2025-01-31 22:55

IndustriyaUnderstanding Forex Market Time Zone

#firstdealofthenewyearFateema

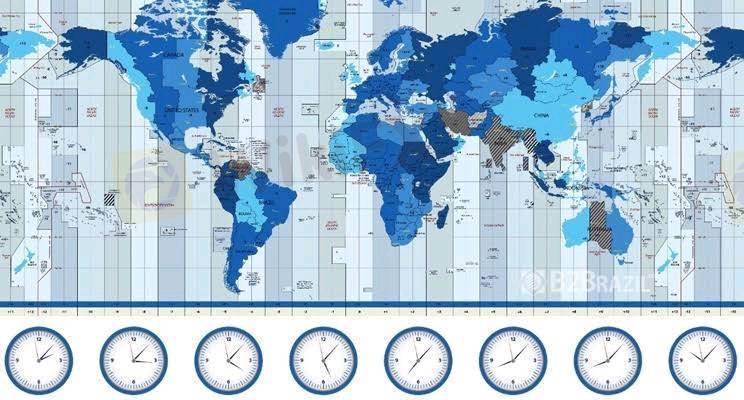

The forex market operates 24 hours a day, five days a week, across different time zones. This continuous operation allows traders to participate in the market at almost any time. Below is a breakdown of the major forex trading sessions and their corresponding time zones:

1. Sydney Session (Asia-Pacific)

*. Time Zone: GMT +10 (AEST) / GMT +11 (AEDT during daylight saving time).

*. Trading Hours: 10:00 PM – 7:00 AM GMT.

*. Key Currencies: AUD, NZD, JPY.

*. Characteristics:

a) The session is relatively quiet compared to others.

b) Focus on AUD and NZD pairs due to their connection to the Australian and New Zealand economies.

2. Tokyo Session (Asian)

*. Time Zone: GMT +9 (JST).

*. Trading Hours: 12:00 AM – 9:00 AM GMT.

*. Key Currencies: JPY, AUD, NZD.

*. Characteristics:

a) Increased volatility, especially during the overlap with the Sydney session.

b) JPY pairs (e.g., USD/JPY, EUR/JPY) are actively traded.

c) Liquidity is moderate, with a focus on Asian markets.

3. London Session (European)

*. Time Zone: GMT +0 (GMT) / GMT +1 (BST during daylight saving time).

*. Trading Hours: 8:00 AM – 5:00 PM GMT.

*. Key Currencies: EUR, GBP, CHF.

* Characteristics:

a) The most liquid and volatile session, accounting for the majority of forex trading volume.

b) Major economic data releases from Europe (e.g., UK, Germany, France) often occur during this session.

c) Overlaps with the New York session, creating the most active trading period.

4. New York Session (North American)

*. Time Zone: GMT -5 (EST) / GMT -4 (EDT during daylight saving time).

*. Trading Hours: 1:00 PM – 10:00 PM GMT.

*. Key Currencies: USD, CAD, MXN.

*. Characteristics:

a) High liquidity, especially during the overlap with the London session (1:00 PM – 5:00 PM GMT).

b) USD pairs (e.g., EUR/USD, GBP/USD) are heavily traded.

c) Major U.S. economic data (e.g., Non-Farm Payrolls, CPI) is released during this session.

5. Overlapping Sessions

*. London & New York Overlap (1:00 PM – 5:00 PM GMT):

a) The most active trading period, with high liquidity and volatility.

b) Ideal for day traders looking for quick opportunities.

*. Sydney & Tokyo Overlap (12:00 AM – 7:00 AM GMT):

a) Moderate activity, with a focus on JPY, AUD, and NZD pairs.

6. Weekend Closure

*. The forex market closes on Friday at 10:00 PM GMT (New York session) and reopens on Sunday at 10:00 PM GMT (Sydney session).

*. During weekends, the market is closed, and no trading occurs.

key Note

a) Best Times to Trade: The London and New York sessions (especially during their overlap) offer the highest liquidity and volatility.

b) Quiet Times: The Sydney session and late New York session are typically quieter, with fewer trading opportunities.

c) Time Zone Adjustments: Be mindful of daylight saving time changes, as trading hours may shift slightly during the year.

By understanding the forex market time zones, you can plan your trading activities to align with the most active and liquid periods, increasing your chances of success.

Katulad 0

Palomaeuro

Mangangalakal

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Understanding Forex Market Time Zone

Nigeria | 2025-01-31 22:55

Nigeria | 2025-01-31 22:55#firstdealofthenewyearFateema

The forex market operates 24 hours a day, five days a week, across different time zones. This continuous operation allows traders to participate in the market at almost any time. Below is a breakdown of the major forex trading sessions and their corresponding time zones:

1. Sydney Session (Asia-Pacific)

*. Time Zone: GMT +10 (AEST) / GMT +11 (AEDT during daylight saving time).

*. Trading Hours: 10:00 PM – 7:00 AM GMT.

*. Key Currencies: AUD, NZD, JPY.

*. Characteristics:

a) The session is relatively quiet compared to others.

b) Focus on AUD and NZD pairs due to their connection to the Australian and New Zealand economies.

2. Tokyo Session (Asian)

*. Time Zone: GMT +9 (JST).

*. Trading Hours: 12:00 AM – 9:00 AM GMT.

*. Key Currencies: JPY, AUD, NZD.

*. Characteristics:

a) Increased volatility, especially during the overlap with the Sydney session.

b) JPY pairs (e.g., USD/JPY, EUR/JPY) are actively traded.

c) Liquidity is moderate, with a focus on Asian markets.

3. London Session (European)

*. Time Zone: GMT +0 (GMT) / GMT +1 (BST during daylight saving time).

*. Trading Hours: 8:00 AM – 5:00 PM GMT.

*. Key Currencies: EUR, GBP, CHF.

* Characteristics:

a) The most liquid and volatile session, accounting for the majority of forex trading volume.

b) Major economic data releases from Europe (e.g., UK, Germany, France) often occur during this session.

c) Overlaps with the New York session, creating the most active trading period.

4. New York Session (North American)

*. Time Zone: GMT -5 (EST) / GMT -4 (EDT during daylight saving time).

*. Trading Hours: 1:00 PM – 10:00 PM GMT.

*. Key Currencies: USD, CAD, MXN.

*. Characteristics:

a) High liquidity, especially during the overlap with the London session (1:00 PM – 5:00 PM GMT).

b) USD pairs (e.g., EUR/USD, GBP/USD) are heavily traded.

c) Major U.S. economic data (e.g., Non-Farm Payrolls, CPI) is released during this session.

5. Overlapping Sessions

*. London & New York Overlap (1:00 PM – 5:00 PM GMT):

a) The most active trading period, with high liquidity and volatility.

b) Ideal for day traders looking for quick opportunities.

*. Sydney & Tokyo Overlap (12:00 AM – 7:00 AM GMT):

a) Moderate activity, with a focus on JPY, AUD, and NZD pairs.

6. Weekend Closure

*. The forex market closes on Friday at 10:00 PM GMT (New York session) and reopens on Sunday at 10:00 PM GMT (Sydney session).

*. During weekends, the market is closed, and no trading occurs.

key Note

a) Best Times to Trade: The London and New York sessions (especially during their overlap) offer the highest liquidity and volatility.

b) Quiet Times: The Sydney session and late New York session are typically quieter, with fewer trading opportunities.

c) Time Zone Adjustments: Be mindful of daylight saving time changes, as trading hours may shift slightly during the year.

By understanding the forex market time zones, you can plan your trading activities to align with the most active and liquid periods, increasing your chances of success.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.