PGM

abstrak: Established in Australia in 2005, PGM offers a wide range of trading assets including forex pairs, indices, commodities, and precious metals. With over 10,000 trading varieties, competitive spreads, and leverage up to 1:400, the platform serves traders of all experience levels. While regulated by Australian authorities, offering negative balance protection, and featuring the MetaTrader 4 and MetaTrader 5 platforms, PGM provides a robust trading environment. However, limitations include a high minimum deposit requirement for the ECN Account, limited educational resources, and the absence of a dedicated mobile trading app.

| PGWReview Summary | |

| Founded | 1995 |

| Registered Country/Region | Melbourne, Australia |

| Regulation | ASIC |

| Market Instruments | FuturesCommoditiesPrecious metalsStocks indexForex exchange |

| Demo Account | ✅(STP account) |

| Leverage | Up to 1:400 |

| Spread | As low as 0.5 pips |

| Trading Platform | MT4 & MT5 |

| Min Deposit | $100 |

| Customer Support | Live chat |

| Email: cn.support@pgmfx.com | |

| Physical Address: INP MELBOURNE, Suite 103, 566 St kilda Road MELBOURNE VIC 3004 | |

PRIMETIME GLOBAL MARKETS Information

PGM was incorporated in Australia in 2015. Currently, PGM mainly provides CFD trading services such as foreign exchange, precious metals, energy, index products, and crypto currencies.

PGM supports the use of the MT4 and MT5 platforms and offers three types of accounts for traders to choose from.

Pros and Cons

| Pros | Cons |

| Multiple strict regulations | The high minimum deposit of ¥5000 for ECN Account |

| More than 10,000 trading products | |

| 400 times leverage | |

| 24/7 service | Delayed response |

| Dedicated servers for data security | |

| Negative Balance Protection | |

| Ultra-low spreadsSpread as low as 0.1pips |

Is PRIMETIME GLOBAL MARKETS Legit?

It is authorized and regulated by the Australian Securities & Investments Commission (ASIC), Regulation Number (AFSL) 470050.

What Can I Trade on PGM?

PGM says it offers 1,0000 + products, Primetime Global Markets allows you to invest in futures, foreign exchange, precious metals, commodities, and stock indices with just one account.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Commodities | ✔ |

| Precious metals | ✔ |

| Foreign exchange | ✔ |

| Stocks | ✔ |

| Options | ✔ |

| Indices | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

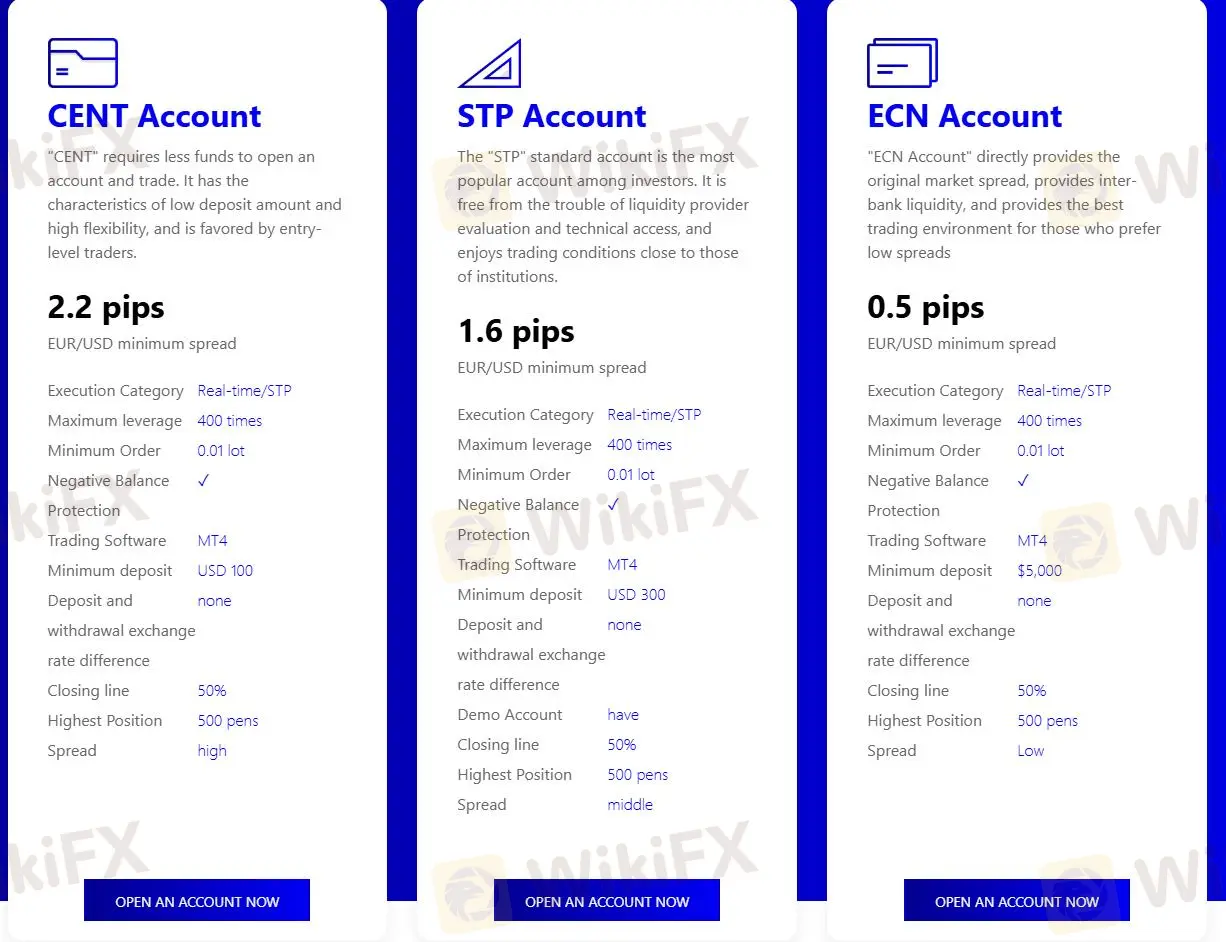

PGM offers three types of accounts for traders: CENT ACCOUNT, STP ACCOUNT, and ECN ACCOUNT. Minimum deposits range from $100 to $5000, and leverage can be up to 1:400.PGM supports trading 10,000+ CFDs.

When it comes to opening an account, PGM gives clear and easy steps. You may refer to:

PGM Fees

PGM offers competitive spreads and commissions across its different account types.

The CENT Account features a minimum spread of 2.2 pips for EUR/USD, making it suitable for beginners with smaller trading volumes and a focus on affordability.

In contrast, the STP Account presents tighter spreads, with a minimum of 1.6 pips for EUR/USD, appealing to traders seeking a balance between cost-effectiveness and functionality.

For experienced traders looking for the lowest spreads, the ECN Account stands out with a minimum spread of 0.5 pips for EUR/USD, albeit requiring a higher minimum deposit.

PGM does not charge any account inactivity fees.

Trading Platform

PGM allows traders to trade with both MT4 and MT5 platforms on Windows Desktop, Google Play, Android APK, iOS mobile terminal, as well as the Web page (for MT4 only).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows DesktopGoogle PlayAndroid APKiOS mobile terminalWeb page | Novice Trader |

| MT5 | ✔ | Windows DesktopGoogle PlayAndroid APKiOS mobile terminal | Skilled traders |

Deposit and Withdrawal

The minimum deposit requirement varies based on the chosen account type: 100USDfortheCENTAccount,300 for the STP Account, and $5,000 for the ECN Account.

But they didn't disclose the deposit and withdrawal methods on their official website.

Broker ng WikiFX

Exchange Rate