2025-02-06 15:11

IndustriyaThe role of market makers in trading

#firstdealofthenewyearFateema

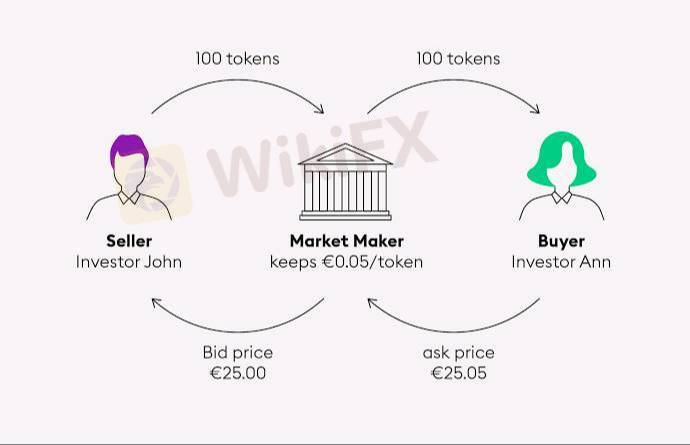

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Katulad 0

murphy

Trader

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

The role of market makers in trading

Nigeria | 2025-02-06 15:11

Nigeria | 2025-02-06 15:11#firstdealofthenewyearFateema

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.