2024-12-25 16:23

IndustriyaYields Rise as Investors Eye Long-Term Risks

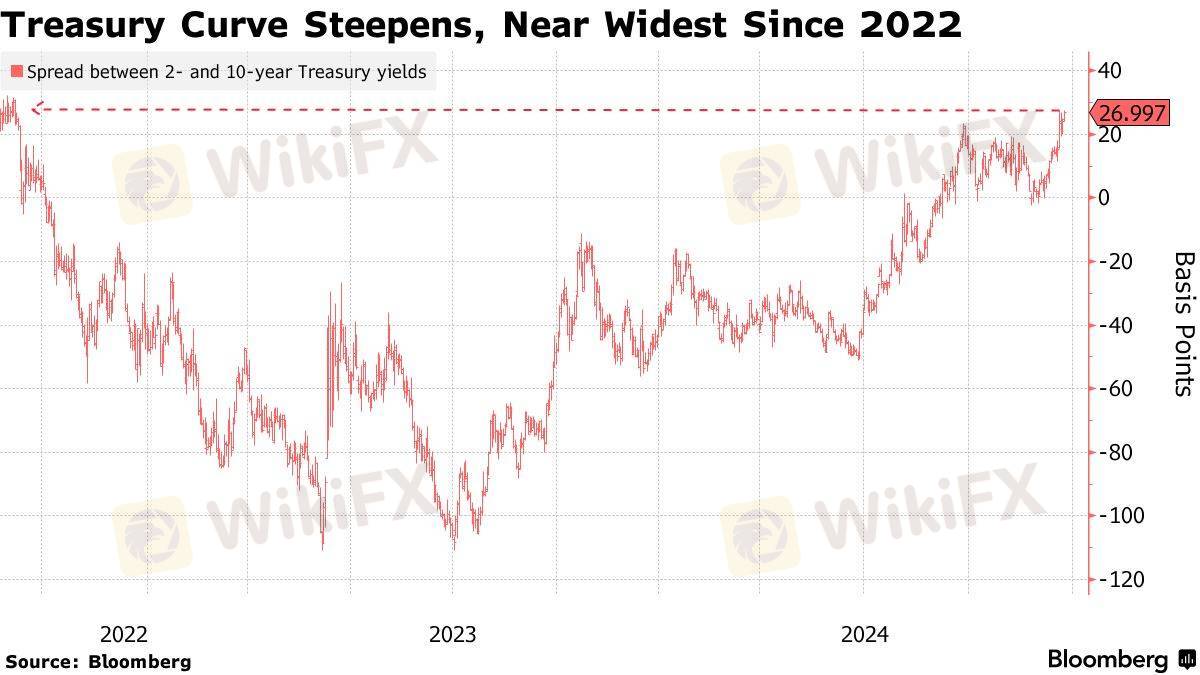

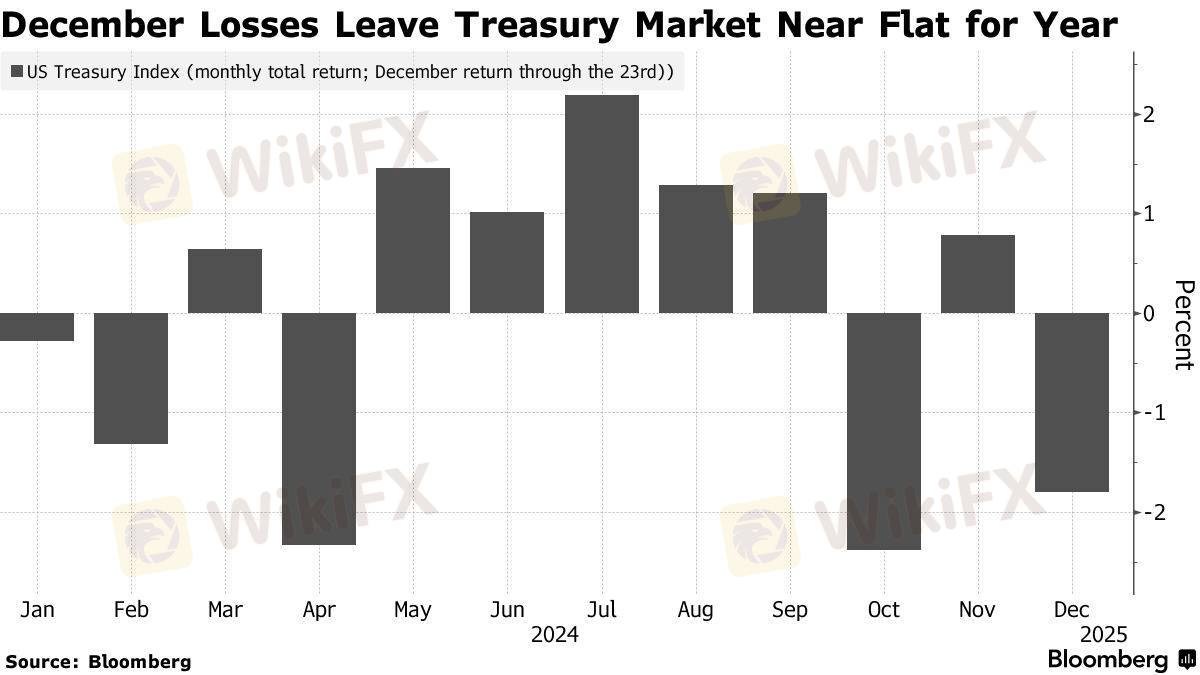

Long-term Treasury yields climbed Wednesday, with 10-year yields at 4.62%, amid low holiday trading volumes. The steepening curve reflects caution over the Fed’s higher terminal rate outlook and fiscal uncertainty under Trump’s incoming administration.

Options traders are betting on further yield increases, with 10-year yields potentially reaching 5% in 2025. Swaps market pricing suggests just 0.33% in Fed rate cuts next year, below the Fed’s projections, fueling further rate concerns.

#Bonds #Treasuries #InterestRates #FederalReserve #USDebt #Yields #Economy

Katulad 0

Gamma Squeezer

Trader

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Yields Rise as Investors Eye Long-Term Risks

| 2024-12-25 16:23

| 2024-12-25 16:23Long-term Treasury yields climbed Wednesday, with 10-year yields at 4.62%, amid low holiday trading volumes. The steepening curve reflects caution over the Fed’s higher terminal rate outlook and fiscal uncertainty under Trump’s incoming administration.

Options traders are betting on further yield increases, with 10-year yields potentially reaching 5% in 2025. Swaps market pricing suggests just 0.33% in Fed rate cuts next year, below the Fed’s projections, fueling further rate concerns.

#Bonds #Treasuries #InterestRates #FederalReserve #USDebt #Yields #Economy

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.