2024-12-25 21:51

IndustriyaOverview of the PO3 Trading Strategy

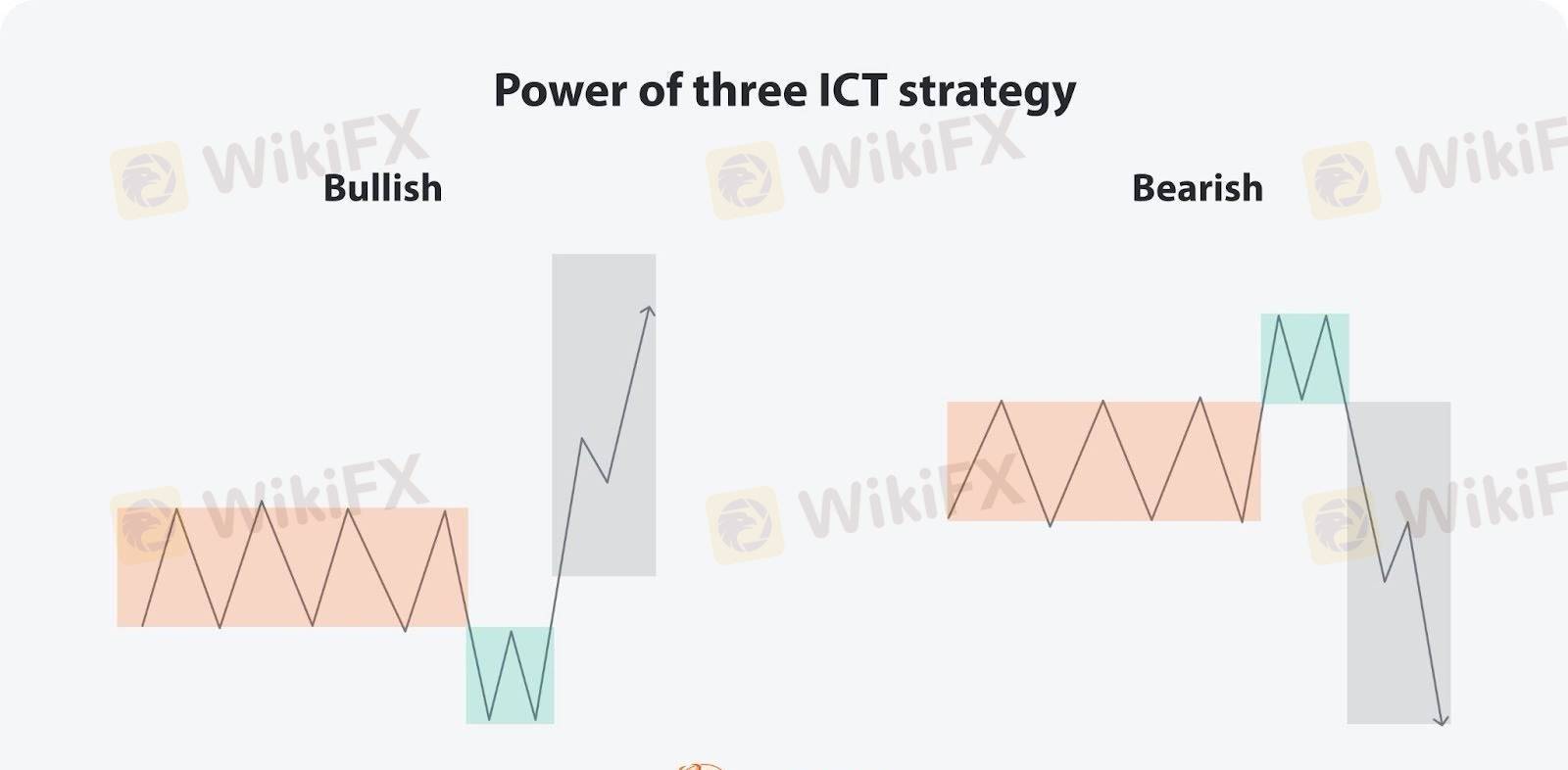

The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

Katulad 0

Kevin Cao

Трейдер

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Overview of the PO3 Trading Strategy

Hong Kong | 2024-12-25 21:51

Hong Kong | 2024-12-25 21:51The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.