2025-01-29 17:05

IndustriyaSwing Trading Strategies

#firstdealofthenewyearFateema

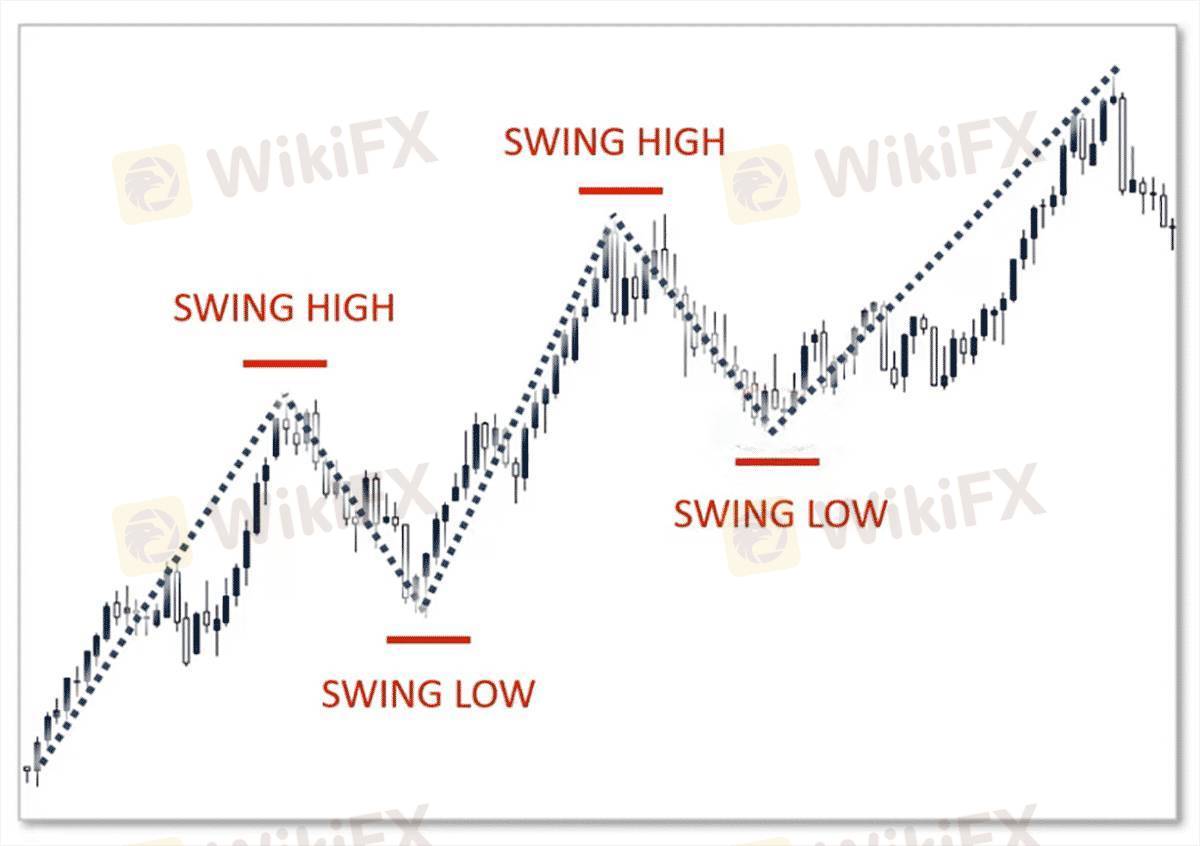

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Katulad 0

Veinticinco25

Trader

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Swing Trading Strategies

Nigeria | 2025-01-29 17:05

Nigeria | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.