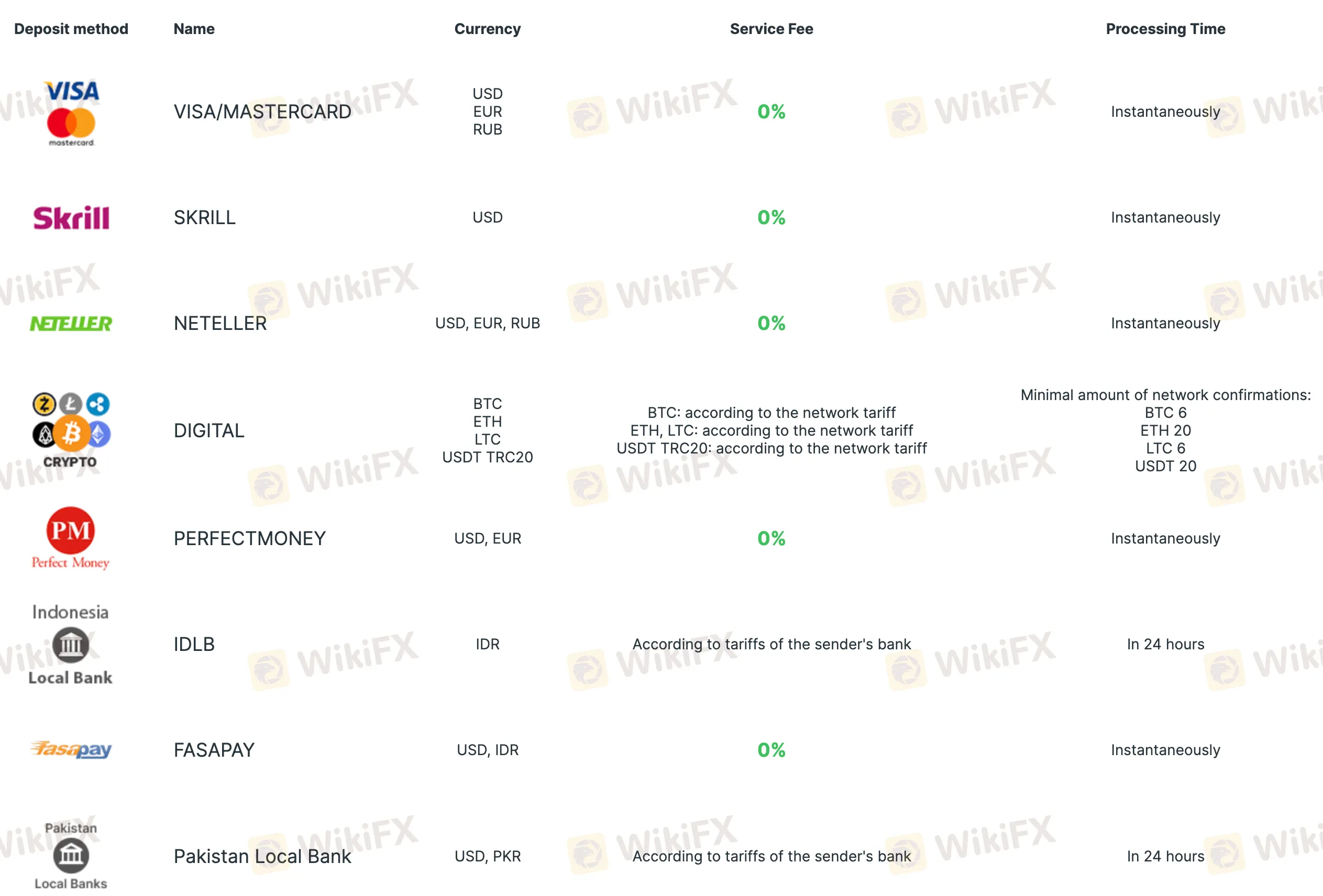

Deposit & Withdraw Methods

Weltrade supports various deposit and withdrawal methods with no service fees for most options and immediate processing times for deposits. These include credit/debit cards (VISA/MASTERCARD), e-wallets like SKRILL and NETELLER, cryptocurrency options (BTC, ETH, LTC, USDT TRC20), PERFECTMONEY, and local bank transfers in Indonesia and Pakistan. Withdrawal methods mirror the deposit options but may include a service fee, with processing times typically within 30 minutes. Cryptocurrency withdrawals have network-specific fees.

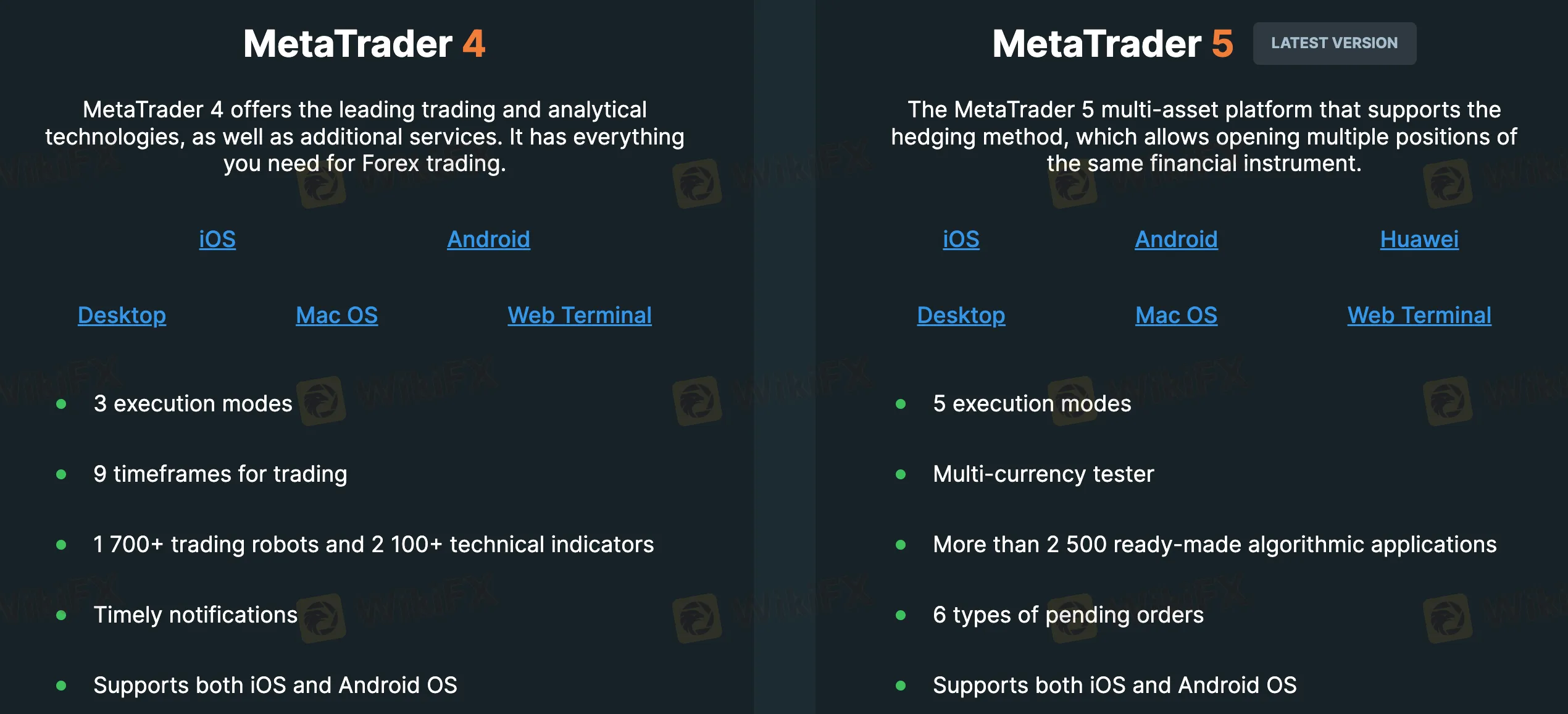

Trading Platforms

Weltrade offers two trading platforms: MetaTrader 4 and MetaTrader 5. MetaTrader 4 (MT4) is known for its analytical technologies and additional services, supporting a range of devices including iOS, Android, Desktop, Mac OS, and offers a web terminal. MT4 features 3 execution modes, 9 timeframes for trading, over 1,700 trading robots, more than 2,100 technical indicators, and provides timely notifications.

MetaTrader 5 (MT5) is the latest version that supports hedging and multiple positions of the same financial instrument. Available on iOS, Android, Huawei, Desktop, and Mac OS, as well as offering a web terminal, MT5 includes 5 execution modes, a multi-currency tester, more than 2,500 ready-made algorithmic applications, 6 types of pending orders, and is compatible with both iOS and Android operating systems.

Customer Support

Weltrade provides 24/7 customer support through various channels. Customers can send a message directly on the website, initiate a live chat for immediate assistance, request a call back, or contact support via email at info@weltrade.com. Additionally, customers can reach out via phone at +44-20-34116458.

Educational Resources

Weltrade offers a range of educational resources including webinars and seminars for live instruction, comprehensive guides for using MetaTrader platforms, a demo account for practice trading, and access to MQL5 signals as well as various trading robots and indicators to aid in technical analysis.

Bonus

Weltrade offers a variety of bonuses and promotional programs including WelBox Quests with cash rewards, dividends on margin, a first deposit bonus, ASTROCARDS for additional funds, a SPINNER wheel with various bonuses, a 100% credit bonus on deposits, and no-commission deposit options to enhance the trading experience of their clients.

Conclusion

Weltrade offers an extensive range of trading instruments and account types tailored to different levels of traders, supported by robust trading platforms and a comprehensive educational resource pool. While its bonus programs and customer service are attractive features, the lack of regulation is a significant drawback that could impact the security and transparency of trading operations. Traders should weigh the advantages of Weltrade's offerings against the potential risks inherent in an unregulated environment.

FAQs

Q: Is Weltrade a regulated broker?

A: No, Weltrade does not currently hold a regulation from a recognized financial regulatory authority.

Q: What trading platforms does Weltrade support?

A: Weltrade offers trading via MetaTrader 4 and MetaTrader 5 platforms.

Q: What types of accounts can I open with Weltrade?

A: Weltrade provides Micro, Pro, and Premium accounts.

Q: How can I deposit funds into my Weltrade account?

A: You can deposit funds using various methods including credit/debit cards, e-wallets, and cryptocurrencies.

Q: Does Weltrade offer educational resources?

A: Yes, Weltrade provides webinars, seminars, and other educational materials.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Broker ng WikiFX

Exchange Rate