2025-01-31 17:56

IndustriyaHow to Determine your forex trading lot sizes.

#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

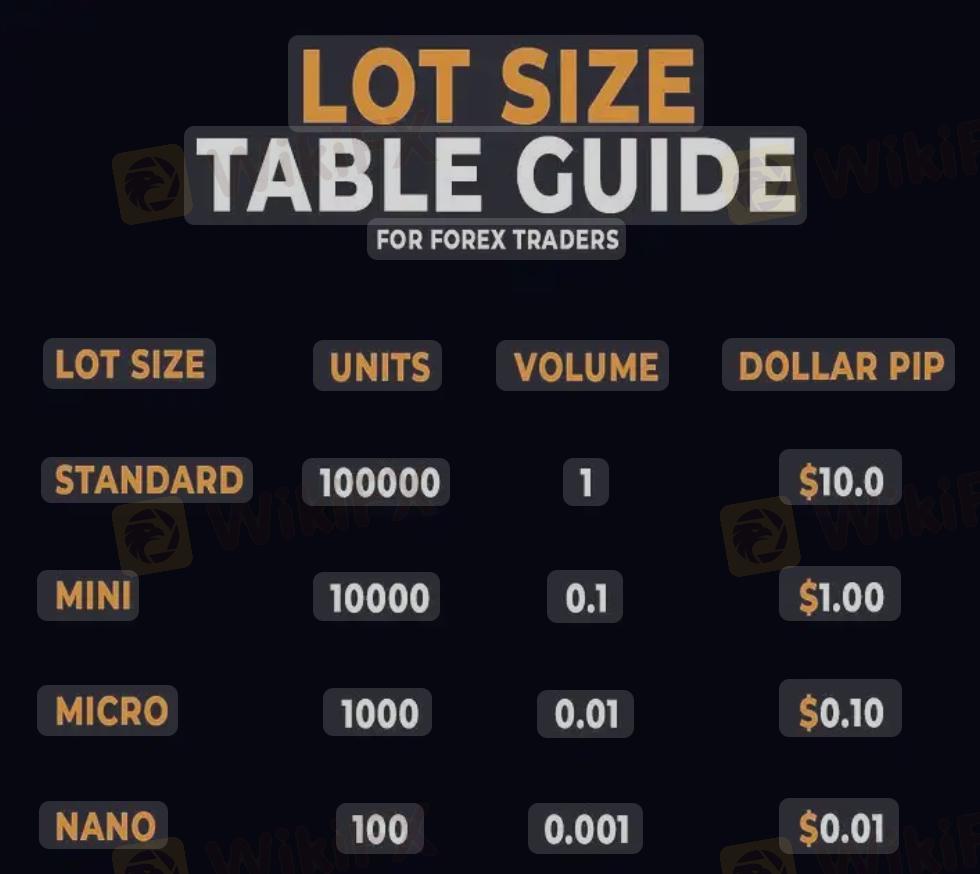

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Katulad 0

Boss8889

Mangangalakal

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

How to Determine your forex trading lot sizes.

Nigeria | 2025-01-31 17:56

Nigeria | 2025-01-31 17:56#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.